Table of Contents

In the world of business, the term turnaround refers to the financial recovery of a company that was previously performing poorly. If someone is invested in a turnaround company, then the investor must pay attention to the quality of the turnaround and evaluate if its performance can sustain.

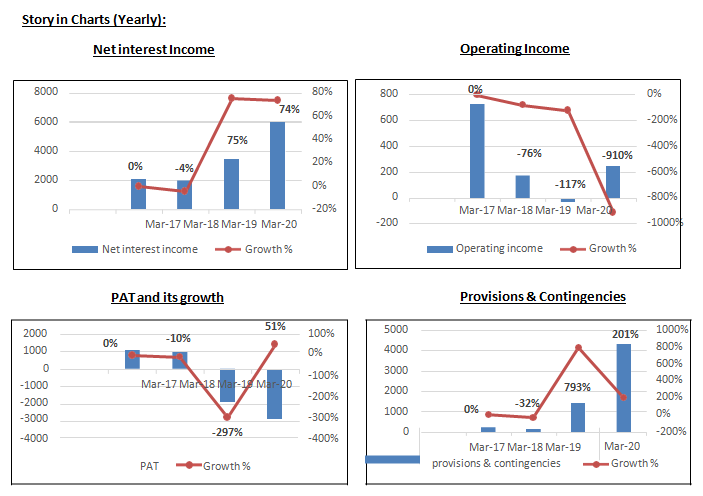

IDFC First Bank is one such turnaround story which is unfolding in the private banking space during the COVID times. After a series of losses for 6 consecutive quarters, IDFC First Bank had started reporting profits from the past four quarters—i.e. in Q4FY20 to Q3FY21. As of today’s date, this is IDFC First Bank share price.

The Story

IDFC First Bank is an Indian banking company headquartered in Mumbai which is a subsidiary of IDFC. The lender was established on December 18, 2018, as a result of the merger of IDFC Bank Ltd (IDFC Bank) and Capital First Ltd.

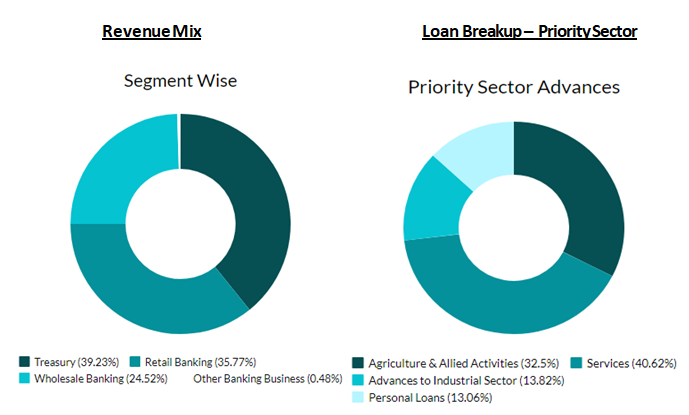

IDFC First Bank has three business verticals: Corporate banking, Consumer banking and Rural banking.

As of December 31, 2020, the Branch Network consisted of 576 branches and 541 ATMs across the country. Retail loans, including such inorganic portfolios, account for 65 percent of total loan assets.

To know more about this bank and increase your understanding about fundamentals of the company, Click Here

Operational Highlights of IDFC First Bank

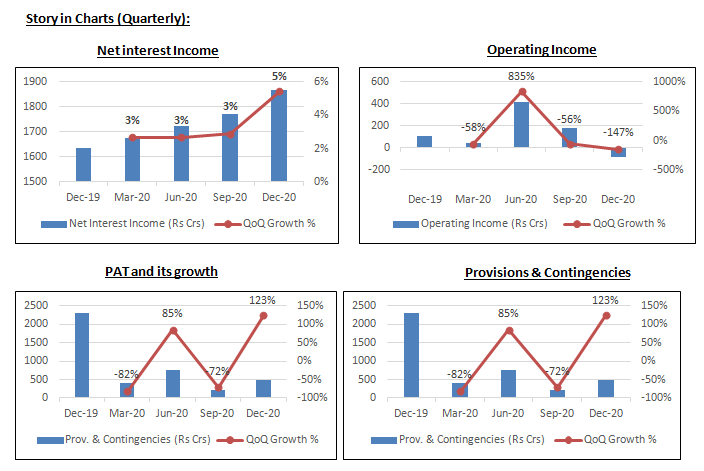

Q3 FY21 Net Interest Income (NII) was Rs. 1868.79 crore, a growth of 14.37% YoY. Net Interest Margin was 4.65% in Q3 FY21 as compared to 3.86% in Q3 FY20.

