Table of Contents

The Story

Privi Speciality Chemicals Ltd. is India’s largest manufacturer, supplier, and exporter of aroma chemicals. It produces aroma chemicals from various terpene molecules, which are used as building blocks in the flavour and fragrance (F&F) industry. Privi manufactures products in four chemical categories: pinene, citral, sandalwood, and phenol. Privi Speciality is India’s leading producer of aroma chemicals such as amber fleur, dihydro myrtenol (citrus flavour), citral derivatives, and so on. As of today’s date, this is Privi Speciality Chemicals Ltd. share price.

They began producing aroma chemicals in 1992. Privi Speciality’s expertise in pinene chemistry, combined with the support of a strong in-house R&D (research and development) centre, has allowed it to expand its product range to over 50 products.

Privi Speciality has four manufacturing facilities in Mahad (Maharashtra) and Jhagadia (Gujarat). They have the expertise and capacity to perform critical reactions such as hydrogenation, condensation, and Grignard reactions, as well as unit operations such as pyrolysis, reactive distillation, high-vacuum distillation, and continuous distillation to deliver consistency in odour and prescribed key parameters in an industry driven by stringent olfaction standards.

They have a total capacity of 32,500TPA (tonnes per annum) in amber fleur, acetates, dihydro myrtenol, ionones, nitriles, sandalwood derivatives, and speciality chemicals. They serve the world’s top ten fragrance companies, controlling two-thirds of the global fragrance market.

What is the market scenario in India?

The fragrance market in India is anticipated to grow at a compounded annual growth rate (CAGR) of about 15% from 2019 to 2025. Lately, pocket perfumes have gained popularity because they are convenient to carry around, therefore acting as one of the significant growth drivers for the market.

Consumers are willing to splurge on fragrance products as their disposable income rises, and their awareness of personal hygiene improves, propelling the market’s growth.

Increased smartphone and Internet adoption, particularly in tier II and tier III cities, has made e-commerce websites more accessible to customers, facilitating online shopping. Furthermore, in recent years, Indians have become more aware of global trends, which has resulted in increased demand for international fragrance brands.

What are the Growth drivers?

Market expansion and penetration of new lifestyle products such as body deodorants have created new opportunities for this sector’s growth. Aroma chemicals are used in various industries, not just personal and household care.

Aroma chemical demand is expected to rise, particularly in emerging economies such as India, China, Brazil, and the African continent.

Consumers are willing to splurge on fragrance products as their disposable income rises, and their awareness of personal hygiene improves. As a result, consumer preferences are changing, leading to lucrative opportunities in the aroma chemicals market.

Increased market penetration and investment in product development will aid the aroma chemicals market’s growth in the coming years.

How is Privi building barriers to entry?

Privi has been supplying Aroma chemicals to global companies for about two decades, so it has considerable in-house expertise and knowledge of the olfactive requirements of various international and regional customers. Furthermore, Privi has used backward integration to use waste generated from pulp mills – (Crude Sulphate Turpentine) because it has a high level of visibility into raw material pricing and availability.

These factors give the company a distinct competitive advantage over a new or existing aroma chemical manufacturer. In addition, Privi has researched various components of the CST and is working on creating value-added products from these inputs that can be supplied to the Flavor & Fragrance industry.

Let’s look at the Financials of Privi Speciality.

