Table of Contents

The ultimate goal of any investor or trader in the markets is to achieve consistent profitability. Trading Strategies are road maps that ensure you stay on track to reach your desired destination.

To accomplish this, you must do the following:-

Making Trading Easier

It is much easier to do something when you know what needs to be done. Trading Strategies outlines all of the criteria that must be met before making any trading decisions. As a result, it will always point you in the right direction, regardless of the distractions.

Improving Objective Decision-Making

Trading entails making decisions. Bad decisions will cost you money, while good decisions will make you money. Trading Strategies ensure that you make objective decisions at all times rather than subjective decisions driven by emotions, which can end up costing you a lot of money and putting your trades and capital at risk.

Developing Trading Discipline

Trading is more of a marathon than a sprint. Therefore, it is critical to develop a solid trading strategy and stick to it with religious zeal throughout your trading career. This is the only way to achieve long-term, consistent profitability in the markets. While traders generally follow daily financial news and technical analysis indicators such as the RSI, Moving Averages, CCI, or MACD to identify potential trading opportunities, sticking to your trading strategies is important.

Highlighting Areas That Need to Be Improved

A trading journal, which is essentially a diary or record of your trading activity, is one of the essential components of a trading plan. Journaling your trading activity will assist you in evaluating the performance of your trading strategies and other aspects of your trading strategy, such as risk management and trading psychology. This will, over time, highlight the areas where you can make improvements to help you become a better trader.

We believe that Indian stock participants are smart enough to inculcate all the above, but what they need is a tool like StockEdge, which is affordable and can give the same premium features that all the sophisticated trading systems provide. And that’s where we fit in.

How StockEdge Strategies help you in picking up the right trade?

There are numerous ways to choose a stock for trading or investing. For example, some may use only technical scans, while others combine derivative and fundamental scans with technical analysis to select stocks for trading. There are over 200 such individual scans in the StockEdge app, and you can combine a few of them in the combination scan section to create your customized stock selection criteria.

Recently, our in-house experienced research team at StockEdge has revamped the entire trading strategies section and front-tested them for many months so that our users can get the best out of it. We are working on more such strategies and hope to add to this section in the coming months.

