Table of Contents

Relative Strength Index (RSI) is a momentum indicator that was developed by J. Welles Wilder.

This indicator measures the speed as well as the change of movement in prices.

This is a leading indicator that is one of the core indicators of technical analysis.

What is the Relative Strength Index?

Relative Strength Index (RSI) is a momentum oscillator. This indicator oscillates between zero and 100.

The RSI is considered to be overbought when it is above 70 and oversold when it is below 30.

Thus one can buy when the RSI moves above 30 from below and sell when it moves below 70 from above.

RSI is mainly used to identify the general trend.

It can also generate signals by making bullish and bearish divergences.

The formula for calculating the Relative Strength Index is:

RSI = 100 – 100 / (1 + RS)

RS = Average Gain over a specified period/ Average loss over the same period

To know more about the Relative Strength Index, you can watch the video below:

Using Relative Strength Index in StockEdge App:

Above we have discussed RSI, now let us discuss how can we use this technical indicator to filter out stocks for trading:

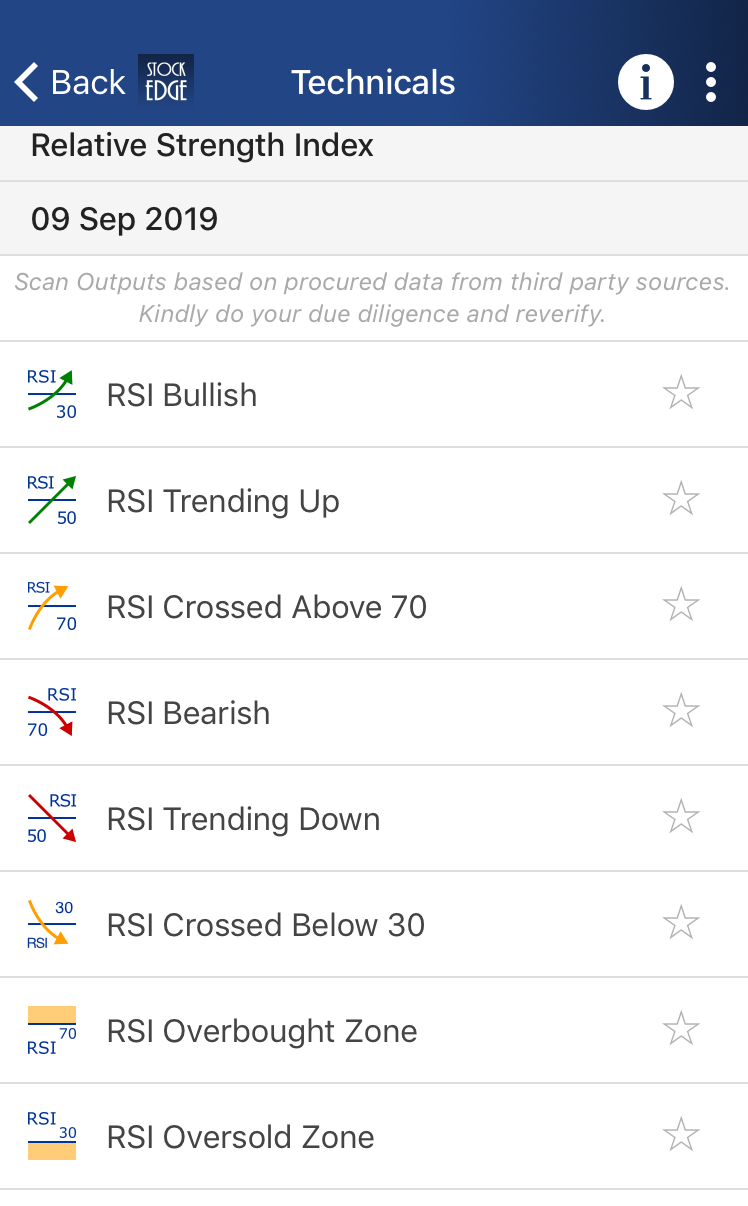

In StockEdge there are many Relative Strength Index scans available for filtering out stocks for trading:

Let us discuss in detail some of these scans:

