Key Takeaways

- Relative Strength: It measures how a stock performs compared to its benchmark or sector index over a given period.

- Purpose: It helps identify whether a stock is outperforming or underperforming the market, assisting in momentum-based trading decisions.

- Calculation: Calculated by dividing the stock’s percentage price change over 55 trading days by the percentage change of its benchmark index or sector.

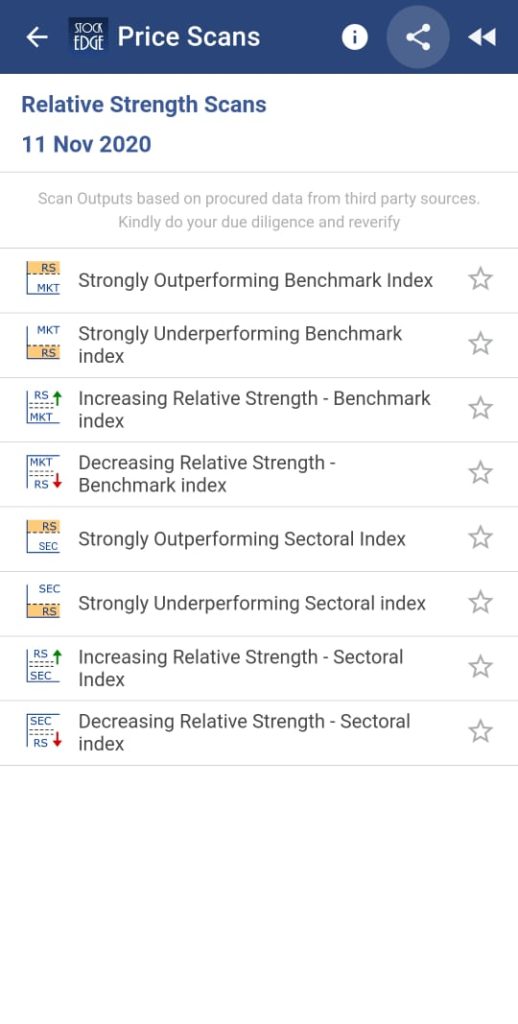

- Scans in StockEdge: StockEdge offers multiple Relative Strength scans like Strongly Outperforming, Underperforming, and Increasing or Decreasing RS trends.

- Trading Insight: By tracking Relative Strength trends, traders can spot bullish or bearish stocks and plan their entries or exits more effectively.

Relative strength is a technique used in momentum investing and identifying value stocks. It consists of investing in securities that have performed well, relative to their market or benchmark. It is a type of momentum investing used by technical analysts and value investors.

Relative strength helps to predict that the trends currently displayed by the market will continue for long enough that they can realize a positive return.

What Is Relative Strength(RS)?

Relative strength is a measure of the price trend of a stock compared to its benchmark index or sectoral index.

Relative strength Scans show the companies which have outperformed/underperformed Benchmark Index like Nifty 50 or Sensex and Sector Index like Realty, Banking, Nifty Auto etc in a period of 55 trading days. A stock’s relative strength trend adds an additional dimension of relative price behaviour to the investment decision.

Relative strength is one of the most useful indicators in the market, highlighting when stocks are outperforming or underperforming a benchmark index or sector over a period of 55 trading days.

Relative Strength is calculated by comparing the percentage price change of a stock over a chosen period to the percentage price change of a benchmark index or sector over that same period. If the stock’s price has risen more than the benchmark, it shows positive relative strength.

It can also be used to compare two companies in the same industry or Index. This comparison examines the performance of two stocks over their benchmark or sector and can help you decide whether you should hold one versus the other.

Using Relative Strength in StockEdge App:

Above we have discussed the Relative Strength, now let us discuss how we can use this technical indicator to filter out stocks for trading:

In StockEdge there are many Relative Strength scans available for filtering out stocks for trading:

Let us discuss in detail about some of these scans:

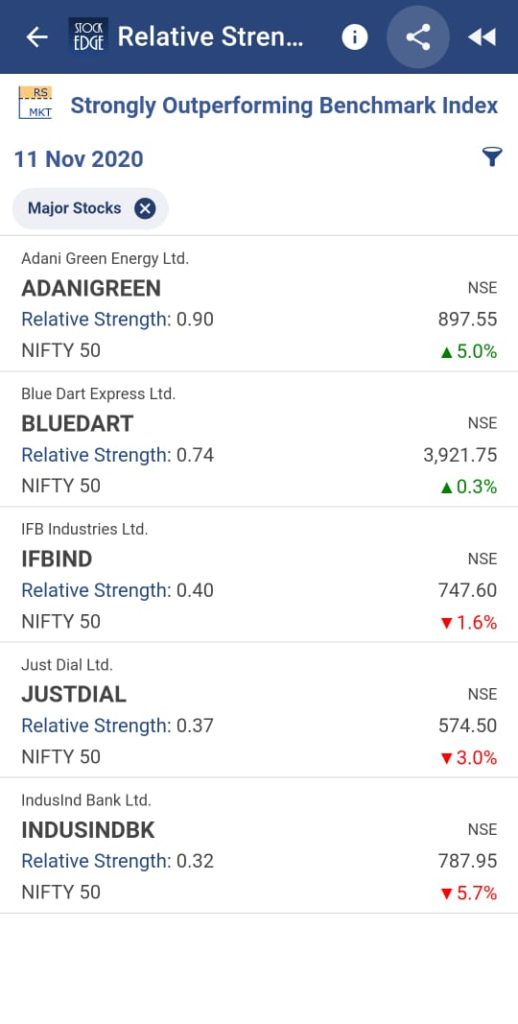

Strongly Outperforming Benchmark Index :

