Table of Contents

Key Takeaways

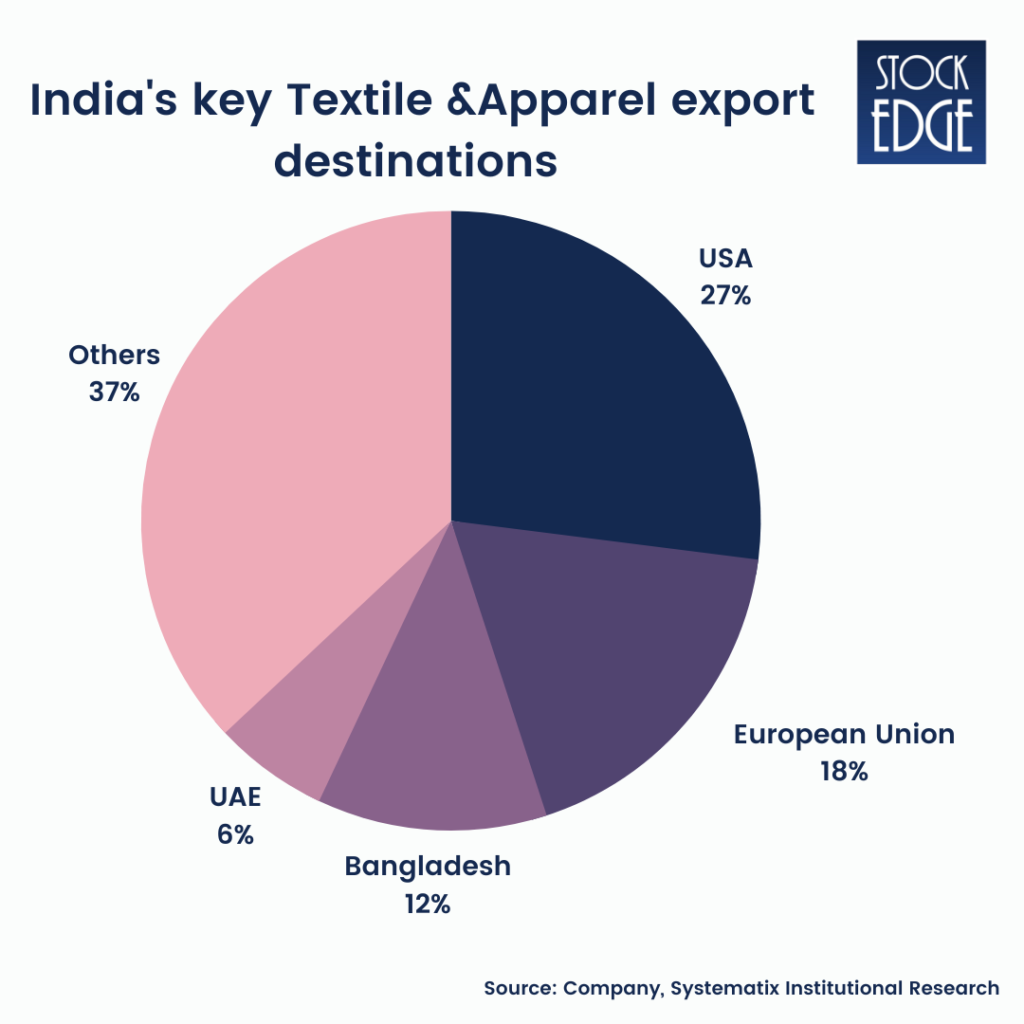

- India’s Textile Sector: India ranks among the world’s top textile producers, contributing significantly to exports and employment. The sector is poised for growth, bolstered by government initiatives and shifting global trade dynamics.

- Favorable Market Conditions: Factors such as the U.S. and China trade tensions and challenges in neighboring countries like Bangladesh present opportunities for Indian textile companies to expand their global footprint.

- Investment Considerations: When evaluating textile stocks, consider factors like raw material costs, export demand, government policies, and the company’s position in the value chain.

- Top Picks:

- Raymond Ltd.

- Vardhman Textiles Ltd.

