Table of Contents

In 1980s, John Bollinger, a well known technician in the market developed a technical indicator named Bollinger Bands. This indicator was developed by using moving average with two trading bands above and below it. The upper band is 2 standard deviation above the moving average and similarly lower band is 2 standard deviation below the moving average. This makes these bands more dynamic and adaptive to volatility. Let us discuss about this technical indicator in details:

What is Bollinger Bands?

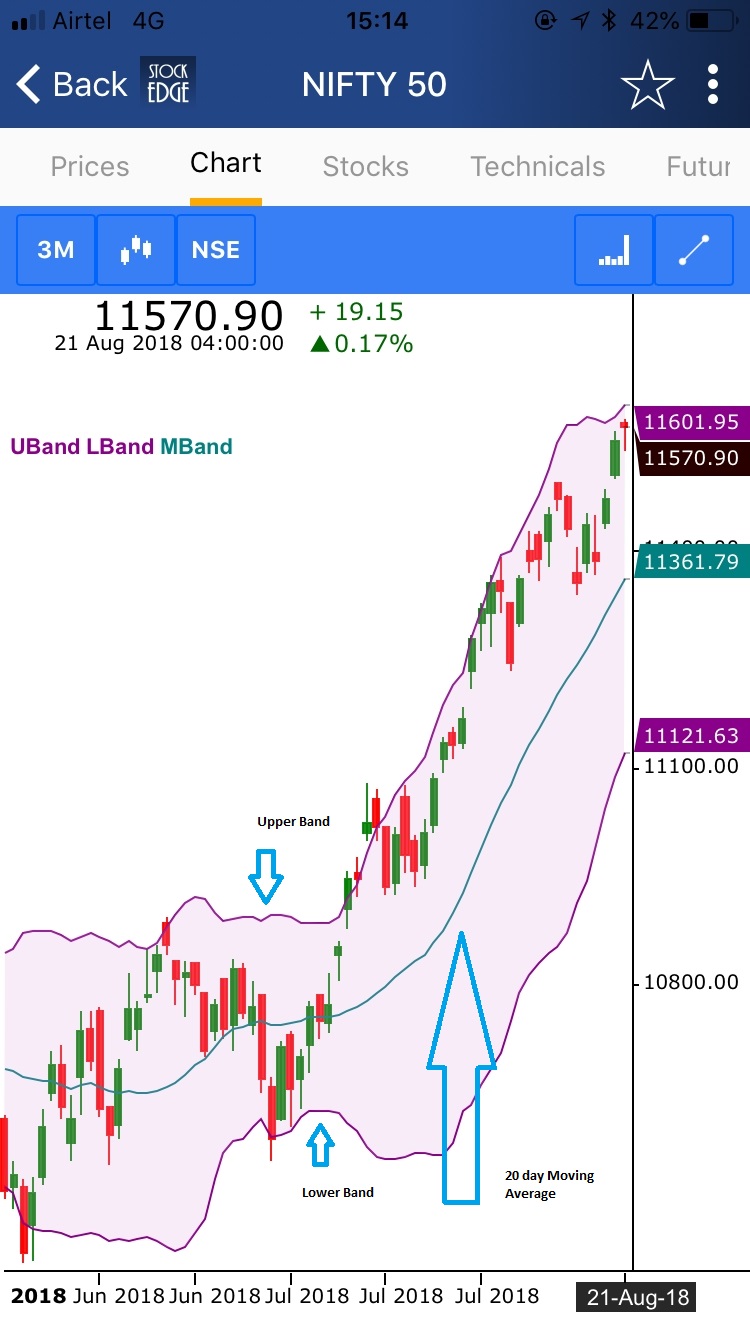

Bollinger Bands consists of the centre line and two price bands above and below it. The centre-line is the 20 period moving average and the bands are two period away from the band either side. This would be clearer from the image below:

Standard Deviation is the mathematical formula for calculation of standard deviation which measures volatility, representing how the price of the stock can vary from its true value. Bollinger bands adjust themselves to the market conditions by measuring the price volatility.

Bollinger Bands Formula

Middle Band= 20 day Simple Moving Average

Upper Band= 20 day SMA + (20 day standard deviation of price * 2)

Lower Band = 20 day SMA – (20 day standard deviation of price * 2)

Trading with Bollinger Bands

Mr. John Bollinger described following important interpretation of Bollinger bands in projecting price trends:

a. Expansion and Contraction of Bollinger Bands

When the Bollinger bands expand, it indicates that the volatility has increased in the stock or index. Similarly when the Bollinger Bands contracts, it indicates that the volatility has reduced in the stock or index. Expansion and contraction of Bollinger bands are cyclic in nature.

b. The upper band act as an area of support and lower band act as an area of resistance

In the trading market, when the price bounces back from the upper Bollinger band then the band can be considered as an area of support. If the prices breach the support and the next 2-3 candles confirm the move in the upward direction then it is considered as upward trend. Similarly when the prices price bounces back from the lower Bollinger band then the band can be considered as an area of resistance. If the prices breach the lower trend and the next 2-3 candles confirm the move in the downward direction then we can say that the trend is downtrend.

In the above daily chart of Sunpharma we can see how upper and lower Bollinger Bands acted as resistance and support and how the breach of the resistance with volume indicated the confirmation of uptrend.

c. When prices move outside the band, it signifies breakout, hence continuation of the trend.

Whenever the price moves out of the band, we can expect the continuation in the trend whether uptrend or the downtrend. This can be seen from the chart below:

See also: Simple Moving Average

Bollinger Bands scans in StockEdge

Now we can use Bollinger Band scans in StockEdge and filter out stocks according to these scans. There are 4 types of conditions available under these scans. They are:

Close Crossing Upper Bollinger Band from Below: It means that the price has crossed upper band from below and it is a Bullish indicator for the continued uptrend. We can see the stocks which satisfy this condition in the image below:

Close Crossing Lower Bollinger Band from Above: This means that the price has crossed lower band from above and closed below it. It is a Bearish signal for a continued downtrend.

Close Crossing Upper Bollinger band from Above: Price has crossed upper band from above and closed below it. It signifies a reversal of the uptrend.

Close Crossing Lower Bollinger Band from Below: Price has crossed lower band from below and closed above it. This is a Bullish signal for reversal of downtrend.

Bottomline

Bollinger Band is one of the most popular trading indicators and has become crucial tools to many technical analysts.

There are numerous ways to set up the Bollinger Bands channels, the trading setup which we have discussed above is the most common and default setting.

By using Bollinger Bands traders can a greater level of analytical sophistication using this simple and elegant tool.

To have a comprehensive idea of Moving Average Convergence Divergence, click here.

Join StockEdge Club to get more such Stock Insights. Click to know more!

Bollinger Bands scans and Interactive charts are only available in the StockEdge Premium

You can check out the desktop version of StockEdge.