Table of Contents

Kirloskar Group

Kirloskar Group has cultivated a legacy of excellence and innovation for over 133 years. When others looked to the past in 1888, one man looked to the future. He launched the country’s industrial revolution from a bicycle shop to India’s first iron plough. Today, the company is known as a leader in castings, diesel engine manufacturing, backup power solutions, pneumatic packages, and cooling solutions, and it serves as the foundation for several industries.

The Group’s businesses are active in agriculture, manufacturing, food and beverage, oil and gas, infrastructure, and real estate. The sustainability and profitability of these businesses can be attributed mainly to a sense of values woven into their foundation.

But before we look at the businesses of the group companies, let us go through the Group’s history!

History of Kirloskar Group

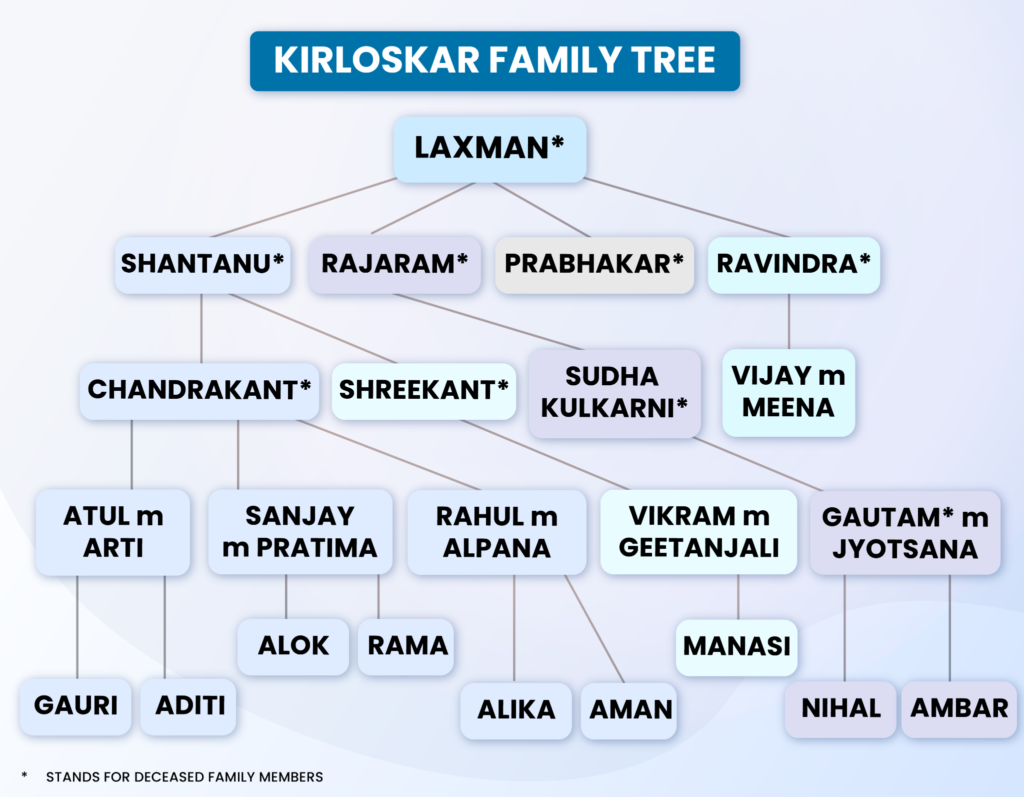

Laxmanrao Kashinath Kirloskar (June 20, 1869 – September 26, 1956) founded the Kirloskar Group. Laxmanrao was born to a Maharashtrian family on June 20, 1869, in Gurlahosur, a village in the Belgaum district of the erstwhile Bombay Presidency.

He was an entrepreneur who loved machines and was passionate about creating newer tools to make man’s life easier and was able to seize business opportunities at the right time.

His first business was a small bicycle repair shop in Belgaum. The road on which he established his shop is now known as Kirloskar Road.

He established a small unit in the former Aurangabad State to manufacture chaff cutters and iron ploughs. Initially, Kirloskar faced opposition from farmers who believed that iron ploughs poisoned the land and rendered it useless.

Superstitious farmers were tough to persuade, and it took Laxmanrao Kirloskar two years to sell his first iron ploughs. Moreover, Laxmanrao Kirloskar could not find a suitable location for his workshop until the Ruler of Aundh offered him a loan of ten thousand rupees, without interest, and 32 acres of arid wasteland near a renowned railway station named Kundal Road.

Laxmanrao brought together 25 workers and their families, transforming the barren, cactus, and cobra-infested expanse into his dream village. His character judgment and disregard for superficial social, economic, and educational qualifications gave him the uncanny ability to bring out the best in seemingly ordinary people. He even hired two ex-convicts to work as Kirloskarwadi’s night guards.

Laxmanrao’s eldest son, Shantanurao Kirloskar, relocated to Pune to begin a new aspect of the Group’s activities – diesel engines. His experience attempting to secure land for his factory in Pune was very different from that of his father in Kirloskarwadi. First, he had to deal with a tangle of red tape and public opposition to acquiring land for industrial purposes.

Finally, after arguing that “factories have a longer life than humans,” Shantanurao Kirloskar won a place for Kirloskar Oil Engines Ltd. (KOEL) shortly after signing a collaboration agreement with the United Kingdom’s Associated British Oil Engines Export Ltd. This collaboration was the first between an Indian and a foreign company, bridging the technological divide between east and west. The factory produced India’s first vertical high-speed engine, fulfilling one of Laxmanrao’s dreams of making engines for farmers.

Businesses

The group’s scope of operations spans a broad spectrum of industrial equipment ranging from pumps & valves, eco-friendly diesel engines & silent generating sets, air & gas compressors, air-conditioning, refrigeration equipment, and a wide range of anti-corrosion coatings and castings for the automotive sector.

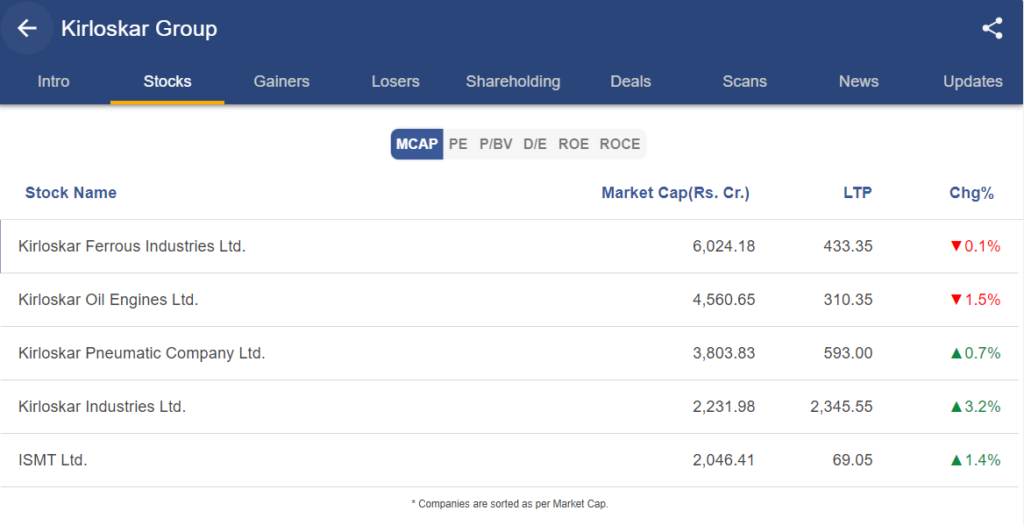

This group has the following listed companies under their business house: –

- Kirloskar Oil Engines Ltd.

- Kirloskar Pneumatic Company Ltd.

- Kirloskar Industries Ltd.

- Kirloskar Ferrous Industries Ltd.

- ISMT Ltd.

Kirloskar Ferrous Industries Ltd.

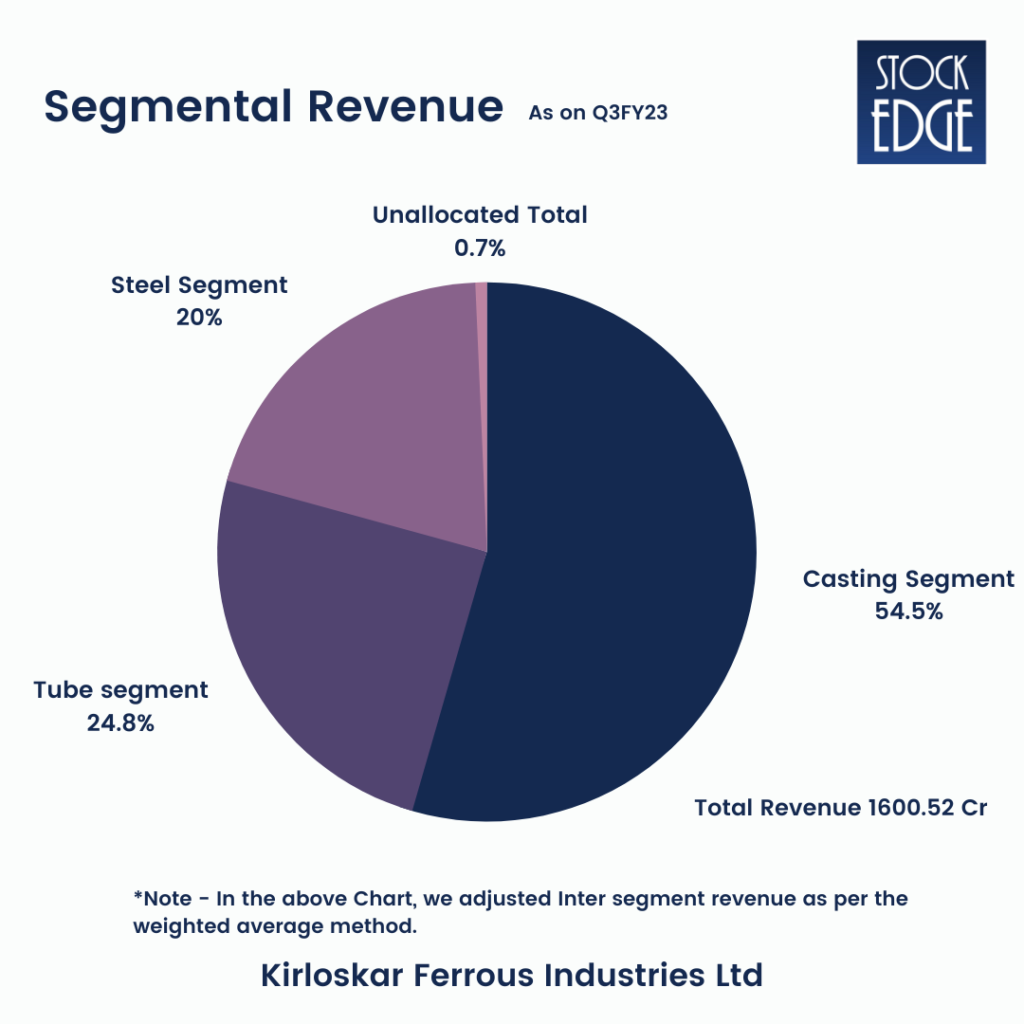

Kirloskar Ferrous Industries Ltd. is a market leader in India for manufacturing critical and intricate quality Pig Iron and Grey Iron castings. The cylinder block, head castings, and housing manufactured by the company are used in various engines, including construction machines, farm equipment, and utility vehicles manufactured by some of the world’s largest automobile manufacturers.

They have three manufacturing facilities in Koppal, Hiriyur, and Solapur. ISMT Ltd, a subsidiary company of Kirloskar Group, will merge with Kirloskar Ferrous Industries Ltd, and the appointed date of the proposed scheme is April 1, 2023. And the exchange ratio for the merger stands at fully paid-up equity shares of Kirloskar Ferrous (nominal value of INR5 each) for every 100 fully paid-up equity shares of ISMT (nominal value of INR5 each) except shares held by Kirloskar ferrous in ISMT.

Kirloskar Ferrous Industries Ltd. shares are traded on both exchanges (NSE and BSE); To get more financial insights and know the Kirloskar Ferrous Industries Ltd share price, click here.

Industry Overview

The steel industry is one of India’s key sectors, accounting for little more than 2% of the GDP.

The automotive industry contributes to around 10 to 12% of steel demand in India. Steel demand from the automobile industry is predicted to be strong due to increased capacity expansion. Rising customer demand is expected to fuel an 18% growth in crude steel output in India in FY22 to 120 million tones.

