Check out the top trending stocks identified by the StockEdge analysts.

Read about Laurus Labs and 4 other stocks below:

As of today’s date, this is the Laurus Labs share price.

Laurus Labs rallied on the back of heavy volumes on a positive outlook.

Laurus Labs revenue fell 20% year on year to Rs 1,029 crore in the December quarter (Q3FY22) due to lower demand in the anti-retroviral (ARV) business formulations due to transitory inventory correction.. Profit after tax fell 43.7 percent year on year to Rs 153.70 crore.

The management expects that demand for ARV business will improve from commodity customers and formation sales from global multilateral agencies in the January-March quarter (Q4).

The sluggishness is only transitory in nature and that it should be normal from – onwards,” the management stated.

Laurus Labs also stated that, despite the challenging environment, it has demonstrated healthy gross margin expansion as a result of a better mix. EBITDA fell 33% to Rs.290 crore, while EBITDA margins fell 535 basis points to 27.7%, owing to higher employee and other expenses.

Laurus Labs expects the momentum to continue, aided by increased product commercialization, and it is well-positioned to meet the rapidly growing global demand for NCE (new chemical entity) drug substances and drug products.

Laurus Labs is a rapidly expanding research-driven pharmaceutical company with three business lines — Generics APIs, Generics Finished Dosage Forms (FDFs), and Synthesis/Ingredients — that operate with globally benchmarked manufacturing capabilities and compliances.

As of today’s date, this is the LIC Housing Finance share price.

The stock has been rallying after LIC Housing Finance declared its Q3 results.

LIC Housing Finance reported a 6% increase in profit after tax to Rs.767.33 crore for the quarter ended December 2021, helped by higher collections and a drop in provisions.

In the same period the previous fiscal, it reported a profit after tax of Rs.727.04 crore. “Income levels were mostly maintained.” During the first three months of the quarter, our collections were strong. Recovery has also accelerated in all regions.

“Even the provisions were less in the quarter because of the provisions we had made earlier,” said the company’s Managing Director and CEO, Y Viswanatha Gowd. The lender reported better growth in the quarter due to higher disbursements during the holiday season. Gowd also stated that as the pandemic eases, growth and asset quality metrics are expected to improve.

Provisions were Rs 355 crore in the quarter, compared to Rs 665 crore in the second quarter of this fiscal.

Net interest income (NII) increased 14% to Rs 1,455 crore, up from Rs 1,281 crore in the same period the previous year.

The net interest margin (NIM) increased to 2.42 percent from 2.36 percent. Gowd anticipates Q4 NIM to be around 2.50 percent.

The default stage 3 exposure was 5.04 percent, up from 2.68 percent on December 31, 2020.

Individual loan portfolio of was Rs 2,29,321 crore, up from Rs 2,04,444 crore previously, representing a 12% increase.

The project loan portfolio of LIC Housing Finance stood at Rs 14,091 crore as of December 31, 2020, down from Rs 15,753 crore.

The total outstanding portfolio of LIC Housing Finance increased by 11% to Rs.2,43,412 crore from Rs.2,20,197 crore.

As of today’s date, this is the Route Mobile share price.

The stock rallied after the company declared its Q3 results.

For the third quarter ended December 31, 2021, Route Mobile reported a 28.33% increase in consolidated profit at Rs 48.27 crore.

In the same period last year, the company earned Rs 37.62 crore in profit after tax. Revenue from operations increased to Rs 567.49 crore during the quarter from Rs 393.52 crore the previous year.

According to PTI, the company’s board of directors approved Rajdipkumar Gupta’s reappointment for a five-year term beginning May 1, 2022, with his current term expiring on April 30, 2022.

Route Mobile also declared a Rs.3 interim dividend per share.

Route Mobile provides cloud communications platform services to enterprises, over-the-top (OTT) players, and mobile network operators (MNO). Route Mobile’s portfolio includes messaging, voice, email, SMS filtering, analytics, and monetization solutions.

As of today’s date, this is the HT Media share price.

The stock rallied after the company reported its Q3FY22 results.

HT Media reported a nearly five-fold increase in its consolidated net profit for the third quarter ended December 2021, totaling Rs.51.23 crore.

According to a regulatory filing, the company made a net profit of Rs.10.33 crore during the previous fiscal’s October-December quarter. Its revenue from operations increased by 36.79 percent to Rs.466.13 crore in the current fiscal quarter, compared to Rs.340.74 crore in the previous fiscal period. HT Media’s total expenses were Rs.440.13 crore, up 16.20 percent from Rs.378.75 crore in Q3/FY 2021-22.

Commenting on the results HT Media Chairperson and Editorial Director Shobhana Bhartia stated that despite commodity price inflation, the company’s operating profit margins improved in the third quarter.

“The media sector performed well in the third quarter of this fiscal year, with an increase in advertising spends, particularly during the holiday season, which was much higher than the previous year’s. The working environment has continued to improve “she stated.

