Table of Contents

Tata Consumer Products Limited was formed by merging Tata Global Beverages and the food business of Tata Chemicals. Today it is one of India’s largest consumer goods companies with a strong presence in branded tea & coffee, salt, water, and other staples. The brands include Tata Tea, Tetley, Vitax, Eight O’clock Coffee, Tata Salt, and Tata Sampann, Himalayan Natural Mineral Water, etc.

With the iconic Tata Salt that pioneered the crusade for iodization in India, the Foods business became one of the most trusted food brands across India after which the company had extended the portfolio to include new salt variants and nourishing food items. Now with Tata Sampann they try to bring the traditional wisdom of Indian food in a contemporary package to deliver the best of taste, nutrition and convenience.

Tata Consumer Products has been able to unite the food and beverage interests of the Tata Group under one umbrella. The strength of the company lies in deep understanding of the consumers in India and in international markets, which helps the leading brands to get wide consumer reach.

The Integrations

The integration of Tata Chemicals Limited’s (TCL’s) consumer business will fetch many synergistic benefits such as a combined distribution network catering to more than 200 million households, diversification into multiple product categories, robust innovation and sustained revenue and cost synergies, which will help the company to drive sustainable growth. The mission is to become a leading diversified products company. As of today’s date, this is Tata Consumer share price.

Tata Consumer Products has been able to grow mainly due to innovation, strategic alliances and acquisitions, and organic growth. The Company has a joint venture (50:50) with Starbucks named as Tata Starbucks Limited, which owns and operates Starbucks cafés in India. After the inauguration of the flagship store in Mumbai in October 2012, the Joint Venture has expanded to 10 different cities, with many more Starbucks cafes planned across the country.

Tata Consumer Products Limited domestic in-house portfolio has become strong and it is scouting a big opportunity in the Rs. 21 lakh crore in the-kitchen consumption market, which is expected to see good growth due to the rising trend of in-house consumption and higher demand for branded products. The company has a lot of tie-ups and is continuously tying -up with a lot of e-commerce platforms so that its product portfolio is widely available.

Tata Consumer also has a Joint Venture with PepsiCo in India, called NourishCo, which produces non-carbonated ready-to-drink beverages focusing on health and enhanced wellness. NourishCo also produces and markets Tata Water Plus — which is India’s first nutrient water, & Tata Gluco Plus —which is an energizing, glucose-based flavored drink. NourishCo also markets and distributes Himalayan Water.

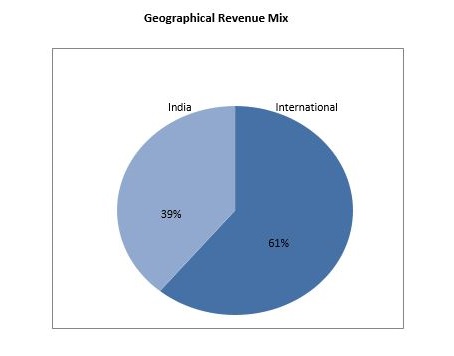

Tata Consumer Products Limited 61% revenue comes from the international market, while 39% from India. The company plans to launch many other products and get into other categories in a much-calibrated manner in the following years.

Operational Highlights:

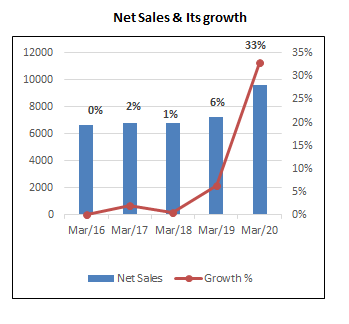

- The company reported growth in sales at Rs 2,714 cr in Q1FY21 as compared to Rs 2,392 cr in Q1FY20.

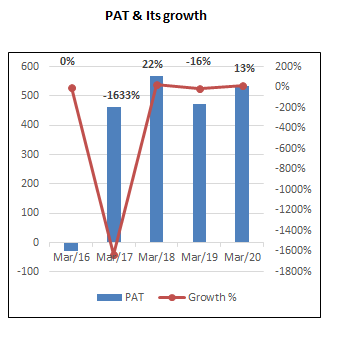

- The EBITDA grew to Rs 483 cr in Q1FY21 as compared to Rs 351 cr in Q1FY20.The PAT grew to Rs 389 cr in Q1FY21 as compared to Rs 197 cr in Q1FY20.

- Despite the lockdown and pandemic, the company’s products have witnessed overwhelming demand and have grown in all parameters.

- The high margins in the food business would help consolidate the operating margins and lead to further improvement in the coming years.