In FY22, the finished steel output totaled 92.82 million tones. The government has planned investments in highways, trains, metro connections, industrial parks, industrial corridors, DFC, water, oil, gas transportation, transmission towers, and affordable housing to boost post-COVID-19 economic recovery. All of these industries will drive steel demand. The government has taken several initiatives to develop the sector, including implementing the National Steel Policy 2017 and automatically approving 100 percent FDI in the steel sector.

India’s automotive manufacturing sector includes commercial vehicles, passenger cars, and three and two-wheelers, contributing around 7% of India’s GDP. By 2026, the Indian automobile sector will be worth $300 billion. India is dominant in the global heavy vehicle market since it is the world’s largest tractor maker, second-largest bus manufacturer, and third-largest heavy truck manufacturer.

Financials

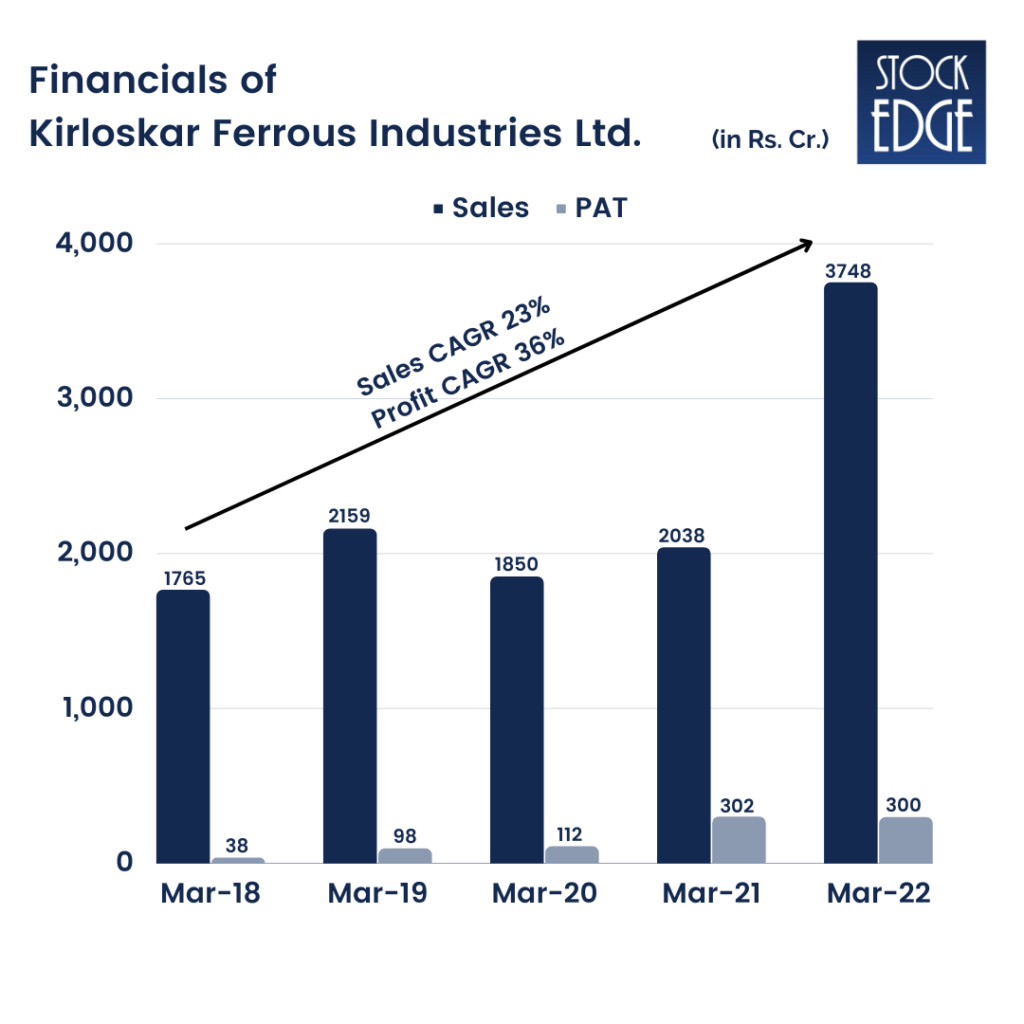

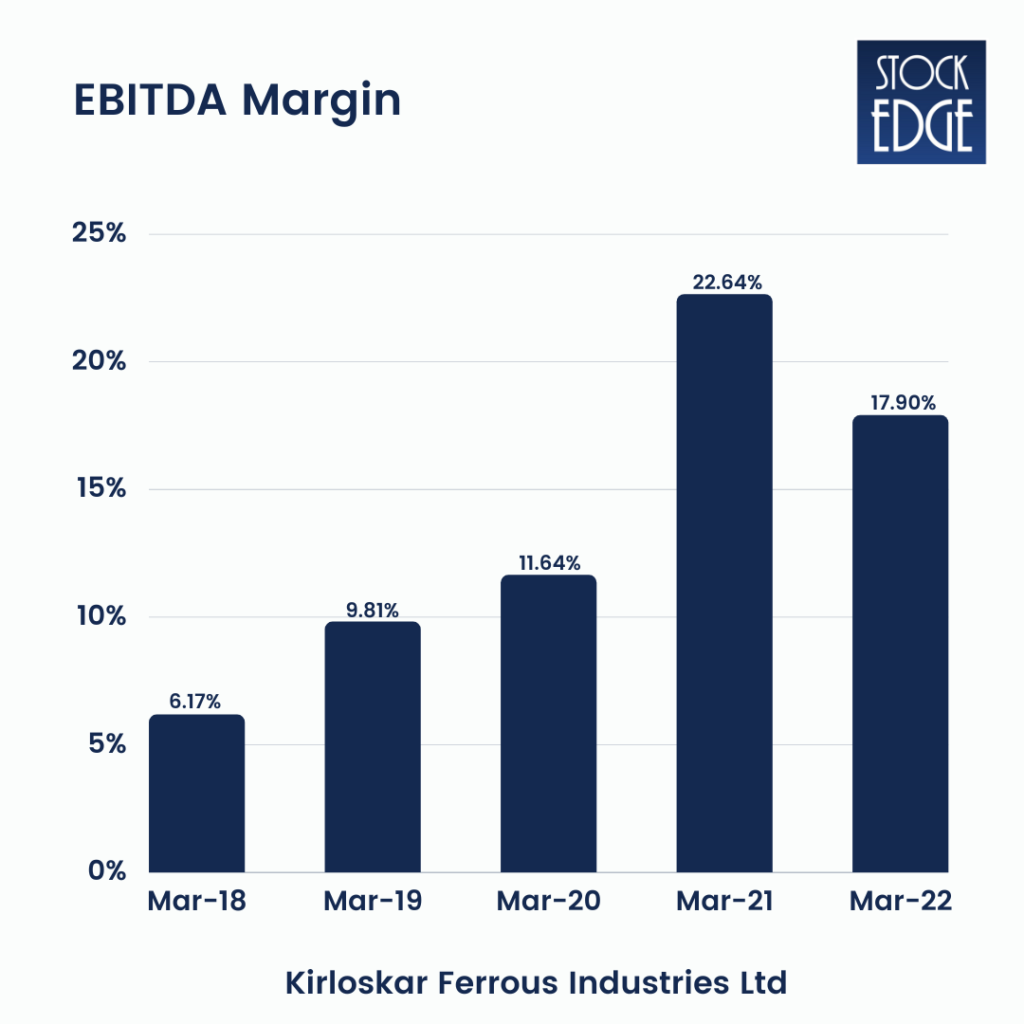

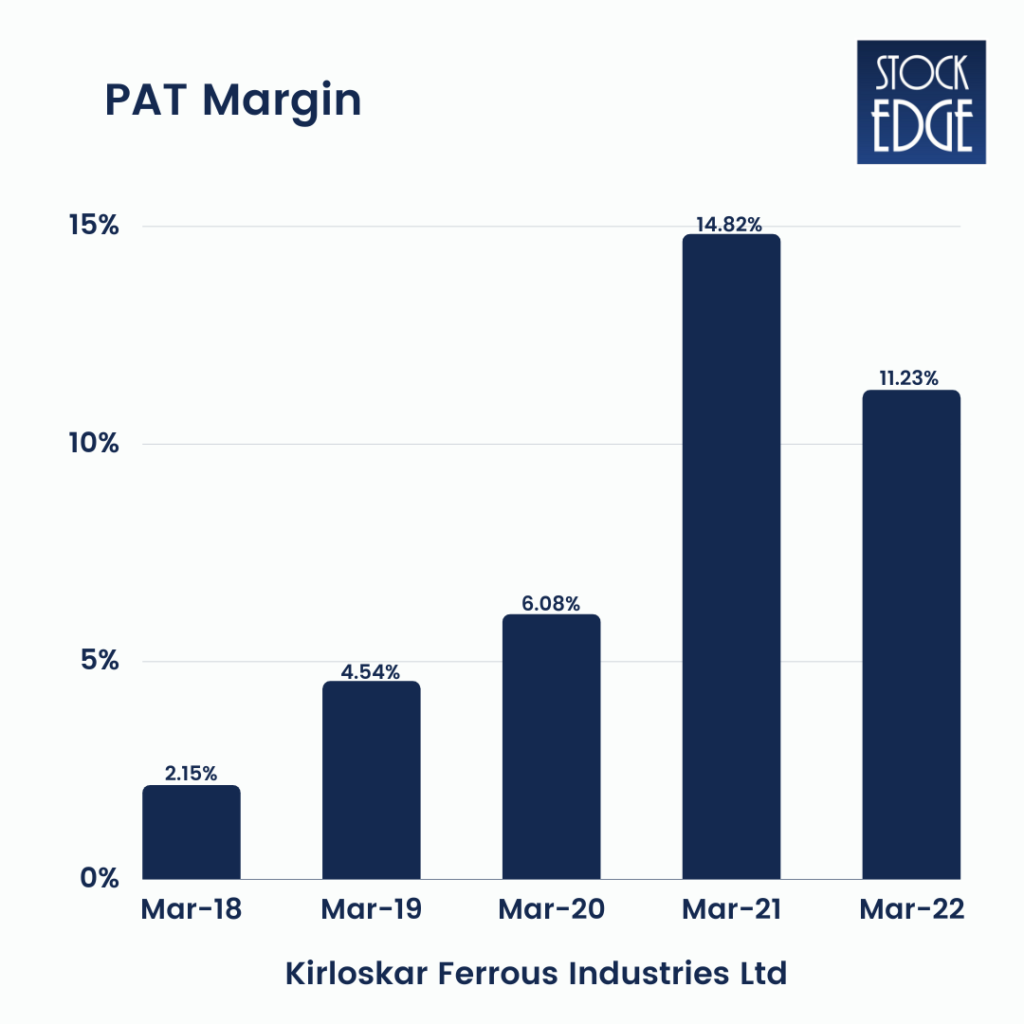

As of Q3FY23, the company reported a revenue of Rs 1601 Cr and a revenue of Rs 1758 Cr in Q2FY23, resulting in a -9% QoQ drop and a 72% annual rise, i.e., Q3FY22 933 Cr. On the other hand, PAT on Q3FY23 is 130 Cr, resulting in a 17% QoQ increase and a 60% YoY increase quarterly. On an annual basis, the FY22 company recorded revenue of Rs 3748 Cr and PAT of Rs 300 Cr, representing an 84% rise in sales over the previous year and a 1% decrease in PAT.

The management has also proactively planned cost-cutting measures. By establishing coke ovens, installing Bell-less tops for blast furnaces, and adopting pulverized coal injection, the business intends to save money through backward integration. The company just completed the second coke oven facility, providing long-term coke self-sufficiency. The second foundry line at Solapur is planned to begin operations in 4QFY23, with the pulverized coal injection project slated to be completed in 3QFY24.

Kirloskar Industries Ltd.

Kirloskar Industries aspire to provide ultimate value to its stakeholders through its strategic investments in the Group companies that form a part of its business model as a Core Investment Company (CIC)*. They are a holding company that generates wind power and has diversified into real estate development through its wholly-owned subsidiary, Avante Spaces Ltd. (Avante).

As part of our business model, they have also leased and licensed their existing commercial properties. Kirloskar Industries Ltd. stock shares are traded on both exchanges (NSE and BSE); To get more financial insights and know the Kirloskar Industries Ltd share price, click here.

*As of 31 March 2022, the Company’s status is an unregistered CIC, regulated by the Reserve Bank of India.

