Check out the top trending stocks identified by the StockEdge analysts.

Read about Hitachi Energy India and 4 other stocks below:

As of today’s date, this is the Hitachi Energy India share price.

The stock has been rallying after Hitachi Energy India Ltd. won orders worth over Rs.160 crore for its key electric components to support the electrification of the country’s rail routes.

The government of India’s electric locomotive manufacturers, Chittaranjan Locomotive Works (CLW) and Diesel Loco Modernisation Works (DMW), both part of Indian Railways, placed orders with Hitachi Energy for traction transformers for passenger and freight locomotives in the December quarter, the companies said on Wednesday.

Indian Railways, as the operator of the world’s fourth-largest railway network, aims to electrify all broad-gauge routes by 2023. Rail electrification is a critical component of India’s drive to achieve net-zero carbon emissions, according to the report.

Hitachi Energy is a global technology leader working to create a more sustainable energy future for all. Hitachi Energy India is the legal entity that operates Hitachi Energy in India (formerly known as ABB Power Products and Systems India Limited).

Traction transformers are essential components of the traction chain, affecting both train performance and operator services. Hitachi Energy transformers power more than half of the world’s electric locomotives and train sets.

Gokaldas export share price, as of today’s date.

The stock rallied the company reported a nearly five-fold jump in net profit at Rs 30.11 crore for the quarter ended December 2021 (Q3FY22). It had posted a profit of Rs 6.05 crore in a year ago quarter (Q3FY21).

Gokaldas Exports’ revenue increased by 95% in Q3FY22 to Rs 524.06 crore, up from Rs 268.07 crore in the same quarter last year. EBITDA the margin increased by 3% year on year.

According to the company, it has maintained its focus on service delivery excellence while increasing capacity and optimising resources for increased productivity. During the last nine months, the company has spent Rs 42 crore on capacity expansion and modernization of its business infrastructure.

Gokaldas Exports is one of India’s leading apparel exporters, with an annual capacity of more than 25 million pieces, supplying garments to global retailers. The company is primarily active in Karnataka, with a few facilities in neighbouring Andhra Pradesh and Tamil Nadu.

Gokaldas Exports specialises in the creation of intricate garment products and designs. Cutting, sewing, embroidery, quilting, and printing are some of the tasks they perform. They have an impressive clientele that includes leading international brands such as Puma, Banana Republic, Adidas, GAP, ‘H&M,’ and others.

Sasken technologies share price, as of today’s date.

The stock tanked after the company reported its Q3FY22 results.

The company reported a total income of Rs. 113.9451 crores for the fiscal year ended December 31, 2021, down by 5.92% sequentially and 8.15% on a year on year basis.

The company reported a net profit of Rs. 30.0790 crores for the fiscal year ended December 31, 2021, down by 19.34% sequentially and 11.28% on a year on year basis.

Sasken is a Product Engineering and Digital Transformation specialist, offering concept-to-market and chip-to-cognition R&D services to global leaders in the semiconductors, Automotive, Industrials, Consumer Electronics, Enterprise Devices, SatCom, Telecom, and Transportation industries. Sasken has been transforming the businesses of over 100 Fortune 500 companies for over 30 years and has multiple patents, powering over a billion devices through its services and IP.

Read this interesting blog on 7 Steps to follow when Trading Breakout Stocks

Polycab India share price, as of Today’s date.

The stock tanked after the company reported its Q3FY22 results.

Polycab India Ltd., the country’s largest manufacturer of wires and cables, announced its third-quarter results for the fiscal year 2021-22 in a press release on Friday, reporting a year over year revenue growth of 23 per cent. Given the increase in numbers for Q3 FY’22, the company’s growth momentum is expected to continue this quarter.

The company reported revenue of Rs 3372 crore for Q3 FY’22, up from Rs 2746.34 crore in Q3 FY’21, a 23 per cent increase year on year.

Polycab reported a 3% increase in EBITDA, which now stands at Rs 362 crores. While its PAT increased by 1% to Rs 248.40 crore for the fiscal quarter ending December 2021, compared to Rs 245 crore for the fiscal quarter ending December 2020.

Despite the challenging environment, the company’s growth momentum continued, and we recorded the highest quarterly top-line in history for yet another quarter, demonstrating the company’s ability to be agile, focus on delivering the highest quality products, and execute well.

