Table of Contents

In today’s Stock Insights of IDFC Ltd, we will discuss an NBFC whose mission is to create long-term value for all its stakeholders by being a dynamic and customer centric organization providing banking and other financial services through its subsidiaries.

With the goal of becoming the most reputable financial service providers in the country and reaching out to millions of people across India through the various subsidiaries, IDFC aspires to live up to the expectations of its customers, employees, investors, and society at large.

IDFC Ltd., is the promoter of IDFC First Bank and IDFC AMC (with a 100% stake). In 2014, IDFC Ltd received a license to set up a universal bank – IDFC Bank. To strengthen its retail franchise, IDFC Bank merged with Capital First Ltd to form IDFC First Bank in December 2018. Currently, IDFC Ltd holds 39.98% (as on 31st March 2021) stake in IDFC First Bank. IDFC First Bank is progressing well towards its stated goal of becoming a mass retail bank, both in terms of assets and liabilities. Its QAAUM stands at Rs. 1,21,081 crore as of December 2020. As of today’s date, this is IDFC share price.

Since 1997, Infrastructure Development Finance Company (IDFC) has been an integral part of the country’s development story, when the company was formed with the specific mandate to build the nation.

IDFC is a public limited company which is incorporated in India under the provisions of Companies Act, applicable in India and is a Non-Banking Finance Company (NBFC) regulated by the Reserve Bank of India (RBI).

IDFC is operating as an infrastructure finance company, i.e. financing infrastructure projects in sectors like energy telecommunication, transportation, commercial and industrial projects including hospital, education, and tourism and hotels.

To know more about this company and increase your understanding about fundamentals of the company, Click Here

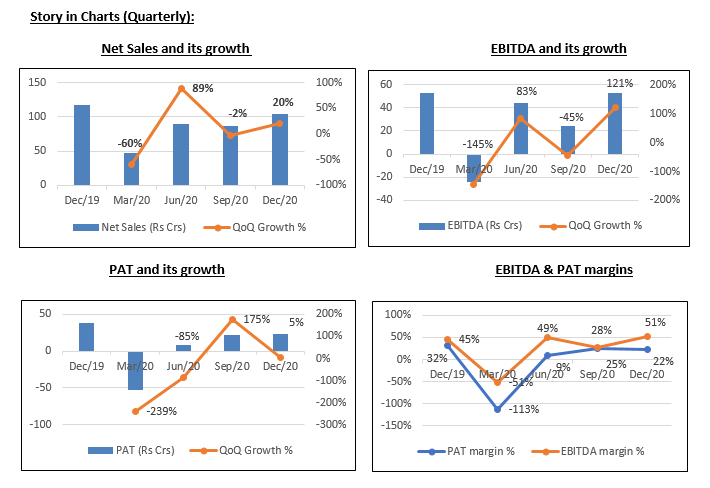

Operational Highlights

- The revenues declined during Q3FY21 to Rs 104 cr as compared to Rs 118 cr in Q3FY20.

- The EBITDA remained flattish to Rs 53 cr in Q3FY21 as compared to Rs 53 cr in Q3FY20.

- The PAT declined to Rs 23 in Q3FY21 as compared to Rs 38 cr in Q3FY20.

- The AAUM in the IDFC AMC improved by 6% on a QoQ basis.

- IDFC First Bank’s Gross NPA reduced sequentially from 1.62% as of Sept 30, 2020 to 1.33% as of Dec 31, 2020. Bank Net NPA reduced sequentially from 0.43% as of Sept 30, 2020 to 0.33% as of Dec 31, 2020 .

- Capital Adequacy Ratio is strong at 14.33% with CET-1 Ratio at 13.82% as of Dec 31, 2020

- CASA Ratio improved to 48.31% as on Dec 31, 2020 from 24.06% as on Dec 31, 2019. Average CASA Ratio also improved to 44.66% as on December 31, 2020 from 20.88% as on December 31, 2019.

Read our latest article on eClerx Services Ltd. – A Leader in Business Transformation

Future Outlook

- IDFC First Bank continues to restructure balance sheet thereby improving earnings

- Healthy growth in the AMC business with strong inflow in debt schemes aided by consistent performance bodes well for the future earnings.

- The company is committed to enhancing shareholders’ values by following its strategy of working in a regulated environment.

- The bank is awaiting final RBI guidelines relating to ownership and control in Indian private sector banks to formally move ahead and execute the unlock value strategy

Technical View

IDFC Ltd bounced from the support zone and is likely to stay positive till it stays above the 44-45 zone. Technical parameters look positive till now. Probable resistance in the short term comes at 58 level and next resistance at 68-70 zone. Till the above support remains intact, there is a high possibility of bounce from the current level.

Bottom Line

The bank continues to progress well on retailization of both assets and liabilities. The overall strategy for the bank has been retailization. More the retail deposits, the more sticky and good foundation of the bank is. Most of the data of the bank has been very transparent. IDFC First bank is a very well placed bank and is progressing well. AMC continues to do well. The AUM is now 1.2 lakh crore, that range slightly above that, with a stable market share of over 4%. The market rebound in the equity section was led by equity AUM improvement. The fixed income delivered a strong AUM growth led by noncash debt.

Know more about IDFC Ltd. and its peers by using the Sectors tab in the StockEdge Web

Check out StockEdge Premium Plans.

Yes,… long-term Growth…. positive.

Thanks for your lovely information.

PLEASE do continue with this great work.

We are glad you liked the content. Keep following us on Twitter to read more such Blogs!

THE BRIEF ABOUT IDFC AND ITS OFFSPRING IS VERY INFORMATIVE. I WOULD LIKE TO READ SUCH BRIEFS ABOUT SMALL AND MID CAPS IN WHICH INVESTORS LIKE ME R INTERESTED.

THANK U

We are glad you liked the content. Keep following us on Twitter to read more such Blogs!

saras

Excellent