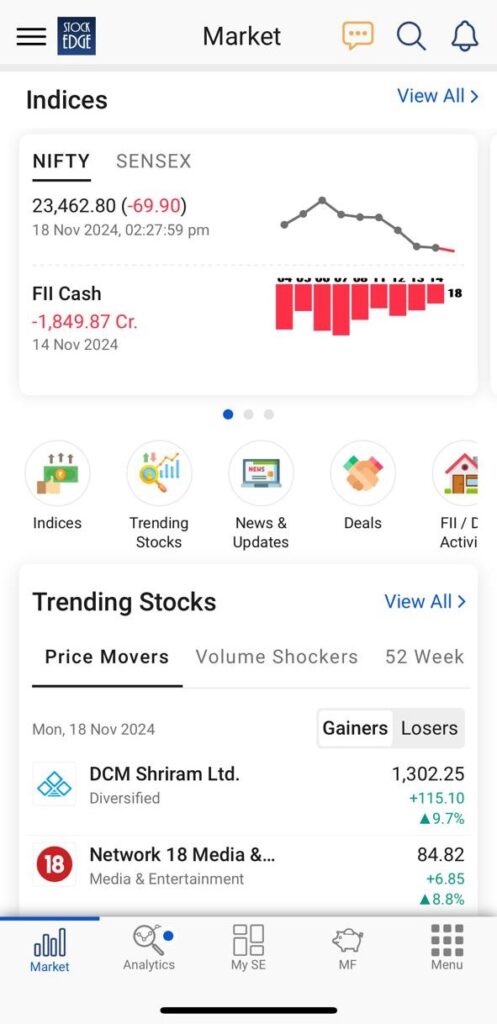

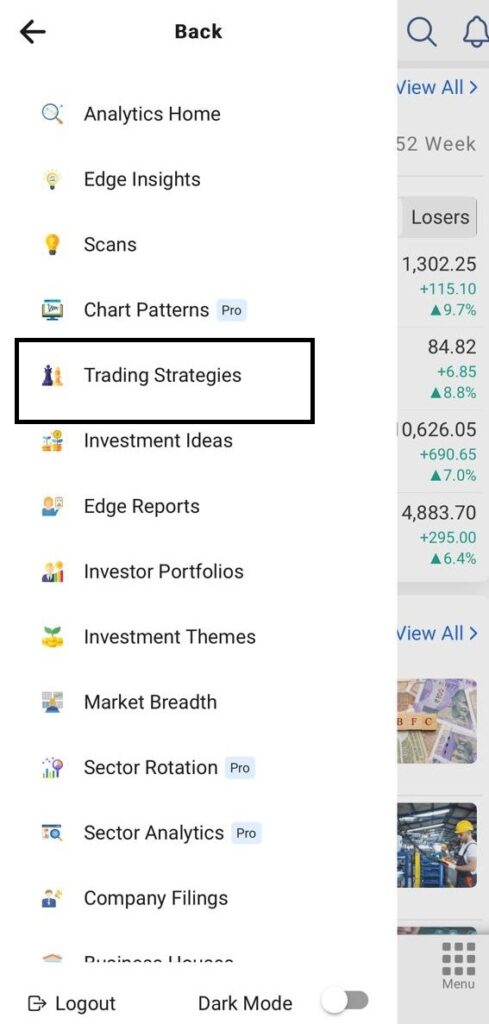

When you launch the StockEdge app, the home page will appear. Next, click on the “Strategies” Tab in the Analytics section to view various trading strategies curated for you.

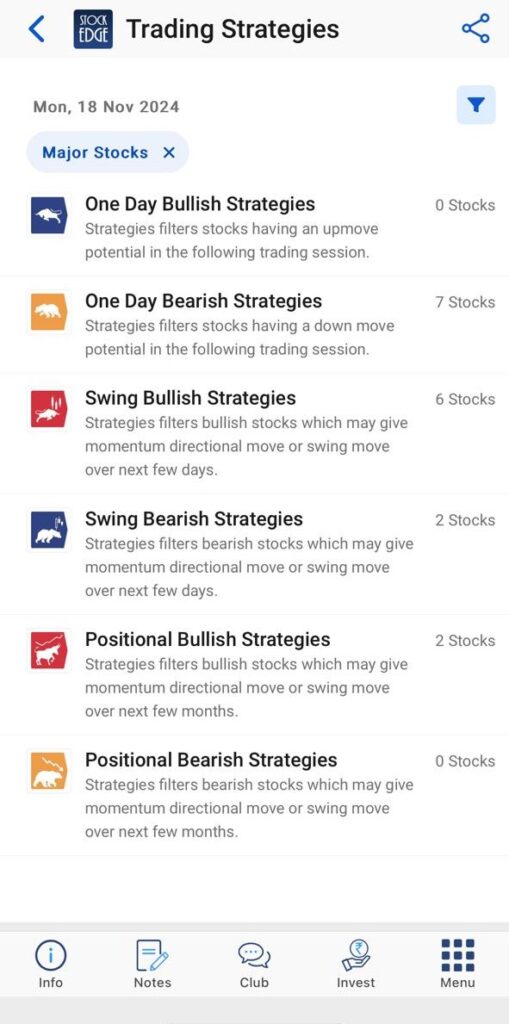

There are six broad categories under the “Strategies” Tab based on One Day, Swing, and Positional Bullish & Bearish views.

In addition, you can look for One-day, Swing, and Positional Scans depending on your trading style and time frame.

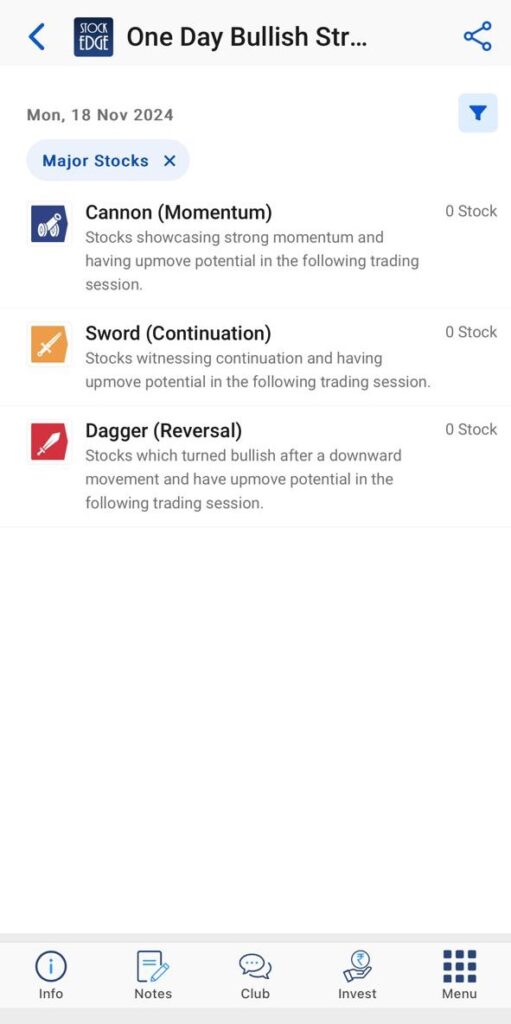

Now let’s say you want to trade based on One day, then you should select the first option, “One Day Bullish Strategies.” Now you get to see three different strategies. These strategies have a combo scan based on various technical & fundamental parameters.