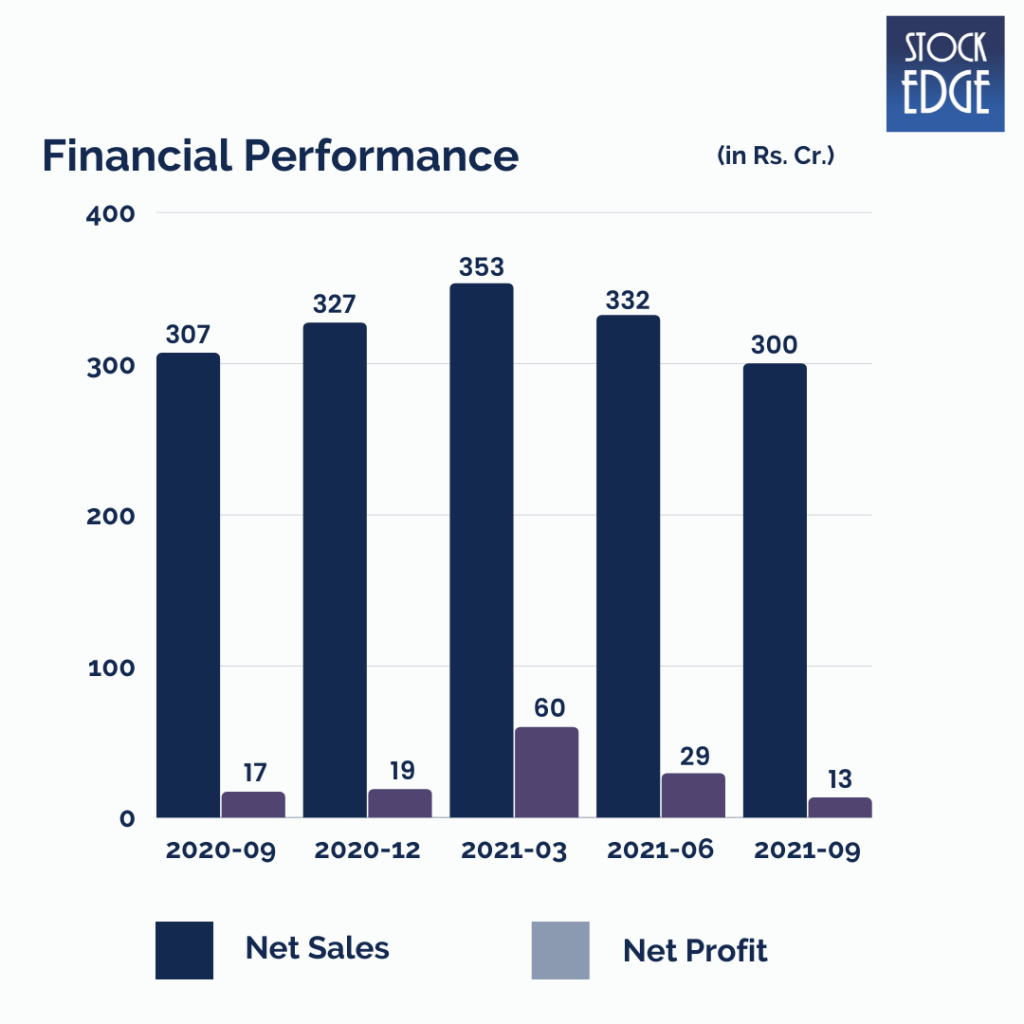

Privi Speciality’s Revenues decreased by 2.3% year on year to Rs.300 crore in the September end quarter. EBITDA decreased by 4.21% year on year to Rs.38 crore, with EBITDA margins at 12.64% in Q2FY22, marginally down from 12.89% in Q2FY21.

If you want to understand the factors that affect EBITDA and EBIT, you can check our blog on it.

Net profit decreased by 22% year on year to Rs.13.26 crore. However, the growth in the share price has been exceptional. The stock price is up by 250% in one year.

Looking at the revenues annually from FY17 to FY21, we see revenues increased by 114%, whereas PAT increased by 333.4%.

Privi Speciality’s established presence, diverse product basket, and long and established relationships with its prestigious clientele have increased profitability.

Who is driving the boat?

Mahesh P Babani took over the reins of Privi Speciality in 1989 and is currently the company’s chairman and managing director. His enthusiasm has propelled the company from its inception to its current size. He is a commerce graduate with over 30 years of operational and managerial experience. He has travelled extensively around the world over the last two decades and has extensive knowledge of the entire value chain of the aroma chemicals business. He is involved in the company’s long-term strategy, business development, and financial management.