Future Outlook of Tata Consumer Products Limited:

The integration of TCL’s consumer business with Tata Consumer Products Limited heightens sustainable revenue and PAT growth visibility owing to multiple growth levers.

The revamped management has enhanced its focus on delivering profitable earnings growth by leveraging on an expanded product portfolio and improvement in return ratios in the coming years, leading to improved earning visibility.

Rising income levels, growing urbanization, a shift in consumer preference towards brands, and rise of e-commerce are some of the key drivers of sustainable growth for staple and processed food companies.

The shift in consumer behavior has created opportunities for low-penetrated categories such as branded pulses, spices and condiments, and ready-to-cook food items which are expected to emerge as essential categories in the post-pandemic era.

See also: Mukesh Ambani Reliance Group: Traditional businesses to Modern age business

How do we analyze the stock using StockEdge?

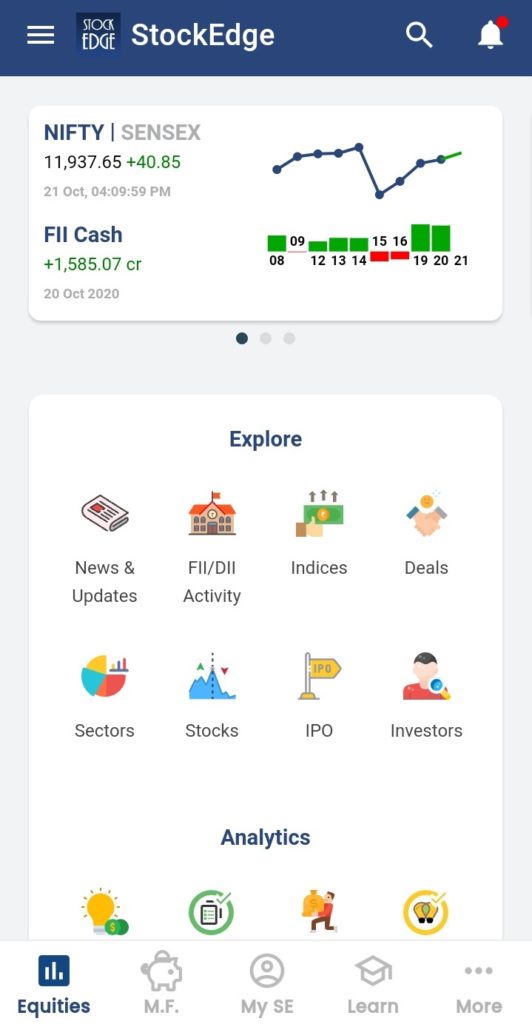

- You can open the StockEdge application and type the name of the stock in the search option and click on the stock.

- After clicking on the stock name, it shows the stocks price graph which is set to default view of 1 day, so to see the price movement on a longer time frame you can click on 5 years to see the trend.

- You can toggle around the different tabs to get more information about the stock such as the Updates -> Corp. Actions, whether there has been any split, bonus issue, the dividend paid, etc. For eg:-

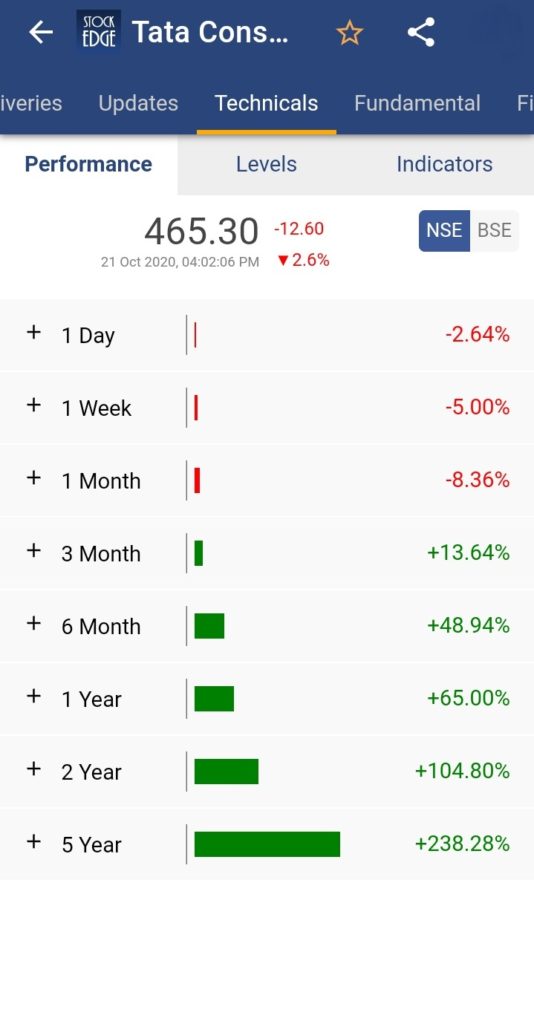

- You can also check the absolute return for the stock in different time frames by clicking on the Technicals tab.

