Table of Contents

Key Takeaways

- Blue-Chip Stocks Overview: Blue-chip stocks are well-established, financially sound companies with consistent earnings, strong brand recognition, and a history of paying dividends. They are ideal for long-term investors seeking stability and moderate, reliable returns.

- Strengths of These Stocks: These blue-chip stocks are known for their solid financials, leadership in core industries, steady dividend payouts, and ability to weather economic downturns. They provide a strong foundation for any long-term investment portfolio.

- Investment Strategy Tips: Investors are advised to diversify across sectors, monitor quarterly performances, and consider valuations before entry. Investing through index-based ETFs or SIPs is suggested for reduced risk and simplified tracking.

- Long-Term Value Proposition: While blue-chip stocks may offer slower capital appreciation compared to small or mid-caps, they provide safety, consistency, and compounding benefits over time. They remain a reliable choice for conservative investors aiming for wealth preservation and steady growth.

- Top Picks:

- Reliance Industries

- TCS

- HDFC Bank

- ICICI Bank

- ITC

The phrase “blue chip” comes from the poker card game. The most basic poker chip sets consist of three colors: white, red, and blue. According to American custom, blue chips are the most valuable among the other chips played in the game.

What are Blue Chip Stocks?

High-priced market equities, known as blue chip stocks, have recently been popular among investors. The corporations that issue blue chip stocks are held in high regard in the stock market and often have a solid track record of financial stability and reputation.

In addition to their reputation, these businesses’ excellent dividend payout policies can be responsible for the stock’s rising appeal. However, people should arm themselves with crucial facts before investing in blue chip stocks.

Blue chip stocks are those of large-cap businesses or those with a high market capitalization. Companies that issue blue chip stocks are well-established and have a solid reputation in the market due to past track records in wealth creation, corporate governance, profitability, execution, etc. It is very important to analyze the market with the help of an efficient stock market analysis app for making more informed investment-related decisions.

Key factors to look at before investing in Blue Chip Stocks

Financial performance of the company

Before investing in a blue chip stock, research the company’s financial performance, including revenue growth, profit margins, debt-to-equity ratio, return on equity, return on capital employed, and profits per share. This will provide information on the company’s financial health and potential to make profits.

Industry forecast

It is also vital to analyze the company’s outlook, particularly when considering investments in blue chip stocks. Competition, the regulatory environment, technical advancements, and macroeconomic conditions can influence the company’s performance and affect the long-term stability of blue chip stocks.

Management team

When considering investments in blue chip stocks, evaluating the management team’s experience, track record, and growth strategy is essential as the management team is critical to the success of the company.

Valuation

Blue chip stock prices should be analyzed concerning the company’s profits and growth potential. Even if it is blue chip stocks, it is critical to avoid overpaying for it.

Dividend history

Many blue chip stocks pay dividends to their shareholders. While making an investment selection, it is critical to evaluate the company’s dividend history and dividend yield.

Long-term investing horizon

Blue chip stocks necessitate a long-term investment horizon. It is critical to maintaining patience and not be misled by short-term market volatility.

ROCE

Return on Capital Employed (ROCE) is a financial measurement that compares a company’s profitability to the capital invested in the organization. When investing in blue chip stocks, consider ROCE while analyzing a company’s financial health. When calculating a company’s ROCE, it’s critical to consider the industry in which it works. Because typical ROCE values vary by sector, comparing a company’s ROCE to its rivals within the same industry is essential.

Mindset before Investing

Before investing in any kind of securities, one should thoroughly research the securities in question.

Before investing in blue chip stocks, One should have a strong belief in the company and faith in the management because the time horizon for these investments is long-term (Buy and Hold). These shares have very little volatility as they have a long track record and have survived many business cycles.

One cannot anticipate that TCS or Reliance will cease operations tomorrow, but it’s doable, just like with Satyam Computer.

Top 5 Blue Chip stocks to look upon

Below is the list of top 5 Blue chip stocks:

Let’s look at the Financial overview of the top 5 blue chip stocks in India

Tata Consultancy Services Ltd

As a leading member of the Tata group and a renowned blue chip stock. For over 50 years, it has partnered with many of the world’s leading enterprises on their transformation journeys through IT services, consulting, and business solutions. TCS provides a comprehensive portfolio of business, technology, and engineering services and solutions headed by consulting.

Financial

TCS reported a slight sequential decline in revenue with net sales at ₹63,437 crore in Q1 FY26, compared to ₹64,479 crore in the previous quarter, indicating a decline of 1.6% QoQ, likely reflecting seasonal weakness or project delays.

Despite this, expenditure also declined marginally to ₹46,562 crore from ₹47,499 crore, providing some cushion to margins. EBITDA came in at ₹16,875 crore, slightly down from ₹16,980 crore, but relatively stable, indicating efficient cost control.

