Table of Contents

Exponential Moving Average (EMA) is a type of moving average that has a greater weight and has more significance on the recent price data.

It is also known as the “Exponentially Weighted Moving Average”.

Exponential Moving Average has more significance on the change in the recent prices than the Simple Moving Average.

Let us discuss this indicator in details:

What is Exponential Moving Average?

Exponential Moving Average (EMA) is as same as the Simple Moving Average(SMA) in terms of identifying trend direction over a specified period of time.

SMA only calculates the average price of data but EMA applies weight to the more current price data.

As it applies more weight to the current price data EMA follow prices more closely than SMA.

Suppose we are calculating the EMA for 9 periods, then the most recent price will get more weight than the previous prices.

The calculation of 9 days EMA will be: –

Exponential Moving Average (EMA) = (P1*9) + (P2 * 8) + (P3 * 7) + ………+ (P9 * 1) / (9+8+7+6+5+4+3+2+1)

Where,

P1 is the most recent price

P2 is the last day price

P3 is the 3 days ago price and so on

To know more about Exponential Moving Average, watch the video below on StockEdge EMA Scan Tutorial:

Using Exponential Moving Average in StockEdge App:

We have discussed about the basics of EMA, now let us discuss how to use this technical indicator to filter out stocks for trading:

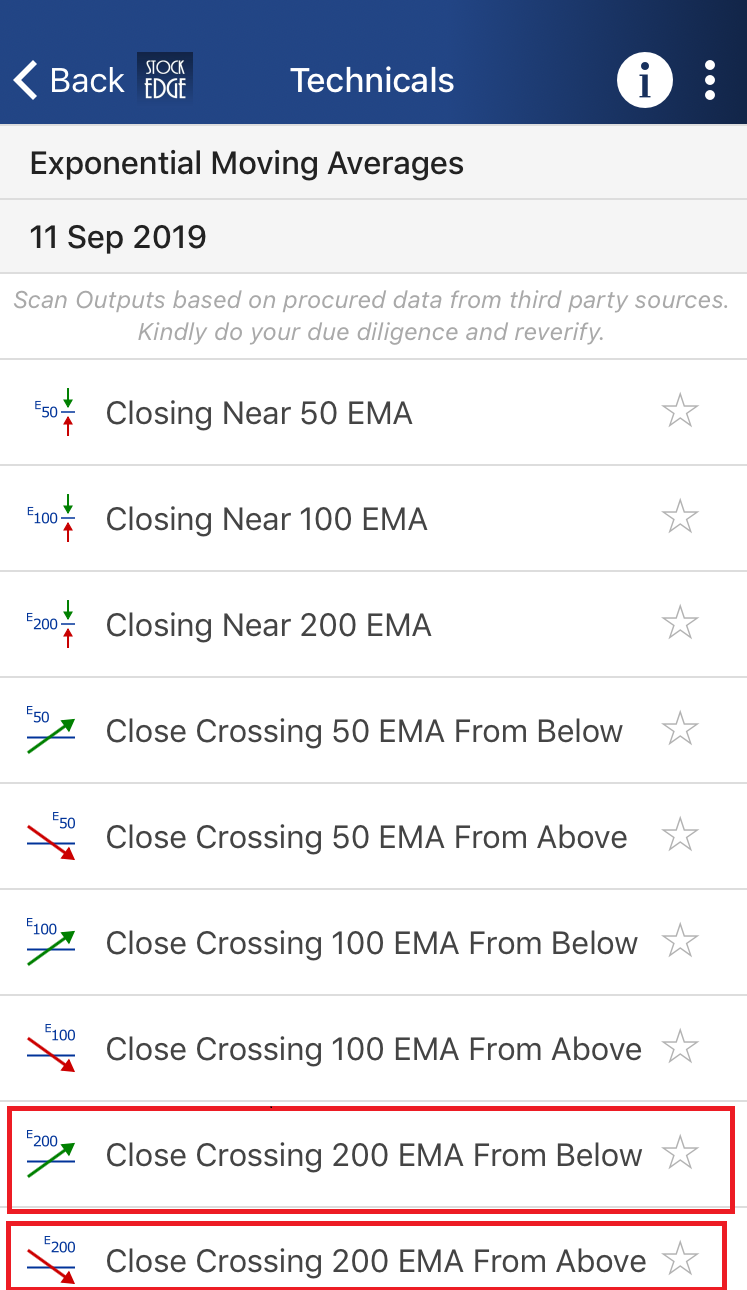

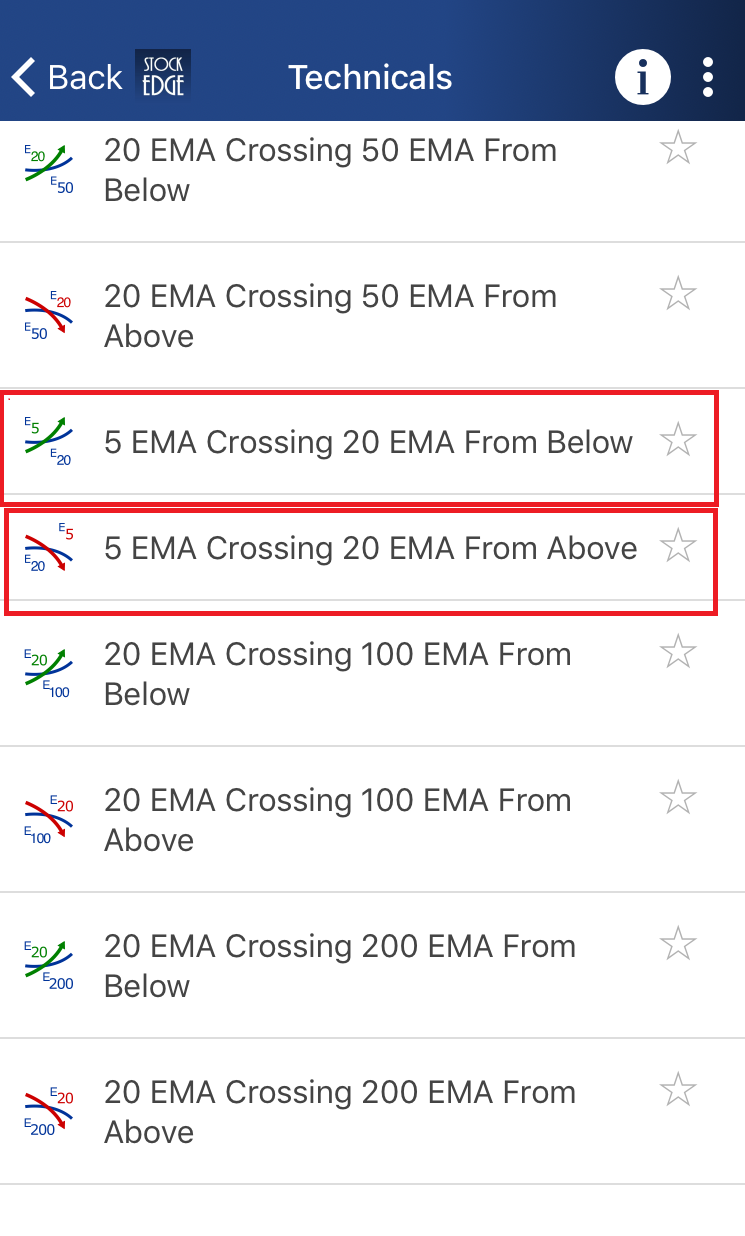

In StockEdge there are many Exponential Moving Average scans available for filtering out stocks for trading:

Let us discuss a few of these scans:

Example 1: Close Crossing 200 EMA from Below:

This is a bullish scan which indicates that the 200 days EMA has crossed the price from below.

When the EMA crosses the prices from below it indicates that the stock has turned bullish and when the EMA crosses the price from above like the Close Crossing 200 EMA from Above scan it indicates that the stock has turned bearish.

