Table of Contents

Today we are going to talk about Tata Motors, which is a leading player in the EV industry, with more than 70% market share, and is at the forefront of indigenous EV efforts, with green vehicles expected to account for 20% of total sales in the next 4-5 years. Tata Motors has been developing a range of affordable electric vehicles as part of its electrification strategy. It has set out on this journey with a vengeance, not only to catch up but also to get ahead of its competitors. As of today’s date, this is Tata Motors’ share price.

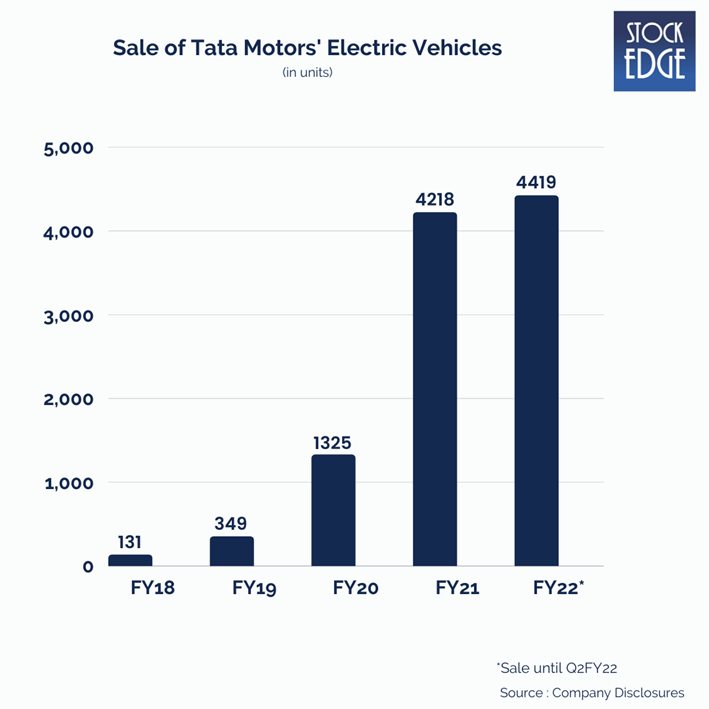

And the results are quite clear! It established itself as a frontrunner in the EV space, a journey that began three years ago with R&D assistance from Jaguar Land Rover.

The EV Journey of Tata Motors

The journey for Tata Motors began in 2017 when it forayed into the EV business. That same year, the government-owned Energy Efficiency Services Ltd. (EESL) chose Tata as the winner for a contract to sell 10,000 EVs to the government.

This gave an anchor opportunity to the company. The journey of electrification taught the company the importance of gaining real-world experience, putting them to real use, and the challenges of the working environment.

As Tata’s vehicles began to hit the road, the company gained a good understanding of the real-world conditions for an electric vehicle.

In 2019, the government announced a policy, which encouraged faster adoption of electric and hybrid vehicles by providing upfront incentives for EV purchases.

This gave the company to advance early in the EV game by developing skill sets, rebranding itself, and driving demand in the personal segment.

What has worked for Tata Motors?

The Tata Tigor EV, which has a range of 213 kilometers on a single charge and costs approximately Rs 9.5 lakhs, was the company’s first offering in the PV segment. The older Tigor EV had a range of 142 kilometers but was primarily sold to EESL.

The company conducted survey’s and with the help of it, they came to know that the minimum range that a customer is looking for to avoid range anxiety is 200 kilometers that means a certified range must exceed 300 kilometers or so, At the same time, the customer is unwilling to pay more than a 25% premium. That meant the Nexon, which cost between Rs 7 lakh and Rs 12 lakh, was the company’s best bet.

On the other hand, Tata Motors was prepared for a masterstroke by 2020. The electric variant of the wildly popular Tata Nexon, priced around Rs.14 lakhs and with a range of more than 300 kilometers, was released by the company.

The Nexon was one of the company’s best-selling models, and the EV gave the company a chance to see how the market worked.

The strategy to price its electric vehicles at a 15-20% premium over conventional petrol/diesel engines worked very well for the company.

Between July and September, Tata Motors’ sales increased by a whopping 50%, thanks largely to a 193% increase in the company’s electric vehicle (EV) portfolio, which includes the popular Nexon EV and Tata Tigor EV. It sold 2,700 EVs during that time period, up from 900 units the previous year.

And, last month, the company’s subsidiary became India’s most valuable EV Company after raising $1 billion from private equity firm TPG Rise Climate.

The transaction is worth more than $9 billion for the yet-to-be-operational subsidiary, with the capital infusion expected in March of next year. In addition, over the next five years, Tata Motors will invest $2 billion in the subsidiary.

The company has a competitive advantage due to the high quality of its vehicles and assurances such as an 8-year (or 1.6 lakh km) warranty on the battery and motor.

Another factor that has aided the Tata Motors EV is the ease of charging with a 15 amp switch in the comfort of your own home.