A highlight this quarter was the sharp rise in other income, which increased to ₹1,660 crore from ₹1,028 crore—up by over 61% QoQ, likely driven by higher treasury gains or forex movement.

Depreciation and interest costs remained largely in line with the trend. As a result, Profit Before Tax (PBT) rose to ₹16,979 crore, up 3.5% from ₹16,402 crore in March 2025, showing improvement despite revenue softness.

ICICI Bank

ICICI Bank is a prominent private sector bank in India that provides various financial goods and services to individuals, small and medium-sized businesses, and corporations. The bank has many branches, ATMs, and other contact points.

With 5,614 branches and 13,254 ATMs across the country, ICICI Bank is India’s second-largest private sector bank. And has approximately 51% of its branches in semi-urban and rural regions. This combination of extensive reach and diverse offerings has made ICICI Bank a popular choice among investors looking for blue chip stocks.

Financial

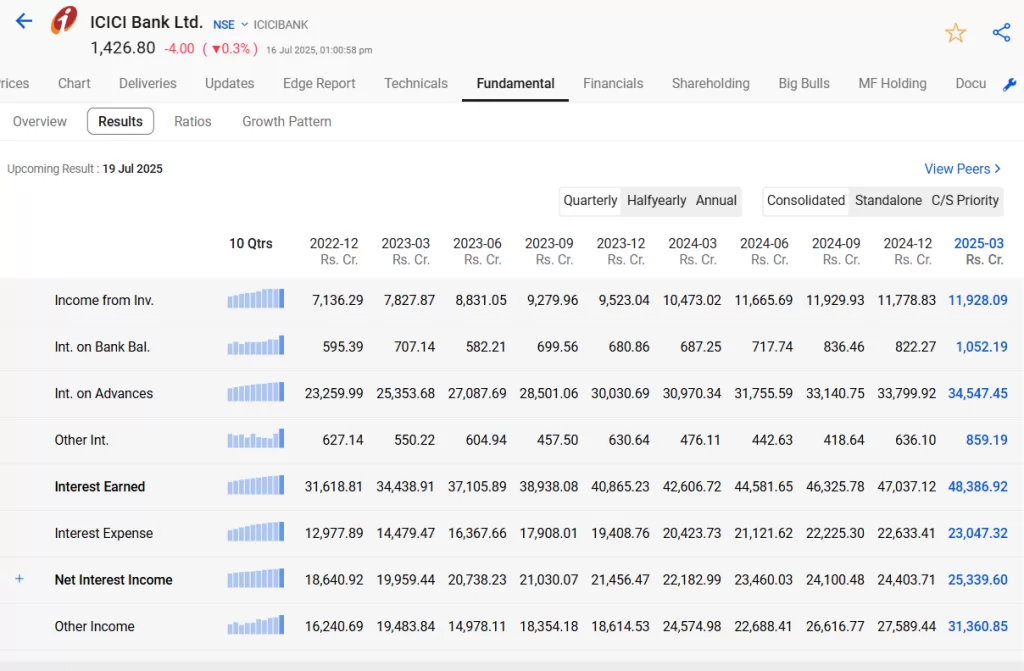

ICICI Bank posted a strong performance in Q4 FY25, with interest earned rising to ₹48,386.92 crore, up from ₹47,037.12 crore in the previous quarter—a 3% sequential growth, driven by higher yields on loans and investment income. The interest on advances rose to ₹34,547.45 crore, and income from investments stood at ₹11,928.09 crore, both reflecting steady credit growth and treasury gains.

Meanwhile, interest expense rose marginally to ₹23,047.32 crore from ₹22,633.41 crore, keeping the pressure on spreads limited. As a result, Net Interest Income (NII) increased to ₹25,339.60 crore, compared to ₹24,403.71 crore in the prior quarter. In addition, other income jumped significantly to ₹31,360.85 crore from ₹27,589.44 crore, suggesting strong fee-based earnings, possibly from retail banking, forex, or investment gains.

Eicher Motors Ltd

Eicher Motors Limited, founded in 1982, is the listed corporation of the Eicher Group in India, a significant participant in the Indian vehicle industry, and the world’s top manufacturer of middleweight motorcycles. EML is a blue chip stock listed company of the Eicher Group in India. The company also has a joint venture with Sweden’s AB Volvo named Volvo Eicher Commercial Vehicles Limited (VECV).

Financial

Eicher Motors delivered a robust set of numbers in Q4 FY25, with Net Sales rising to ₹5,241.11 crore, the highest in the last 10 quarters and up 5.4% QoQ from ₹4,973.12 crore. This growth reflects strong demand for its vehicles and a healthy volume mix. Total expenditure also increased to ₹3,983.42 crore, up from ₹3,771.93 crore, but remained under control relative to revenue growth, supporting operating margins.