- KPR Mill Ltd.

- Welspun Living Ltd.

- Arvind Ltd.

- Trident Ltd.

Textile trove: Threads, Textures & Attire

Indian textiles and clothing have been slaying the game for ages with their clinical craftsmanship and global appeal. Cotton, silk, and denim from India are all the rage worldwide, and thanks to the rise of Indian design skills, Indian fashion has been rocking it in the world’s fashion capitals.

With an extensive raw material and manufacturing base, India is the world’s second-largest exporter of textiles and clothing. As a result, the textile sector contributes significantly to the economy domestically and through exports, making it an attractive investment opportunity for those interested in textile stocks. It accounts for around 7% of industrial production, 2% of GDP, and 15% of total export revenues. In addition, the industry is one of the primary employment producers in the country, directly employing around 45 million people.

India’s garment business is worth one trillion rupees. Over 33% of its knitwear output and 20% of its woven-garment manufacturing are exported by volume. Around 25% of its garment output is exported, leaving 75% for home use.

The organized sector of the clothing industry accounts for around 20% of the entire industry, with a focus on exports. Most are limited companies, while the remainder is proprietary or partnership companies.

Overview of the textile industry in India

For over 5,000 years, Indian textiles have been famed for their fineness and mesmerizing colors, attracting people worldwide. India had various commercial contacts with the rest of the globe, and Indian materials were famous in antiquity. Throughout the early decades of the Christian period, Indian silk was fashionable in Rome. Cotton textiles 2 were also shipped to China during the silk route’s peak. Throughout the 13th century, silk cloths from south India were sold to Indonesia. Prior to the arrival of the Europeans in India, India exported printed cotton textiles called chintz to European nations and the Far East.

The Indian textile industry is divided into three sectors: a) mills, 2) handlooms, and 3) power looms. The mill sector is made up of around 1834 mills, including composite and spinning mills. There are approximately 35 lakh handlooms spread over India. The power loom sector comprises around 22.05 lakh power looms scattered among more than 5 lakh units.

Sector Analysis

The global textile market size is expected to grow from $530.97 billion in 2021 to $575.06 billion in 2022 at a compound annual growth rate (CAGR) of 8.3%. The textiles market is expected to grow to $760.21 billion in 2026 at a CAGR of 7.2%.

Increasing demand for online shopping is expected to drive the textile manufacturing market. Manufacturers can now sell their products on a larger platform than before, which will increase their customer base geographically, driving the growth of the textile manufacturing market. In countries such as India, for instance, e-commerce portals have boosted the sales of traditional garments by giving larger exposure to producers who were confined to one geography.

The textile industry in the Asia Pacific is expected to witness significant growth, owing to the thriving fashion and clothing industry in countries like India, China, and Vietnam, among others. Over the forecast period, the growing trade agreements between various countries to support the textile sector are likely to aid the market in the region. For instance, in India, 100% foreign direct investment (FDI) is allowed in the textile sector. Further, the market is expected to be augmented by the growing demand for medical textiles, especially after the COVID-19 pandemic. Asia Pacific was the largest region in the textile market in 2021. Western Europe was the second largest region in the textile market. Given these projections, textile stocks may be a lucrative investment opportunity for those looking to capitalize on the growth potential of the global textile industry. To perform an in-depth analysis of the textile sector, an effective stock market research tool is all that an investor needs.

Factors affecting textile stocks

Demand and supply

Domestic and foreign demand for textile goods can impact Indian fabric stocks while changes may act as volume shockers and might affect the stock values of textile companies. Similarly, any disruptions in the supply chain might influence output and, as a result, stock prices.

Prices of raw materials

The cost of raw materials such as cotton, silk, jute, and polyester may have a considerable influence on the textile business. Any changes in the pricing of these raw materials might affect the cost of manufacturing and hence the profitability of textile stocks.

Labor cost

Labor costs are crucial to the textile industry’s manufacturing costs. Any changes in labor costs, such as a rise in minimum wages, can influence the profitability of textile companies, affecting textile stocks in India.

