Table of Contents

Key Takeaways

- The Future of Clean Energy: Green hydrogen, produced using renewable energy sources, is gaining prominence as a sustainable alternative to fossil fuels. It’s poised to play a crucial role in reducing carbon emissions across various sectors.

- India’s Strategic Shift: As the world’s third-largest energy consumer, India is focusing on green hydrogen to decrease its reliance on imported fossil fuels and to meet its growing energy demands sustainably.

- Investment Considerations: New government policies and technological advancements are pivotal in shaping the sector’s growth.

- Top Green Hydrogen Stocks to Watch:

- Reliance Industries Ltd.

- Larsen & Toubro Ltd.

- NTPC Ltd.

- TATA Power Ltd.

- GAIL (India) Ltd.

- MTAR Technologies Ltd.

Believe it or not! Climate change has become a severe issue worldwide, with extreme weather events, rising sea levels, and significant disruptions to ecosystems affecting our livelihoods. It is causing widespread economic and social impacts. Additionally, if we continue to rely on burning fossil fuels for our energy needs, the world will face the risk of severe energy crises because fossil fuels are not infinite. Therefore, transitioning to renewable energy sources, such as green hydrogen, is crucial to mitigate these risks, ensuring a sustainable and stable energy supply.

Green hydrogen, generated using renewable energy sources, is swiftly becoming a pivotal element in the worldwide shift to sustainable energy. As both governments and corporations advance towards decarbonization, green hydrogen stands out as a potential solution to fulfill energy demands and cut carbon emissions.

For investors, this shift presents an exciting opportunity to support environmental sustainability while potentially reaping significant financial returns. This blog explores the best green hydrogen stocks to consider for 2025, offering insights into market potential and key players.

But before discussing top green hydrogen stocks, let’s have a brief overview of what exactly green hydrogen is and why India needs green hydrogen.

What is Green Hydrogen?

Green Hydrogen refers to hydrogen produced through electrolysis using electricity generated from renewable sources. However, currently, most of the world’s hydrogen is being produced from natural gas and coal. But when it is produced using renewable energy sources, it is termed as Green Hydrogen.

Why does India need Green Hydrogen?

India is the world’s third-largest energy consumer, with a significant portion of its energy needs met by fossil fuels. Coal, oil, and natural gas dominate the energy mix, contributing to high greenhouse gas emissions. Moreover, India is also the world’s third-largest crude oil importer, with an import dependency of over 80%. It also imports 54% of natural gas and 24% of coal, which largely affects India’s financial account balance. India, being a developing nation, needs to find an alternative to strengthen its national energy demand.

Applications of Green Hydrogen in India

- Transportation Sector: Green hydrogen can revolutionize transportation by powering fuel cell vehicles, reducing dependence on imported oil, and cutting down on emissions. Hydrogen-powered buses, trucks, and trains are being explored as sustainable alternatives to traditional fossil fuel-powered vehicles.

- Industrial Applications: Industries such as steel, cement, and chemicals are major carbon emitters. Green hydrogen can replace fossil fuels in these industries, providing a cleaner energy source for high-temperature processes and reducing industrial emissions.

- Power Generation and Storage: Green hydrogen can be used for power generation through hydrogen fuel cells or by blending with natural gas in power plants. Additionally, it serves as an effective storage solution for intermittent renewable energy, ensuring a stable and reliable energy supply.

The practical application is endless, therefore investing in green hydrogen stocks at an early stage could be beneficial for you in the long term.

Government Initiatives and Policies

The Union Cabinet has announced the National Green Hydrogen Mission with an initial allocation of Rs. 19,744 crore. This mission aims to position India as an epitome for the production, utilization, and export of green hydrogen.

It will result in the following likely outcomes by 2030:

a) The initiative aims to establish a green hydrogen production capacity of at least 5 million metric tonnes (MMT) annually, along with an addition of around 125 GW of renewable energy capacity within the country

b) Over Rs. 8 lakh crore in total investments,

c) Creation of over 6 lakh jobs,

d) Cumulative reduction in fossil fuel imports over Rs. 1 lakh crore, and

e) Abatement of nearly 50 MMT of annual greenhouse gas emissions.