Let’s look at one of the Strategies and talk about it. These strategies help filter stocks that may be bullish on the next trading day.

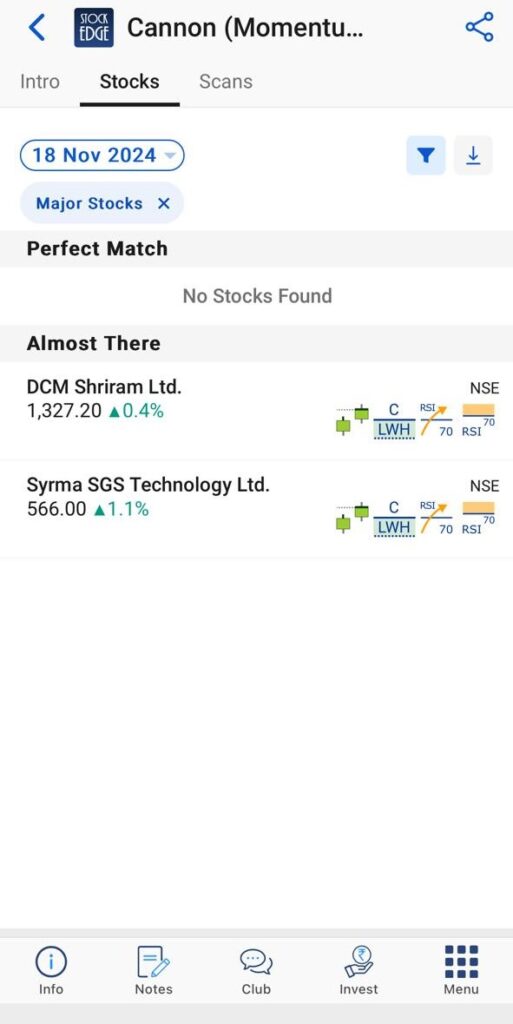

Cannon (Momentum): strategy is for selecting stocks with strong bullish momentum and maybe bullish on the next trading day.

Description: As the name suggests, this strategy selects the stocks for the next trading day based on technical momentum on the previous days with the perspective that the momentum may continue. The strategy looks for some confirmation of a few established technical indicators. It can be used for intraday trading. One may run the strategy on the major stock category only.

Remember one thing, Stocks under “Perfect Match” are the stocks that fulfill 100% criteria. While Stocks in “Almost there” are the ones that satisfy 75% of the criteria.

Illustrative Execution Strategy: Now, you must look at the charts of these filtered stocks and try to see through price action if it is showing bullish momentum—Trade only in them which looks bullish to you. On a particular morning, we have to manually note down the first 15 minutes candle’s high of the stocks already filtered in the strategy.

You can do this process from any reliable charting platform. Next, a stop-loss buy order can be placed just above the 15 minutes candle’s high so that if the price moves above this level, a buy trade can be triggered with stop loss and a target ratio of 1: 1.5. If executed trades neither trigger stop-loss nor hit the target by 3:20 PM on the same day, you should square off all open positions at 3:20 at the market price and remove all pending orders.

Illustrative risk reward: The illustrated risk-reward ratio for this trading methodology is 1: 1.5. The actual numbers will depend on the stock’s volatility and the individual’s risk-taking appetite.

Length of trade: Same day in which the stock appears in the strategy.

Caveats: You can avoid illiquid stocks and use market stop loss to prevent significant slippages.

Some General trading guidelines:

- Use stop loss strictly. This is one of the best ways to reduce your loss and retain the gains you have made.

- Take risks as per your risk potential. Understand your commitments and dependents, take risks wisely. You can only lose money which you can afford to lose.

- As a trader, you should not be in a hurry to make more money in a short period. Watch the markets and price movements carefully and then decide.

- Be practical and have realistic expectations. Don’t ever make decisions based on emotions.

- Use trailing-stop loss for the trades which are already in the profit.

Similarly, you may select other trading strategies based on your temperament and take advantage of our premium offerings.

It would help if you remembered that the above combination lists stocks that satisfy the set of scans in the shared strategy disclosed in the scan tab. The list of stocks ideas derived are not recommendations to buy or sell. You must use your research to make your decisions. We would also recommend using the “My Combination scans” section to create your trading strategies.

Until then, keep an eye out for the next blog and our midweek and weekend editions of “Trending Stocks and Stock Insights.” Also, please share it with your friends and family.

Happy Trading!