Check out the share trend of Ion Exchange (India) Ltd.

Ion Exchange (India) Ltd. – Highlights

- Ion Exchange (India) Ltd., was trading at Rs.2178.90, up by 7.0% on the BSE.

- The stock hit a fresh 52-week high of Rs.2395 in today’s trading session.

- This move in the stock was after the company said it received orders worth Rs 1,000 crore.

- “The company has received a letter of award and a contract from the State Water Supply and Sanitation Mission, Namami Gange, and the Rural Water Supply Department under the Jal Jeevan Mission for two EPC projects, for survey, design, preparation of a Detailed Project Report (DPR), supply, construction, and commissioning of a water treatment plant, and O&M for a period of ten years for rural drinking water supply to 1000 villages in the state.

- The value of these two projects is expected to be around Rs 1,000 crore; the exact value will be determined after the DPR is approved. According to the company, the project will be built and commissioned within 21 months of the contract’s signing.

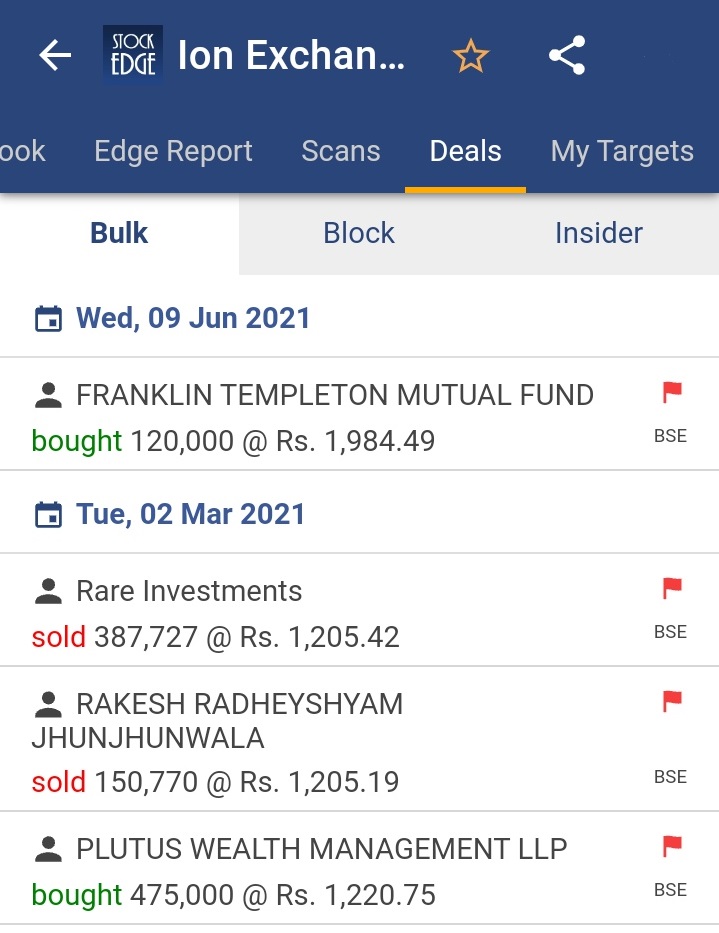

- Franklin Templeton Mutual Fund purchased 120,000 shares of Ion Exchange via bulk deals on Wednesday, June 9, 2021, for Rs 1,984.49 on the BSE, according to exchange data. However, the seller’s name was not immediately ascertained.

- On June 8, 2021, ION Exchange Ltd reported a 26.79 % year-on-year increase in consolidated net revenues for the March-21 quarter, totaling Rs445.15cr. Net sales revenues were up 27.50 % sequentially to Rs445.15cr, compared to total revenues in the Dec-20 quarter.

- Full-year revenue for FY21 was Rs1450 cr, a -2.02 % decrease from the previous year. ION Exchange saw solid growth traction in all three verticals for the fourth quarter ended March 21, namely water treatment engineering, water treatment chemicals, and consumer products.

- In the fiscal year ending March 21, net profits increased by 144.21 % to Rs70.48 crore. This was largely due to increased sales traction from the water treatment and water care segments at both the institutional and retail levels. Higher sales resulted in a 110 % increase in EBITDA for engineering services and a 74 % increase in EBITDA for the chemicals business year on year.

- Net margins in the March-21 quarter were 15.83 %, up from 8.22 % in the March-20 quarter and 8.23 % in the December-20 quarter. COVID’s impact on routine business was only for one quarter.

- For the fiscal year 2020-21, the Board of Directors has recommended a Final Dividend of Rs. 10/- (Rupees Ten) per Equity Share of face value Rs.10/- each. If approved by Shareholders at the upcoming Annual General Meeting (AGM), the Dividend will be credited within 30 days of the AGM.

- In 1964, Ion Exchange was founded as a subsidiary of Permutit, UK. In 1985, it became a wholly owned Indian company. The company has expanded its global footprint and offers a diverse product line. It provides one-stop water and non-water treatment solutions to a wide range of industries, including infrastructure, industry, institutions, municipalities, homes and communities, both urban and rural.

- The company provides a wide range of water cycle solutions, including pretreatment, process water treatment, waste water treatment, recycling, zero liquid discharge, sewage treatment, packaged drinking water, sea water desalination, and so on.

- In addition, the company manufactures ion exchange resins, membranes, and specialty chemicals for water and waste water treatment, as well as non-water applications.

For more fundamental data and analysis, click on Ion Exchange (India) Ltd.

Read our latest article on United Breweries Ltd. – India’s Largest Beer Company

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company has been produced for only learning purpose. Since equity involves individual judgments, this analysis should be used for only learning enhancements and cannot be considered to be a recommendation on any stock or sector.