By focusing on Emerging India clusters and new age channels, the company has revitalised its demand generation capabilities and Go-To-Market strategy. In addition, we have begun work on developing a robust ESG framework that will align the company to best global standards and serve as guiding principles for sustainable business practises,” said Mr Inder T. Jaisinghani, Chairman and Managing Director, Polycab India Limited, in response to the company’s performance.

The company’s wires and cables business increased by 24% year on year to Rs 2967.90 crore in Q3 FY’22 from Rs 2,402.30 crore in Q3 FY’21.

The company’s domestic business grew and remained healthy, while its institutional business recovered as a result of increased private investment across industries. Its profitability increased sequentially as a result of improved operating leverage and well-timed price increases.

In the face of global market challenges, its FMEG business grew by 11% year on year. The company saw growth in October, but December saw lower trade as consumer sentiments on the third wave rolled out. Overall, growth was close to 57 per cent.

Polycab India manufactures and sells wires and cables as well as fast-moving electrical goods (FMEG) under the ‘POLYCAB’ brand. Aside from wires and cables, it also manufactures and sells FMEG such as electric fans, LED lighting and luminaires, switches and switchgear, solar products, conduits and accessories.

Shoppers Stop share price, as of today’s date.

The stock has been rallying after Shoppers Stop Ltd. reported a strong operational performance with EBITDA margins improving by 580 bps year-on-year (YoY) to 19.2 per cent in the December quarter (Q3FY22).

According to the company, EBITDA performance was driven by robust demand recovery and tight cost control, while E-commerce sales continued to grow rapidly, increasing by 39%. The company is no longer in net debt.

Shopper’s Stop revenue increased by 35% year on year to Rs 1,070 crore in Q3FY22. Due to a strong festive and wedding season, the company’s demand was close to pre-covid levels in Q3FY22. During the quarter, the company added three stores on a net basis, bringing the total store count to 83. (4.0 million sq. ft.). In Q3FY22, the company reported a profit after tax (PAT) of Rs 50 crore, compared to a loss of Rs 21 crore in Q3FY21.

According to the company’s management, there has been consistent demand during the holiday season and the marriage season in October and November. The company saw an increase in customer spending as well as an increase in Average Transaction Value (ATV).

“Encouraged by the strong rebound, the Company now expects an accelerated growth trajectory, driven by a robust recovery from the lockdown blues, accelerated small-size store expansion, growth in the private-label mix, and an increased focus on high-growth beauty business.” “The third wave may result in a minor blip in the growth trajectory,” the company said.

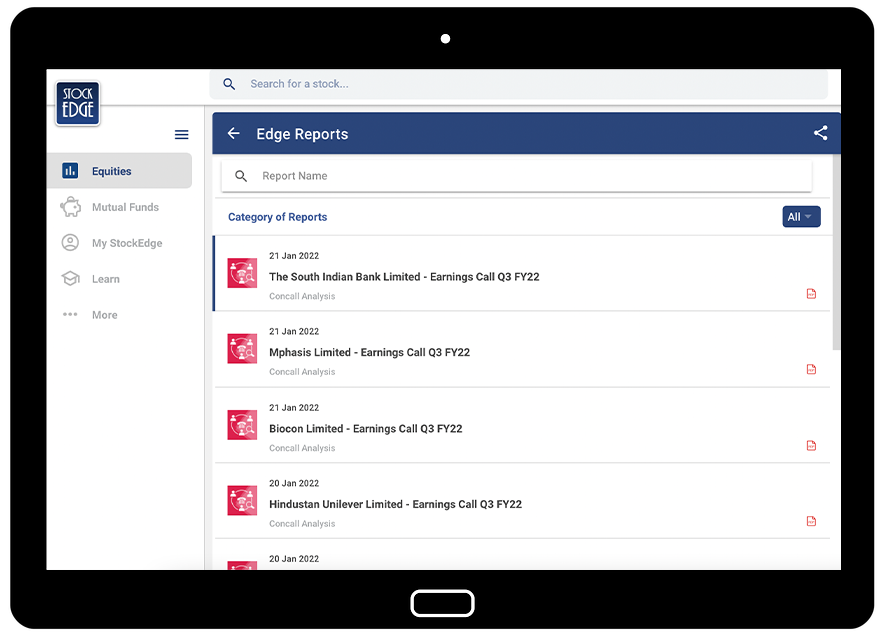

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company have been produced for only learning purposes. Since equity involves individual judgments, this analysis should be used only for learning enhancements and cannot be considered a recommendation on any stock or sector.

Excellent