Table of Contents

Today’s blog discusses Poonawalla Fincorp Ltd., which has been outperforming its benchmark index. The Company has announced its quarterly results on 1st Feb 2022. As of today’s date, this is Poonawalla Fincorp share price.

The Story

Kolkata based Magma Fincorp was bearing the brunt of the liquidity crisis due to deteriorating asset quality and profitability, which was impacting its performance.

Adar Poonawalla, who heads Serum Institute pumped in fresh blood to rescue when his Company Rising Sun Holdings Ltd. bought a majority stake. The name was changed to Poonawalla FinCorp, and Adar Poonawalla was appointed as the Chairman of the Company. Later the headquarter was shifted to Pune.

Let’s try to understand the business segments of Poonawalla Fincorp!

Poonawalla Fincorp has four business segments.

Asset-Backed Finance – The Company will primarily finance used cars. The Company has a strategic partnership with CARS24 to provide seamless financing to pre-owned car customers. Poonawalla Fincorp aims to create a digitally-enabled consumer lending platform, and this partnership with CARS24 is a step in that direction. Poonawalla Fincorp Ltd will fulfill consumer loans originated through CARS24 as part of this collaboration. Furthermore, both parties will share in the risk and reward.

Small and Medium Enterprise Financing – The Company provides collateral-free business loans to SME business owners, financing the broad platform of national grassroots economic growth. The Company helps SMEs with their working capital and business expansion needs. The Company’s customer segment comprises micro, small and medium-sized manufacturers, distributors, dealers, traders/shop owners and service providers engaged across industries.

Under the Go-Digital initiative, the Company can provide an end-to-end digital and paperless experience to over 3,500 SME customers who used the ECLGS limit.

Overall, the Company expects to focus on improving asset quality through a direct and secure strategy, contributing to the Company’s bottom line.

Housing Finance Business – Poonawalla Housing Finance Ltd. is a 100% subsidiary of the Company. The affordable housing finance segment is India’s largest – and most challenging – housing finance sector. The typical affordable Housing Finance Company customer in India lives in Tier-2 and Tier-3 cities, is unfamiliar with the concept of credit, earns a low informal income, lacks income documentation, and is typically self-employed. In addition, the push for affordable housing by the Government of India will further expand the Company’s current housing portfolio. As a result, the Company is poised to be a unique, affordable finance company with a national presence with focused deep market penetration in 103 locations across 19 states using unit model implementation.

General Insurance – Magma HDI General Insurance is a joint venture between Magma Fincorp Ltd. (now known as Poonawalla Fincorp) and HDI Global SE, Germany. It offers various general insurance products for retail and institutional clients through its 304 offices spread across 22 states.

What are the Core Strategic Pillars of Poonawalla Fincorp?

- Capital and Parentage – Building on benefits derived from being part of the Cyrus Poonawalla group.

- Professional Management – Highly experienced management team with strong industry exposure.

- Product Strategy – Targeting ‘Select’ customers with a mix of secured & unsecured products for better risk-adjusted return.

- Operating Efficiencies – Process optimization through enhanced use of technology.

- Liability Management – Amongst the lowest Cost of funds in the industry with diversified liability mix.

- Asset Quality and Risk – Focus on asset quality through a robust risk management framework.

- Digital Focus – End-to-end digitization using data analytics.

What are the aspirations and vision for 2025 of the Company?

- To be amongst Top 3 NBFCs for consumer and small business finance.

- Risk-calibrated accelerated growth ~3x of FY21 AUM.

- Amongst the lowest COF in the industry ~250 bps reduction in Borrowing Cost.

- Best-in-class Asset Quality; Net Stage 3 < 1%.

- Accelerate the growth trajectory of Poonawalla Housing Finance Ltd., followed by value unlocking through IPO.