Government policies

Government policies such as taxes, import-export laws, subsidies, and incentives may all have a substantial influence on the textile business. Any modifications in these rules may impact India’s textile stocks.

Competition

The rivalry in the textile business might impact textile stocks in India. The introduction of new companies or the advent of new technologies can influence the profitability of existing players, which can affect stock prices.

An advantage for Sector

Policy Support

- In the Indian textile sector, 100% FDI (automatic route) is permitted.

- The entire budget for the textile sector in the Union Budget 2022-23 was Rs. 12,382 crores (US$ 1.62 billion). In addition, the Textile Cluster Development Scheme receives Rs. 133.83 crore (US$ 17.5 million), the National Technical Textiles Mission receives Rs. 100 crore (US$ 13.07 million), and the PM Mega Integrated Textile Region and Apparel Parks Program receives Rs. 15 crore (US$ 1.96 million).

- The government authorized a PLI program of Rs. 4,445 crores (US$ 594.26 million) in October 2021 to build seven integrated mega textile parks and increase the textile industry in the country which could potentially impact the performance of textile stocks.

Increasing Investments

- The government created many programs, such as the Technology Upgradation Fund Scheme (TUFS), Scheme for Integrated Textile Parks (SITP), and Mega Integrated Textile Region and Apparel (MITRA) Park scheme, to attract private equity (PE) and employ more people, having a positive effect on textile stocks.

- From April 2000 to December 2021, total FDI inflows into the textiles sector were $3.93 billion, indicating the potential impact on the performance of textile stocks.

Robust Demand

- The Indian technical textiles industry is predicted to grow to $23.3 billion by 2027, owing to greater product awareness and higher disposable incomes.

- Cotton production in India is expected to grow to 7.2 million tons (43 million bales of 170 kg each) by 2030, owing to rising consumer demand.

Top textile stocks in India

Trident Ltd

Company overview

Trident Ltd. is one of the textile stocks to look after in the industry. Trident Ltd is the flagship company of Trident Group, an Indian commercial conglomerate and worldwide player based in Ludhiana, Punjab, with a market capitalization of over USD 3 billion. As of today, this is Trident share price

The business has evolved into a global textile powerhouse thanks to the innovative leadership of its founder chairman, Mr. Rajinder Gupta, a first-generation entrepreneur. Trident Limited manufactures yarn, household linen, paper made from wheat straw, chemicals, and captive electricity.

The company boasts cutting-edge production facilities in Barnala (Punjab) and Budni (Madhya Pradesh) and diverse customers from more than 150 countries. The corporation has two subsidiaries as of March 31, 2022: Trident Global Corp Limited, its wholly-owned Indian subsidiary, and Trident Europe Ltd, its wholly-owned international subsidiary.

Trident Global Corp Ltd. primarily functions as the company’s retail arm. It is the company’s public face in the home market. On the other hand, Trident Europe Ltd gives access to European markets and strengthens the company’s brand.

The company entered the bed linen sector in 2016 by opening a Budni, Madhya Pradesh plant. Investors looking for fabric stocks with a global presence and a strong reputation should take note of Trident Ltd, the organization has a global presence in over 150 countries, with marketing offices in Chandigarh, Bhopal, Gurugram, New Delhi, and Mumbai, as well as international operations in New York, the USA, Dubai, and the United Kingdom.

To maintain the pace of its rapid expansion, the company established ‘Vision 2025’, a plan for synchronizing Group activities to strengthen its positioning across all business verticals.