Key Challenges

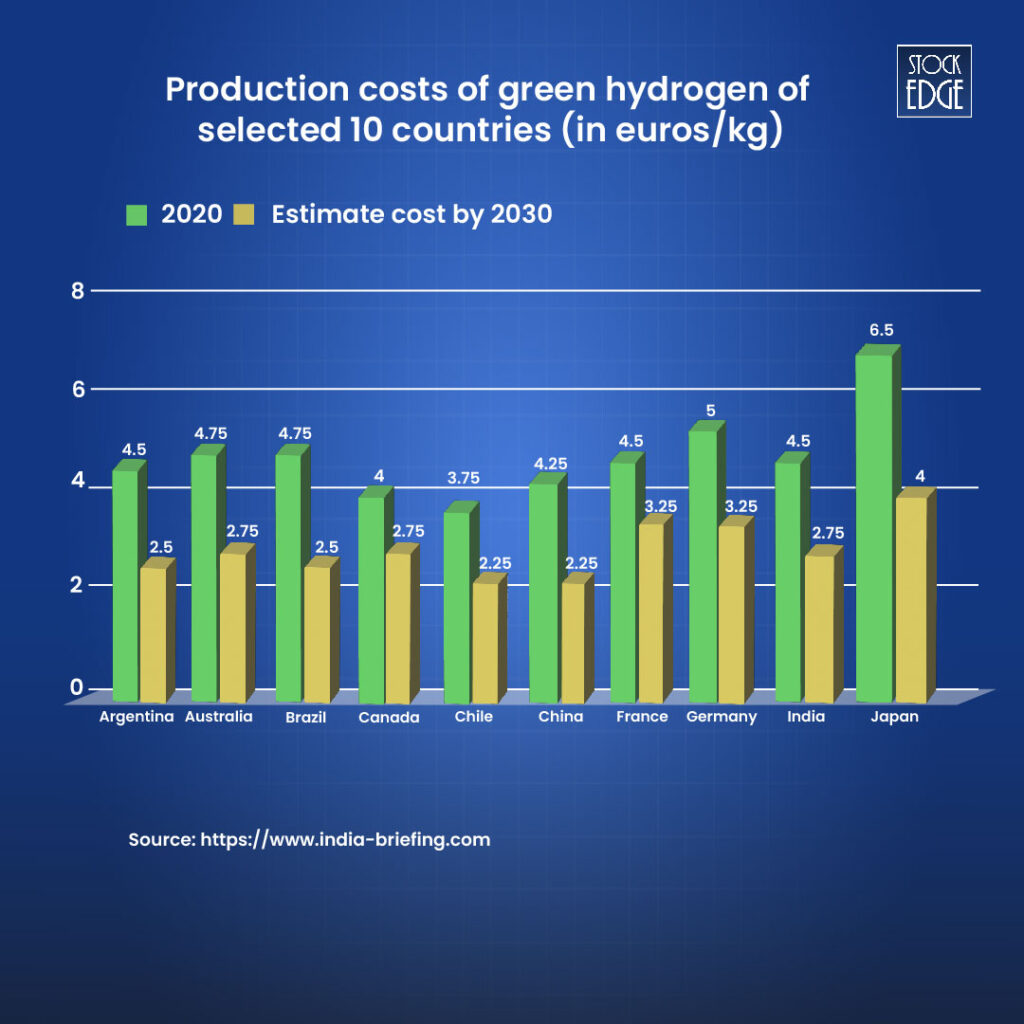

Green hydrogen production is a capital intensive process. The technology involved in green hydrogen production is still in its early stages and is expensive, leading to higher production costs. According to a 2020 analysis by the Council for Energy, Environment, and Water, a kilogram of grey hydrogen costs between USD 1.7-2.3, and blue hydrogen ranges from USD 1.3-3.6. In contrast, green hydrogen costs between USD 3.5-5.5 per kilogram. Additionally, the transportation and storage of green hydrogen present significant challenges.

Here is an estimate of country wise production cost per Kg (in euros) by 2030:

However, despite the challenges, the government initiatives are strong, with India ranking 4th globally for adding capacity for total renewable energy in the country.

At this point, investing in green hydrogen stocks can provide you with an early-bird advantage to grow your investments.

Top 6 Green Hydrogen Stocks in India

At StockEdge, we have a dedicated investment theme on Green Hydrogen which we strongly believe could be the fuel of the future. A source of clear energy.

To know more on Investment themes, read: Powerful Investment Themes for Retail Investors

For this particular investment theme, our team has come up with 6 stocks that have the potential to grow(to become top gainers) in case of a boom in usage of green hydrogen in the future. Let’s discuss each stock separately to understand investment opportunities in green hydrogen stocks:

- Reliance Industries Ltd. The company is constructing one of the world’s largest integrated renewable energy manufacturing facilities. Spanning 5,000 acres in Jamnagar, the Dhirubhai Ambani Green Energy Giga Complex will consist of four Giga factories, with an investment of Rs 60,000 crore announced in FY21. The first factory will produce integrated solar photovoltaic modules, the second will focus on advanced energy storage batteries, the third will manufacture electrolysers for green hydrogen production, and the fourth will develop fuel cells to convert hydrogen into motive and stationary power. Given its aggressive push into renewables, Reliance often features among top gainers NSE in the energy sector.

