Table of Contents

In today’s blog, we discuss 4 stocks which can benefit the most from the Budget.

The Budget Special Coverage

Well, well, well…now that the budget is out and people have their own opinion and analysis. Generally, we see that many economists are born on the day following the “Budget” to give their remarks on the same. But we won’t bother you with the exact highlights you have read in the last 24 hours from different sources.

We did our research and tried to connect the dots, and we have come up with four stocks that can be looked at on the overall infrastructure and construction-related theme.

So, let’s begin…

Budget Beneficiary 1

About 7.50 L crore is set aside for capital expenditure and infrastructure development by the Govt of India under the PM Gati Shakti Yojna. This can be a game-changer move with the potential to generate 10% GDP growth on a sustainable basis if things work well.

We have picked IRB Infrastructure Developers as one of India’s leading infrastructure developers, specializing in roadways and highways in this coverage. They have in-house solid integrated project execution capabilities – Engineering, Procurement and Construction (EPC) and Operation and Maintenance (O&M) – across all its business verticals.

IRB Infrastructure has a strong order book. They recently won the rights to build one leg of the mega Ganga Expressway project. This is also their largest build-operate-transfer (BOT) project.

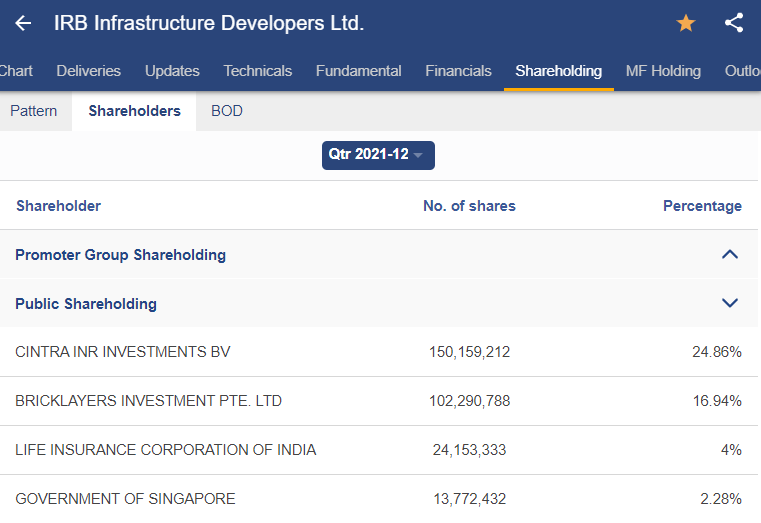

They have two major investors: one strategic investor, Cintra INR Investments BV, and one sovereign wealth fund, Bricklayers Investment Pte Ltd. The objective of raising funds from them was to deleverage the holding company’s debt and the remainder used for growth. As of today’s date, this is IRB Infrastructure Developers Ltd. share price.

Budget Beneficiary 2

Infrastructure development is widely recognized as the key to achieving growth, and it has also been a focus of the Indian government’s recent plans and policies. Because no modern construction activity can take place without cement in some form or another, the cement industry is an essential component of infrastructure development.

With an annual installed capacity of 545 MTPA as of FY21, India is the world’s second largest cement producer after China.

Government spending on infrastructure and housing is expected to be a key growth driver in normalizing cement demand.

If one looks at the significant catalysts for the cement industry, then they are as follows:-

- Rural Housing & Affordable Housing

- Highways & Rural Roads

- Metro Railways & Ports

- Ports & Railways

Dalmia Bharat has emerged as one of India’s most respected cement manufacturers, contributing to national development through adequate capacity creation, consistent, high-quality standards, and value-added products. This is Dalmia Bharat share price as of Today’s date. The company is launching the following initiatives to grow its business:

- They are expanding brownfield capacity in Eastern India by 7.8 MnT.

- Dalmia Bharat has collaborated with roadside eateries within a 60-kilometre radius of the plant site, using them as dispatch centres to help reduce average turnaround time.

- Reaching a renewable energy utilization rate of 100 per cent by 2030.

- Using superior technology and digitalization to improve logistics and ease of doing business.

