Table of Contents

Let’s discuss about Stochastic Indicator:

Stochastic Indicator is one of the technical leading indicators developed by George Lane. According to him, stochastic does not follow any price or volume but it follows the speed or momentum of price.

He also said that as a rule, the momentum of the price of the stock changes faster than the price itself.

In this way stochastic oscillator can be used to foreshadow reversals when the indicator reveals bullish or bearish divergences.

Let us discuss about in details:-

What is Stochastic?

The Stochastic indicator compares where a security’s price closes over a selected number of period. The most commonly 14 periods stochastic is used. The Stochastic indicator is designated by “%K” which is just a mathematical representation of a ratio.

The formula for calculating Stochastic is:

%K= (Today’s Close)-(Lowest low over a selected period)/ (Highest high over a selected period)- (Lowest low over a selected period)

The stochastic indicator always moves between zero and hundred, hence it is also known as the stochastic oscillator.

The value of stochastic oscillator near to zero signifies that today’s close is near to lowest price security traded over a selected period and similarly value of stochastic oscillator near to hundred signifies that today’s close is near to highest price security traded over a selected period.

How is it used?

Stochastic can be used in the following ways:

Overbought and oversold zones

Generally, stochastic oscillator reading above 80 is considered overbought and stochastic oscillator reading below 20 is considered oversold.

Stochastic Reversing from Overbought or Oversold zones mainly works in the trading market as compared in the trending market.

This is explained from the example below:-

We can see from the chart below that the axis bank was in consolidation for quite some time.

Whenever stochastic reversed from the overbought zone it fell down and whenever it reversed from the oversold zone the prices went up.

While in the trending stock like ITC we can see that Stochastic is still in the overbought zone and it is still trending up:-

Trading divergences

- Positive Divergence is formed when price makes a new low, but stochastic oscillator fails to make new low. This divergence suggests a reversal of trend from down to up.

- Negative Divergence is formed when price makes new high, but stochastic oscillator fails to make new high. This divergence suggests a reversal of trend from up to down.