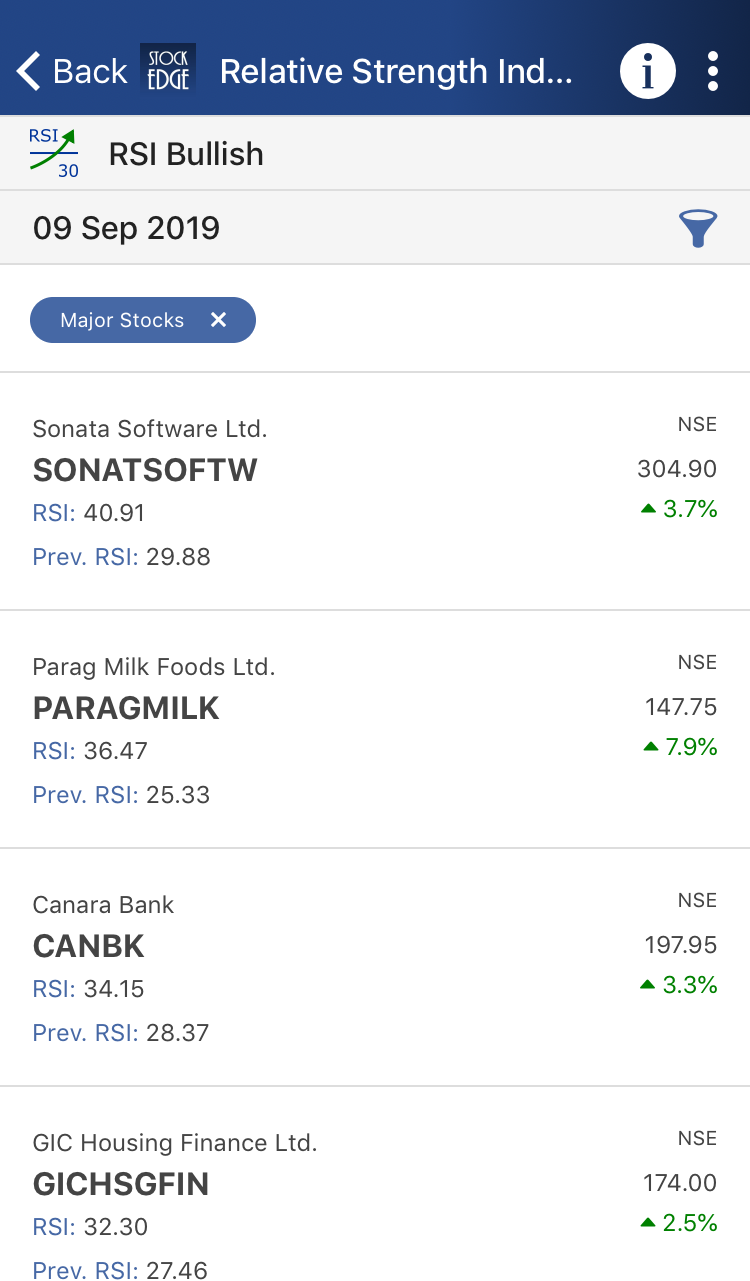

1. RSI Bullish:

This is a bullish scan that indicates that the RSI has crossed 30 which means that it is exiting the oversold zone.

Following is a list of stocks which has fulfilled this criterion on 9th September:

If you want to see the technical chart of Sonata Software, then you can click on the company and find the technical chart with RSI plotted on the subgraph:

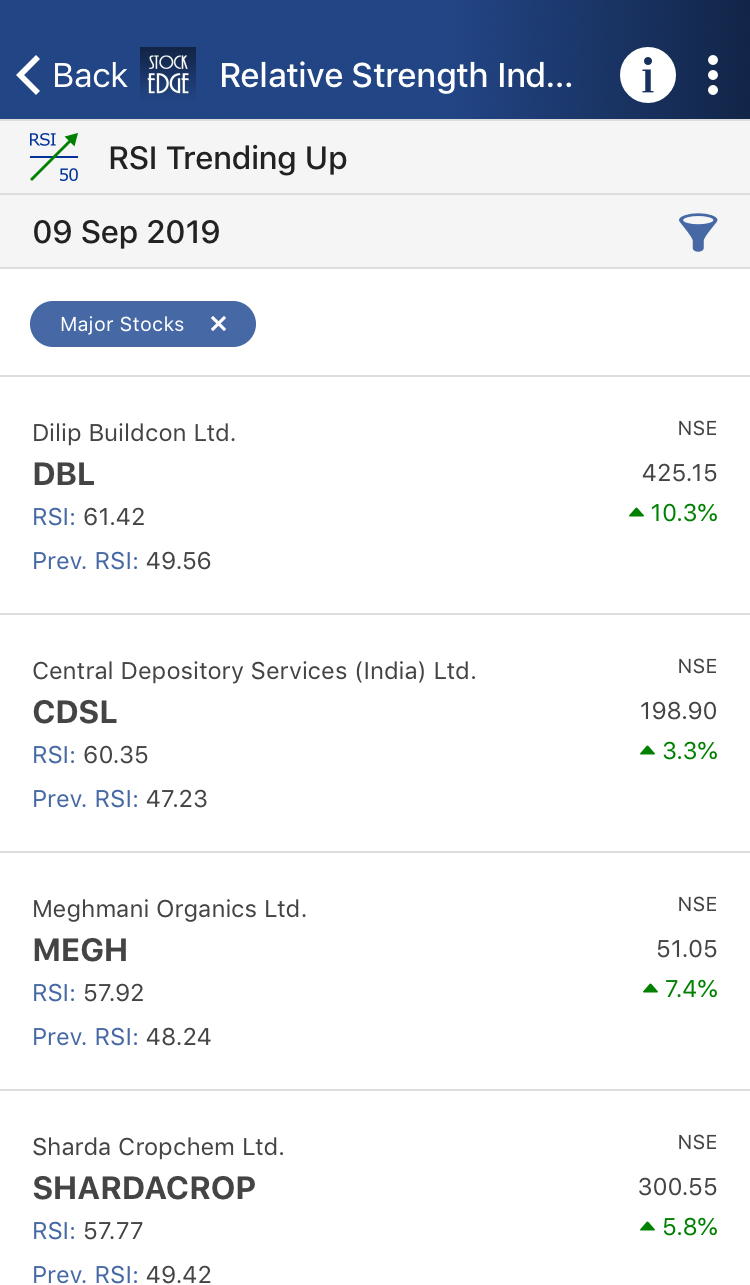

2. RSI Trending Up:

RSI 50 is considered an important line. When the RSI crosses 50 from below then the stock is considered to be bullish and when the RSI crosses 50 from above then the stock is considered to be bearish. By trending up it means that RSI has crossed 50 from below.

Following is a list of stocks which has fulfilled this criterion on 9th September:

If you want to see the technical chart of Dilip Buildcon Ltd., then you can click on the company and find the technical chart with RSI plotted on the subgraph:

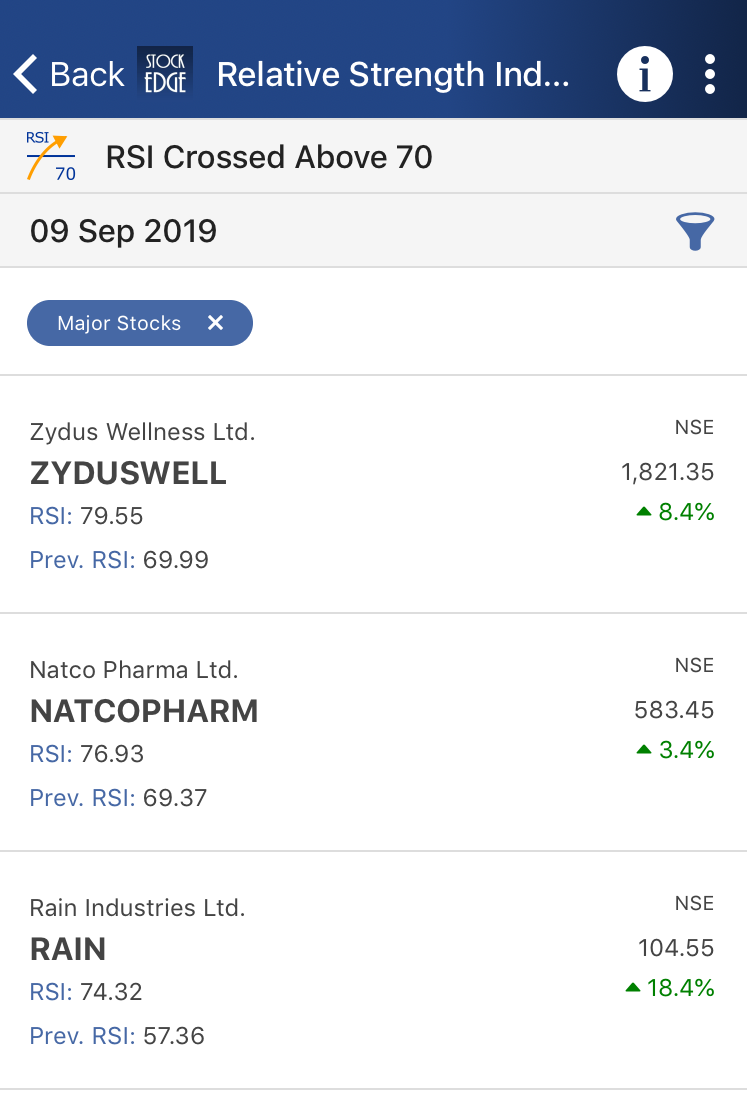

3. RSI Crossed Above 70:

This is a bullish scan that indicated that the RSI has crossed 70 which means it is entering the overbought zone.

