Read about Solara Active Pharma Sciences and 4 other stocks below:

The shares of Solara Active Pharma Sciences Ltd. were trading at Rs.620.20, down by 20% in today’s trading session.

Solara Active Pharma has fallen 36% in the last two days on the BSE.

The reason behind this massive fall of Solara Active Pharma was its extremely weak earnings in the quarter ended December and the resignation of Managing Director and Chief Executive Officer Bharath Sesha.

Due to lower revenue, Solara Active Pharma reported a consolidated net loss of Rs.140 crore in the December quarter (Q3FY22). In Q3FY21, the pharmaceutical company made a profit of Rs.65.78 crore.

The company’s revenue fell 74% sequentially and 76% year on year (YoY) to Rs.105 crore in Q3FY22. It reported an operating loss of Rs.81.7 crore in Q3FY21, compared to a profit of Rs.88.5 crore in Q3FY21. As of today’s date, this is the Solara Active Pharma share price.

Revenue from operations fell during the quarter due to continued softness in demand for Ibuprofen and a few other essential products, as well as a delay in approval for Covid-19 products. Furthermore, the Group accounted for a provision for sales return to carry out its strategy of shifting toward direct sales to customers while significantly limiting sales through channels.

Aside from this one-time effect, the management stated that “Solara’s Q3FY22 performance was muted primarily due to subdued regulated market demand and higher costs driven by volatile material pricing environment and increased logistics cost.”

Management believes that the demand has bottomed out and that the business will return to normalcy in Q4FY22.

“We remain committed to meeting our long-term growth and profitability targets, and we expect to recover in the second half of the next fiscal year. In the short term, we hope the top line trajectory to return to pre-Q3 FY22 levels, “the management of the Solara Active Pharma stated.

According to the company, Rajesh Salwan, who is currently the executive vice-chairman, has been given the additional responsibility of MD & CEO.

The shares of Schneider Electric Infrastructure Ltd. were trading at Rs.128.40, up by 19.8% in today’s trading session.

The stock rallied after the company declared its Q3FY22 results.

A stellar Q3FY22 performance fueled the rally. Its revenue increased by 27.13 per cent year on year and by 99 per cent sequentially to Rs.600.46 crore. Similarly, PAT increased by 57.11 per cent year on year and 699 per cent quarter on quarter to Rs.52.38 crore. As of today’s date, this is the Schneider Electric share price.

Due to supply-side issues and high commodity prices, the company’s manufacturing growth is sluggish. However, orders are picking up steam, led by the MMM, Mobility, and Diffused segments. Lincoln, Torrent, GE T&D, Bhutan Engg. and others have placed significant orders.

Schneider Electric Infrastructure is engaged in manufacturing, designing, building and servicing technologically advanced products and systems for the electricity network.

The shares of Sapphire Foods India Ltd. were trading at Rs.1454.60, up by 12.1% in today’s trading session.

The stock rallied after the company declared its Q3 results.

Sapphire Foods Ltd. delivered an outstanding performance in the quarter ended December 2021. It has reported the highest quarterly sales, EBIDTA, and PAT figures. As of today’s date, this is the Sapphire Foods share price.

During the quarter under review, the company also added the most restaurants in its history. Sapphire Foods is a leading YUM franchise operator in the Indian subcontinent, with operations in India, Sri Lanka, and the Maldives, and is the largest international QSR chain in Sri Lanka by revenue and number of restaurants of March 31, 2021.

Sapphire Foods Ltd. reported total revenue of Rs.505.50 crore in December 2021, an increase of 52% year on year from Rs.332.80 crore in December 2020.

The company’s quarterly Net Profit (PAT) was Rs.51 crore in December 2021, up from Rs.2.90 crore in December 2020, representing a 1678 per cent increase year on year.

EBITDA was at Rs117 crore in December 2021, up from Rs69.10 crore in the previous corresponding quarter, representing a 69 per cent increase year on year.

The EBITDA margin for the December 2021 quarter was 23.20 per cent, up from 20.8 per cent the previous quarter. For Q3FY22, the net profit margin was 10.10 per cent.

According to the company’s management, the company delivered its best-ever performance in Q3FY22, which is a reflection of the Sapphire story, which includes two global brands with scale and profitability, Sapphire’s execution mindset and capability, a compact omnichannel new restaurant model, values-based culture and experienced team, and the capability and capital to deliver on growth ambitions.

The shares of Laurus Labs Ltd. were trading at Rs.550.85, up by 2.2% in today’s trading session.

The stock started rallying after it said it had received purchase orders from a leading global life sciences company. As of today’s date, this is the Laurus Labs share price.

The supplies will begin in March 2022. “The execution of these orders is conditional on the fulfilment of certain performance obligations,” Laurus Labs stated in an exchange filing.