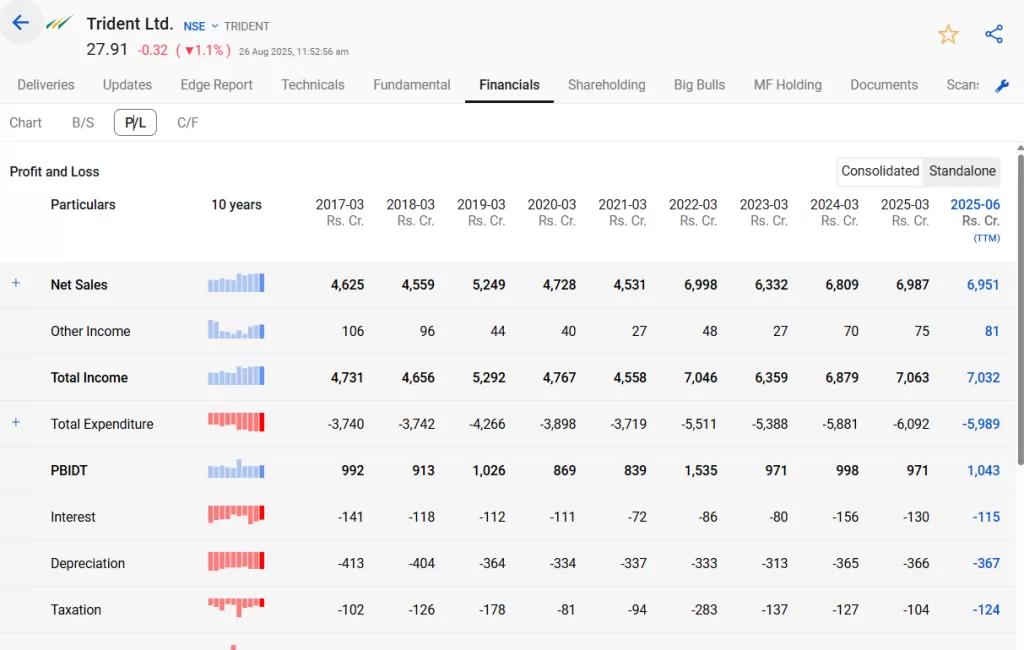

Financial performance

Trident Ltd. has shown steady revenue growth over the years, with net sales rising from around ₹4,600 Cr in FY17 to nearly ₹7,000 Cr in FY25 (TTM ~₹6,951 Cr). However, profitability has remained under pressure due to rising expenditures, interest, and depreciation costs, keeping PBIDT largely range-bound. While the topline is stable, margin expansion appears limited, highlighting the need for efficiency improvements to drive long-term earnings growth.

To get more financial insights and know the Trident Ltd. share price, go to web.stockedge.com

Indo Count Industries Ltd

Company overview

Indo Count Industries Ltd (ICIL) is another textile sector stock to look after. It is a company that manufactures home textiles and bedding. In addition, the Company produces and exports bed sheets, bed linen, and blankets. The Company has made 17 brands, each with its characteristics. Existing brands include Sleep. RX. Layers, Holistic, Kids Corner, Color Sense, and a few more; new brands include Maximix, Hotel at home, and Flip. As of today, this is Indo Count Industries share price

The Company exports to over 50 countries across five continents and plans to expand its geographical reach. On a Slump Sale basis, the Company bought GHCL Limited’s Home Textile Business, comprising its 45 million meter production plant in Bhilad, Gujarat. With this acquisition, it has become one of the world’s largest makers of Home Textile bedding, with an annual capacity of 153 million meters.

The Company collaborated with the UK brand Jasper Conran to create a unique bed and bath set. The first collection was released on March 22. The collection is sold globally only via Indo Count under the Jasper Conran London brand. The collaboration will help realize the long-term goal of becoming the Conran Shop for home textiles worldwide and it is a high value among textile stocks.

