Table of Contents

Every investor’s investment decision majorly looks for companies which have low debt in their books, as such companies normally stand out in adverse macro scenarios. This ratio indicates how much is the company leveraged itself for the working of its business. Total Debt to Equity Ratio is one of the important Solvency ratios. Let us discuss it:

Total Debt to Equity Ratio

The D/E Ratio measures a company’s financial leverage. This ratio is calculated by dividing a company’s total debt by its net worth. The total debt consists of the company’s long term and short term borrowings which is reported under Non-Current and Current liabilities respectively. It indicates how much debt a company is using to finance its assets. If the D/E ratio is less than 1 then the company is expected to be financially strong as assets will be more than liabilities but if it’s more than 1 then its expected to be highly leveraged thus solvency will be questionable as liabilities will be higher than assets. Higher debt to equity ratio is preferable if the business is unique and dynamic or monopolistic in nature and doing exceptionally well.

Watch the video below to Everything you want to know about Debt Equity Ratio:

Importance of Total Debt to Equity Ratio:

High Debt to Equity ratio indicates that the company has been aggressive in financing the growth with debt. This indicates a high level of risk. It may also result in volatile earnings as a result of an increase in interest expense. If it continues to rise then such company gets impacted more when macros turn adverse like weakening rupee or rising interest rates. Having said that, we also need to check whether the same sector companies have the same high debt to equity ratio or not. The ratio varies from sector to sector. For example, the Real estate sector will have a high debt to equity ratio compared to the Information Technology Sector.

See also: How To Identify Stocks To Avoid For Investment?

Debt to Equity Ratio Formula:

The formula for calculating the Debt to Equity ratio is:

Debt to Equity ratio= Total Debt(Long term and Short term Borrowings)/ Total Equity(Equity share capital and Reserves or other Equity)

For example:

Company ABC’s short term debt is Rs.10 Lac and its Long term Debt is Rs.5 Lac, its total shareholder’s equity accounts for Rs.4 Lac and its reserves amount to Rs.6 Lac then using the formula of Debt to Equity ratio {(10+5)/(4+6)} we get 1.5 times or 150%