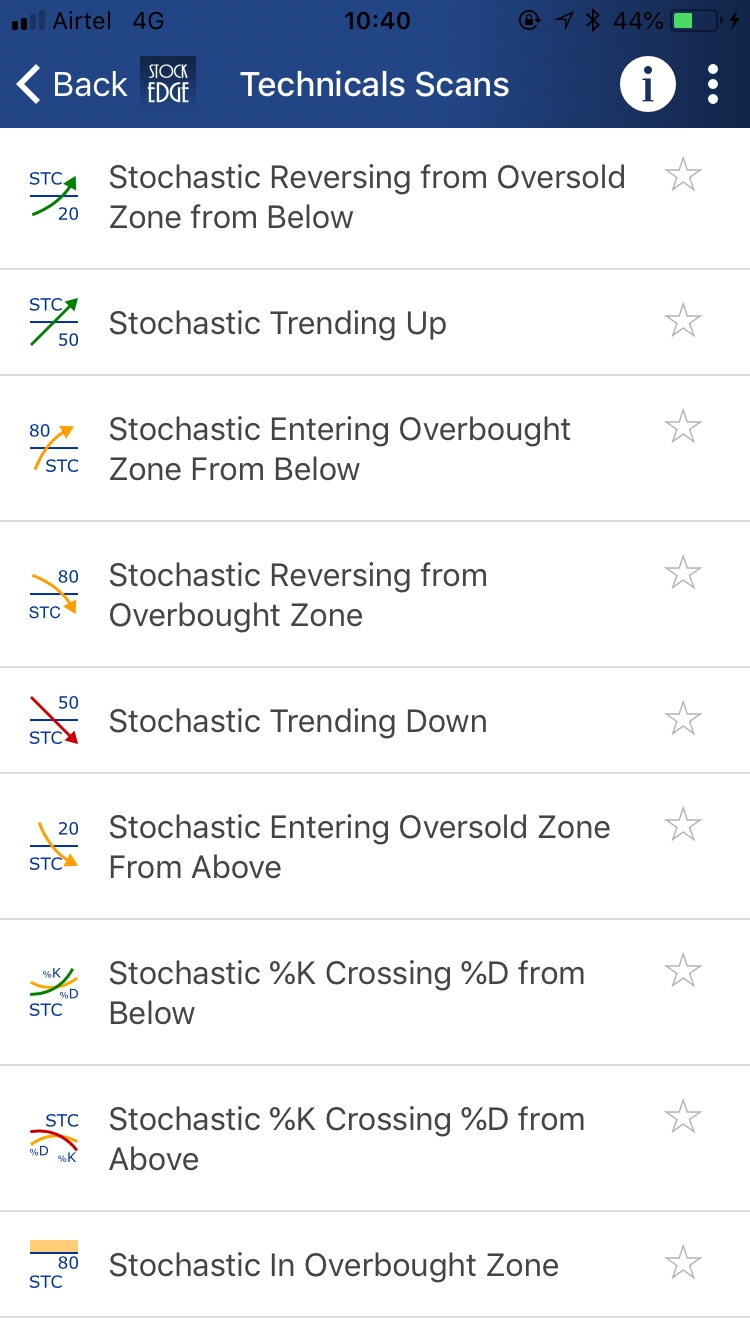

Stochastic scans in StockEdge

There are many conditions of stochastic available in StockEdge where we can scan and filter out stocks according to it. Let us discuss how stochastic indicator can be used with the help of StockEdge:-

Conditions

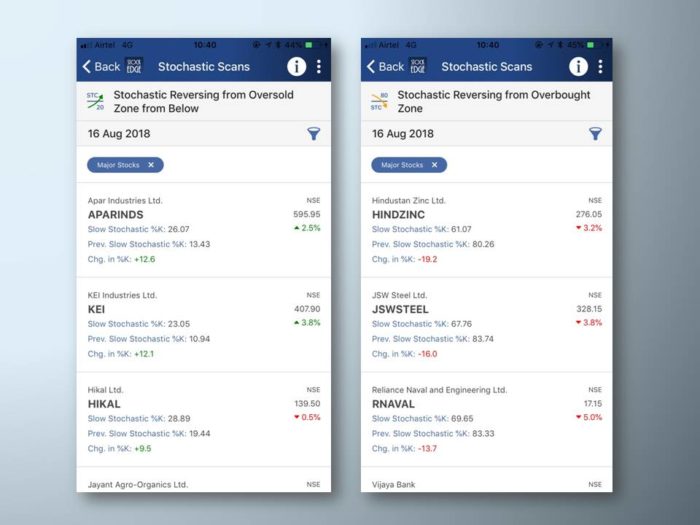

Stochastic Reversing from Oversold zone from below: A bullish price reversal has been attempted. One should buy when the price moves above 20 from the oversold zone.

This is indicating that the price is bullish and now moving towards the overbought zone.

We get list of the stocks in StockEdge those which are reversing from oversold zone from below.

Stochastic Reversing from Overbought zone: A bearish price reversal has taken place.

One should sell when the price moves down below 80 from the overbought zone.

This is indicating that the price has become bearish and now moving forward to the oversold zone.

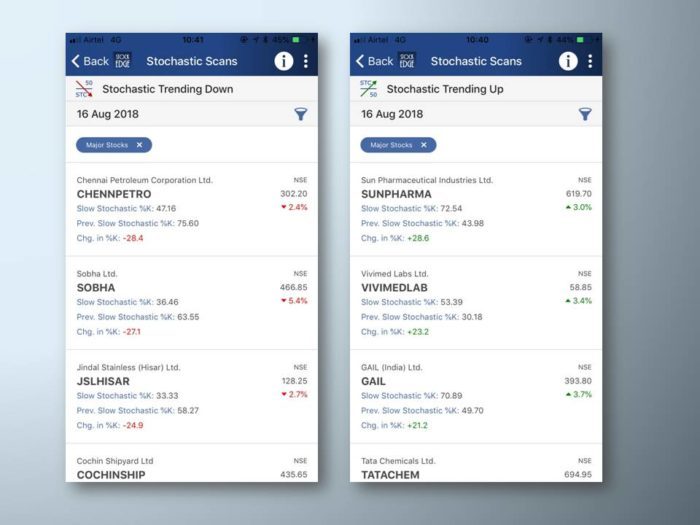

Stochastic Trending Down: When the stochastic falls beyond 50, we sat that stochastic is trending down. It signifies continuation in the downtrend

Stochastic Trending Up: When the stochastic rises above 50, we say the stochastic is trending up. It signifies continuation in the uptrend.