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Road Ahead…

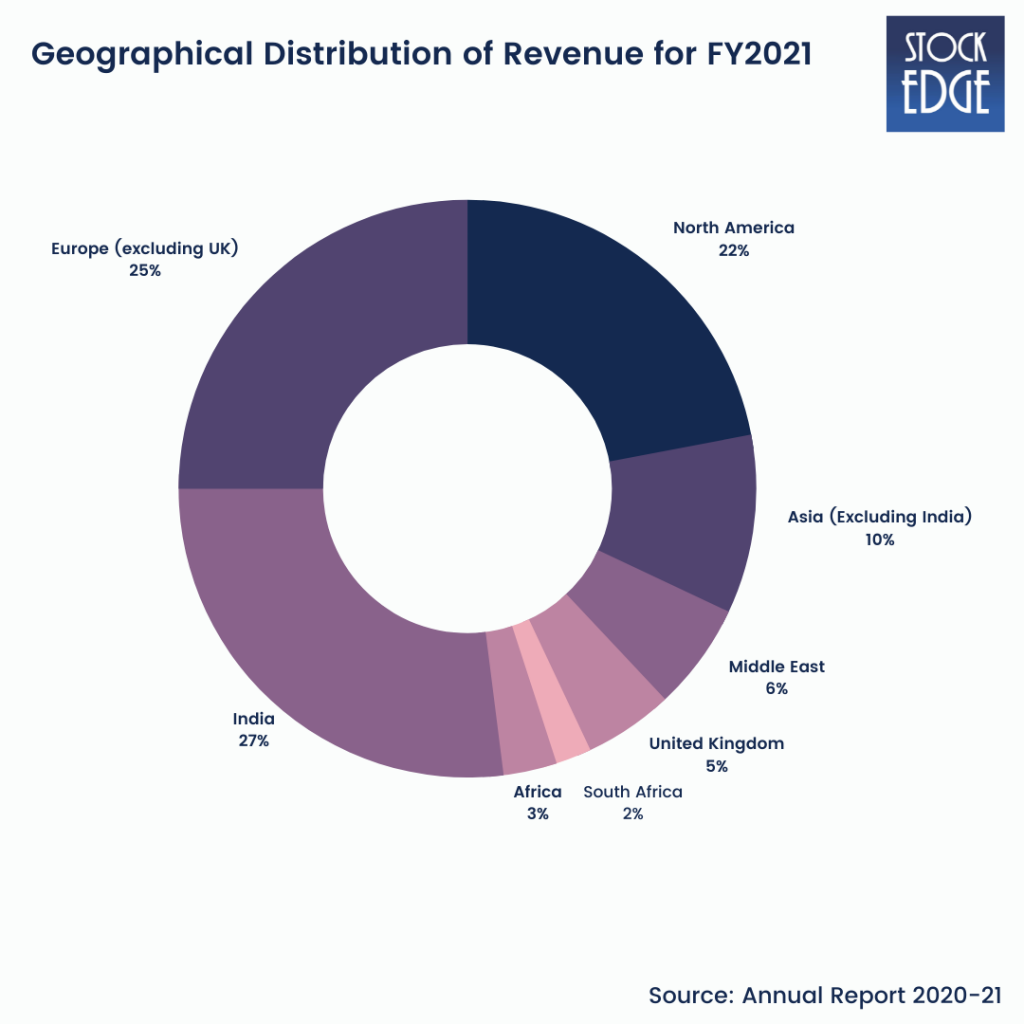

With the presence of Privi’s 100% subsidiary in the United States, the company’s market share is increasing year after year. The business in the United States is expanding. Privi’s growth continues to be driven by key accounts in emerging and developing markets and its ability to offer a diverse range of products. Privi is still selling value-added products made from backward integrated feedstocks, contributing to its revenue. Privi continues to build strategic long-term business relationships with global leaders in the F&F industry, such as Givaudan, Firmenich, IFF, Symrise, MANE, Robertet, Takasago, and other global leaders in FMCG, such as P&G, Henkel and Reckitt Benckiser.

Going forward, Privi Speciality anticipates strong growth in the medium term due to increased demand for aroma chemicals, which is their primary business.

Privi Speciality intends to expand its product line in the coming years. In addition, it is working on aggressive plans to provide a much larger basket of materials to its valued customers worldwide.

Privi Speciality is expanding its presence in developing markets (Nigeria, Egypt, the United Arab Emirates, and South Africa) by seeking new customers and additional market share from existing customers.

However, as with such companies, there exist risks like currency risks which is relatively low as they are exporters and importers (they import 70% of the raw materials and they exports over 70% of the finished goods), then there exists raw material price volatility which can impact margins.

Apart from that, environmental regulations need to be adhered to. For example, wastewater discharge during the production of various synthetic aroma chemicals contains many effluents that pollute the environment. So, they must be discharged following applicable regulations. Noncompliance with regulations can result in severe repercussions and penalties, which could result in a setback.

So we will have to wait and see how the company develops from here on out.

Until then, keep an eye out for the next blog and our midweek and weekend editions of “Trending Stocks and Stock Insights.” Also, please share it with your friends and family.

Happy Investing!

Nice information sir

Thanks for sharing the information with us, it was very informative.