Company Overview

The company generates wind power, one of the world’s fastest-growing renewable energy sources. In Maharashtra, they have seven windmills at Tirade Village, Ahmednagar. In addition, they offer wind power units to our third-party customers following Maharashtra State Electricity Distribution Company Limited’s Open Access Permits (MSEDCL).

Through sustainable design, construction, and operations, Avante, a subsidiary of KIL, aspires to have green buildings that focus on energy consumption, decreasing carbon emissions, energy consumption, and waste, conserving water, prioritizing safer materials, and limiting our exposure to pollutants. The green construction offering will elevate us beyond the market’s traditional real estate options, resulting in faster inventory sales.

In addition, they want their architectural ideas to be adaptable to future demands. For example, with the surge in EV mobility and the government’s emphasis on reducing reliance on fossil fuels, our designs are intended to incorporate multi-level vehicle parking with EV charging points.

Financials

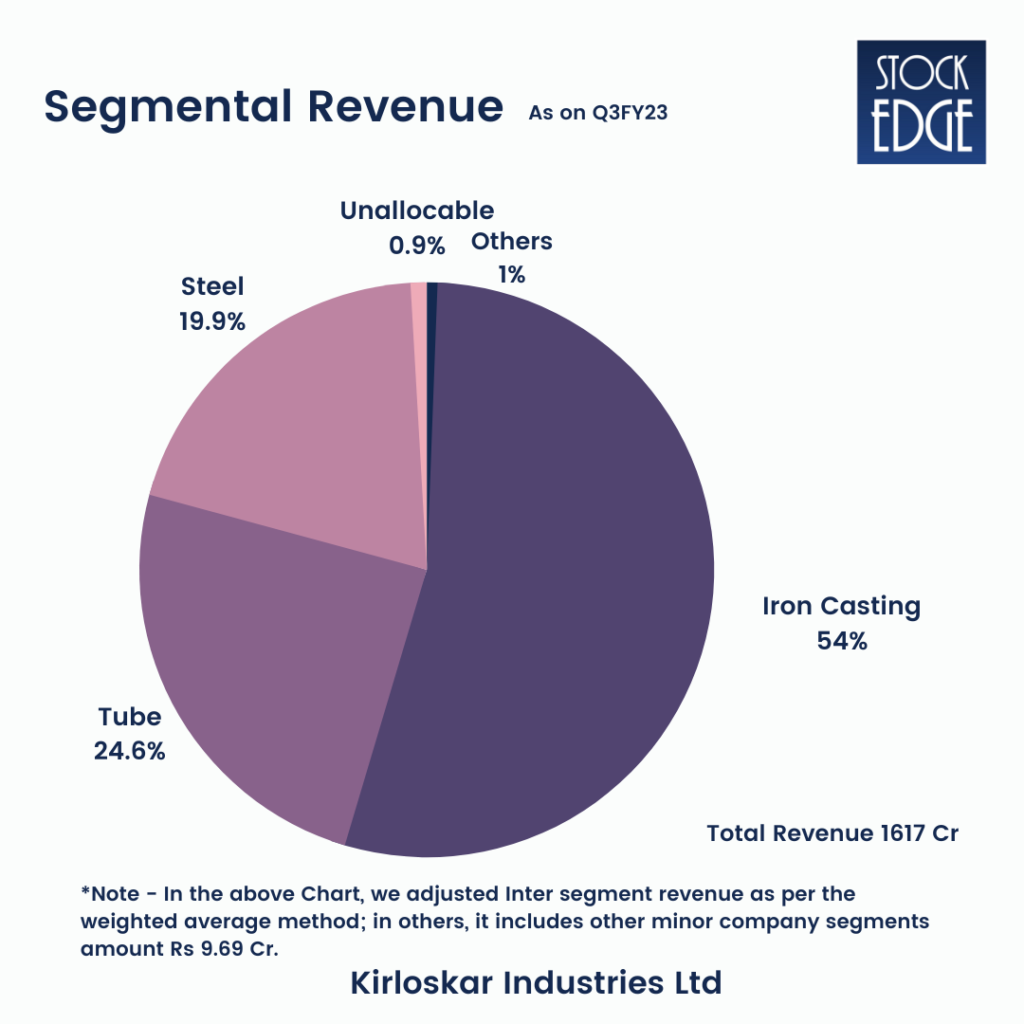

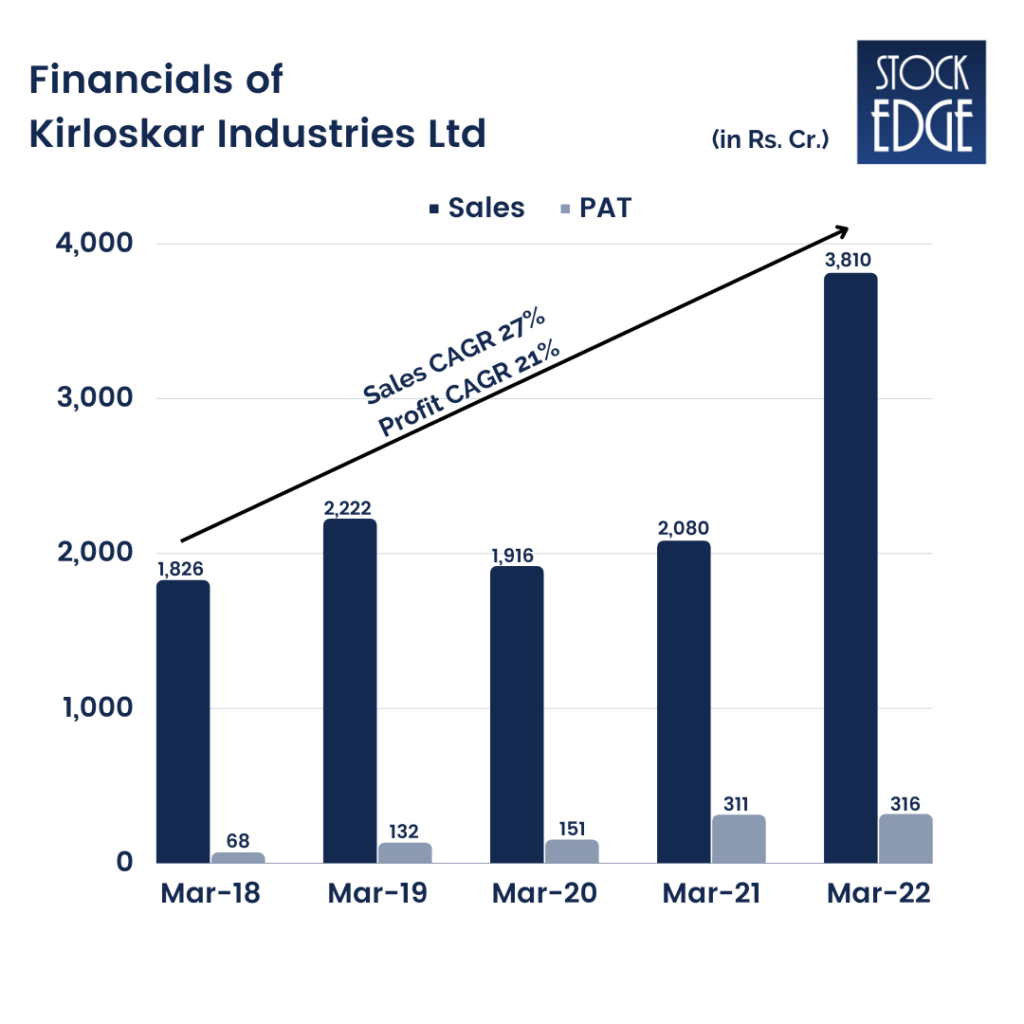

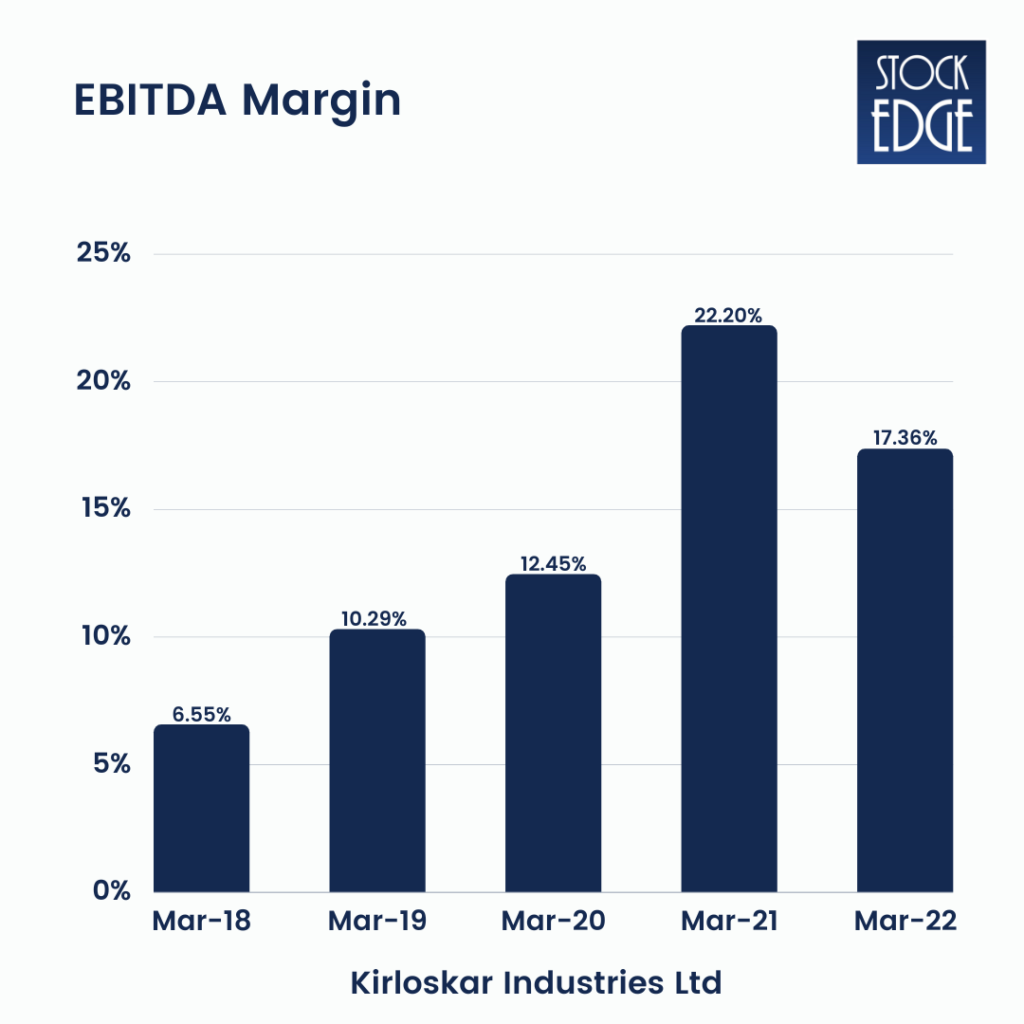

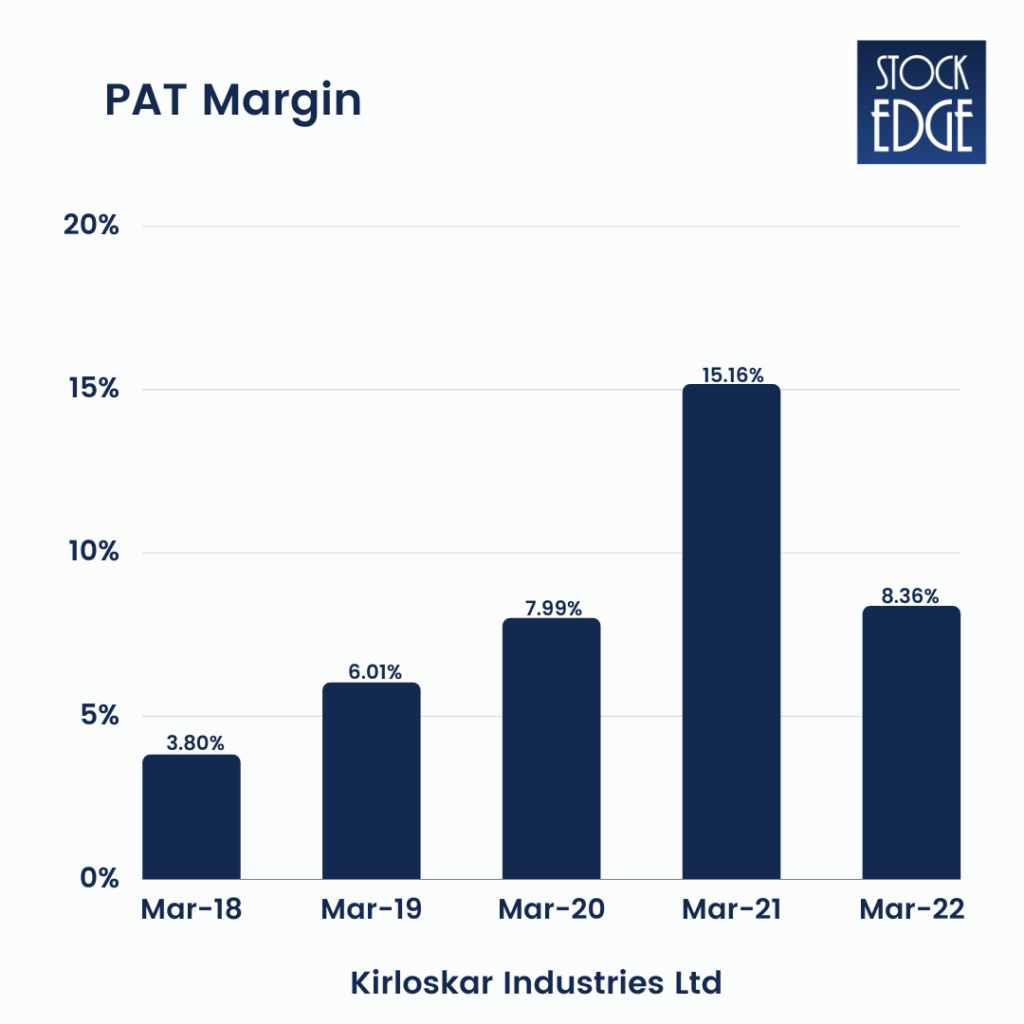

As of Q3FY23, the company reported a revenue of Rs 1607 Cr and a revenue of Rs 1787 Cr in Q2FY23, resulting in a 10% QoQ drop and a 72% annual rise, i.e., Q3FY22 936 Cr. On the other hand, PAT on Q3FY23 is 133 Cr, resulting in a 2% QoQ increase and a 56% YoY increase.

On an annual basis, the FY22 company recorded revenue of Rs 3810 Cr and PAT of Rs 316 Cr, representing an 83% rise in sales and a 2% increase in PAT over the previous year.

Kirloskar Oil Engines Ltd.

Kirloskar Oil Engines Ltd. is one of the world’s largest Genset manufacturers, specializing in products for a wide range of customers. As the Kirloskar Group’s flagship company, they are one of India’s largest diesel Genset manufacturers, with dominant market leadership. They design and sell indigenous engines for agricultural, Genset, and industrial off-highway equipment.

Their diverse product line, which includes 2.5HP to 740HP engines and diesel gen-sets with power outputs ranging from 5kVA to 1,500kVA, caters to a wide range of customers. Their strong engineering capability is built on the foundation of our cutting-edge research facility, allowing us to provide unique value to our customers through new products. Kirloskar Oil Engines Ltd. shares are traded on both exchanges (NSE and BSE); To get more financial insights and know the Kirloskar Oil Engines Ltd share price, click here.

Industry Overview

The worldwide Industrial Engines market is expected to develop at a CAGR of 3.9% between 2021 and 2027. Kirloskar Oil Engines Limited (KOEL) is India’s leading independent engine manufacturer and the engine of choice for major construction equipment OEMs in domestic and international markets. Throughout the year, the Company’s long-standing relationships with key stakeholders such as original equipment manufacturers (OEMs), end-users across operational sectors, suppliers, workers, and communities remained robust.

The Company increased its market position in the Industrial industry across functional categories by offering the correct ‘fit for market’ product with assured deliveries at a reasonable price, backed up by Kirloskar CARE’s comprehensive aftersales service network across India. To maintain market leadership, the Company has cooperated with leading equipment manufacturers and continues to harness its capabilities to develop technologies.

The Company is also focusing on introducing new applications by collaborating with OEMs and addressing their needs for machines under development and forthcoming BS-V emission standards. Increased government spending, mostly on road building and infrastructure projects to get the economy back on track, is fueling growth in this area. The Company will also strive to recruit new industrial OEMs as clients, capitalizing on the China+1 strategy that has come to dominate in light of the global macro climate.