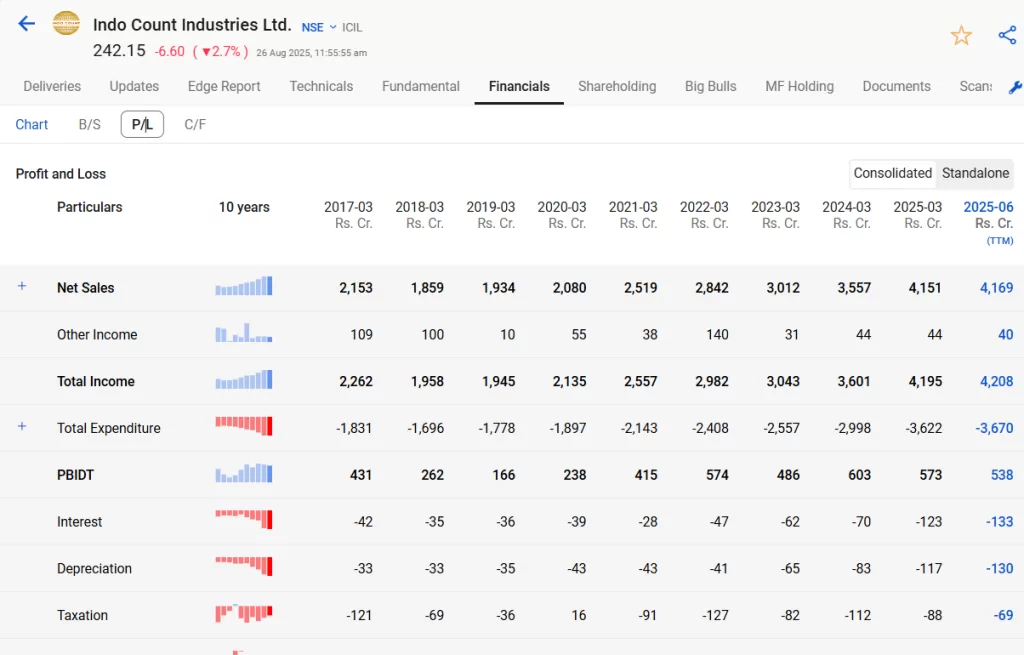

Financial performance

Indo Count has shown consistent revenue growth, with net sales rising from ~₹2,153 Cr in FY17 to over ₹4,100 Cr in FY25 (TTM ~₹4,169 Cr). Profitability has improved compared to earlier years, though operating margins remain under pressure due to rising expenses and higher interest & depreciation costs. Overall, the company reflects steady topline expansion but needs tighter cost control to strengthen bottom-line growth.

To get more financial insights and know the Indo Count Industries Ltd share price, go to web.stockedge.com.

Gokaldas Exports Ltd

Company overview

Gokaldas Exports Ltd is another textile stock that operates in the textile industry. They design, manufacture, and sell a wide range of clothes for men, women, and children and serve the demands of various prominent worldwide fashion brands and stores. The company sells clothing for all climates and seasons, including outerwear, activity, and stylish wear. As of today, this is Gokaldas Exports share price

Customers and suppliers have long-standing ties with the organization. Customers include some of North America and Europe’s most well-known worldwide fashion stores. In addition, it serves a diverse international clientele, with the top ten customers accounting for almost 90% of sales in fiscal 2022. For the fiscal year 2021-22, the corporation established three owned subsidiary companies to handle its expansion strategy, the corporation established three owned subsidiary companies to handle its expansion strategy and strengthen its position among other textile stocks.