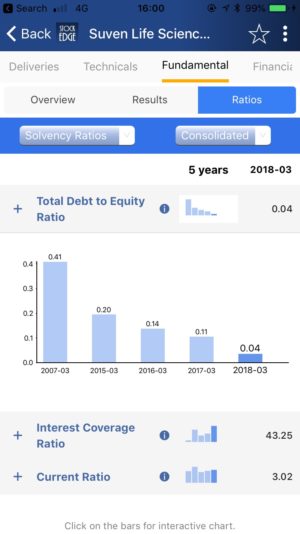

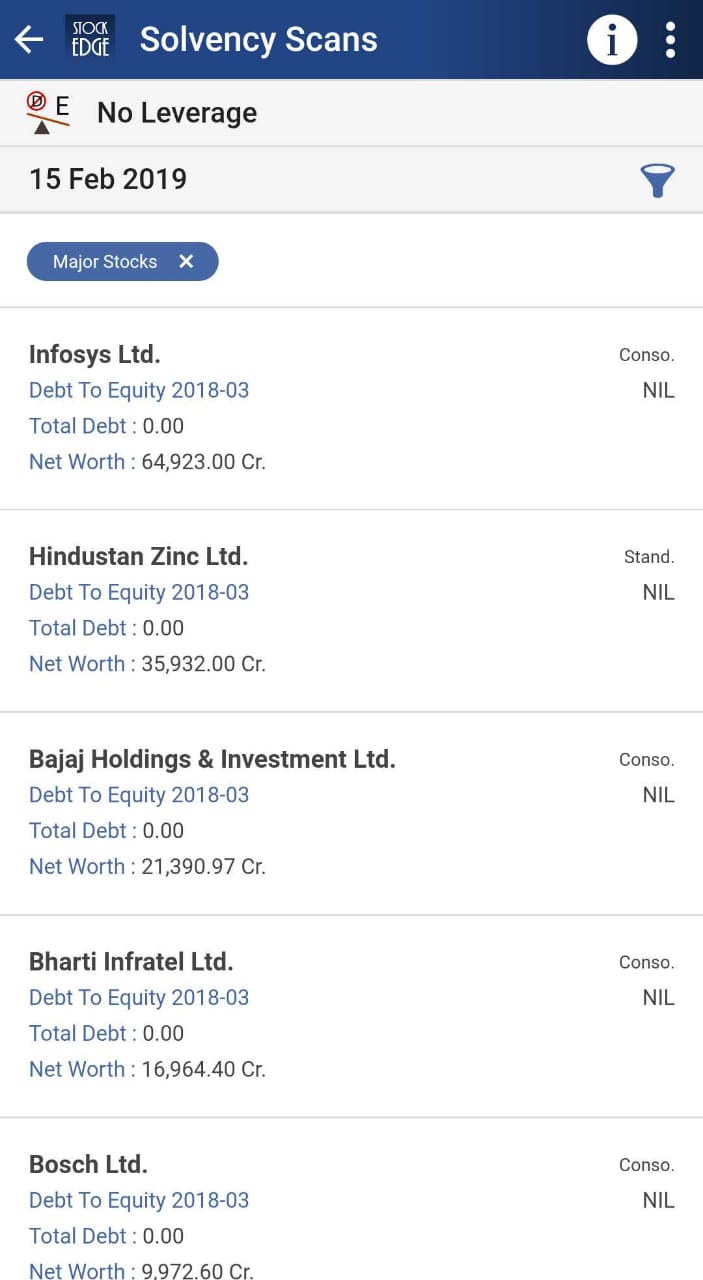

With Stockedge App we don’t have to calculate Debt to Equity ratio on our own. StockEdge gives us the Debt to Equity ratio of the last five years of any company listed in the stock exchange. Thus we can look and compare the ratio of any company and filter out stocks accordingly. It helps us to filter out even those companies which do not have debt at all or have near zero debt comparatively.

Suppose we want to look at Debt to Equity ratio of Suven Life Sciences Ltd. For last 5 years then in the Fundamental tab of Suven Life Sciences Ltd, click on the fundamentals tab, we will get Ratios tab. Then in the Ratios tab click on the Solvency Ratios, we will get Debt to Equity ratio of Suven Life Sciences Ltd.

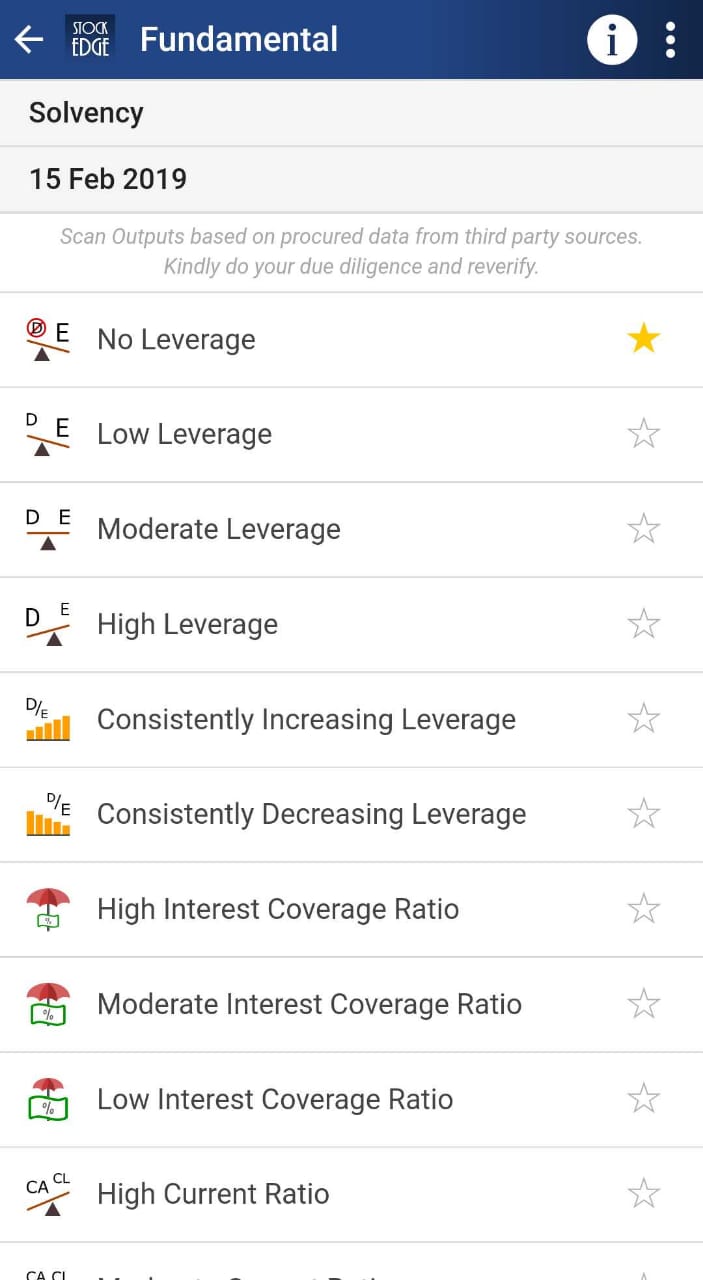

Debt-Equity ratio (Leverage) Scans

Using these scans with the click of a button you can identify companies with no debt, with low debt, with moderate debt and with high debt.

Bottomline

Debt to Equity ratio is a useful financial ratio as it is used to measure the Company’s financial leverage. It is used to measure the company’s ability to repay its obligations. This ratio is available with every stock under stockEdge app for free. Thus check peers for understanding whether a high Debt to Equity ratio is really a bad investment or not. Thus if you have not downloaded this app till now then you are missing on your investment opportunity. Download this app right now and enjoy all these scans.

Click here to know more about the Premium offering of StockEdge.

You can check out the desktop version of StockEdge using this link.

Nicely explained with an example, Value-added article.

Thanks for your kind words