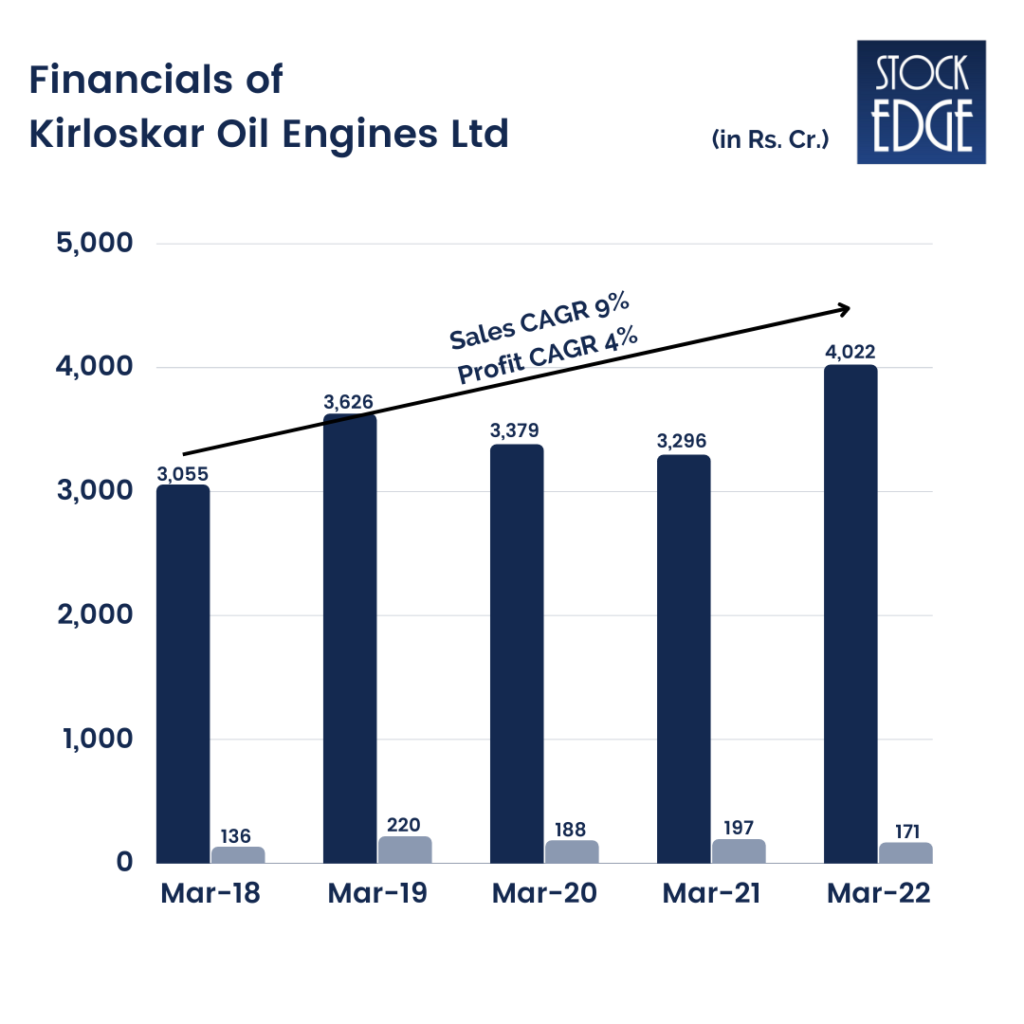

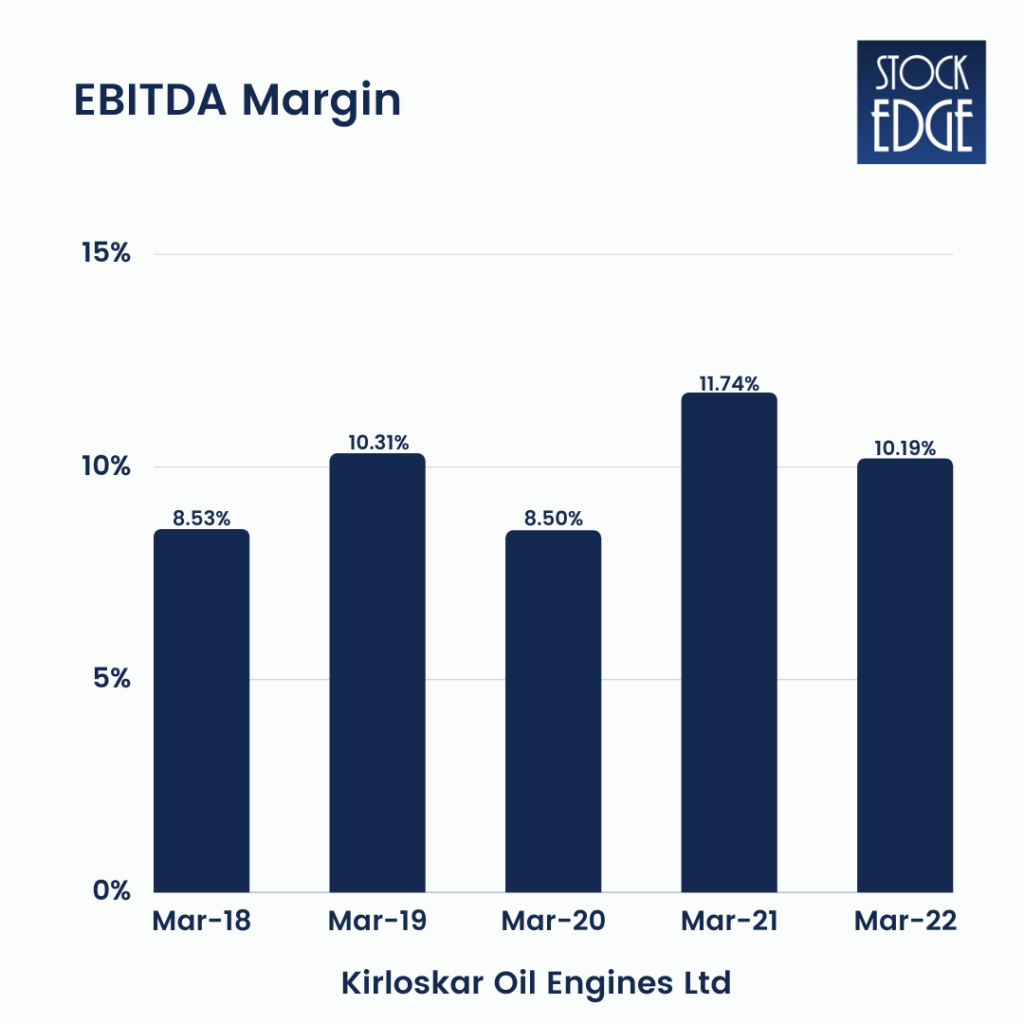

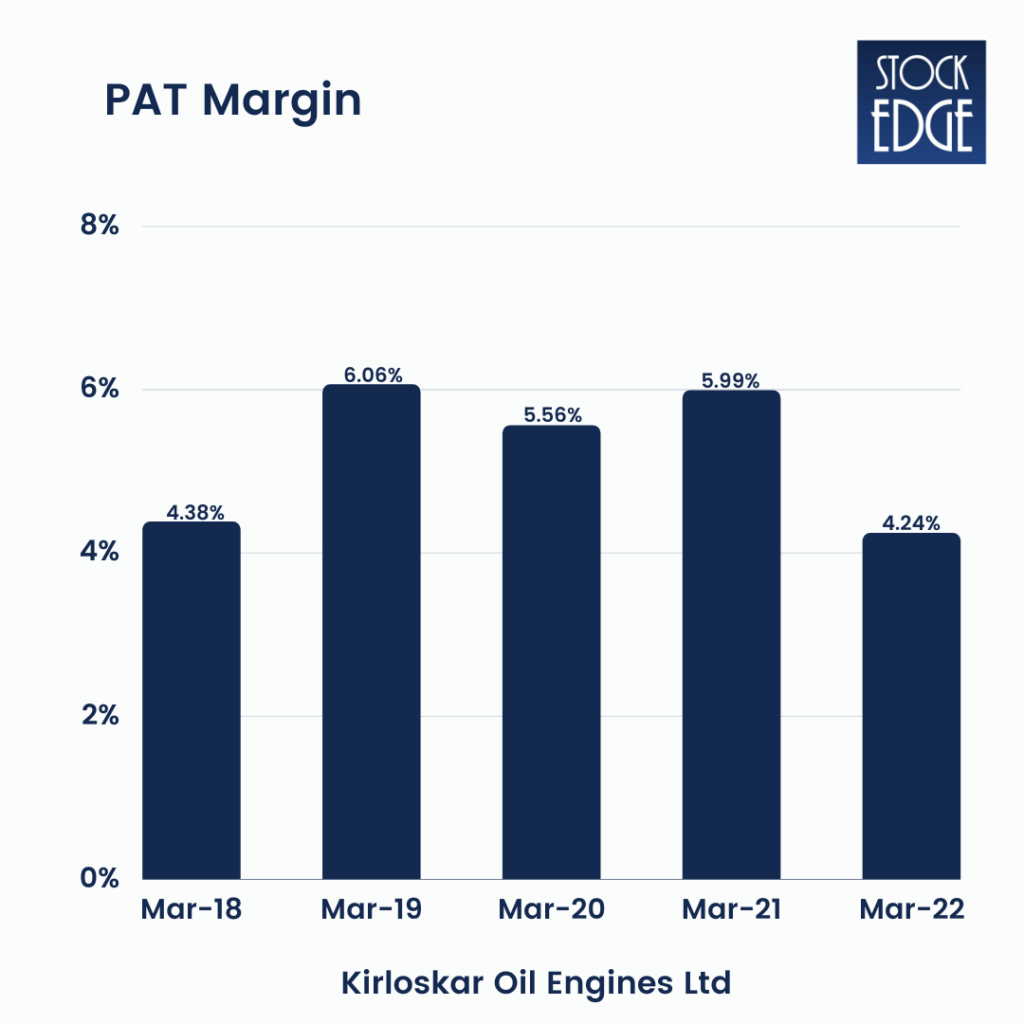

Financials

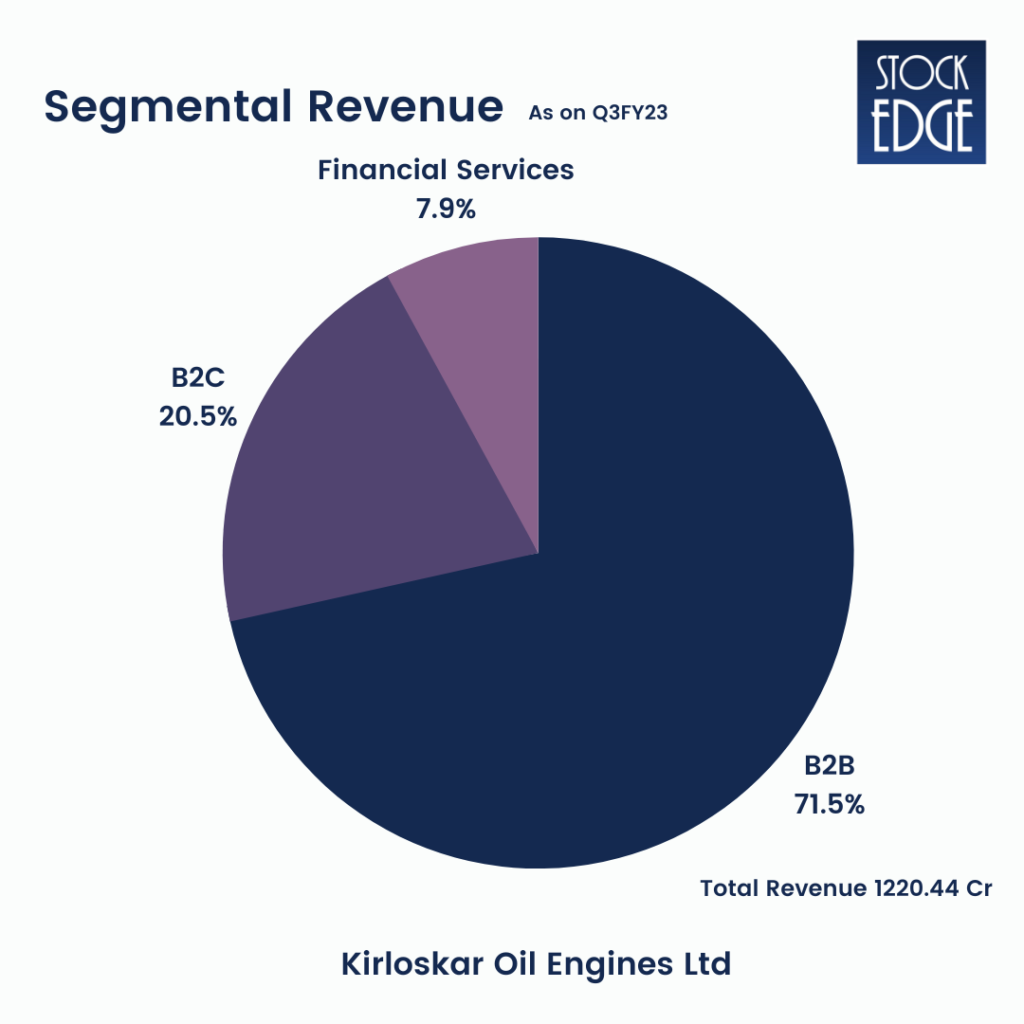

As of Q3FY23, the company reported a revenue of Rs 1220 Cr and a revenue of Rs 1228 Cr in Q2FY23, resulting in a 1% QoQ drop and a 20% annual rise, i.e., Q3FY22 1018 Cr. On the other hand, PAT on Q3FY23 is 88 Cr, resulting in a 6% QoQ increase and a 203% YoY increase. On an annual basis, the FY22 company recorded revenue of Rs 4022 Cr and PAT of Rs 171 Cr, resulting in a 22% rise in sales and a -13% decrease in PAT.

Management also stated they want to increase sales to INR65 billion over the following three years by FY25E. The organization disclosed five strategy pillars to attain its goals:

* Organically increase core business at a CAGR of 7%.

* To increase the share of aftermarket revenue as KOEL’s servicing intensity is lower at 15% of equipment sales vs. the industry level of 20-22%.

* To improve market share in HHP with a foray into engines above 1,500KVA by addressing the data center space.

* To increase the share of exports from 10% to 25-30% of sales. * To deepen and broaden its reach to lower-tier cities.

Furthermore, they want to increase margins to double digits, helped by the growth of higher profit categories.