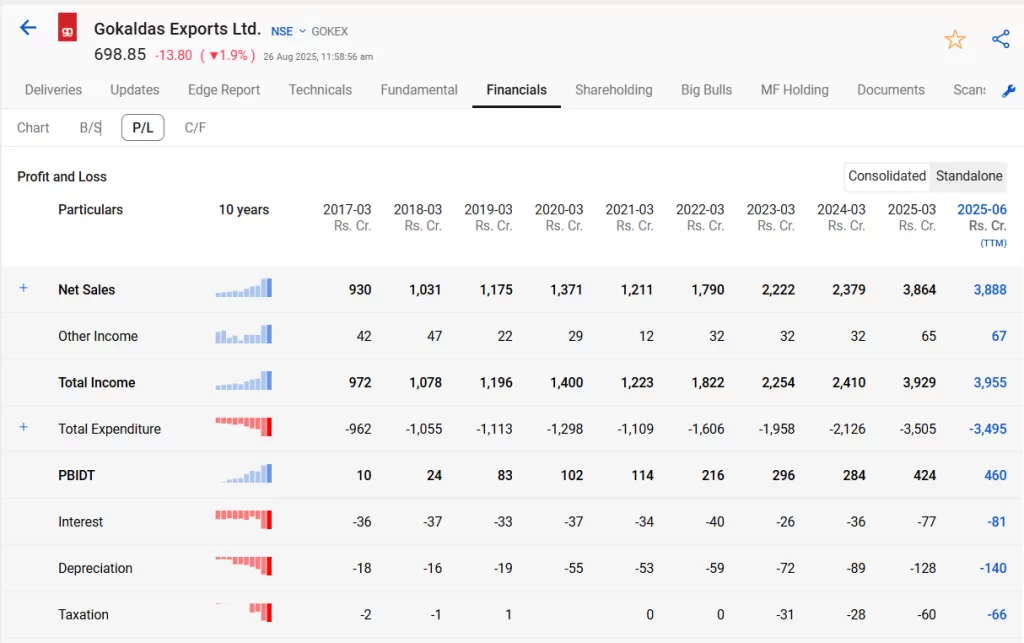

Financial performance

Indo Count Industries has delivered steady revenue growth, with sales nearly doubling from around ₹2,100 crore in FY17 to over ₹4,100 crore in FY25 (TTM). However, while the topline has expanded consistently, margins have faced pressure due to higher operating costs, interest expenses, and depreciation. Profitability has improved from earlier years but remains volatile, highlighting the need for tighter cost control to translate strong sales into sustainable bottom-line growth.

To get more financial insights and know the Gokaldas Exports Ltd share price, go to web.stockedge.com

Ambika Cotton Mills Ltd

Company overview

Ambika Cotton Mills Ltd (ACML), situated in Coimbatore, Southern India, produces top-grade Compact and Elitwist cotton yarn for hosiery and weaving, as it one of the best in the list of textile stocks. They are a well-established participant in the international and local yarn markets, with exports accounting for around 60% of total revenue. The company was established in 1988 and had five production plants in Dindigul, Tamil Nadu, with a combined spindle capacity of 1,08,288 compact spinning and knitting spindles. As of today, this is Ambika Cotton Mills share price

Ambika Cotton Mills has the unusual distinction of being the market leader in the shirting industry and is the chosen client of all high-quality shirt makers worldwide. Because of their flawless track record of product quality and delivery fulfillment, they have a highly distinct section in the business.

They have also installed clean wind power to meet 100% of their electricity needs (27.4 MW).

They provide 100% cotton Compact yarn counts ranging from 20s to 120s combed for producing luxury branded shirts and t-shirts worldwide. Ambika’s yarn has been highly acknowledged and praised by the top shirt and knitted garment producers locally and globally. It is well-known for its contamination-free 100% cotton ring spun & compact yarn explicitly designed for shirting and is a valuable addition to textile stocks.