The provision for the quarter was Rs. 482.23 crore as compared to Rs.2,304.76 crore in the corresponding period last year. This includes additional COVID provisions of Rs. 390 crore during Q3 FY21.

Net profit increased to Rs. 137.15 crore as compared to a loss of Rs.1,613.54 crore, in the corresponding period last year.

Overall loan growth remained flat owing to rebalancing of the portfolio.

CASA ratio was 48.31 percent as of December 31, 2020, compared to 24.06 percent as of December 31, 2019. Core Deposits (Retail CASA and Retail Term Deposits) increased 100% to Rs. 58,435 crore in Q3 FY21.

Fee and Other Income (without trading gains) increased33% to Rs. 582 Crore in Q3 FY21.

Asset quality during the quarter. Gross NPA was 1.33% in Q3 FY21 compared to 2.83% in Q3 FY20. Net NPA was 0.33% as compared to 1.23% in Q3 FY21.

This above is after the impact of the Supreme Court of India notification to stop fresh NPA classification post August 31, 2020, till further orders. Without this impact, the pro forma GNPA in Q3 FY21 would have been 4.18% and the NNPA in Q3 FY21 would have been 2.04%. Collection efficiency for standard loans was at 98%.

According to the stated strategy, the Infrastructure loan book was reduced by 26% to Rs. 11,602 crore in Q3 FY21 and by 7% from Rs. 12,502 crore at September 30, 2020.

Future Outlook

As per the stated strategy, the Bank is focused on growing the retail loan book and decreasing the wholesale loan book, primarily the infrastructure loans to reduce concentration risk on the portfolio.

Management Guidance

IDFC First Bank plans to improve the Cost to Income ratio to about 50-55% over the next 5 years. However, in the medium term it is expected to remain around the same levels, largely due to branch expansion plans. This would add to the pressure on the bank’s internal accruals and may impact the profitability in the medium- to –long term.

The bank intends to increase its NIM (Net Interest Margin) to around 5%-5.5% over the next five years, owing to lower funding costs and careful product segment selection, particularly in areas where it has demonstrated strong proven capabilities over the years.

On the CASA front, it tries to reach a CASA ratio of 30% within five years. The bank has already achieved this target during the quarter and expects to maintain this going forward. It is also guided to bring down the infrastructure financing book to zero in the next five Years.

The bank continues to expand its retail loan book while slowing the growth of its wholesale loan book. This strategy will assist in improving its liability profile through incremental funding raised throughout the year, as well as in better conserving and utilising its capital.

The management plans to improve the mix of its loan book to at least 70% retail loans in the next few years.

Slippages increased in Q3FY21 as a result of exposure to the MSME segment, which was impacted by the pandemic. This is expected to keep credit costs elevated in the next two to three quarters.

Key weaknesses: (I) relatively low proportion of CASA deposits; (II) further increase in proforma NPA would be cause of concern and (III) elevated cost.

Read our article on Axis Bank Ltd – Just the Bank You Need

StockEdge Technical View

IDFC FIRST BANK bounced after making a pullback to the breakout area and likely to stay positive in the near term till the stock holds 55 level on closing basis. Next probable support comes at the 50-52 zone. Technical parameters look quite strong till now. and suggest further strength till the stock holds above the support area.

Bottom Line

As per the management, the bank is ahead of its plans for the five-year strategic growth path guided earlier and expects to achieve it before FY23E.

The bank is expected to report improvement in earnings profile over the medium term backed by healthy capitalisation and increased focus on realisation of the loan book.

The addition of capital funds raised by the bank continues to help the bank to achieve its long term goals along with reducing overall costs. In FY21, the bank’s deposit book, particularly retail deposits, has grown by leaps and bounds.

Moreover, the operating costs as well as the cost of funds are expected to remain elevated on a shorter to medium term, along with incremental provision required on stressed books. Thus, impacting the profitability in the short to medium term.

The ability to maintain good asset quality in the growing retail portfolio over a longer period and on a larger scale will be a key monitorable for the bank.

Know more about IDFC First Bank Limited and its peers by using the Sectors tab in the StockEdge Web

Check out StockEdge Premium Plans.

Will my idfc firstbank share s go high.

You can read our entire blog and the technical views in order to take any action on the given company.