It is a bullish indicator which shows a list of stocks that are strongly outperforming the Benchmark index i.e increase in stock price is more than the increase in the price of the Benchmark Index in the period of 55 trading days. Stocks with a Relative strength of more than 0.1 are shown here.

Following is a list of stocks which has fulfilled this criterion on 11th November 2020:

Similarly, in the scan – ‘Strongly Underperforming Benchmark Index’ , the user get a list of stocks that are strongly underperforming the Benchmark index i.e increase in stock price is less than the increase in the price of the Benchmark Index.

See also: Average True Range (ATR)

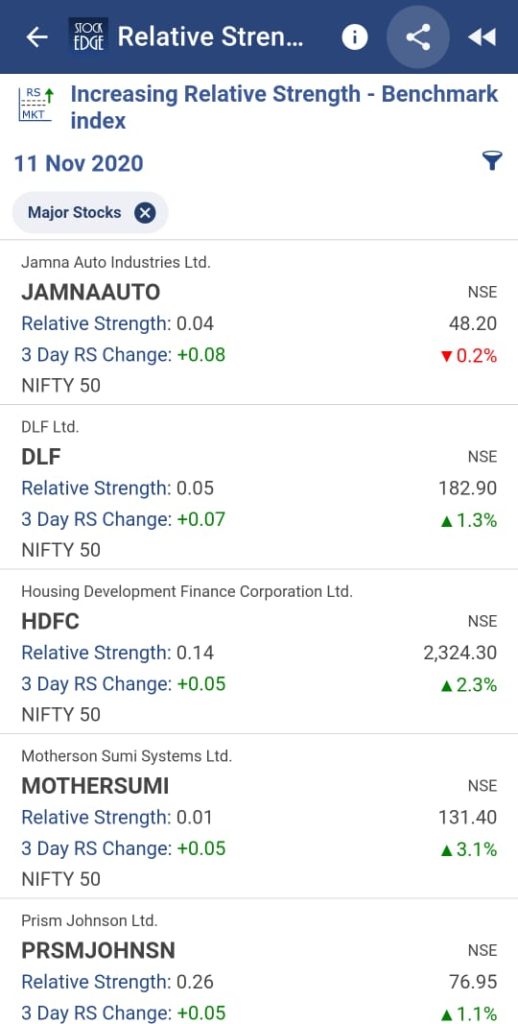

Increasing Relative Strength- Benchmark index:

Stocks whose strength has been increasing for the last three days. This scan will contain a list of stocks whose RS (Benchmark Index) is increasing for the last three days (RS1>RS2>RS3>0)

Following is a list of stocks which has fulfilled this criterion on 11th November 2020:

Similarly, in the scan – Decreasing Relative Strength – Benchmark index, the user will get a list of stocks whose strength is decreasing for the last three days(RS1<RS2<RS3).

See also: Learn about the Relative Strength Index (RSI)

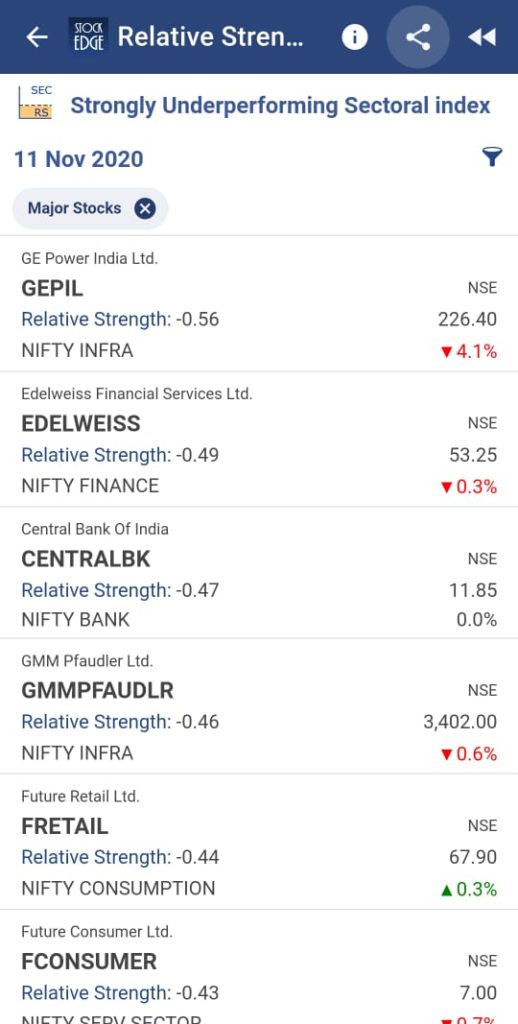

Strongly Under-Performing Sectoral Index:

Stocks which are strongly underperforming the Sectoral index i.e stock price has not increased compared to price of Sectoral Index. Stocks with Relative strength less than -0.1 are shown here

Following is a list of stocks which has fulfilled this criterion on 11th November,2020:

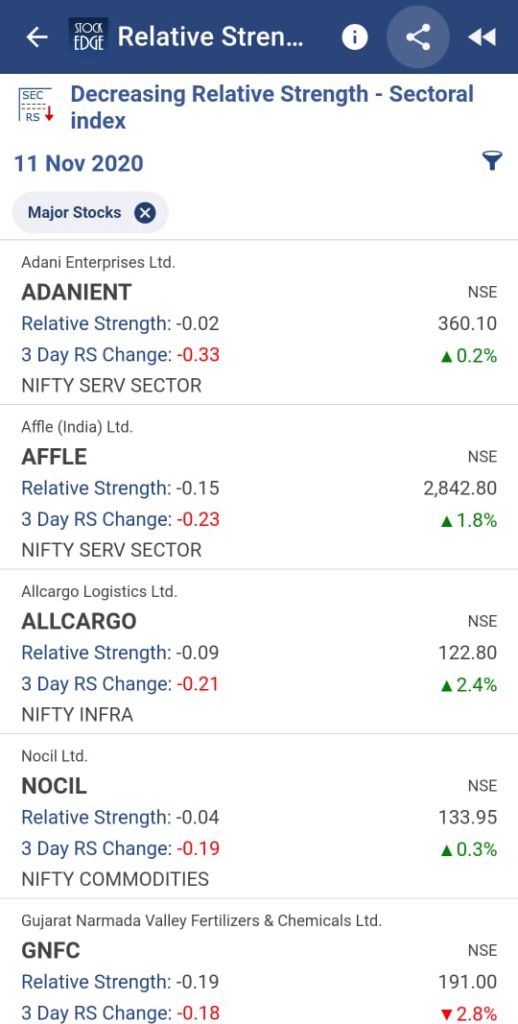

Decreasing Relative Strength- Sectoral Index:

Stocks whose Relative Strength is decreasing for the last three days. This scan will contain a list of stocks whose RS (Sectoral Index) decreasing for the last three days (RS1<RS2<RS3<0)

Following is a list of stocks which has fulfilled this criterion on 11th November 2020:

Above are examples of Relative Strength scans that tell you if the stock is bearish or bullish and also give us a list of the stock which fulfills the criteria of the particular day.

You can filter out the stocks and trade accordingly using these scans and analyze them on the Edge Charts in StockEdge, or you may use the charting platform TradingView as per your liking!

Frequently Asked Questions (FAQs)

How do you calculate relative strength?

It is calculated by dividing the percentage price change of a stock over a period of 55 trading day by the percentage change of a market index or sector over the same period.

What is a good relative strength number?

A Relative Strength indicates that the stock outperformed the market, whereas Relative Strength indicates that the stock underperformed the market, and Relative Strength = 1 indicates that the stock performed on par with the market.

What is the relative strength of a stock?

It is a measure of the price trend of a stock compared to its benchmark index or sectoral index.

What is relative strength vs rsi

The relative strength is a measure of the price trend of a stock compared to its benchmark index or sectoral index whereas Relative Strength Index (RSI) is a momentum oscillator. This indicator oscillates between 0 and 100. RSI is considered to be overbought when it is above 70 and oversold when it below 30.

Join StockEdge Club to get more such Stock Insights.

You can check out the desktop version of StockEdge here!

i am day trader plz suggest plan suitable for me. I also invest for long term. I also want to analysis relative strength.

Please check our premium plans at https://stockedge.com/Plans/compare

Excellent description. This is very helpful

Thankyou for your feedback. you can premium plans at https://stockedge.com/Plans/compare

Can you do momentum stock ranking.

We will try our best to write content on this also soon

i want elaborate explanation on RELATIVE STRENGTH in selection of stocks.

please see that the list of stocks in any screener will be imported to excel sheet for our further processing.

Sure we will update on this soon

Good article very useful for learning.

Hi,

(1) Can you use this app for both AU & US stocks ?

(2) Can you do Relative strength scans to Index, Sector or Industry on the free plan or which plan do you have to use for these scans

(3) What data can get on the free plan,

(4) What is the limit on requests for the free plan

Please provide your mail id our team will contact you soon!

I am a swing trader and had been using Stock Edge and RS screener for some time and it’s showing very good results.

It would be good if we also have Sectoral RS, I mean, for the sectors mentioned in Stock Edge Eg. Abrasive, Tyre, etc, comparison to Nifty 50. I am sure that would give us further Edge in Stock selection.

Stock Edge is doing fantastic Job. Keep it up.

Our team will work on this and thanks for using Stockedge

Hi

Nicely explained.

One q

Why 55?

What period suitable for teaching more aggressive momentums, say one month period?

Regards

Very good presentation