Kirloskar Pneumatic Company Ltd.

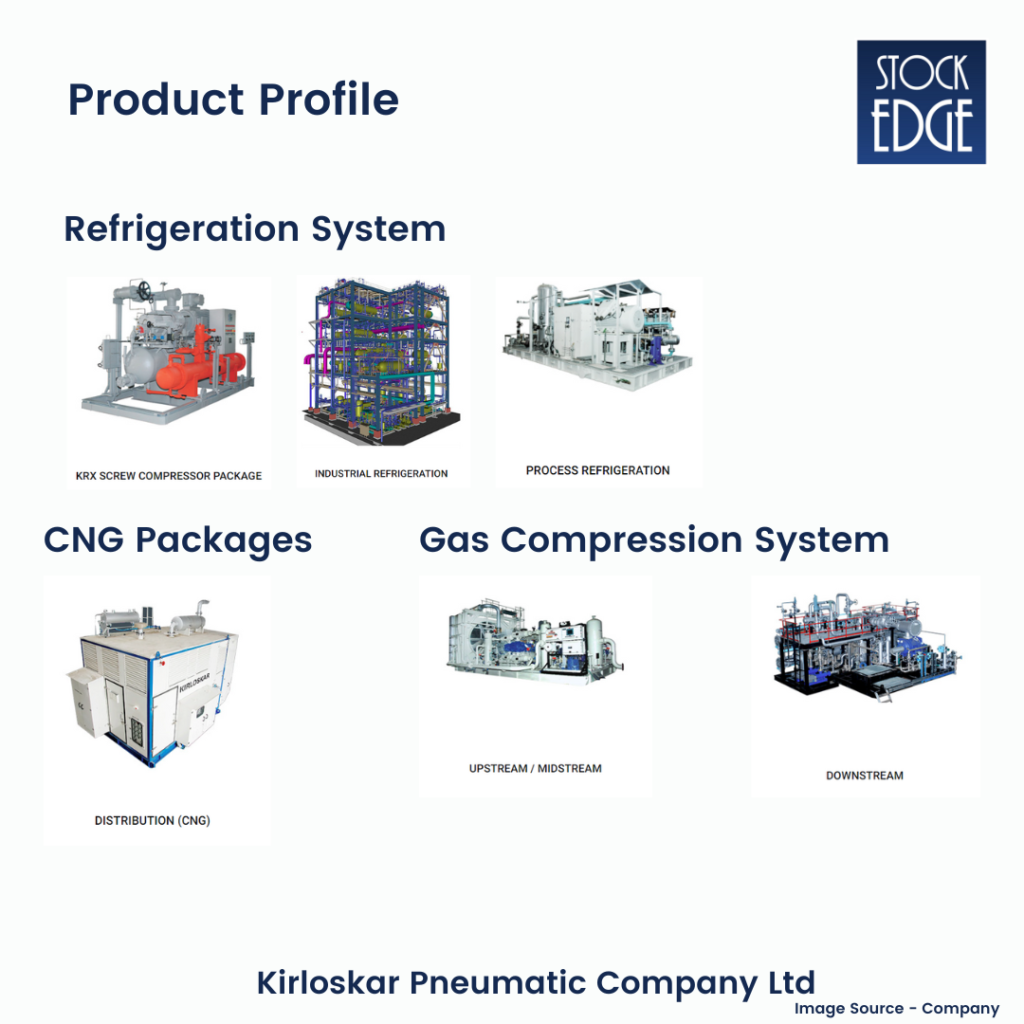

Kirloskar Pneumatic Company Limited (KPCL), a leading player in India’s Air, Refrigeration, and Gas Compression business, has served diverse industries around the world by deploying its design, R&D, manufacturing, and innovation capabilities. KPCL, founded in 1958* by Shantanurao Kirloskar, is a core company of the Kirloskar Group with a rich 133-year legacy. Using cutting-edge manufacturing technologies, they focus on providing sophisticated and high-tech products.

They serve various industries, including oil and gas, steel, cement, food processing, railways, air separation, automobiles, defense, and marine. Kirloskar Pneumatic Company Ltd. shares are traded on BSE only; To get more financial insights and know the Kirloskar Pneumatic Company Ltd share price, click here.

Industry Overview

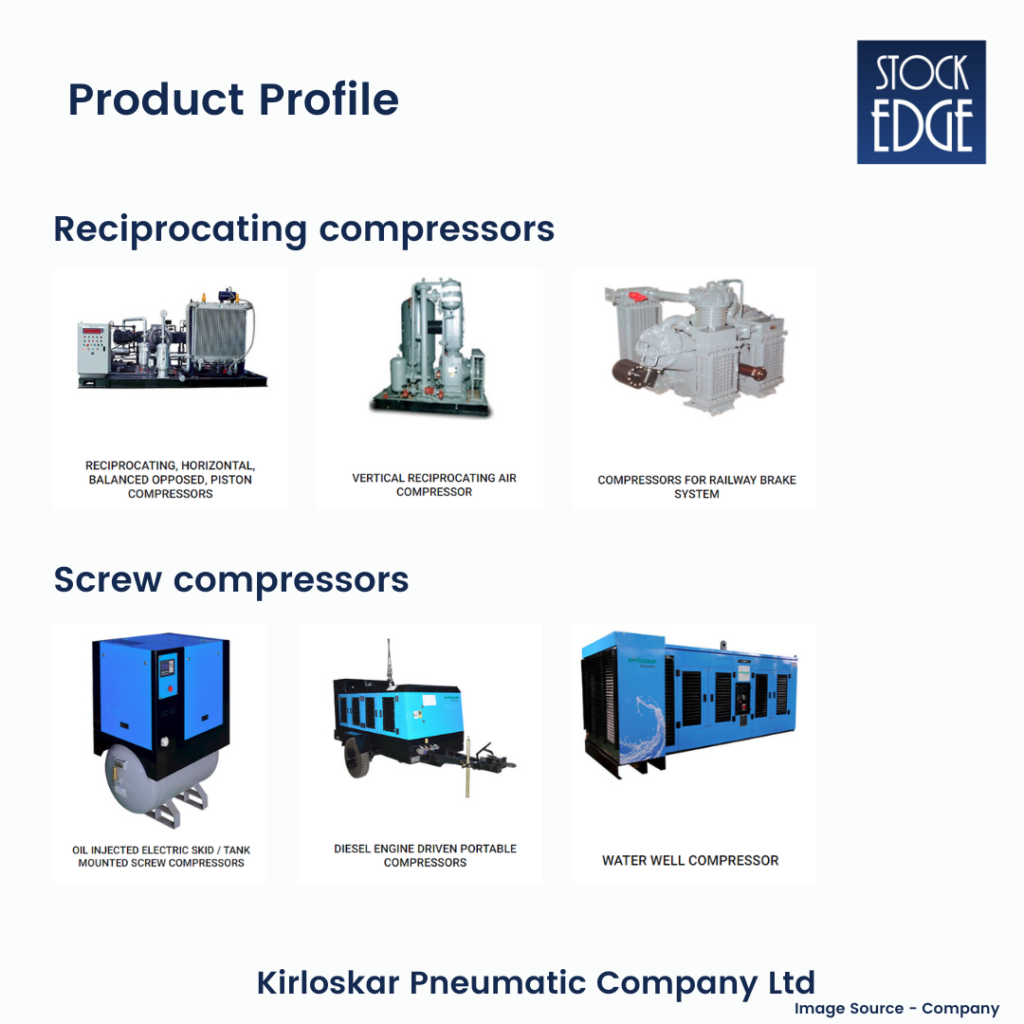

The company primarily manufactures compressors and compression systems for the air, refrigeration, and gas industries. A worldwide air compressor industry worth more than $25 billion is growing at a pace of 3% to 4% each year. The main product categories are reciprocating compressors, screw compressors, and centrifugal compressors. KPCL has long been a critical participant in the reciprocating compressor industry.