- Larsen & Toubro Ltd. In January 2022, the company signed a Memorandum of Understanding (MoU) with HydrogenPro, a leading electrolyser technology and manufacturing company based in Norway, to collaborate on the emerging green hydrogen market. Together, L&T and HydrogenPro will establish a joint venture in India for the gigawatt-scale production of alkaline water electrolysis using HydrogenPro technology for the Indian market. Additionally, the company has launched a green hydrogen plant at its AM Naik Heavy Engineering Complex in Hazira, Gujarat, which produces 45 kg of green hydrogen daily. As a result of its innovation, L&T is gaining attention among trending stocks in the renewable energy space.

- NTPC Ltd. The Central Public Sector Undertaking (PSU) under the Ministry of Power and the Government of India is involved in electricity generation and related activities. They recently initiated India’s inaugural green hydrogen blending initiative within the PNG network located in NTPC Kawas township, Surat. This endeavor is a collaborative project between NTPC and Gujarat Gas Limited (GGL). The production of green hydrogen in Kawas involves electrolyzing water with power sourced from an existing 1 MW floating solar project. The company is actively seeking opportunities to generate green hydrogen using renewable energy sources and to employ it across various applications.

- TATA Power Ltd. The company generates power from renewable energy sources, i.e., wind and solar. So, it would benefit from an increase in demand for renewable energy as green hydrogen has to be produced by the electrolysis process enabled by renewable energy. For this, TATA Power continues to stay among trending stocks in the clean tech portfolio.

- GAIL (India) Ltd. The company was established in 1984 as a Central Public Sector Undertaking under the Ministry of Petroleum & Natural Gas (MoP&NG). It has commissioned its maiden green hydrogen plant in Vijaipur, Madhya Pradesh. The 10-megawatt proton exchange membrane electrolyser for the green-hydrogen producing unit at the Vijaipur complex has been imported from Canada.

- MTAR Technologies Ltd.

The corporation produces hydrogen electrolysers. MTAR is partnering with Bloom Energy to diversify its product range in the clean energy sector, with a focus on developing:

a) Hydrogen boxes: These utilize hydrogen to generate power.

b) Electrolysers: These devices produce green hydrogen from water, which will be utilized in power units to generate electricity with zero carbon emissions.

Investing in green energy stocks can even diversify your existing portfolio. However before you make an investment decision here are three factors to consider.

Key Factors before Investing in Green Hydrogen Stocks

- Government Policies – India’s National Green Hydrogen Mission and various government incentives play a crucial role in the growth of the green hydrogen sector. Policies such as subsidies, tax incentives, and regulatory frameworks can significantly impact the viability and profitability of green hydrogen projects.

- Technological Advancements and Innovation – The green hydrogen sector relies heavily on technological innovations to reduce production costs and improve efficiency. Assess the technological capabilities of companies, including their research and development efforts, advancements in electrolyzer technology, and scalability of their solutions.

- Company Financial Health and Market Position – Evaluate the financial stability and market position of companies. More importantly, a strong balance sheet, consistent revenue growth, and robust strategic partnerships is essential.

Conclusion

The green hydrogen sector presents a compelling investment opportunity as the world transitions to sustainable clean energy. With increasing government support, technological advancements, and a growing market potential, green hydrogen stocks are poised for significant growth. Investors should consider diversifying their portfolios, adopting a long-term perspective, and staying informed about policy changes and technological innovations. As India takes ambitious steps with its National Green Hydrogen Mission, the country is set to become a world leader in the green hydrogen economy, offering substantial opportunities for investors.

Frequent Asked Questions (FAQ)

Are hydrogen stocks a good investment?

Hydrogen stocks are worth buying because they focus on long term growth as clean energy gains global focus, but they involve high risk as well due to evolving technology, high production costs, and competition.

What are the top hydrogen stocks?

Top hydrogen stocks are Reliance Industries Ltd, Larsen & Toubro Ltd, NTPC Ltd, and Tata Power. These companies focus on hydrogen production and clean energy tech and are building long term growth solutions.

What are green hydrogen stocks?

Green hydrogen stocks are shares of companies that are involved in the production, distribution, or development of green hydrogen, a clean fuel made by using renewable energy like solar or wind to split water into hydrogen and oxygen through a process called electrolysis.