Check out the share trend of Godawari Power & Ispat Ltd.

Godawari Power & Ispat Ltd. – Highlights

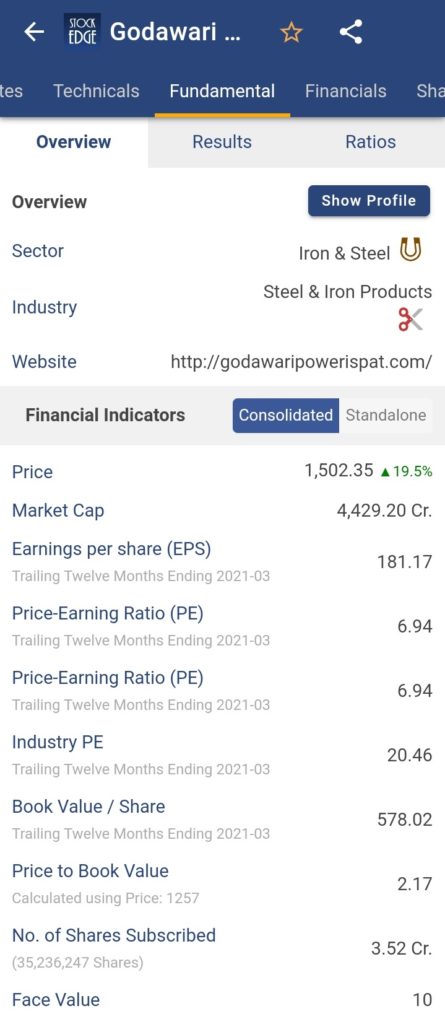

- The share price of Godawari Power & Ispat Ltd., was trading at Rs.1502.35, up by 19.52% hitting a 52-week high of Rs.1508.40 in today’s trading session.

- The stock price increased after the company’s shareholders approved a proposal to divest its stake in Godawari Green Energy (GGEL), a material subsidiary of the company.

- GGEL is a Special Purpose Vehicle (SPV) promoted by GPIL, with a fully diluted equity stake of 77.82 percent. The company was formed with the goal of establishing a solar power project under the Jawahar Nehru National Solar Mission (JNNSM) of the Government of India Phase -I launched by the Ministry of New and Renewable Energy (MNRE) through a designated nodal agency NTPC Vidyut Vyapar Nigam (NVVN) a Subsidiary of NTPC to address the country’s growing energy needs in an environmentally sustainable manner. GGEL has been operating a 1×50 MW Solar Thermal Power Plant in Village- Nokh, Tehsil- Pokhran, Dist- Jaisalmer, Rajasthan, since June 2013.

- On the 25th of May 2021, the company announced a multifold increase in consolidated net profit of Rs.304 crore for the quarter ended March 2021 (Q4FY21), owing primarily to higher revenues. In Q4FY20 quarter, it made a profit of Rs.34.22 crore. The company’s total income increased by 60% year on year to Rs.1,264 crore in the fourth quarter, up from Rs.788 crore in the same period last year.

- Meanwhile, the company announced that its board of directors has approved a proposal to build a captive solar PV power plant with a capacity of 250 MW in Raigarh District, Chhattisgarh, at a cost of Rs.750 crore. The project will be funded primarily through internal accruals. According to the company, the power generated in this project will be consumed captively in the company’s existing plant in Silatra Industrial Area, Raipur, and Chhattisgarh.

- In order to make a strategic investment and acquire distressed assets in the steel and metal sector, the board has also approved the use of its surplus funds up to Rs.200 crore to invest/grant loan/inter-corporate deposit or in any other form to asset reconstruction companies, distressed asset funds, and/or other corporate bodies.

- Since March 12, 2021, the stock has increased by 165% after the company received approval from the Chhattisgarh Environment Conservation Board, Raipur, for “consent to operate” the increased capacity of the iron ore pellet plant and consent to establish manufacturing facilities in other divisions.

- Incorporated in 1999, GPIL is a flagship company of Raipur-based Hira Group of Industries, which is an integrated steel manufacturer and is having dominant presence in the long product segment of the steel industry; mainly into mild steel wire. GPIL is an end-to-end manufacturer of mild steel wires. In the process, the company manufactures sponge iron, billets, Ferro alloys, captive power, wires rods (through subsidiary company), steel wires, Oxygen gas, fly ash brick and last but not the least pallets.

For more fundamental data and analysis, click on Godawari Power & Ispat Ltd.

Read our latest article on Divi’s Laboratories Ltd – Striving for leadership through chemistry

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company has been produced for only learning purpose. Since equity involves individual judgments, this analysis should be used for only learning enhancements and cannot be considered to be a recommendation on any stock or sector.

Excellent trending stocks.it would be more accurate, if it provided bit earlier, but still good attention.