Table of Contents

You may be wondering what ASM and GSM are? Well, let me help you crack these jargons down. Shareholders are sometimes afraid of losing their return or incurring a loss on their investment. They also often wonder, “Have I bought the right stock and made a good investment? Will my stock get delisted?” With THIS blog, we’ll try to cater to your concerns and help you get rid of such dilemmas.

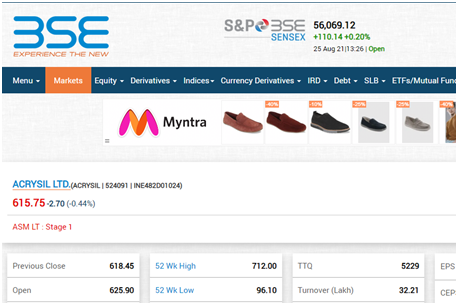

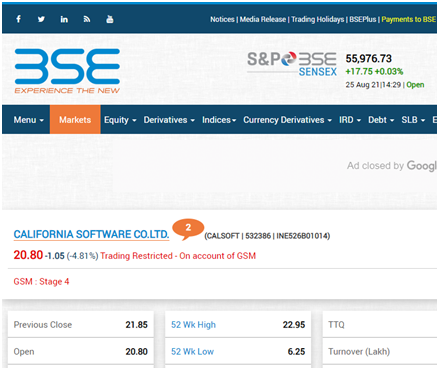

If you trade on the BSE or NSE, you may notice that the following text appears below the name of certain companies: “GSM: Stage – 01” or “ASM: Stage: 1”.

Before we can understand the consequences, we must first understand what GSM and ASM is. We’ll go over them one by one.

GSM is an abbreviation for Graded Surveillance Measure. It is a system that monitors securities with unusual price fluctuations or poor financial health. In order to improve market integrity and protect investors’ interests, SEBI and stock exchanges have implemented this surveillance measure.

What is the purpose of GSM?

The primary goal of GSM is to alert and advise investors to be extra cautious when dealing in these securities, as well as to advise market participants to conduct necessary due diligence before dealing in these securities.

Which securities are eligible for GSM?

The following criteria are used to shortlist security under GSM:

Criteria: 1

1. Securities with the latest available Net Worth (Share Capital + Reserves & Surplus – debit balance in P&L) of less than or equal to Rs. 10 crores; AND

2. Securities with the latest available Net Fixed Assets (Tangible Assets + Capital Work in Progress) of less than or equal to Rs. 25 crores; AND

3. Securities with a PE greater than two times the PE of the benchmark index (Nifty 500) OR with a negative PE.

Securities Excluded:

1. Securities in which price discovery is still yet to occur, as per SEBI circulars CIR/MRD/DP/01/2012 and CIR/MRD/DP/02/2012 dated January 20, 2012.

2. Securities that have already been suspended;

3. Securities on which derivative products can be traded;

4. Securities that are included in any index (NSE or BSE);

5. Public Sector Enterprises and their subsidiaries, if any;

6. Securities that have been listed in the last year through an Initial Public Offering (IPO);

7. Securities that have paid dividends in each of the previous three years;

8. Securities with institutional holdings of more than 10% only if the following conditions are met: the promoter entity has not sold any shares in the last 5 years, and the current trading price of the security is within the range of the respective security’s High and Low price in the last 3 years.

9. Securities listed in the last year through a Scheme of Arrangement involving a Merger or Demerger:

- In the event of a demerger, the following conditions must be met:

- If the parent company is subject to GSM, the resulting demerged companies must also be subject to GSM.

- If the parent company is not subject to GSM, the resultant demerged companies shall not be subject to GSM at the time of demerger and shall be considered during the subsequent quarterly review.

- In the case of a merger of companies, if any of the securities at the time of the merger are subject to GSM, the same shall be continued on the resultant entity.

Criteria: 2

The following criteria will be made applicable for the direct inclusion of securities under GSM – Stage I.

1) Securities with a total market capitalization of less than Rs. 25 crore; AND

2) Securities with a PE greater than twice the PE of the benchmark index; OR

3) Securities with a negative PE, the following should be considered:

The scrip’s P/B (Price to Book) value is greater than two times the Benchmark Index’s P/B value (Nifty 500), or the P/B value is negative.

The identification and review of securities for Graded Surveillance Measures takes place on a quarterly basis. Securities included in the GSM Framework will be reviewed, and securities that do not meet the inclusion Criteria – I & II will be removed from the GSM Framework.

GSM Consequences: If any security meets the above-mentioned criteria, it will be assigned a stage. Surveillance Action will be initiated based on the Stage:

Surveillance Actions at Various Stages

- The applicable margin rate shall be 100%, with a price band of 5% or less, as applicable.

- Trade for Trade with a price band of 5% or less as applicable and an Additional Surveillance Deposit (ASD) of 50% of the trade value to be deposited by the Buyers

- Trade for Trade with a price band of 5% or lower as applicable, trading permitted once a week (every Monday / first trading day of the week), and ASD (100% of trade value) to be deposited by Buyers

- Trade for Trade with a price band of 5% or lower as applicable, trading permitted once a week (every Monday / first trading day of the week), and ASD (100% of trade value) to be deposited by Buyers with no upward movement.

The list of securities moving to/from higher stages of Graded Surveillance Measures shall be communicated to the market via periodic circular(s).

The Additional Surveillance Deposit (ASD) will be paid only in cash and will be held until further notice.

Let us try to understand what ASM is.

ASM is an abbreviation for Additional Surveillance Measure. The purpose or goal of ASM is nearly identical to that of GSM, namely to improve market integrity and protect investors’ interests by implementing various enhanced pre-emptive surveillance measures, but it is focused on controlling security volatility.