Taking advantage of group company synergies

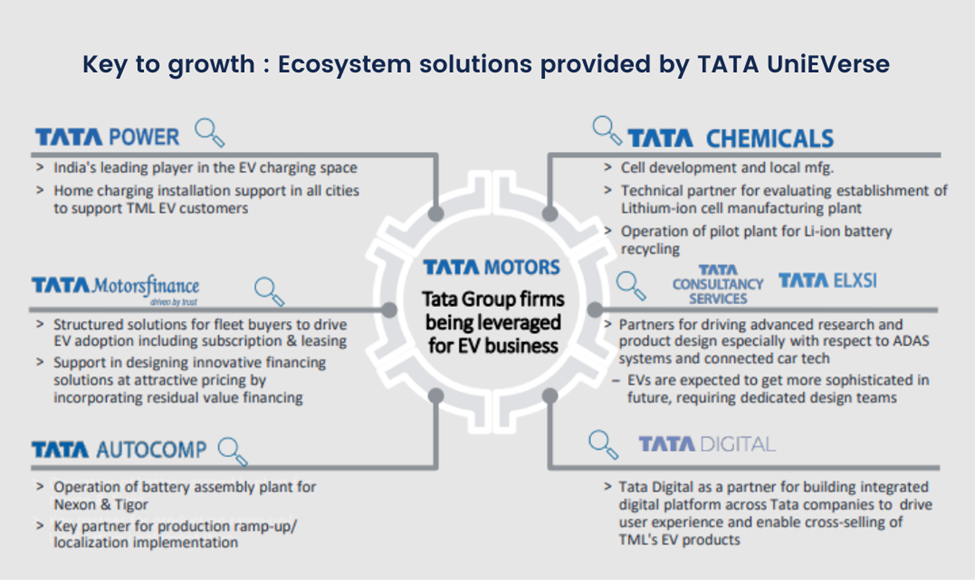

As part of Tata’s plan to increase adoption, the company has created Tata UniEVerse, an ecosystem that will leverage group synergies and will bring together several Tata companies to provide EV solutions to consumers.

So, it collaborated with Tata Power to provide end-to-end charging solutions for the home, workplace, captive, and public charging.

As part of this collaboration, the company has installed fast-charging stations in metros such as Mumbai, Delhi, Pune, Bengaluru, and Hyderabad, in addition to chargers on highways.

So far, Tata Power has installed 1,000 EV charging stations in 180 cities across India. In addition, every Nexon EV sold comes with a free home-charging solution. As of today’s date, this is Tata Power share price.

In addition to looking into active chemical manufacturing and battery recycling, the company has partnered with Tata Chemicals in its effort to build a component supplier ecosystem and manufacture lithium-ion battery cells. As of today’s date, this is Tata Chemicals share price.

The EV industry in India is in its early stages, but it is expected to grow rapidly in the future due to the introduction of more affordable EVs, the expansion of charging infrastructure, the closing of the price gap between conventional and electric vehicles, and inherent cost savings in operating and maintenance.

Meanwhile, the company is betting on more than just passenger vehicles to drive the change.

The commercial vehicle division, which includes buses, trucks, and light commercial vehicles, is also beginning to electrify.

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans.

Tata Motors will launch an electric vehicle to fill the gap in last-mile delivery

Encouraged by the demand for electric vehicles in the last-mile delivery segment, Tata Motors plans to launch an EV model in the segment shortly.

According to Girish Wagh, executive director of Tata Motors’ commercial vehicle business unit, the company is working with e-commerce companies to understand their range and performance requirements.

A pure electric platform for the cargo segment is also in the works.

There is a strong pull for EV offerings in the last-mile delivery segment due to increased EV awareness. The management team has done extensive research on the industry and plans to provide a solution rather than just a vehicle.

While the launch is still a few months away, the company is already working with some end-users to understand their needs.

The Road Ahead

Due to a severe shortage of chips, the company is experiencing a six-month wait for electric vehicles, prompting the automaker to report a larger quarterly loss.

The opportunities lie in democratizing EV adoption by making them available to every segment of the Indian automotive customer through rapid localization of all components and the deployment of a fast-charging network.

More than 10 EV models are expected to be released over the next three years. Furthermore, falling battery prices and stringent emission standards enacted over the next two years may mark a tipping point for accelerated EV penetration.

Tata is at the forefront of India’s electric mobility chapter, and we see it paying off well for Tata because they are co-developing the ecosystem and thus addressing a much broader part of the value chain.

Until then, stay tuned for the next blog and keep watching this space for our midweek and weekend editions of ‘Trending Stocks”. And, share it with your friends & family.

Thanks for enlighting our minds.

Waiting for an Electric Car with atleast 700 – 1000 Km of Mileage on Single Charge.

Great insights.

Thank you so much for sharing the information. It’s really very helpful. keep it up Rowthautos