According to the confidentiality agreement, the customer’s name, product details, and volume cannot be disclosed. According to the company, this is not a related party transaction, and none of the promoters/promoter group/group companies has any interest.

Read this interesting blog on 7 Steps to follow when Trading Breakout Stocks.

The shares of Greenlam Industries Ltd. were trading at Rs.376.80, up by 10% in today’s trading session.

The company declared its Q3FY22 results on February 8 2022.

Greenlam Industries’ Q3 revenue increased by 34.4 per cent year on year to Rs.450 crore, owing to strong demand in the laminate business. On a year-over-year basis, revenue in the Laminate business increased by 38.1 per cent in value and 1.7 per cent in volume. As of today’s date, this is the Greenlam share price.

EBDITA was Rs.53.4 crore, a 7.9 per cent decrease year on year. The company’s net profit was Rs.26.9 crore, a 15.8 per cent decrease year on year.

In response to the results, Saurabh Mittal, Managing Director and Chief Executive Officer of Greenlam Industries Ltd., stated, “This quarter, our consolidated topline increased by 34.4 per cent year on year to Rs449.7cr.” The laminate business led the way in growth due to improved product mix and price increases, but volumes remained flat.

The performance was impacted by disruption at the Behror plant, which was temporarily shut down for seven days and then operated with restrictions by CAQM (Commission for Air Quality Management) guidelines on pollution-related issues in the National Capital Region. However, this disruption had an impact on our revenues and margins and increased raw material inventory. As a result, our net profit for the period was Rs26.9cr, our networking capital days were 76 days, and our net debt was 178.5 cr.

In December 2021, the company announced an investment of Rs.950 crores over 2-3 years to set up its third Laminate plant and expand into two adjacent categories – Plywood and Particle Board. Greenlam South Limited, a wholly-owned subsidiary of Greenlam Industries Ltd based in Naidupeta, Andhra Pradesh, will invest in the third laminate plant and particleboard.

HG Industries Limited will operate the dedicated plywood manufacturing facility, a newly acquired subsidiary based in Tindivanam, Tamil Nadu. Greenlam will transition from a decorative surfacing company to a leading integrated wood panel player due to this expansion.

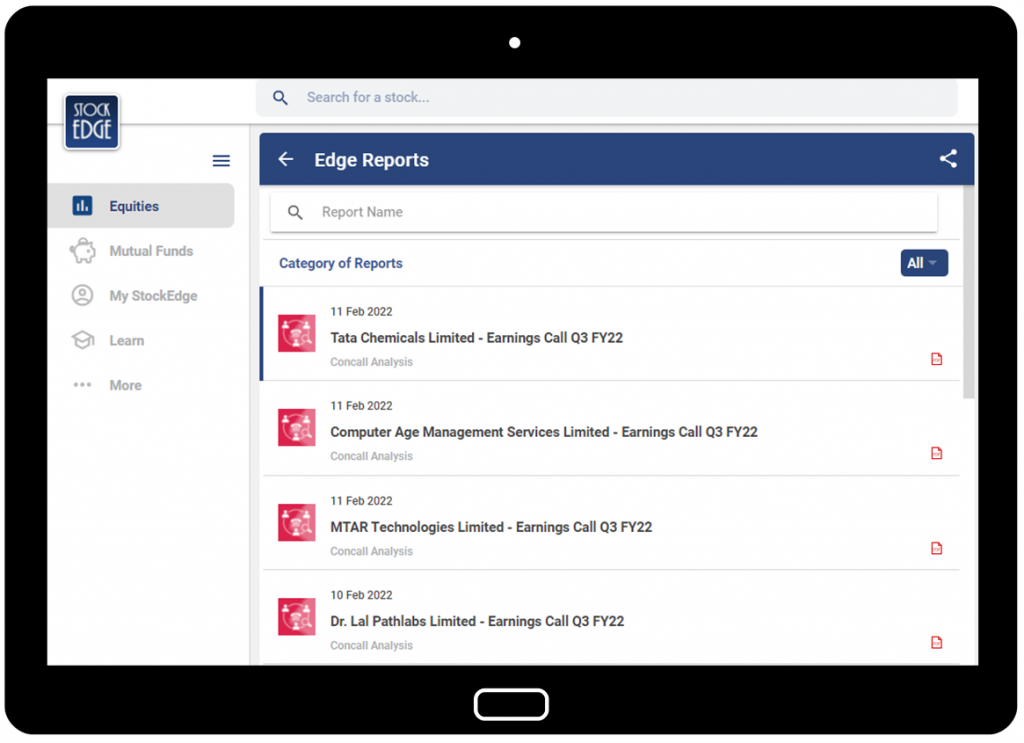

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company have been produced for only learning purposes. Since equity involves individual judgments, this analysis should be used only for learning enhancements and cannot be considered a recommendation on any stock or sector.

Thanks a lot

Very useful and great guidance.