Difference between ASM and GSM?

The main purpose of GSM is to protect investors from stocks and does not allow intra-day trading, whereas the purpose of ASM is to control volatility in security. GSM and ASM have different intentions, but their sole purpose is to protect the interests of investors.

Which Securities are eligible for ASM?

The following are the criteria for shortlisting and reviewing securities under the Long-term and Short-term ASM Frameworks.

Section I: Long-term Surveillance Measures (Long-term ASM)

The criteria listed below shall be made applicable for stock selection in the Long Term ASM Framework.

1) High–Low Price Variation (based on corporate action adjusted prices) in 3 months > (150% + Beta (β) of the stock * Nifty 50 variation) AND Concentration of Top 25 clients ≥ 25% of combined trading volume of NSE & BSE in the stock in the last 30 days. AND Market Capitalization > Rs. 100 Crore as on review date.

2) Close–to–Close Price Variation (based on corporate action adjusted prices) in the last 60 trading days > (100% + Beta (β) of the stock * Nifty 50 variation). AND Concentration of Top 25 clients≥ 25% of combined trading volume of NSE & BSE in the stock in the last 30 days. AND Market Capitalization > Rs. 100 Crore as on review date.

3) Close–to–Close Price Variation (based on corporate action adjusted prices) in 365 days > (100% + Beta (β) of the stock * Nifty 50 variation) AND High–Low Price Variation (based on corporate action adjusted prices) in 365 days > (200% + Beta (β) of the stock * Nifty 50 variation) AND Market Capitalization > Rs. 500 Crore as on review date AND Concentration of Top 25 clients ≥ 25% of combined trading volume of NSE & BSE in the stock in the last 30 days.

4) Average daily Volume in a month is ≥ 10,000 shares & monthly volume variation in stock is > 500% of Average daily volumes in preceding 3 months at both Exchanges (NSE and BSE) AND Concentration of Top 25 clients ≥ 25% of combined trading volume of NSE & BSE in the stock in last 30 days.

AND Average Delivery % is less than 50% in last 3 months AND Market Capitalization > Rs. 500 Crore as on review date AND Close–to–Close price variation (based on corporate action adjusted prices) in last one month ≥ (50% + Beta (β) of the stock * Nifty 50 variation) Exemption: Bulk / Block (maximum of buy /sell value), i.e., Average Volume of Bulk or Block Quantity / Average Volume of the Security greater than 50%.

5) Close to Close price variation > 25% + (Beta * Nifty 50 Variation) in a month AND PE negative OR > 2 times of PE of Nifty 50 AND Market Capitalization < Rs. 500 Crores as on review date.

6) Close-to-Close price variation of the SME stock ≥ ±25% + (Beta (β) of the stock * NIFTY SME EMERGE Index Variation) in 15 days OR Close-to-Close price variation of the SME stock ≥ ±50% + (Beta (β) of the stock * NIFTY SME EMERGE Index Variation) in 30 days OR Close-to-Close price variation of the SME stock ≥ ±90% + (Beta (β) of the stock * NIFTY SME EMERGE Index Variation) in 3 months AND PE of the stock is negative OR PE of the stock ≥ 2 times the PE of NIFTY SME EMERGE Index.

Note: For stage-wise surveillance action on SME stock after inclusion in Long Term ASM criteria 6: i. Price variation > (+ 25% + Beta (β) of the SME stock * NIFTY SME EMERGE Index Variation) shall be considered. ii. The concentration of Top 25 clients excluding market makers shall be considered.

7) Scrips with a price band of ±10%, ±5%, ±2% AND Close-to-Close Price Variation (based on corporate action adjusted prices) in 365 days ≥ (200% + Beta (β) of the stock * Nifty 50 variation) AND High-Low Price Variation (based on corporate action adjusted prices) in 365 days ≥ (300% + Beta (β) of the stock * Nifty 50 variation) AND Market Capitalization > Rs. 1000 Crores as on review date AND Concentration of Top 25 clients ≥ 25% of combined trading volume of NSE & BSE in the stock in last 30 days

Action on the stocks shortlisted as per Criteria 7:

- The shortlisted scrips shall be placed directly in Stage IV of Long Term ASM w.e.f. beginning of T+3 days (T day being the day on which scrip was shortlisted).

- The shortlisted scrips shall be retained in Stage IV for a minimum period of 90 calendar days.

- Post completion of 90 calendar days, such scrips shall be subjected to stage wise review (that is at present undertaken on a weekly basis by the Stock Exchanges).

Securities completing 90 calendar days in the Long-term ASM Framework would be eligible for exit from the framework subject to stage-wise exit.

In addition to the above, the stocks satisfying the below criteria after inclusion / stage-wise movement under the Long Term ASM shall be placed in Stage IV of Long Term ASM and shall be retained in Stage IV till such time the stocks satisfy the criteria:

High-Low Price Variation (based on corporate action adjusted prices) in 6 months ≥ (200% + Beta (β) of the stock * Nifty variation) AND non-promoter holding in the stock < 10%

Note: The Beta (β) factor shall be applicable only in case of positive index variation. The securities satisfying any of the above six criteria shall be shortlisted under Long-term ASM. The following securities shall be excluded from the process of shortlisting of securities under ASM:

- Public Sector Enterprises and Public Sector Banks

- Securities already under Graded Surveillance Measure (GSM)

- Securities on which derivative products are available

- Securities already under Trade for Trade

To know more about it in detail, click on the following link.

Visit the StockEdge website to avail various scans of Stock Markets.

To read more blogs click visit the blog section of StockEdge.