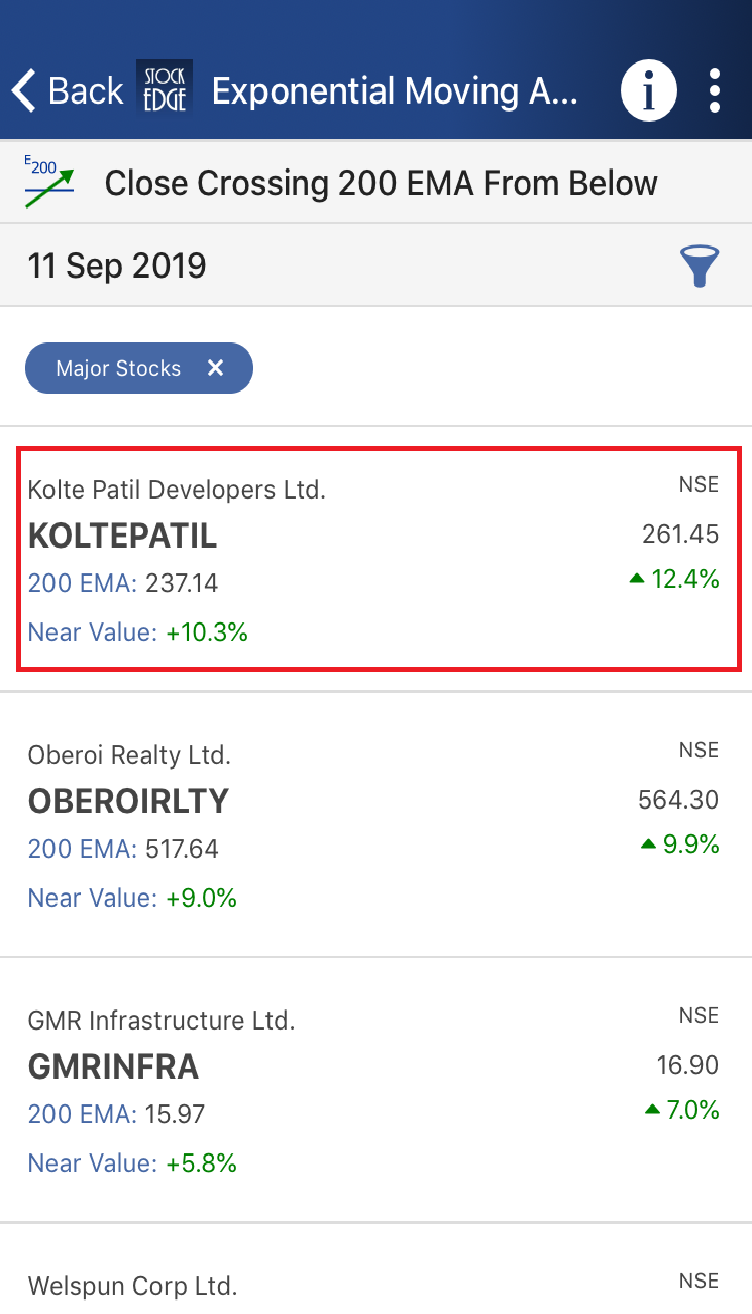

After clicking on this scan you can see a list of stocks which has fulfilled these criteria:

In StockEdge you will get the technical chart with EMA plotted by clicking on the name of stock as shown below:

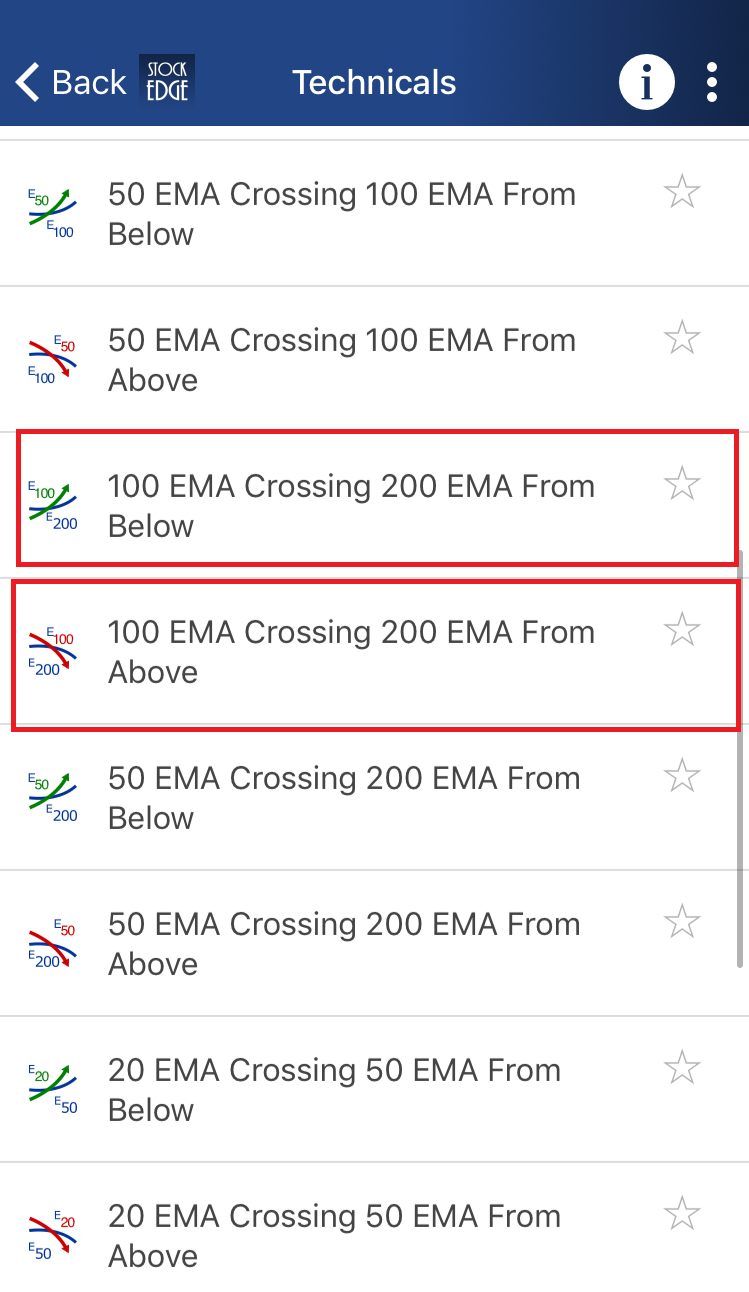

Example 2: 100 EMA Crossing 200 EMA from Above:

A trader can also get buy and sell signals from the crossovers of the smaller period EMA and longer period EMA.

This is a bearish scan which indicates that the 100 days EMA is crossing 200 days EMA from above.

If a smaller period EMA crosses longer period EMA from above, it means bearish reversal may take place and if a smaller period EMA from below like the 100 EMA Crossing 200 EMA from Below scan, it means bullish reversal may take place.

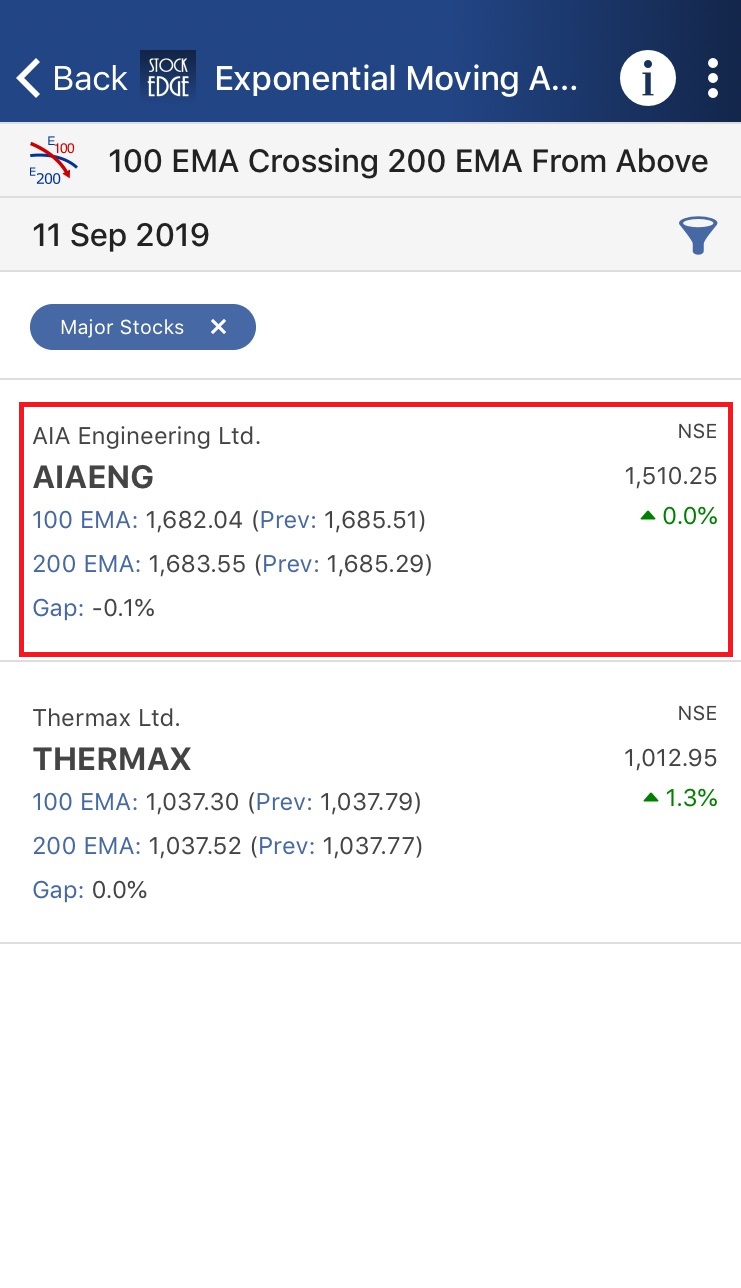

After clicking on this scan you can see a list of stocks which has fulfilled these criteria:

In StockEdge you will get the technical chart with EMA plotted by clicking on the name of stock as shown below:

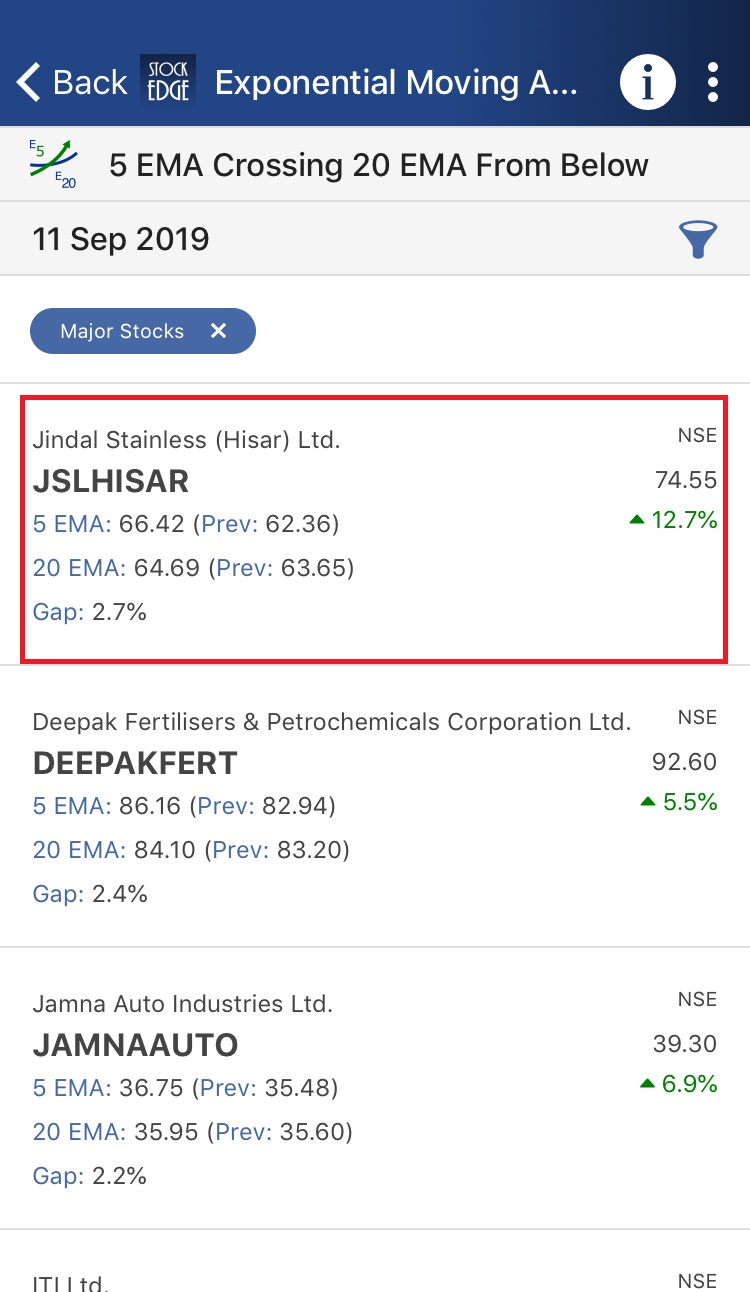

Example 3: 5 EMA Crossing 20 EMA from Below:

This is a bullish scan which indicates that 5 days EMA is crossing 20 days EMA from below.

If the shorter period crosses longer period from below, it indicates a bullish reversal may take place and if shorter period crosses longer period from above just like the 5 EMA Crossing 20 EMA from Above scan it means a bearish reversal may take place.

After clicking on this scan you can see a list of stocks which has fulfilled these criteria:

In StockEdge you will get the technical chart with EMA plotted by clicking on the name of stock as shown below:

Check Out Also: Simple Moving Average (SMA)

Above are examples of the EMA scans that generates buy and sell signals and also give us a list of the stock which fulfils the criteria of the scans for that particular day.

You can filter out the stocks and can trade accordingly using these scans.

Exponential Moving Average scans is one of the free tool offered by StockEdge App which you can download from the Play Store.

Interactive charts are only available for paid subscribers. You can check out our subscriber plans from here.

To have a comprehensive idea of Exponential Moving Average, StockEdge.com.

Sir most useful information thanks.

Sir most useful information thanks. yes sir I was not knowing about Ema but using.