Table of Contents

Started in 1999 the HDFC Asset Management Company was set up as a joint venture between Housing Development Finance Corporation (HDFC) and Standard Life Investments (SLI). Today, it is one of the country’s leading asset management companies that offers numerous schemes targeting different customer requirements and risk profiles, helping to draw an increasing customer base focused on individuals.

The offering of systematic transactions by the company further strengthens its appeal to individual clients. By providing them with need based product solutions to achieve their financial goals as well as continuous customer service, it aims to remain important to its clients.

The business completed an initial public offering in FY18-19 and became a publicly-traded company in August 2018. Currently, the public owns 26.1 percent of the company. The investment manager for the HDFC Mutual Fund Schemes (HDFC MF) is the HDFC Asset Management Firm (HDFC AMC).

The principal shareholders include Housing Development Finance Corporation Limited (HDFC) and Standard Life Investments Limited (SLI) who own 52.7% and 21.2% stake respectively.

The business provides a wide range of savings and investment products through asset classes that provide its clients with income and wealth creation opportunities. It also provides high net worth individuals (HNIs), family offices, domestic corporates, trusts, provident funds and domestic and global entities with portfolio management and segregated account services, including discretionary, non-discretionary and advisory services. As of today’s date, this is HDFC Asset Management Company share price.

HDFC Asset Management Company Operational Highlights

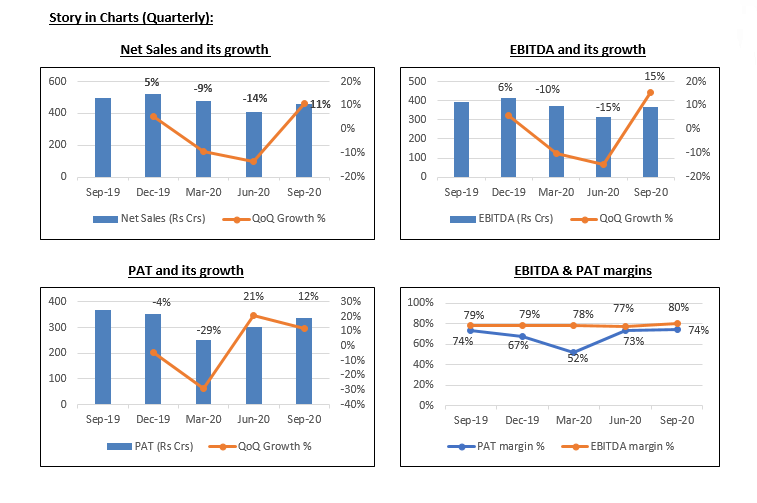

- The revenues during the quarter declined to Rs.456 cr in Q2FY21 as compared to Rs.498 cr in Q2FY20. Change in asset mix with decline in proportion of equity AUM impacted revenue momentum.

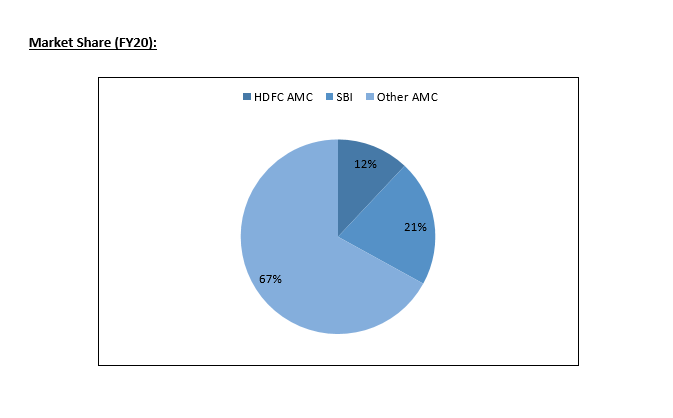

- The AUM has degrown by 3.2% YoY/ 0.9% QoQ to INR 3,54,400 Cr. Due to a loss of share in equity AUM, it has lost market share by 80 bps to 13.2 percent. It has, however, gained market share in debt. Its lost share in actively Managed Equity, its mainstay

- The profits during the quarter declined to Rs.338 cr in Q2FY21 as compared to Rs.368 cr in Q2FY20. PAT of last year includes a one time tax cost. Ex the same, PAT would have grown

- The no. of accounts fell 2% YoY to 9.21 million. Its unique investors were at 5.5 million down by 1 million sequentially (steady share).

See also: Burger King IPO – Do you want to grab a bite?

Future Outlook

- The fund house has hired 2 fund managers with distinctive investment styles and carved out 2 schemes and is expected to carve another in few quarters

- It plans to launch new investment styles and funds to mitigate the stagnancy of weak performance.

- The strong brand franchise and efficient operational strength is positive, however, would await clarity on AUM trend given launch of new products and diversification of investment style.

Management Update

- The company Equity fund’s market share fell due to fund performance. It is yet the largest manager of actively managed funds. The performance in large products has been soft.

- It plans to have 4-5 differentiated style to hedge the overall market performance

- It is important for the market to do well. Inflows do not substantially raise AUM for the total size of the business as much as MTM does.

StockEdge Technical Views

HDFC AMC is trading on the verge of a breakout in the weekly chart and is likely to see a short-term breakout above the swing high of 2580 level. Crucial support on the downside comes at the 2000-2100 zone. Probable resistance in the near term comes at 2720-2770 zone.

Bottom Line

The uncertainty in the markets and underperforming of the various schemes of the fund house have led to the decline in the share of the HDFC AMC and also contraction in the AUM. The fund house has taken steps like appointment of new fund managers, new schemes to regain its position. This development will be carefully watched out for the future going ahead.

We remain optimistic about the strong brand franchise and successful organizational strength, but, given the introduction of new products and diversification of investment style, we would expect clarification on the AUM trend. Hence going ahead, we will look into all these developments and thereafter take any investment decisions.

Join StockEdge Club to get more such Stock Insights.

You can check out the desktop version of StockEdge.

Disclaimer:

This document and the process of identifying the potential of a company have been produced for only learning purposes. Since equity involves individual judgements, this analysis should be used for only learning enhancements and cannot be considered to be a recommendation on any stock or sector. Our knowledge team has limited understanding and we all are learning the art and science behind this.