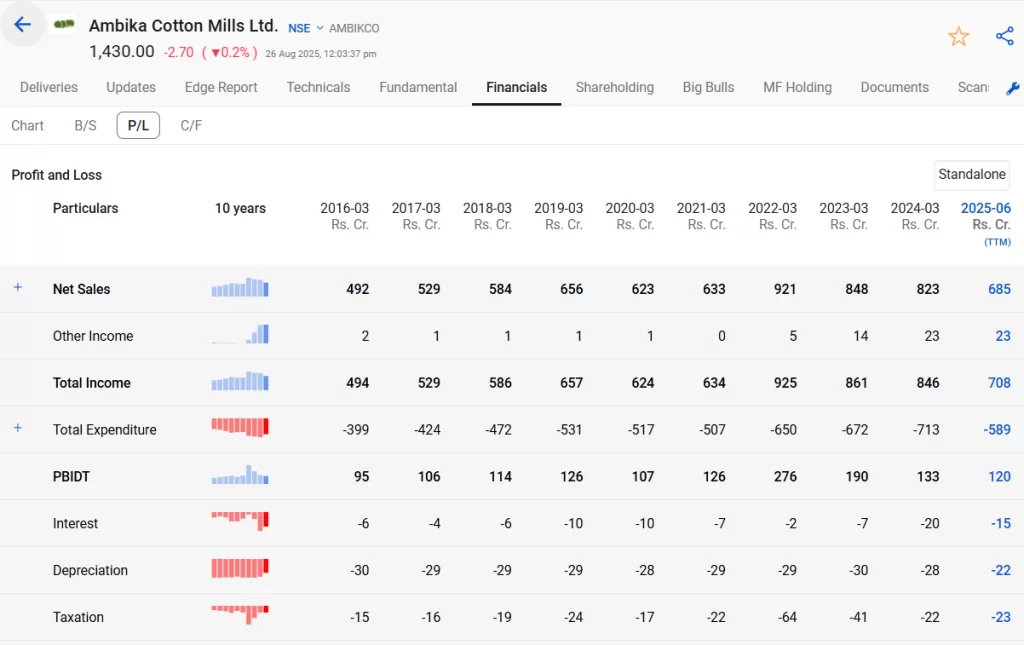

Financial performance

Ambika Cotton Mills has shown a mixed financial performance over the last 10 years. Net sales grew steadily from ₹492 Cr in FY16 to a peak of ₹921 Cr in FY22, but have since declined to ₹685 Cr (TTM FY25). Other income has risen sharply in recent years, supporting total income at ₹708 Cr in FY25 TTM. Expenditure has increased in line with revenues, keeping margins under pressure.

PBIDT rose strongly to ₹276 Cr in FY22 but has weakened to ₹120 Cr in FY25 TTM, reflecting a contraction in profitability. Interest and depreciation remain relatively stable, while taxation fluctuates with earnings. Overall, the company enjoyed strong growth till FY22, but recent years indicate a slowdown with shrinking margins and pressure on operating performance.

To get more financial insights and know the Ambika Cotton Mills Ltd share price, go to web.stockedge.com.

Nitin Spinners Ltd

Company overview

Nitin Spinners is a textile stock that operates in the textile industry. It was founded in 1992 in Bhilwara with a limited capacity of 384 rotors and has since expanded its activities to include open-end yarns, ring-spun yarns, mixed yarns, knitted textiles, and completed woven fabrics. It presently has a capacity of 3,07,344 spindles and 3,488 rotors and can produce 75,000 tons of yarn per year. It also has 63 Knitting Machines installed, capable of producing 8,500 tons of knitted textiles per year, as well as 168 looms with dyeing, printing, and finishing facilities capable of producing roughly 300 lakh meters of fabrics per year. The Company’s production operations are strategically positioned near the raw material suppliers. It also has good access to major ports and marketplaces. As of today, this is Nitin Spinners share price

Investing in world-class technology, continual expansion and value addition, commitment to consistent product quality, attention on customer happiness, and prompt product delivery are all essential components of the Company’s operation, therefore, investing in Nitin Spinners is a good option for those interested in the textile stocks market.