- Next, we click on the Fundamental tab. to check the financial ratios and get a quick analysis of the numbers which also depicts the trend over the period of 9 years. There is a drop-down that you can click to see different sets of ratios such as solvency, valuation, growth, etc.

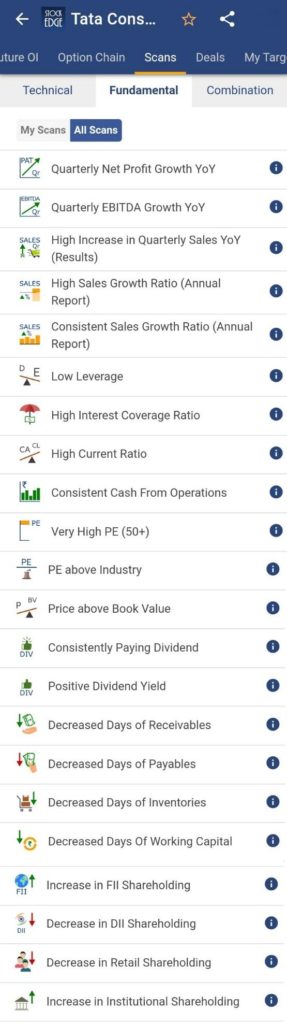

- We ran a fundamental scan to the company from our application StockEdge and we found the company to satisfy many positive scans which indicate it is in good hands.

StockEdge Technical Views:

Tata Consumer is trading below resistance zone and likely to stay weak till it stays below 540-545

zone. Next immediate resistance level comes at 555 and then next at 580 level. Probable support

comes at 520 level. Technical parameters and volume setup looks quite strong as of now.

Frequently Asked Questions

Is Tata consumer a good buy?

This blog and the process of identifying the potential of a company has been produced for only learning purpose. Since equity involves individual judgments, this analysis should be used for only learning enhancements. Please do not consider it to be a recommendation on any stock or sector. Our knowledge team has limited understanding and we all are learning the art and science behind this.

What does Tata consumer do?

Tata Consumer Products is a focused consumer products company uniting the food and beverage interests of the Tata Group under one umbrella. It is home to key brands such as Tata Tea, Tetley, Tata Salt and Tata Sampann.

What are all the Tata products?

The TATA consumer products include tea, coffee, water, and salt, Spices, Pulses, Organic, Ready-to-Cook Mixes, Red & White Poha, Besan & Jeera, Sattu, Dal Snacks, Chutneys, and Virgin Coconut Oil under different brands.

What happened to Tata Global Beverages?

Tata Group announced to demerge the consumer business of Tata Chemicals and merge it with Tata Global Beverages, later renaming Tata Global Beverages to Tata Consumer, to create a focused consumer products company.

Who is the owner of Tata Group?

Founded by Jamsetji Tata in 1868, the Tata group is a global enterprise, headquartered in India, comprising 30 companies across ten verticals. The group operates in more than 100 countries across six continents. Tata Sons is the principal investment holding company and promoter of Tata companies. 66 % of the equity share capital of Tata Sons is held by philanthropic trusts, which support education, health, livelihood generation and art and culture. Companies include Tata Consultancy Services, Tata Motors, Tata Steel, Tata Chemicals, Tata Consumer Products, Titan, Tata Capital, Tata Power, Tata Advanced Systems, Indian Hotels and Tata Communications.

Bottom Line:

Tata Consumer Products Limited is the flag-bearer for the Tata group’s aspirations in the FMCG space. The combination of the Foods business of Tata Chemicals and the Beverages business of Tata Global Beverages allows it to participate in opportunities spread across all three segments of the food and beverage consumer basket – in-the-kitchen, on-the-table and on-the-go.

Synergistic benefits of merger in the form of portfolio and distribution expansion, new leadership focusing on improving return profile and strong parental support have turnaround the prospects for Tata Consumer Products Limited, which was earlier posting volatile performance due to a large portfolio of commoditized beverage categories in matured consumer markets.

Join StockEdge Club to get more such Stock Insights. Click to know more!

Click here to know more about the offering of the StockEdge Club.

You can check out the desktop version of StockEdge.

Disclaimer:

This blog and the process of identifying the potential of a company has been produced for only learning purpose. Since equity involves individual judgments, this analysis should be used for only learning enhancements. Please do not consider it to be a recommendation on any stock or sector. Our knowledge team has limited understanding and we all are learning the art and science behind this.