Table of Contents

The Indian Meteorological Department (IMD) of India has updated its forecast for monsoon 2024 could have above normal rainfall throughout the country. After several days of heat waves in parts of the country, the arrival of the monsoon will be a relief for many. But how does it affect the Indian stock market? Is above-normal rainfall during the monsoon season good or bad? This blog will explain the impact of monsoons on the stock market.

Introduction: India is a land of agriculture

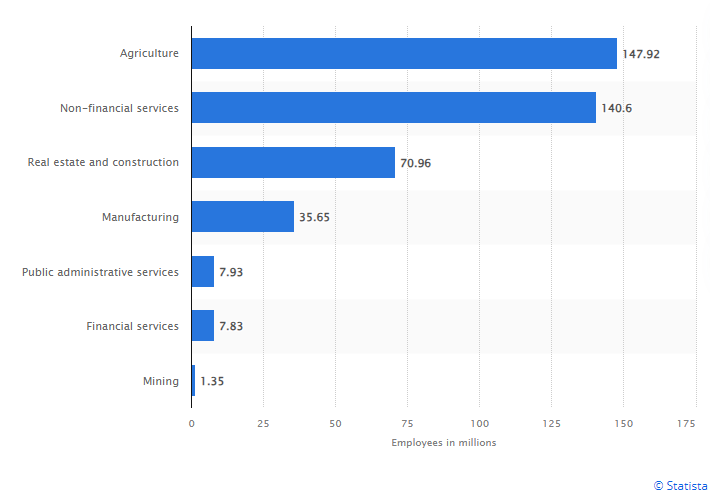

Our country is often termed a land of agriculture, has a rich agricultural heritage and remains one of the world’s leading agricultural producers. The sector employs around half of the country’s workforce and contributes significantly to its GDP.

Number of people employed across major sectors in India in FY 2024 (million)

Importance of Monsoon in India

The majority of our country’s population is dependent on agriculture. Therefore, a normal or above-normal monsoon in the Indian subcontinent is crucial for its growing economy because agriculture, which heavily relies on rainfall, forms a significant part of India’s GDP and employs a large portion of its population. Adequate rainfall ensures good crop yields, stabilizing food prices, boosting rural income, and increasing consumer spending. This, in turn, positively affects various sectors such as consumer goods, fertilizers, and rural-focused industries.

Thus, any adverse changes in monsoon impact the country’s economy, which in turn affects the Indian stock market as well.

How does the monsoon impact the Indian stock market?

