Table of Contents

Amrit Kaal’s journey started with the objective of building a robust logistics infrastructure and manufacturing sector, but it eventually evolved into reviving the mining stocks in India.

This sector not only drives the growth of the core sectors of the Indian economy but has also emerged as the world’s largest mining industry. According to the Ministry of Statistics and Programme Implementation (MOSPI), the Indian mining sector witnessed a substantial growth of 6.7% year-over-year in April 2024, which indicates a significant increase in production.

In this blog, you will understand the mining sector, learn about the top 4 mining stocks in India, know why it is the right time to invest in mining stocks and explore the future prospects of mining stocks in India.

Let’s start the blog by exploring the mining sector in detail.

Understanding the Mining Sector

India has immense natural resources, particularly metallic and nonmetallic minerals, including minor minerals, which serve as raw materials for many industries and are paving the path for rapid industrialization and infrastructural development.

It has one of the most diversified mineral deposits in the world. It is also one of the top five producers of bauxite, iron, and zinc ore. Despite that, the mining sector’s contribution to India’s GDP is between 2.2% and 2.5%. However, according to data from the Ministry of Statistics and Programme Implementation (MOSPI), India’s mining GDP rose from ₹76,877 crore (US$ 9.25 billion) in the third quarter of FY23 to ₹82,680 crore (US$ 9.95 billion) in the third quarter of FY24.

Currently, India has produced 95 minerals, including 4 fuel, 10 metallic, 23 non-metallic, 3 atomic, and 55 minor minerals (for building and other products).

Now, let’s look at the mining sector’s production trend.

Production Trend of Mining Sector

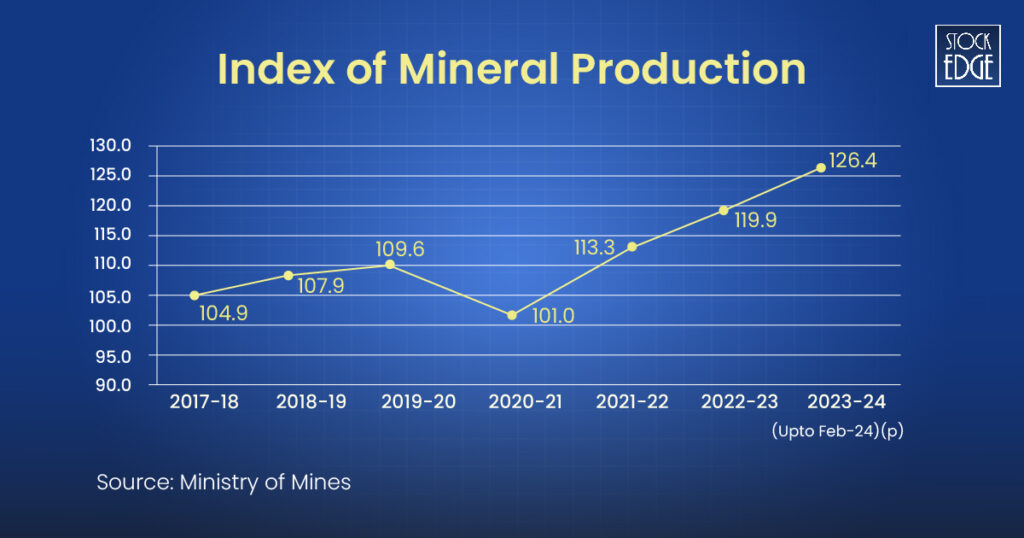

As we can see, the Indian mining industry reflected positive growth in the fiscal year 2023-2024. The Index of Mineral Production (IMP) acts as a report card for the mining sector, measuring the relative changes in the volume of output over time compared to a base period, which is currently 2011-2012. According to the Ministry of Mines, the IMP is expected to reach 126.4 by February 2024, which indicates a 5.4% increase compared to last year’s index of 119.9.