The impact of the economic recovery and a turnaround in advertiser sentiment is reflected in HT Media’s business performance.

Its revenue from the ‘Printing & publishing of newspapers & periodicals’ segment was Rs 396 crore, up 36.89% from Rs 289.27 crore in the previous period.

While revenue from “Radio broadcast & entertainment” increased 27.23% to Rs 34.48 crore, compared to Rs 27.10 crore in Q3/FY21. HT Media’s revenue from the ‘Digital’ segment increased 42.36 percent to Rs 36.19 crore, up from Rs 25.42 crore.

“Print (both English and Hindi publications), radio, and digital all experienced revenue growth on an annual and sequential basis. Revenue growth in our Print business has been driven by both strong advertising growth and improved circulation traction. Our Shine business is doing well, with an increase in recruitments “.

Read this interesting blog on 7 Steps to follow when Trading Breakout Stocks

As of today’s date, this is the Orient Bell share price.

The stock rallied after the company reported its Q3FY22 results.

The company reported total income of Rs. 184.95 crores for the fiscal year ended December 31, 2021, compared to Rs. 168.33 crores for the fiscal year ended September 30, 2021 and Rs.148.36 crores for the fiscal year ended December 31, 2020.

The company reported a net profit of Rs. 12.10 crores for the fiscal year ended December 31, 2021, compared to a net profit of Rs. 8.67 crores for the fiscal year ended September 30, 2021 and a net profit of Rs.7.53 crores for the fiscal year ended December 31, 2020.

According to the investor presentation, the Business Environment – Q3FY22 was as follows:-

Domestic Demand – Resilient in October, but relatively milder in November and December following price increases in the face of spiralling increases in gas and other input costs.

More stringent pollution controls are being implemented in the Delhi NCR beginning in late October, which will have an impact on construction activities in the region.

Overall, Q3 revenues increased year on year, with gains in both volumes and ASP.

Exports – The lack of available containers/higher ocean freights, as well as the closure of certain geographies following Covid’s resurgence, impacted trade.

New capacity additions, container freights, and energy costs development hereon, as well as demand sustenance following the partial lockdowns imposed by states recently amidst the 3 rd Covid wave, provide cues for Q4.

Orient Bell Ltd. is engaged in the manufacturing of ceramic tiles.

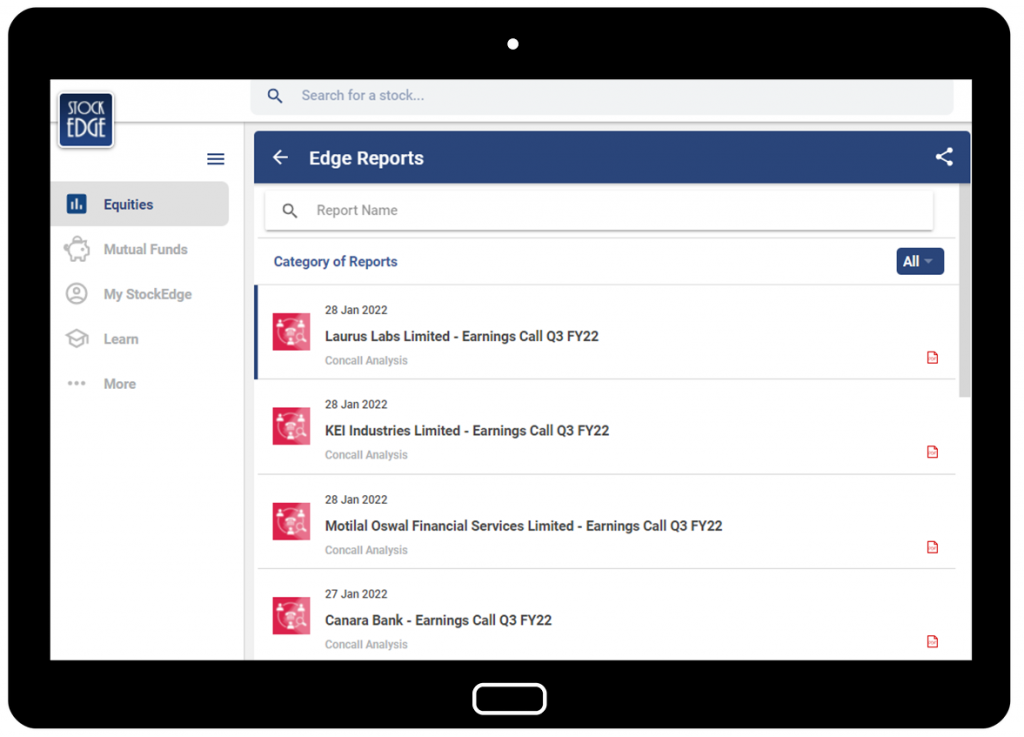

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company have been produced for only learning purposes. Since equity involves individual judgments, this analysis should be used only for learning enhancements and cannot be considered a recommendation on any stock or sector.