We can see the name of the companies which fulfil these conditions in the image below:

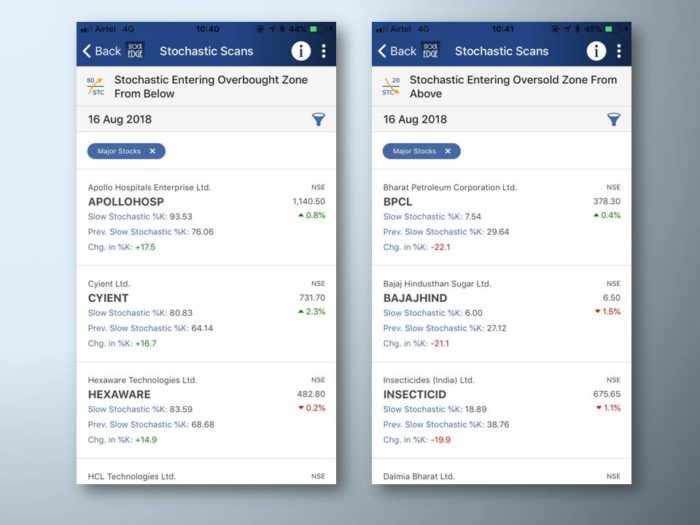

Stochastic Entering Overbought zone from below: This is also a bullish continuation scan. It indicates that the prices have crossed 80 and now in the overbought zone.

Stochastic Entering Oversold zone from above: It is a bearish continuation scan. This indicates that the prices have crossed 20 and from above and likely to enter the oversold zone.

We can see the name of the companies which fulfil these two conditions in the image below:

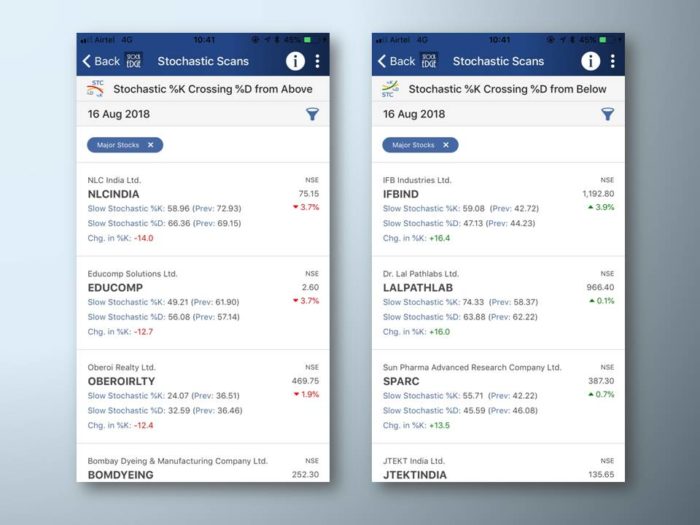

Stochastic %K Crossing %D from Below: This is a bullish crossover. We get a buy signal when %K crosses %D from below.

Stochastic %K Crossing %D from Above: This is a bearish crossover. We get a sell signal in the stock when %K crosses %D from above.

From the image below we can see which stocks fulfil these two conditions:-

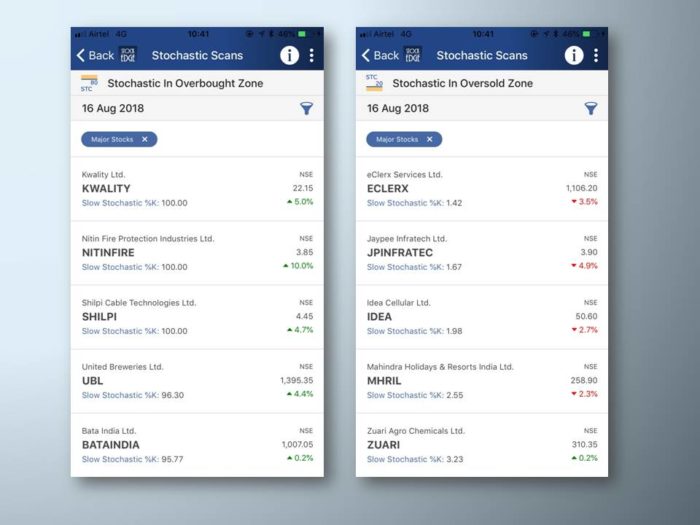

Stochastic in Overbought zone: In the overbought zone we should usually book profit and avoid taking new buy in this zone. 80-100 is considered as the overbought zone.

Stochastic in Oversold zone: In the oversold zone 0-20 is considered as the oversold zone.

We get the names of the stocks which are in the overbought and oversold zones.

Conclusion

This momentum indicator is one of the favourite indicators of most of the technicians. Stochastic can really work very well in the trading markets as well as the trending market.

This momentum indicator helps in making entry and exits decisions. StockEdge helps us to easily filter out the stocks using the above conditions of Stochastic.

Stochastic Scan is a premium offering available to paid users, to subscribe to the plans and know more about the offerings, you can click on here.

To get a comprehensive idea on Stochastic, click here.

Excellent, it gave me knowledge of entry and exit of the stock, very much useful

very nice my use full lekh thanks 🙏 sir