The industrial and process refrigeration sector is valued at over $9 billion globally and is growing at a pace of more than 3% per year. This industry is considered a ‘global’ business since the corporation may produce these plants/packages anywhere and sell/install them globally. KPCL is an established player in this industry in India. Finally, the gas compression business is most likely the fastest-growing process gas industry. This industry is worth more than $6 billion and is growing at a pace of more than 10% due to new hydrogen and CO2 sequestration opportunities.

KPCL has traditionally supplied compressors and compression packages to the oil and gas industries – upstream, midstream, downstream, and distribution CNG stations. It also engages in other companies, such as RoadRailer, which was stabilized during FY22. This is also the first Inter-Modal, Road-Rail logistic operation between Chennai and Delhi that runs smoothly from factory to warehouse. Furthermore, container companies may now connect the RoadRailer to their trains, opening up new routes for this industry in the future.

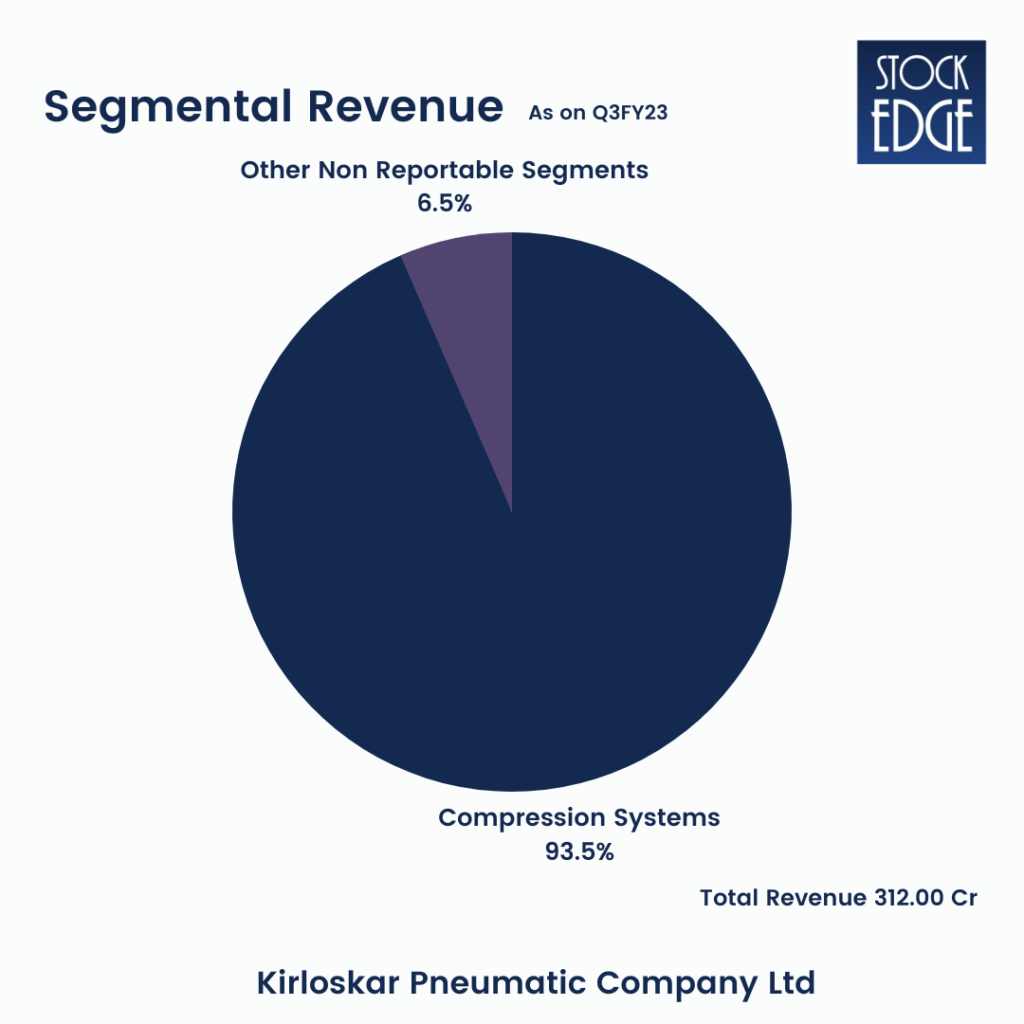

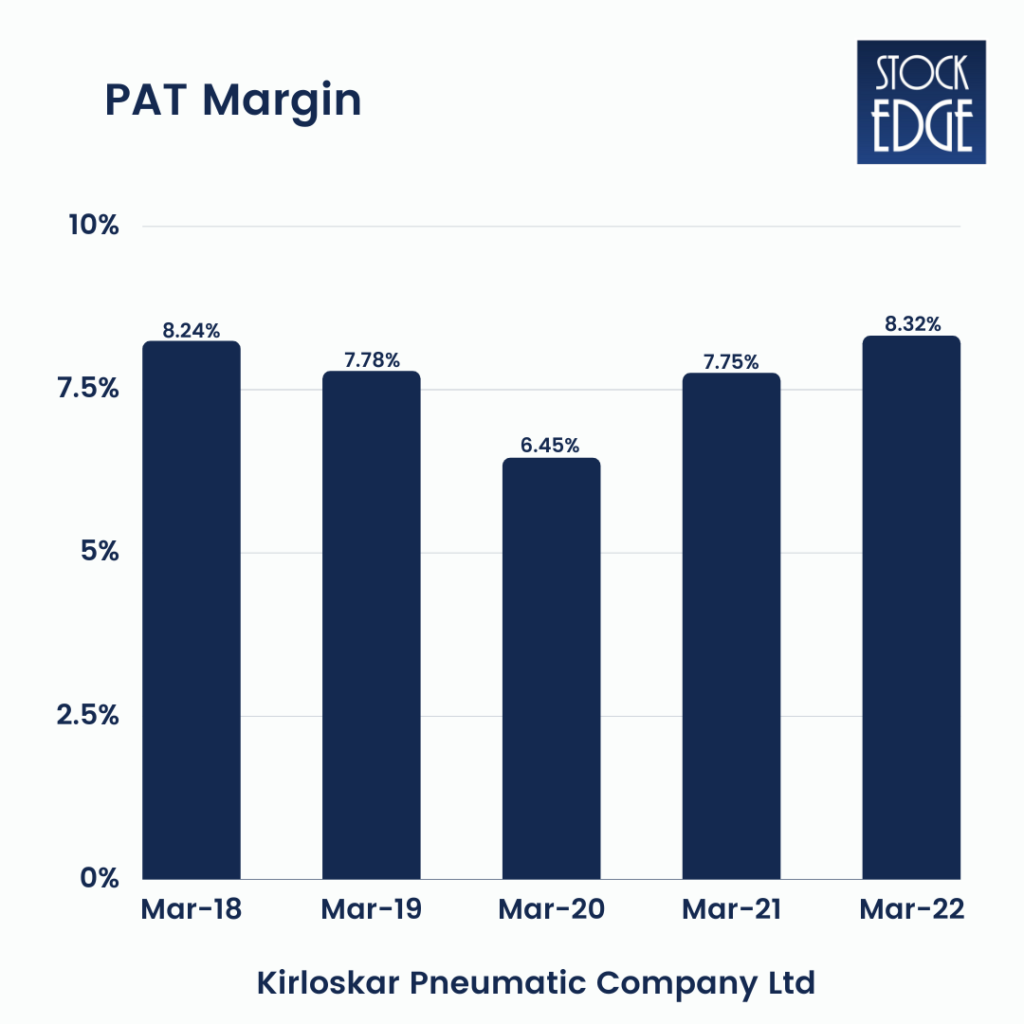

Financials

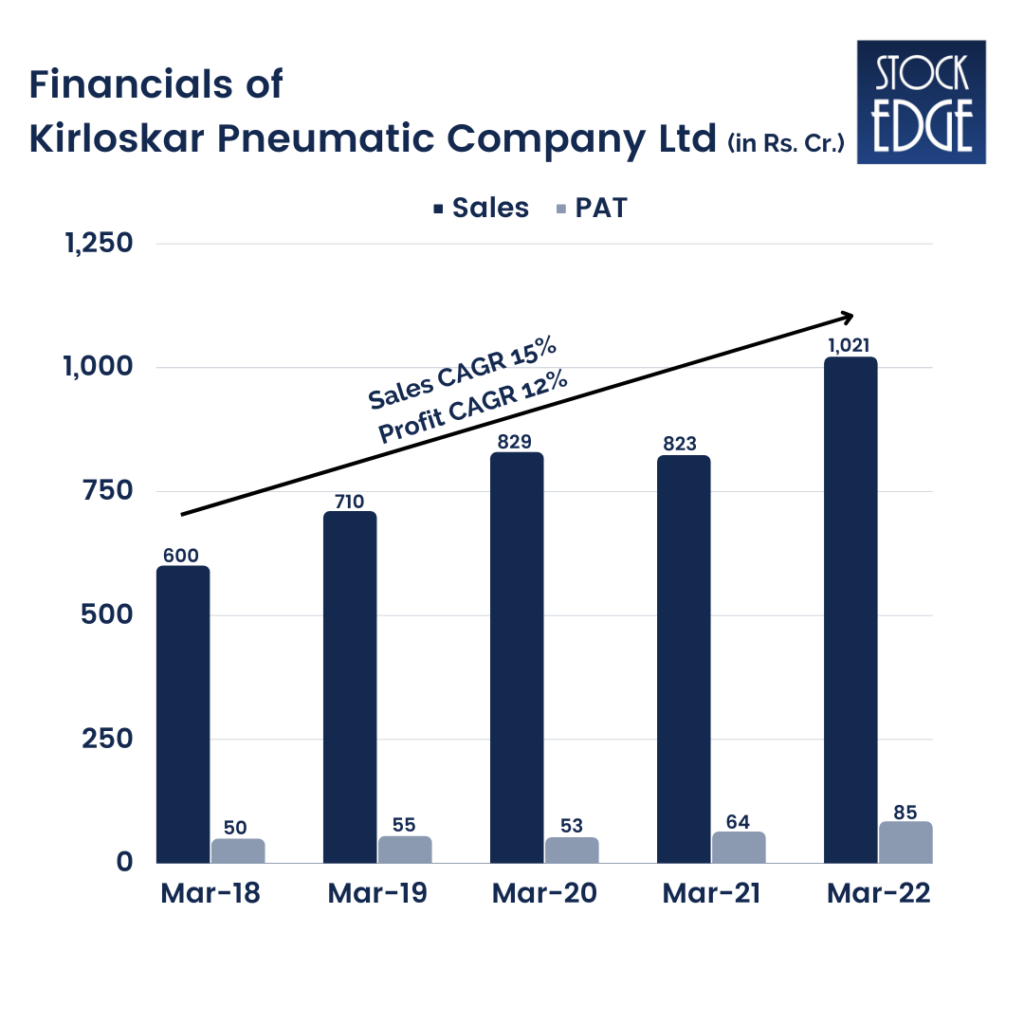

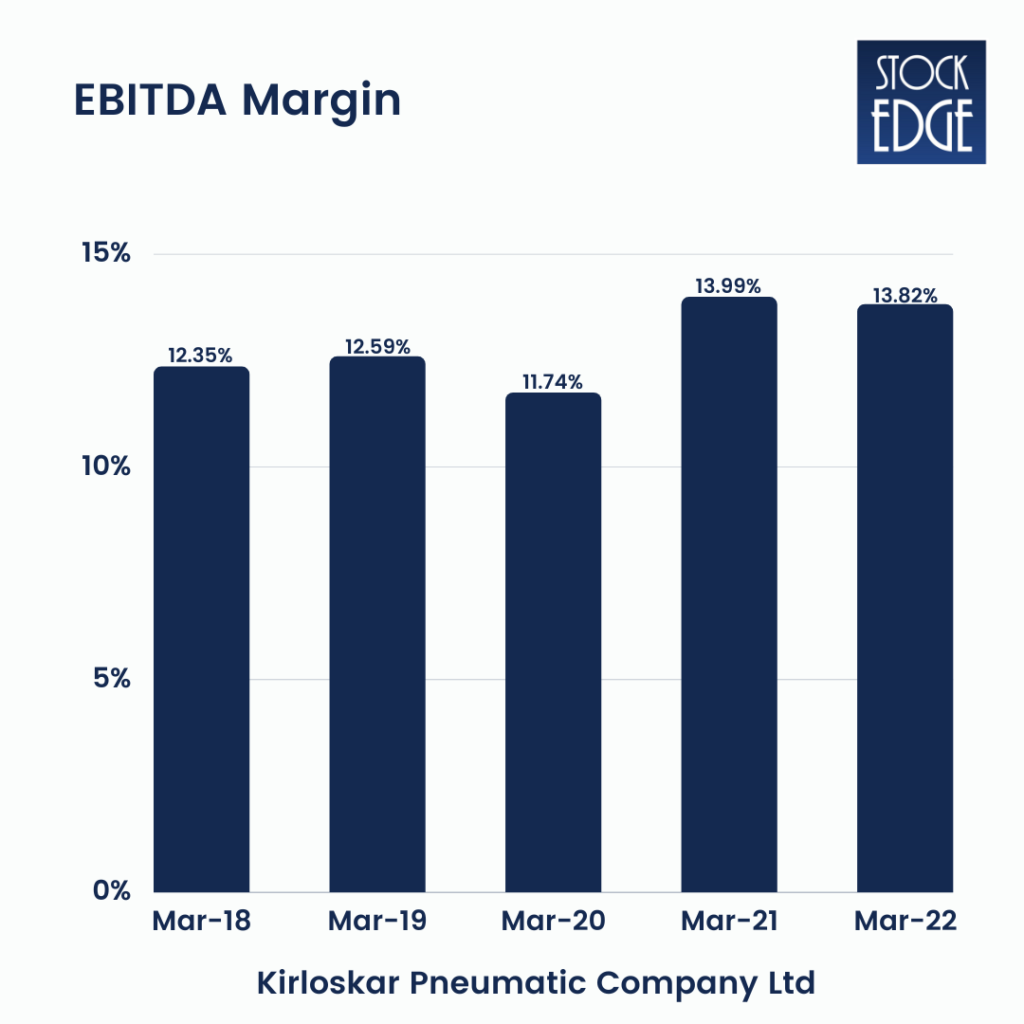

As of Q3FY23, the company reported a revenue of Rs 312 Cr and a revenue of Rs 295 Cr in Q2FY23, resulting in a 6% QoQ rise and a 37% annual increase, i.e., Q3FY22 227 Cr. On the other hand, PAT on Q3FY23 is 33 Cr, resulting in a 22% QoQ increase and a 175% YoY increase. On an annual basis, the FY22 company recorded a revenue of Rs 1021 Cr and PAT of Rs 85 Cr, resulting in a 24% rise in sales and a 33% increase in PAT.

Management said they expect to double sales over the following two to three years, reaching INR20 billion by FY25E. The organization published its growth forecast for each division to meet sales targets.

