Table of Contents

Solvency ratio is used to analyze the company’s financial position. The current ratio helps investors and creditors understand the liquidity of a company and how easily that company will be able to pay off its current liabilities. This ratio expresses a firm’s current debt in terms of current asset. The current ratio also sheds light on the overall debt burden of the company. If a company is weighted down with a current debt, its cash flow will suffer. Let us discuss.

Current Ratio (CR)

It is used to analyze the ability of the company to pay off its current liabilities. This ratio considers the current assets which includes both liquid and illiquid assets relative to company’s current liabilities. It is known as “current “as it incorporates all current assets and liabilities for a shorter duration of time. It basically means how fast a company can liquidate its assets to pair of its current liabilities. It is also known as the Working Capital Ratio as it determines the working capital requirement and status of the company.

Watch the video below on Everything you want to know about CR:

Impact of Current Ratio

A higher CR is always more favorable than a lower current ratio because it shows the company can more easily make current debt payments. If a company has to sell of fixed assets to pay for its current liabilities, this usually means the company isn’t making enough from operations to support activities. In other words, the company is losing money. Sometimes this is the result of poor collections of accounts receivable. ideally, the current ratio should be greater than or equal to 1, which implies that it is able to settle its current liabilities.

For creditors, this ratio plays a vital role in determining the capability of the company pay back its debt timely and to assess the financial liquidity.Similarly, it helps investors to assess the strength of the company’s operation and capability of future earnings and growth prospects via assessing the company’s working capital feasibility.

Current Ratio Formula:

Current ratio = Current Assets/Current Liabilities

Therefore, a firm with current assets of Rs 1,59,851 and current liabilities of Rs. 64,527 would have CR of 1,59,851 /64,527 = 2.48

The above ratio of 2.48 implies that the company is liquid enough to settle its current liabilities as and when they arise.

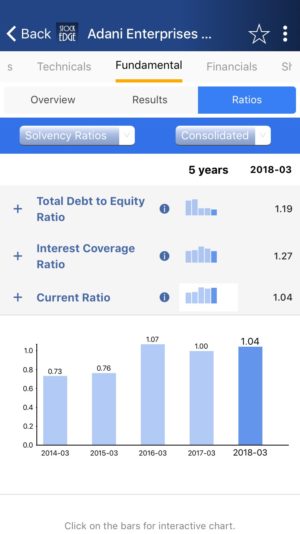

We don’t have to calculate current ratio on our own. StockEdge gives us current ratio of the last five years of any company listed in the stock exchange. We can look and compare the current ratio of any company and filter out stocks accordingly from its in built scan option in the app.

Suppose we want to look at the current ratio of Adani Enterprises Ltd. of last 5 years. In the Fundamental tab of current ratio, click on the fundamentals tab, we will get Ratios tab. Then in the Ratios tab click on Solvency Ratios, CR will come of Adani Enterprises Ltd.

See also: Interest Coverage Ratio: How to calculate & Definition

Bottomline

When we analyze the current ratio, it is best to compare the company with their industry peers with similar business models to establish the level of liquidity required by the Industry. We have these parameters freely available under every stock. So if you have not downloaded our app then download it immediately to do your own research. We also have paid featured scans based on Solvency, with the help of these ready-made scans you can with the click of a button filter out good companies for investment purpose. These scans are part of the premium offerings of StockEdge app.

Click here to know more about the Premium offering of StockEdge.

You can check out the desktop version of StockEdge using this link.

Hi, is this ratio can be considered as reverse of ‘Debt to Asset’ Ratio ? Please clarity. If that’s not the case please suggest why Debt to Asset ratio is not considered in this blog as part of Solvency Ratio. Thanks in advance.