The company is on track to increase cement grinding capacity by 35% to 48.5mnt by the end of FY24.

Budget Beneficiary 3

Yesterday, Finance Minister Nirmala Sitharaman announced the allocation of Rs 48,000 crore under (Pradhan Mantri Awas Yojana) urban and rural schemes.

The affordable housing finance segment is the largest – and most challenging – segment of India’s housing finance sector. The typical affordable HFC customer in India lives in Tier 2 and Tier 3 cities, is unfamiliar with the concept of credit, earns a low informal income, lacks income documentation, and is typically self-employed. These realities necessitate the use of specialized expertise and that used in traditional lending.

The following realities capture the typical characteristics of the affordable housing finance niche:

- Low average ticket size: Loans of H10 lakh or less account for nearly 70% of the niche.

- Self-employed: Almost 85% of affordable HFCs cater to the growing needs of the self-employed, whose yields are typically higher than those of the salaried segment.

- Format: Most of the financing is for single-family homes and self-occupied houses, indicating that they are for active use rather than investment.

- The loan-to-value ratio is low: More than 60% of loans made in the affordable housing finance niche have a Loan To Value (LTV) of less than 70%, indicating that the borrower has more skin in the game and the lender has less risk.

- Undocumented income: This segment is distinguished by a distinct reality in which most borrowers lack documented formal income; they are sought by customers who are new to credit, and the entire process necessitates a cash flow-based assessment.

The home loan market in India is expected to grow at a CAGR of around 22% between 2021 and 2026, and the major catalysts are housing shortage, mortgage penetration, cost, government support, urbanization, etc.

When we were exploring the Affordable Housing theme, Aavas Financiers came to us as a perfect fit for the list because there is a massive opportunity to tap the affordable housing finance market, which regulators favour. Aavas focuses on risk-adjusted asset pricing in a rapidly expanding niche segment supported by robust distribution. As of today’s date, this is Aavas Financiers share price.

Apart from that, direct customer sourcing and collections, which results in higher yields, favourable funding costs supported by improved credit rating, scorecards to evaluate risk profiles and in-house risk testing, real-time collections tracking are some of the other points that made us select the stock.

Budget Beneficiary 4

Now coming to the last stock of our discussion is APL Apollo Tubes, which is engaged in producing Electric Resistance Welded (ERW) steel tubes. The company’s multi-product offerings include a wide range of Pre- Galvanized Tubes, Structural Steel Tubes, Galvanized Tubes, MS Black Pipes, and Hollow Sections, making APL Apollo one of India’s leading branded steel product manufacturers. As of today’s date, this is APL Apollo Tubes share price

The reason for selecting this stock is simple; anything related to infrastructure will benefit the metal & construction industry.

Steel tubes and pipes are divided into ductile iron, seamless, and welded pipes. Welded pipes are further classified as SAW (HSAW and LSAW) and ERW. Rolling plates and welding the seam are used to create ERW pipes.

They are primarily used in constructing commercial buildings such as airports, malls, metros, bus bodies, greenhouse structures, sprinklers, and prefabricated structures.

The demand for structural steel tubes in India is expected to grow in the coming years. In India, there is a paradigm shift in the approach to steel consumption and increased recognition and acceptability for structural steel tubes and pre-engineered building materials.

And by now, you must have identified the reasons for the growth drivers of the stock, which are Higher infrastructure spending – highways, bridges, flyovers, and public utilities; increased demand for E-commerce/Warehouse construction, Consumer preference for higher-quality residential construction, Rising housing demand as a result of population growth.

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Closure

So that’s all we’ve got. We’ve already pushed our good fortune too far. And with that, we’ll conclude our coverage.

However, as with such companies, various kinds of business risks can hurt the expectations of retail investors, so we caution you to take proper advice from your financial advisor before taking any position in any of the above stocks. The article was written to enlighten our users to look at the budget to explore, think and make the most of the budget.

You can also use StockEdge to track these stocks.

Until then, keep an eye out for the next blog and our midweek and weekend editions of “Trending Stocks and Stock Insights.” Also, please share it with your friends and family.

Very informative