a) Gas: The government plans to build 6,000 new gas stations, 60% for booster compressors and the remainder for online or mother stations. With a stronghold in this industry, the business anticipates at least 3,000 compressor orders.

b) Air: the business wants to enhance its market share in the INR50 billion market by introducing newly built screw compressors (screw compressor market: 75% share).

c) refrigeration: by constantly developing new products, the firm has been targeting sectors such as dairy, pharma, food processing, drinks & brewery, Oil & Gas, Pharmaceutical, Chemical & Fertilizers, etc. The business introduced the Khione series Screw Compressors, which have an INR1.5 billion import market in refrigeration.

ISMT Ltd.

Kirloskar Ferrous Industries Limited, the flagship company of the Pune-based Kirloskar group, acquired ISMT Ltd in March 2022. ISMT Ltd is the Asia Pacific Region’s largest integrated manufacturer of precision seamless tubes, tubular components, and steels (erstwhile The Indian Seamless Metal Tubes Limited).

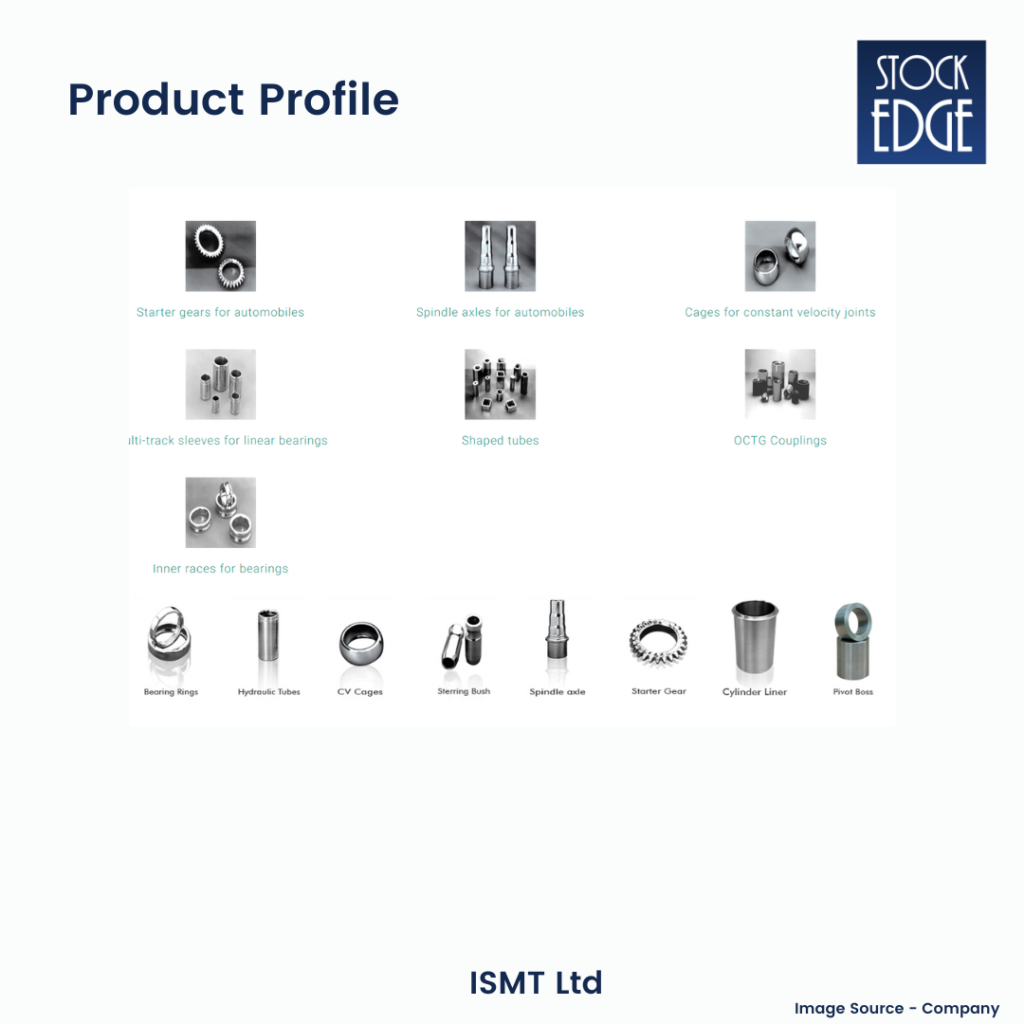

ISMT Ltd. was founded in 1989 by a group of technocrats to manufacture specialized seamless tubes in India. ISMT Ltd. manufactures various value-added products for these industries and tubes.

Bearing rings, gear blanks, shifter sleeves, cages for constant velocity joints, swaged and machined axles, threaded and coupled casings, couplings, and various other products fall into this category. The shares of ISMT Ltd. are traded on both exchanges (NSE and BSE); To get more financial insights and know the ISMT Ltd share price, click here.

Company Overview

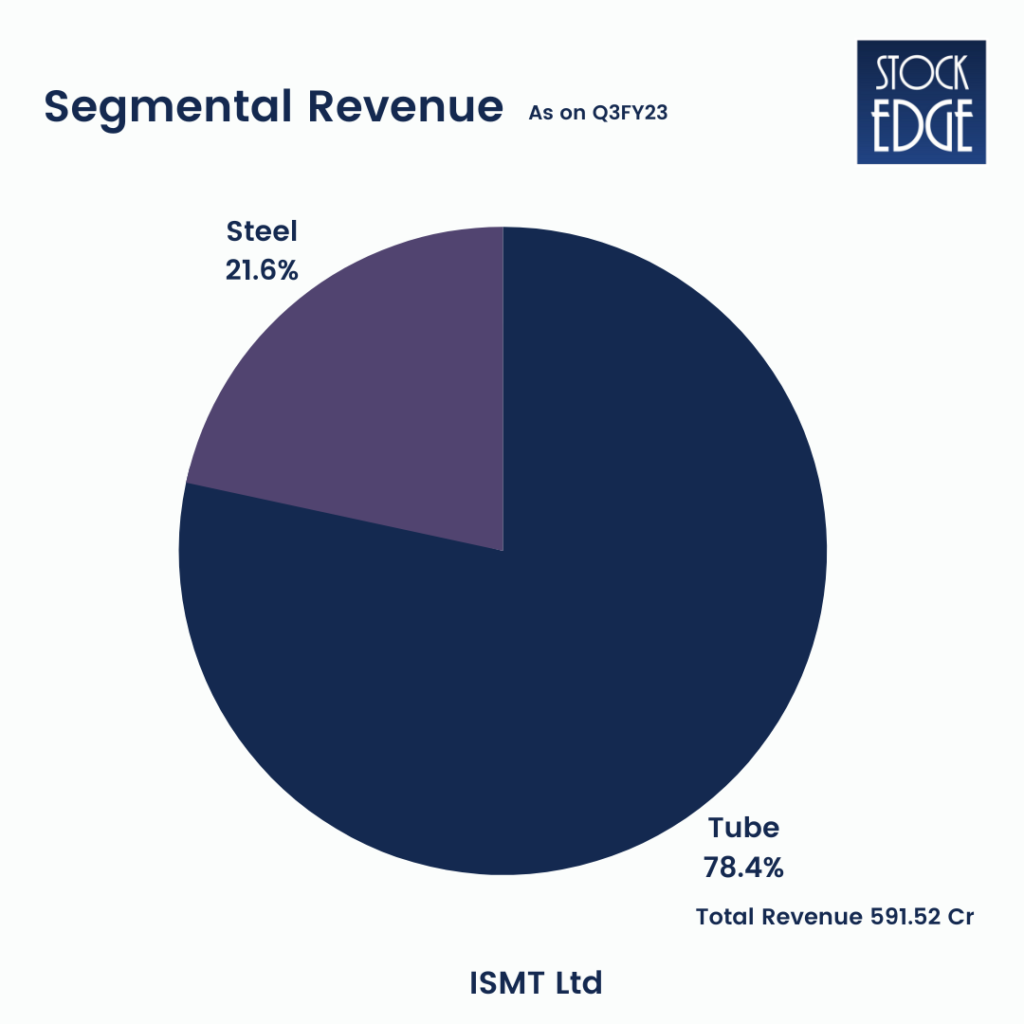

ISMT is involved in the Seamless Tube and Steel Industries. Seamless Tube is a capital-intensive sector that employs cutting-edge technology. While the industry competes with other types of pipes and tubes in some applications, it outperforms them in terms of surface quality, machineability, strength-to-weight ratio, and longevity.