Following is a list of stocks which has fulfilled this criterion on 9th September:

If you want to see the technical chart of Zydus Wellness Ltd., then you can click on the company and find the technical chart with RSI plotted on the subgraph:

See also: Relative Strength (RS)

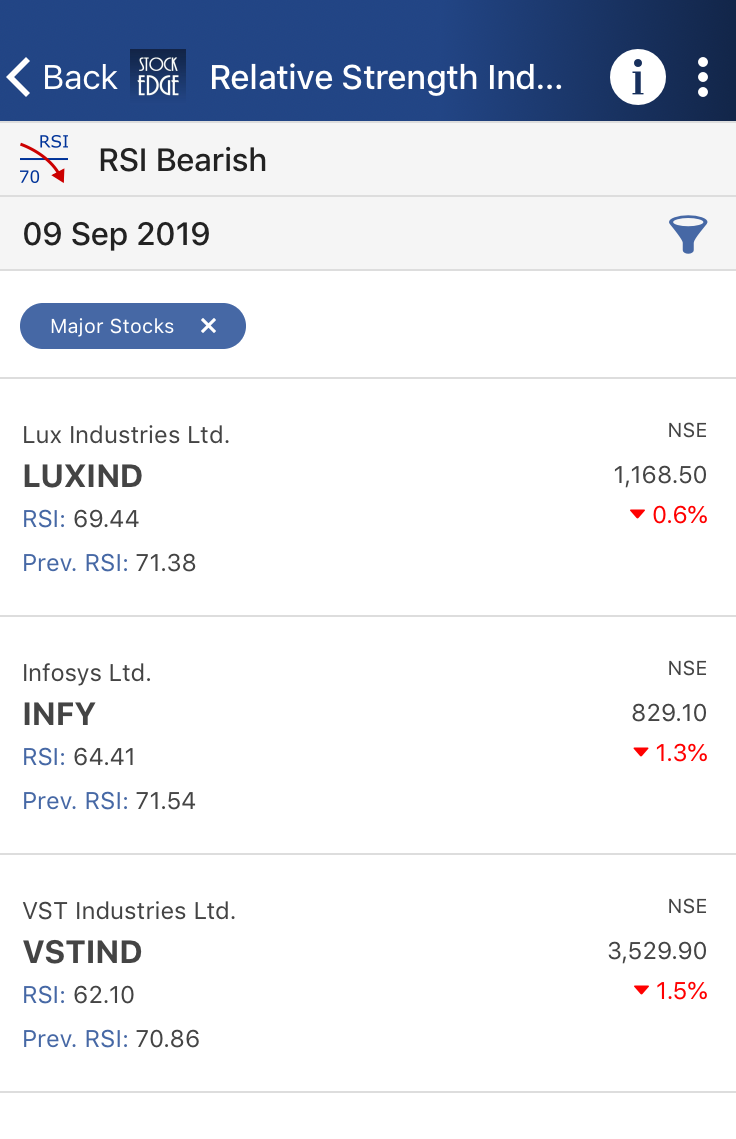

4. RSI Bearish:

This is a bearish scan as it indicates that the RSI has crossed below 70 from above.

Following is a list of stocks which has fulfilled this criterion on 9th September:

If you want to see the technical chart of Lux Industries Ltd., then you can click on the company and find the technical chart with RSI plotted on the subgraph:

Above are examples of the Relative Strength Index scans that tell you if the stock is bearish or bullish and also give us a list of the stock which fulfills the criteria of the particular day.

You can filter out the stocks and can trade accordingly using these scans.

Frequently Asked Questions

What is a good relative strength index number?

RSI values of 70 or above indicate that a security is becoming overbought or overvalued and a trend reversal or corrective pullback in price is possible. An RSI of 30 or below indicates an oversold or undervalued condition of the stock.

How do you use the relative strength indicators?

Relative Strength Index is a popular indicator developed by J. Welles Wilder, It helps traders evaluate the strength of the current market.

It is also scaled from 0 to 100. Typically, values of 30 or lower indicate oversold market conditions and an increase in the possibility of price strengthening (going up). Values of 70 or higher indicate overbought conditions and an increase in the possibility of price weakening (going down).

Which indicator works best with RSI?

Short-term moving average crossovers, like the 5 EMA crossing over the 10 EMA, are best suited to complement RSI. The 5 EMA crossing from above to below the 10 EMA confirms the RSI’s indication of overbought conditions and possible trend reversal in the market.

Relative strength vs relative strength index

The relative strength tells about the value of a stock in comparison to another stock, index, or benchmark, while the Relative Strength Index tells about the performance of a stock in comparison to the recent performance of the same stock.

Join StockEdge Club to get more such Stock Insights. Click to know more!

You can check out the desktop version of StockEdge.

Really RSI is very useful for a trader I very much thank full to the stock Edge creater for presenting this indicater such a simple manner

What length should we select in RSI?

Good app

I am very very exciting can I win the market..

Great learning ride with SE

We are glad you liked the content. Keep following us on Twitter to read more such Blogs!

Vry informative app that can wrk superbly well for traders n investors as well..

Thanx for educating about RSI, this app is developing intrest in reading as most of the doubts are educated alongwith the things as they are in the app.

Love StockEdge, as it is a self help for the investors. Things are explained in very simpler manner. God bless