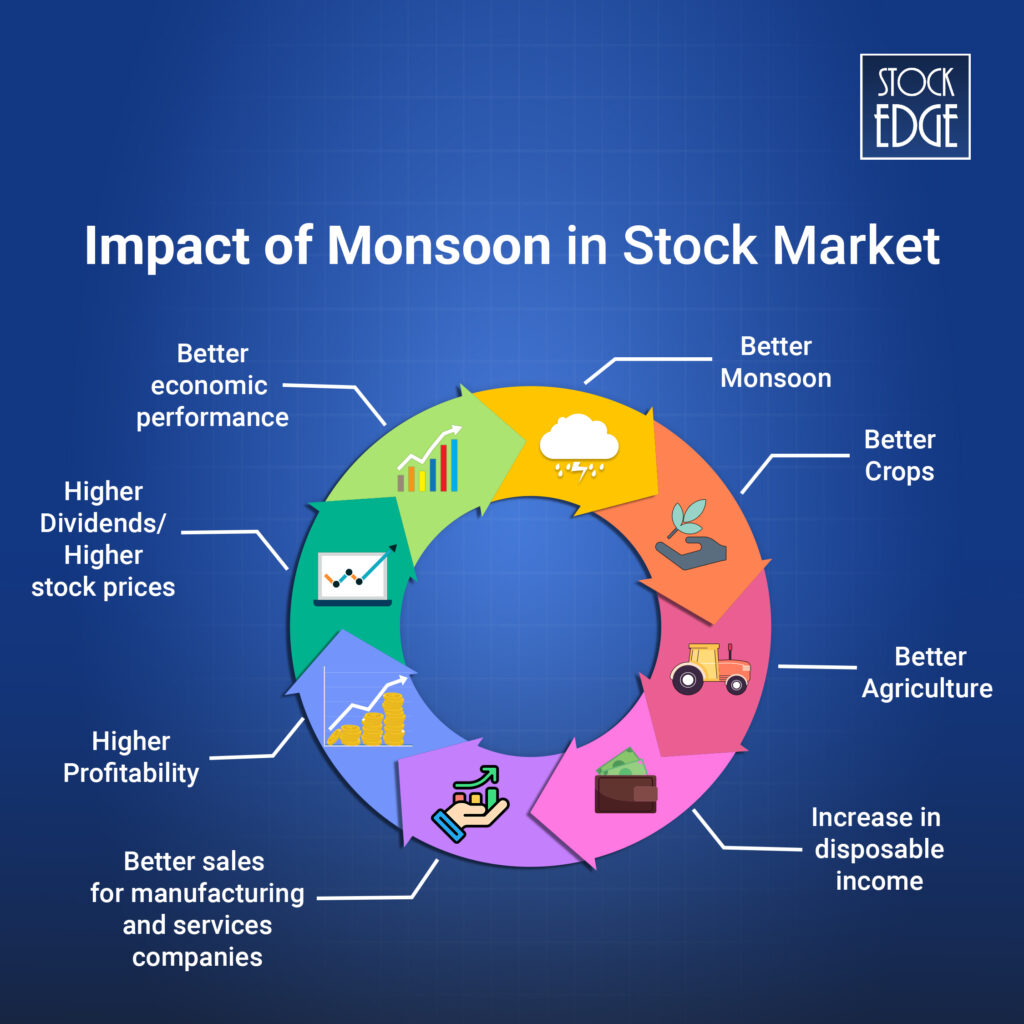

Adequate rainfall is essential for the agriculture sector. Millions of lives are dependent on agriculture, as more than 60% of India’s total population comes from rural India. A failed monsoon can have a domino effect on the country’s growth and economy as well as the stock market. Monsoons have a direct correlation with the economy: Here is how.

Now that you have an understanding of how a normal monsoon can affect our economy and the stock market.

What is a Normal Monsoon?

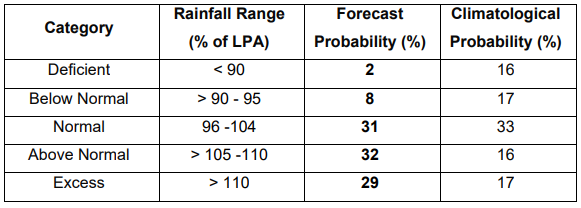

The Indian Meteorological Department (IMD), labels the monsoon as ‘normal’ or ‘deficient’ based on how it fares against its benchmark Long Period Average (LPA), which is calculated over a 50 year period. This acts as a benchmark for measuring the rainfall. The country is said to have received deficient rainfall if the actual rainfall falls below 90% of LPA and excess rainfall if the rainfall is greater than 110% of LPA. It is deemed ‘normal’ when the actual rainfall received falls between 96 and 104% of LPA. However, broadly there are 5 categories which are given below:

In 2024, the IMD forecast the rainfall over the country as a whole is likely to be 106% of the long-period average (LPA) with a model error of ± 4%. Thus, it is categorized as above normal.

Monsoon Impact on Sectors

An above-normal monsoon positively impacts various sectors of the stock market, particularly those linked to agriculture and rural consumption. Here’s how it affects different sectors:

- Agriculture and Allied Industries: Increased rainfall enhances crop yields, benefiting companies in the agricultural sector, including those involved in farming equipment, seeds, fertilizers, and pesticides. Companies like Mahindra & Mahindra (farm equipment) and UPL (agrochemicals) often see a rise in their share price.

- Consumer Goods: Higher agricultural output boosts rural incomes, leading to increased demand for consumer goods. Companies producing FMCG (fast-moving consumer goods), such as Hindustan Unilever and Nestlé India, typically experience higher sales and stock performance.

- Automobile: Improved rural income leads to higher sales of two-wheelers, tractors, and entry-level cars, benefiting companies like Hero MotoCorp, Bajaj Auto, and Maruti Suzuki.

- Banking and Financial Services: Better agricultural output reduces the risk of loan defaults among farmers, improving the asset quality of banks with significant rural exposure.

- Retail: Increased disposable income in rural areas can lead to higher spending in retail sectors.

Overall, an above-normal monsoon creates a ripple effect across these sectors, leading to broader economic growth and a positive sentiment in the stock market.

Thematic Investment: Monsoon 2025

The forecast by IMD for above-normal rainfall in 2025 presents a promising outlook for thematic investment across several sectors. It may enhance agricultural productivity which is expected to positively impact companies in the agriculture sector, including those specializing in fertilizers, pesticides, and farming equipment. Moreover, improved rural income is likely to drive demand in the consumer goods, automotive, and retail sectors, boosting overall economic activity.

Therefore, we at StockEdge have developed an investment theme on monsoon and also curated a list of stocks which may directly or indirectly get benefits from an above normal monsoon in 2025.