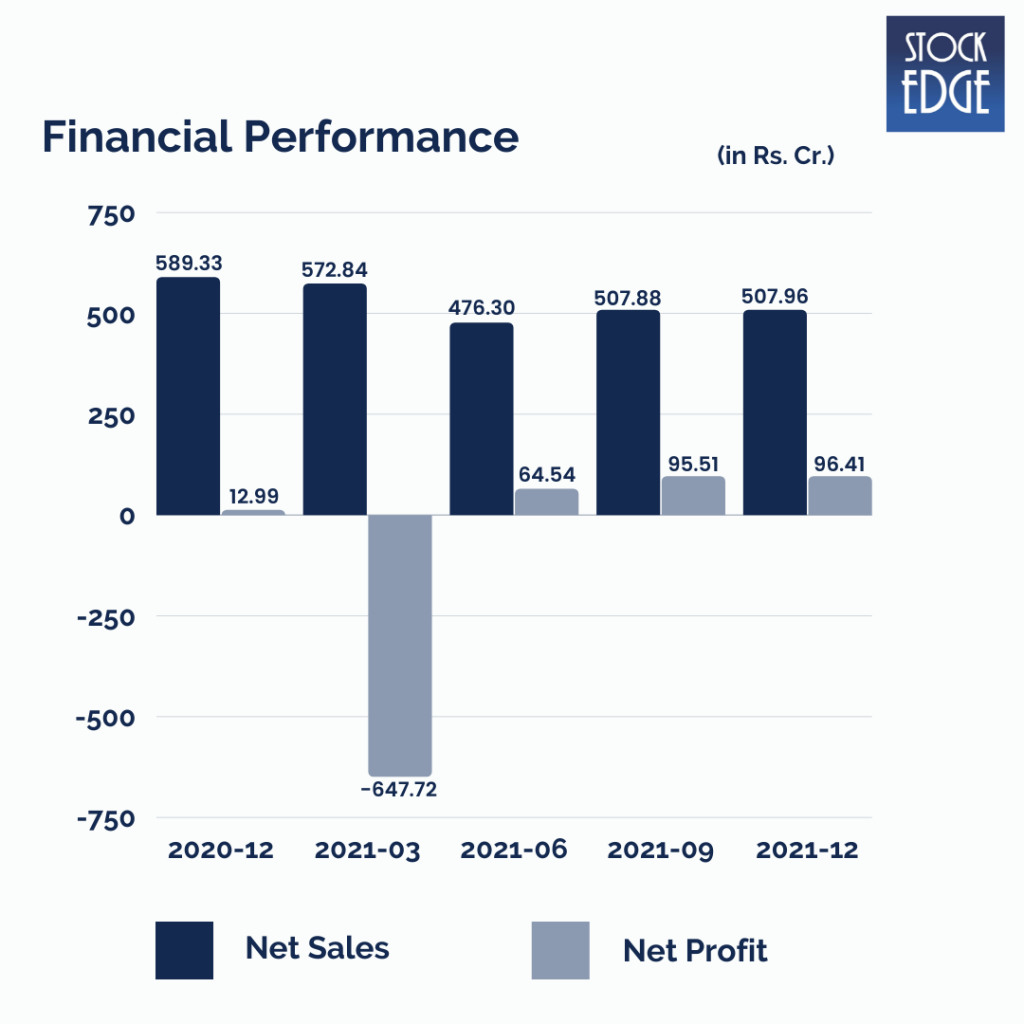

Let’s look at the Financials of Poonawalla Fincorp.

Poonawalla Fincorp’s net profit increased dramatically to Rs.96 crore for the third quarter ended December 2021 (Q3Fy22) from Rs.13 crore in Q3Fy21, owing to improved interest margins and a decrease in credit costs. As a result, Net Interest Margins (NIM) were 8.8 per cent in the third quarter of FY22, up from 8.5 per cent in December 2020. On the other hand, NIM fell sequentially from 9.1 per cent in Q2Fy22. In addition, its credit costs have dropped dramatically to Rs.2 crore, down from Rs.182 crore in Q3Fy21 and Rs.35 crore in Q2Fy22. As a result, gross non-performing assets (GNPAs) fell to 3.5% in December 2021, down from 6.9% a year earlier and 4.1% in September 2021.

Net NPAs were also down 1.8% from 4.5%in December 2020 to 2.0% in September 2021. Assets under management (AUMs) at the finance company were flat at Rs 15,228 crore at the end of December 2021, compared to Rs 15,006 crore in December 2020 and Rs 15,275 crore in September 2021. At the end of December 2021, the capital adequacy ratio was 54.2%.

During the quarter, the Company entered into several co-lending / fintech partnerships and added small-ticket LAP and medical equipment loan products.

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Road Ahead…

Poonawalla Fincorp focuses on Consumer and Small Business Finance to aid further growth. In addition, the Company focuses on using data analytics to increase sales & distribution improve collection efficiency and risk monitoring. The Company’s upcoming product pipeline includes Consumer Financing, Supply Chain Financing, EMI Card, Co-branded Credit Card, Merchant Cash advances, and Machinery loans.

However, as with such companies, there exist risks like slower economic activity and weak rural demand that could lead to high credit costs, increased competition across the Company’s product segments from captive finance companies and small finance banks, and a growing number of lending Fintech companies could impact the performance of the Company.

So we will have to wait and see how the Company develops from here on out.

Until then, keep an eye out for the next blog and our midweek and weekend editions of “Trending Stocks and Stock Insights.” Also, please share it with your friends and family.

Happy Investing!

Very good

Res Sir

I m at present at Boston

Which kind of service you provide

Kindly inform to me

Ready to make payment

I m long term investor

I m in need of quality stock

One or two

Whatever your charge

Kindly inform me

Hi Sir, thank you for showing interest towards our services. The concerned person from the team will get back to you. We have shared your details with the Team.