Seamless tubes are used in the oil and gas exploration business, the power sector, the automotive industry, construction equipment, bearings, material handling equipment, structural components, and various other mechanical applications. The consumption of seamless tubes heavily relies on long-term economic growth and expansion in the automobile and capex industries.

It also features an integrated steel plant that produces steel using electric arc furnace technology. Its primary business is the production of specialized alloys and bearing steel. Except for some clients requiring steel for particular applications, the end user categories include Bearing, Automotive, Engineering, and Forging Customers. The fortunes of specialty and alloy steel products are closely related to the automobile and auto component industries.

Financials

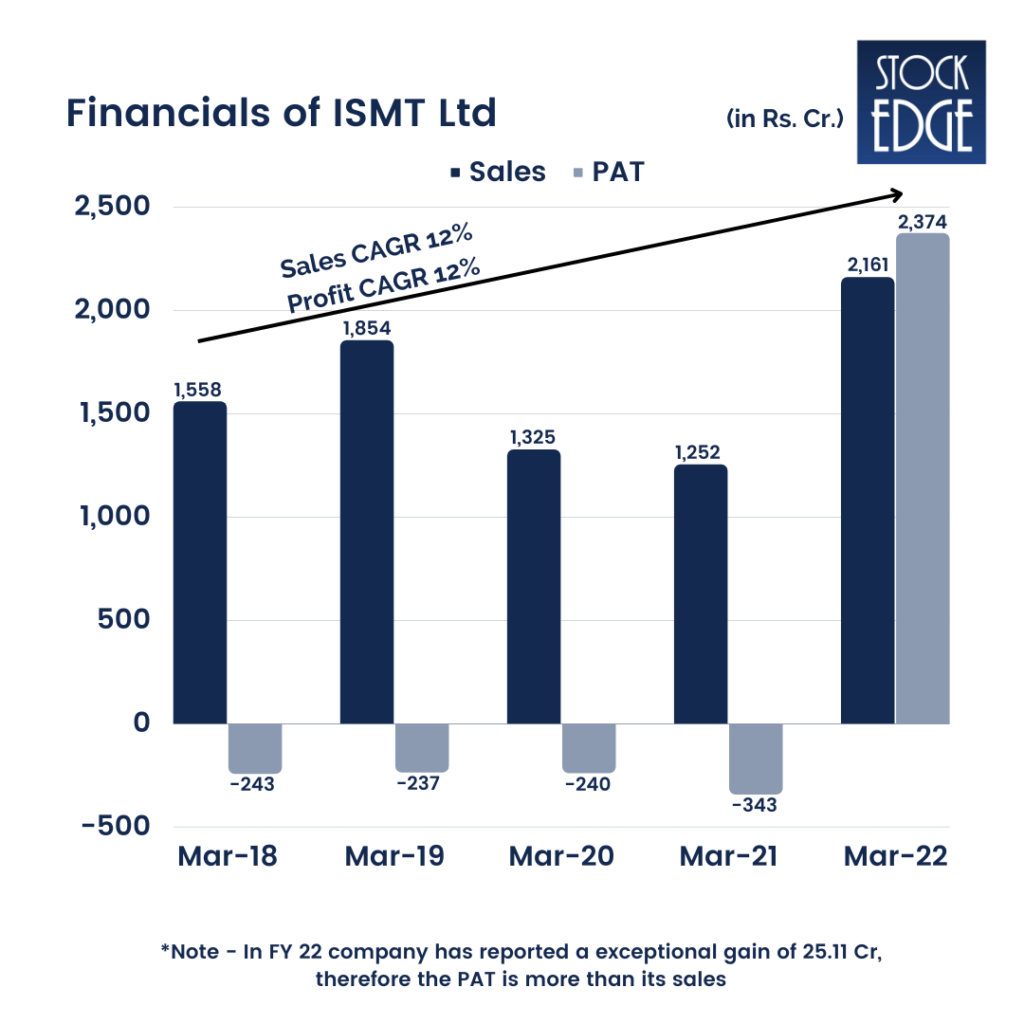

As of Q3FY23, the company reported a revenue of Rs 598 Cr and a revenue of Rs 709 Cr in Q2FY23, resulting in a 16% QoQ drop and a 12% annual growth, i.e., Q3FY22 534 Cr. On the other hand, PAT on Q3FY23 is 29 Cr, resulting in a 3% QoQ decrease and a 142% YoY decrease.

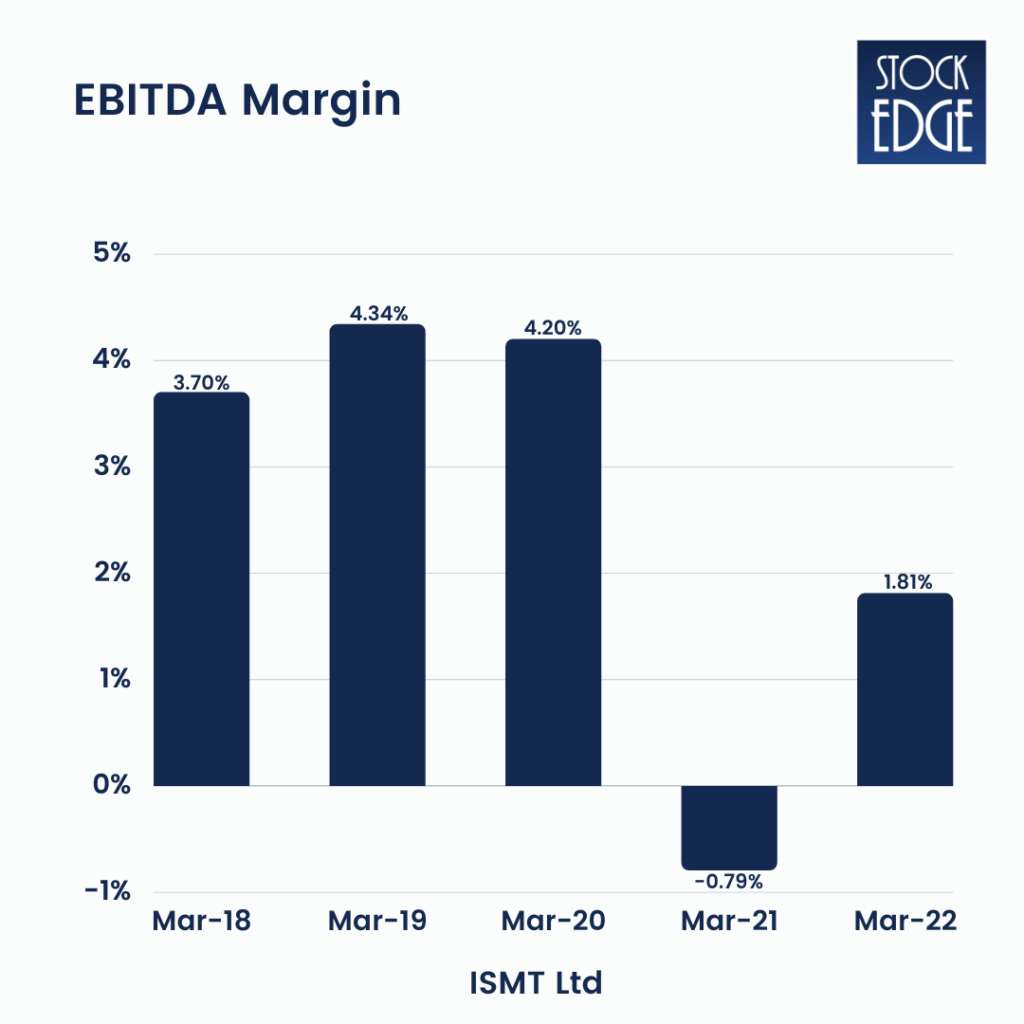

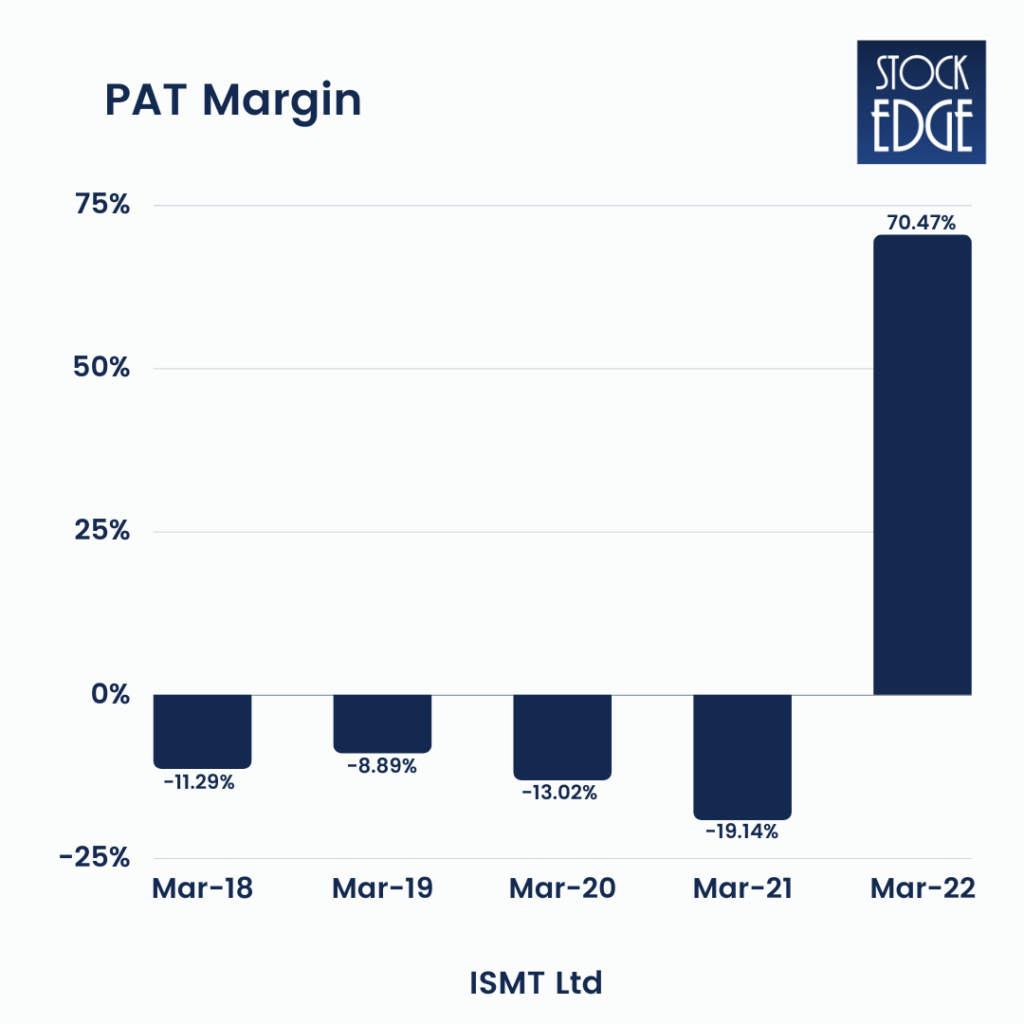

On a yearly basis, the FY22 company reported a revenue of Rs 2161 Cr and a PAT of Rs 2374 Cr, resulting in a 73% increase in sales compared to the previous year and a significant increase in PAT from negative -343 Cr in FY21 to positive 2374 Cr in FY22 due to exceptional gains reported in the Q4FY22 quarterly report of amount 25.11 Cr.

Note – Above the chart of PAT margin shows 70.47%, this is because of exceptional gain in the FY22 of amount Rs 25.11Cr, actual PAT for the FY22 is 5.53 Cr.

Note – ISMT Ltd will be merged with Kirloskar Ferrous Industries Ltd, and the appointed date of the proposed scheme is April 1, 2023. And the exchange ratio for the merger stands at fully paid-up equity shares of Kirloskar Ferrous (nominal value of INR5 each) for every 100 fully paid-up equity shares of ISMT (nominal value of INR5 each) except shares held by Kirloskar ferrous in ISMT.

Know more about Kirloskar Group by using the Business Houses tab in the StockEdge Web

Business Houses are one of the paid tools offered by the StockEdge App

Check out StockEdge Premium Plans.

Until then, keep an eye out for the next blog on “Stock Insights.” Also, please share it with your friends and family.

Happy Investing!

excellent report of kirl group.

Good job