To know more on Investment themes, read: Powerful Investment Themes for Retail Investors

There are 10 investable stocks for your portfolio across different sectors, which may be beneficial in case of a good monsoon in 2024. Let’s discuss each stock separately:

Best Monsoon Stocks for 2025

- Hindustan Unilever Ltd.: The first monsoon stock in our list is India’s largest FMCG company with a heritage of over 80 years in India. The company is a part of the everyday life of millions of consumers across India. The majority of demand for Hindustan Unilever is derived from the rural segment, and a good monsoon season leads to bumper crop production. It basically lowers the input prices of raw materials and eventually improves the company’s revenue performance. Thus, the monsoon has a combined effect on revenue growth and margin expansion. Hence, this could positively impact the stock price of Hindustan Unilever.

- Mahindra & Mahindra: Incorporated in 1945, Mahindra & Mahindra Ltd (M&M) is the flagship company of the Mahindra group. M&M is one of the most diversified auto companies in India and a leading manufacturer of tractors & utility vehicles, exhibiting a strong presence in the agribusiness, which is dependent on good monsoons. A normal monsoon is important for both agriculture and the rural economy at large, and it could impact its stock price positively in the case of a good monsoon. This is the second monsoon stocks pick.

- Dabur: Dabur India has a good penetration in rural segments, which leads to increased demand due to good monsoon. It portfolio of products includes five flagship brands with distinct brand identity:

-Vatika for premium personal care,

-Hajmola for digestives,

-Real for fruit juices and beverages and

-Fem for fairness bleaches and skin care products.

Thus, a good monsoon can lead to a rise in demand for its products due to the rise in purchasing power of the rural segments, which in turn may positively affect Dabur’s stock price. - PI Industries: PI Industries is one of India’s foremost agrochemical companies offering integrated and innovative products and solutions to its customers. The business environment across the company’s key business verticals remains favourable. A forecast and initial trend of a good monsoon with even distribution leads to growth in crop acreage.

- Escorts Kubota: Escorts Kubota Limited is one of the leading engineering conglomerates in India. It has diversified business in three different segments mainly Agri machinery, Construction Equipment and Railway Equipment. It offers tractors in the range of 12 HP (horse-power) to 75 HP in the domestic market. A good monsoon supports farm income & fosters cash flow thereby augmenting the demand for tractors.

- UPL Ltd.: UPL is a global leader and ranks under the top five agricultural solutions companies worldwide. A healthy monsoon trend increases the demand for crop protection solutions. It has better prospects given the confluence of factors such as a healthy monsoon trend, better price realisations, strong demand for herbicides to fill in for labour shortage, locust infestation, higher cash transfers by the government, higher MSP (minimum support price) for selected crops and higher procurement.

- Coromandel International Ltd.: The company is engaged in the business of farm inputs comprising fertiliser, crop protection, speciality nutrients and organic compost. A normal monsoon leads to a rise in demand for speciality nutrients and fertilisers. Above-normal rainfall, good soil moisture conditions and proactive steps taken by the government in procuring a bumper Rabi harvest will lead to positive sentiments in the farming community, resulting in early demand for agricultural inputs produced by the company (fertilisers, speciality nutrients, crop protection, etc.).

- Bayer CropScience Ltd.: The company has a robust crop protection portfolio including products to manage insects, pests, weeds and diseases. It also includes biological solutions that use nature’s own defences to protect crops. The demand for crop protection increases with the forecast of normal or above monsoon which could lead to a positive impact on this stock.

- Deepak Fertilisers And Petrochemicals Corporation Ltd.: The company addresses the growing needs of agriculture, pharmaceutical, mining, chemicals and infrastructure sectors in India. DFPCL is among India’s leading producers of fertilisers and industrial chemicals. The equally-distributed and good monsoon gives a boost to the demand for fertilisers and chemicals from rural areas.

- V.S.T. Tillers Tractors Ltd.: The company is now the largest manufacturer of Power Tillers in India. The tiller and tractor segment benefits from a bumper Rabi production. Besides, the forecast of a normal monsoon augurs well for rural incomes thereby increasing the demand for tillers and tractors. A forecast of normal monsoon augurs well for tractor demand.

The Bottom Line

In conclusion, an above-normal monsoon has the potential to significantly boost the Indian economy by enhancing agricultural productivity, which in turn increases rural incomes and consumer spending. This upliftment cascades through various sectors, including consumer goods, automotive, retail, and banking, leading to broader economic growth. The positive impact on agricultural output and rural prosperity stabilises prices and reduces inflationary pressures, fostering a favourable environment for investment. As these sectors thrive, investor confidence grows, driving a positive momentum in the stock market. Thus, a bountiful monsoon not only strengthens the agricultural foundation of the Indian economy but also propels overall economic development and market performance.

thank you for sharing this article

Dear sir… thank you from bottom of heart for this amazing blog which gives very helpful information for understanding of agro related stocks.