EBITDA for the quarter stood at ₹1,257.69 crore, up from ₹1,201.19 crore in the previous quarter, showing operational efficiency and consistent cost management. Additionally, Other Income increased sharply to ₹380.39 crore, the highest in the last 10 quarters, adding significantly to profitability.

On the cost side, depreciation and interest expenses rose slightly to ₹201.37 crore and ₹15.54 crore, respectively, but remained well within manageable levels. Profit Before Tax (PBT) surged to ₹1,421.17 crore, compared to ₹1,297.31 crore in the December quarter, reflecting a 9.5% QoQ growth.

Bajaj Finserv Ltd

Bajaj Finserv Ltd. is a well-established player in the financial services industry and can be considered as one of the top blue chip stocks in the market. It provides asset acquisition solutions through financing, general insurance, family and income protection through life and health insurance, and retirement and savings solutions to millions of consumers.

Financial

In the latest quarter ending March 2025, Bajaj Finserv Ltd. reported a strong performance with net sales rising to ₹36,595.36 crore, a sharp 14% increase over the previous quarter. However, this growth was accompanied by a significant rise in expenditure, which climbed to ₹23,867.86 crore, indicating higher operational costs.

Despite the cost pressures, the company managed to post an EBITDA of ₹12,727.50 crore, up slightly from ₹12,373.18 crore in the previous quarter. Interest expenses also rose to ₹6,395.79 crore, reflecting increased borrowing costs.

Depreciation saw a steady rise to ₹339.49 crore, possibly due to continued asset additions or capital investments. Overall, the company delivered a healthy Profit Before Tax (PBT) of ₹5,993.29 crore, showing a modest growth from ₹5,808.41 crore last quarter. While top-line growth remains strong, the narrowing gap between revenue and profit suggests rising costs could be a key factor to monitor in the coming quarters.

Asian Paints Ltd

Established in 1942, the Asian Paints group is one of India’s most reputable blue chip stocks and the largest paint company in the country, producing varnishes, enamels, lacquers, surface preparation, organic composite solvents, and thinners. It operates in 15 countries and 26 paint production plants worldwide, supplying customers in over 60 nations.

Financial

In the latest quarter ending March 2025, Asian Paints Ltd. reported net sales of ₹8,358.91 crore, showing a marginal decline from ₹8,549.44 crore in the previous quarter, indicating some pressure on revenue. Expenditure dropped to ₹6,922.71 crore from ₹6,912.71 crore, remaining nearly flat, suggesting controlled costs.

However, EBITDA slipped significantly to ₹1,436.20 crore from ₹1,636.73 crore, reflecting a contraction in operating margins. Depreciation rose to ₹301.10 crore and interest expenses were ₹52.79 crore, both relatively stable but slightly higher compared to previous quarters. Notably, the company reported an exceptional loss of ₹182.96 crore, which impacted its profitability.

As a result, Profit Before Tax (PBT) fell sharply to ₹999.20 crore from ₹1,468.34 crore in the prior quarter. Overall, while costs remained stable, a dip in sales, reduced operating profit, and one-time exceptional items dragged down the company’s bottom line this quarter.

Alternative Way to Invest

Investing in blue chip stocks, which are large-cap stocks with strong fundamentals and track records, is a popular option for investors seeking stable returns. However these large-cap stocks typically trade at a premium due to their strong fundamentals and track records, and blue chip stocks are also constituents of the Nifty 50 Index. Holding these large-cap shares in substantial volumes is nearly hard for retail investors.

One alternative for blue chip stocks can be to invest in ETFs (Exchange Traded Funds) or Mutual Funds of the index. The only negative is that the investment will be spread among multiple companies. For example, the sum invested in the Nifty 50 index fund will include India’s top 50 companies. This will lead to over-diversification. Before investing in any AMC, one must also consider tracking error and expense ratios. So Invest in those AMC with a minor expense ratio, tracking error, and good track record.

Rationale

Because of their moderate volatility, these large-size stocks are ideal for a peaceful investment. Apart from capital appreciation of the stocks, these large-cap stocks also had an excellent Dividend Payout ratio. Therefore provides a steady cash flow to an investor as an additional income. These equities are also included in the Nifty 50 Index. These firms have weathered multiple business cycles and are the market leaders in their respective fields.

However, as with such companies, various risks are associated, such as volatility in raw material prices, the slowdown in the economy, etc. which can impact the Company’s performance.

Until then, keep an eye out for the next blog on “Stock Insights.” Also, please share it with your friends and family.

Happy Investing!

Best information is given by you.

And

Thanks for Vivek sir

good suggestion given

quite informative for small investors ,keep it up

best crispy information given…

appreciate yr inputs

best crispy information given…

appreciate yr inputs