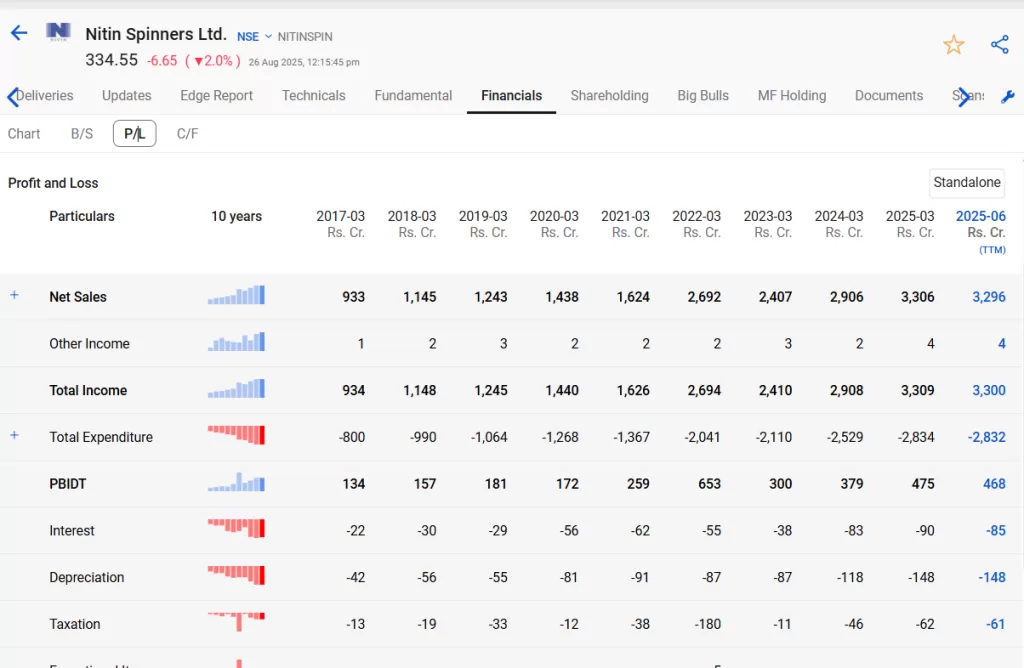

Financial performance

Nitin Spinners has delivered strong growth over the last decade, with net sales rising from ₹933 Cr in FY17 to about ₹3,296 Cr in FY25 (TTM). Total income mirrors this trend, touching ₹3,300 Cr. Expenditure has also grown significantly, but PBIDT expanded from ₹134 Cr in FY17 to ₹468 Cr in FY25 TTM, showing healthy operating performance despite cost pressures. Interest and depreciation remain on the higher side due to debt and capex, while taxation varies with profitability. Overall, the company has shown consistent revenue growth with improving scale, though margins are affected by rising finance and depreciation costs.

To get more financial insights and know the Nitin Spinners Ltd share price, go to web.stockedge.com.

A. REASON TO INVEST IN THE APPAREL INDUSTRY

- Under Made in India, the Government of India seeks to establish a viable plan to develop a supportive ecosystem for the growth of the Textiles Engineering Industry in India and fulfill 75% of domestic demand by 2026-27.

- India’s textile sector is one of the largest employers and is on course to become the largest exporter.

- The government has sanctioned the establishment of seven Apparel Parks and Mega Integrated Textile Regions with a total investment of INR 4,445 crore over five years to attract cutting-edge technology and enhance FDI and domestic investment in the sector.

- PM MITRA Parks will provide an integrated textiles value chain from spinning, weaving, processing/dyeing, and printing through garment manufacture in a single site, lowering shipping costs.

- The following government policies are favorable and provide attractive incentives to the manufacturers

- Amended Technology Upgradation Fund Scheme (ATUFS)

- Scheme for Integrated Textile Parks (SITP)

- Integrated Skill Development Scheme (ISDS)

- Technology Mission on Technical Textiles (TMTT)

- Swarnjayanti Gram Swarozgar Yojana (SGSY)

Conclusion

The textile business is essential to the world economy, influencing everything from fashion to home design. This business has grown significantly over the years, owing to causes such as global population expansion, urbanization, and rising disposable income levels. With these trends expected to continue, the textile sector is anticipated to expand more in the following years which would eventually the textile stocks.

Investors interested in the textile sector will discover several chances in companies dedicated to innovation and sustainability. These businesses are well-positioned to capitalize on the rising demand for environmentally friendly products, which will likely rise in the future. Yet, before making an investment choice, examining market trends and industry competitiveness is critical. Businesses that can distinguish themselves in product quality, innovation, and sustainability are more likely to succeed in the long run.

Another crucial factor to consider when investing in the textile sector is the company’s financial condition. While sustainability and innovation are essential, investors must also ensure that the company they are investing in has a sound financial track record and is well-positioned to weather any economic downturns.

Finally, the textile business offers several prospects for investors ready to evaluate market trends and competition thoroughly. Given the growing demand for sustainable products and the increased emphasis on innovation, companies that can differentiate themselves in these areas will likely be the most successful in the long run. When making an investment decision in textile stocks, like with any other, it is critically important to conduct due diligence and thoroughly analyze the company’s financial stability in textile stocks.

Very nice analysis and observations on Textile Industries

Good article

excellent coverage

good analysis

Good information about companies and their performance