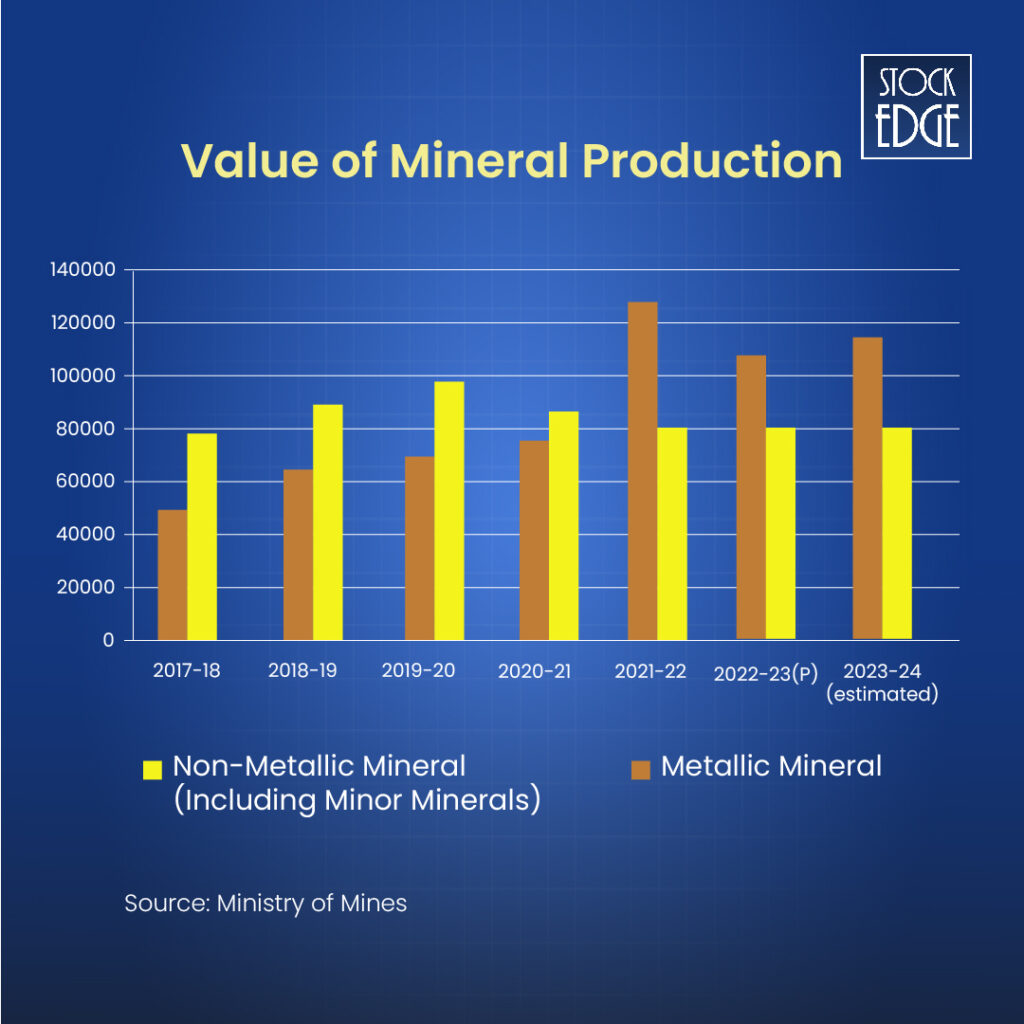

The total value of mineral production (excluding atomic and fuel minerals) during 2023-24 is projected at ₹1,92,734 crore, an increase of 2.03% over the previous year. Metallic minerals constitute the majority, with an estimated value of ₹1,10,785 crore, representing 57.5% of the total mineral production value. Non-metallic minerals, including minor minerals, are valued at ₹81,949 crore, contributing to 42.5% of the overall production value.

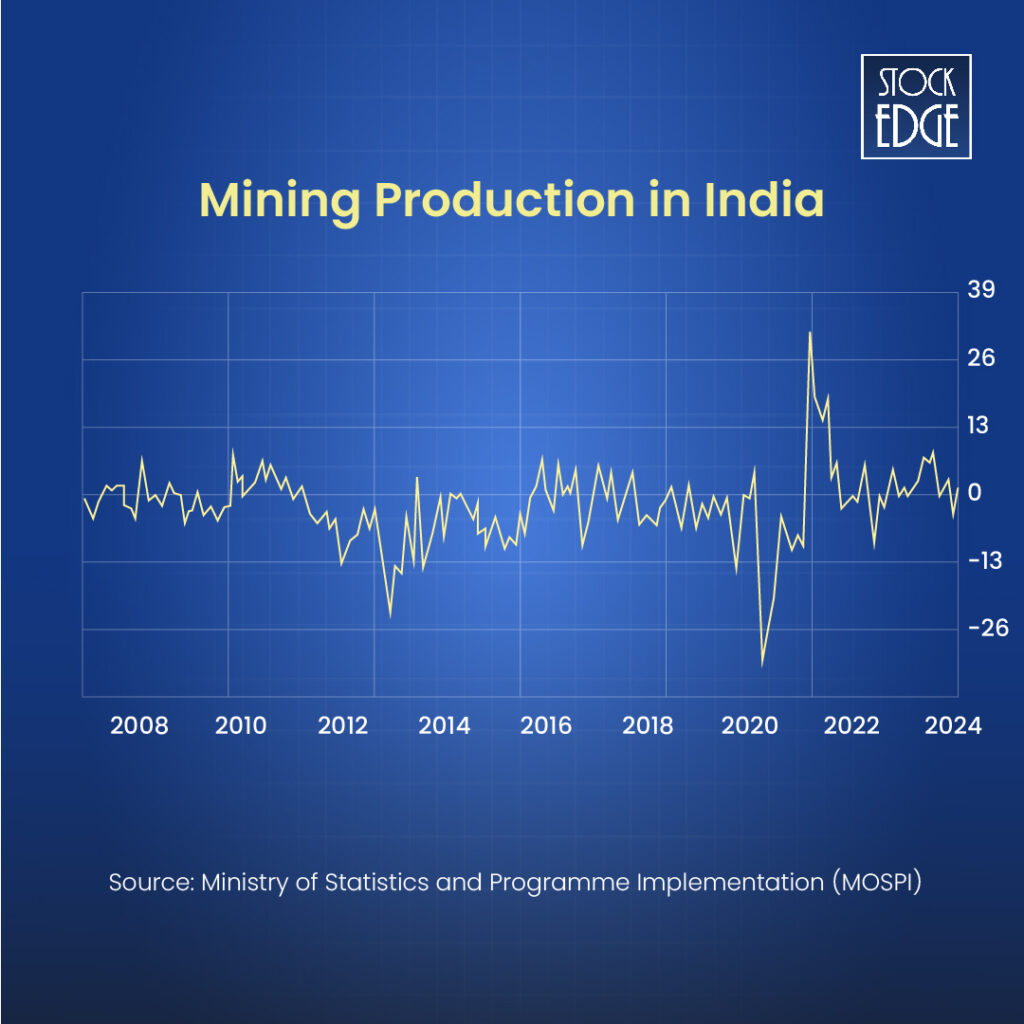

According to the Ministry of Statistics and Programme Implementation (MOSPI), mining production in India averaged 2.96% from 2006 to 2024, with an all-time high of 36.50% in April 2021 and a record low of -26.90% in April 2020.

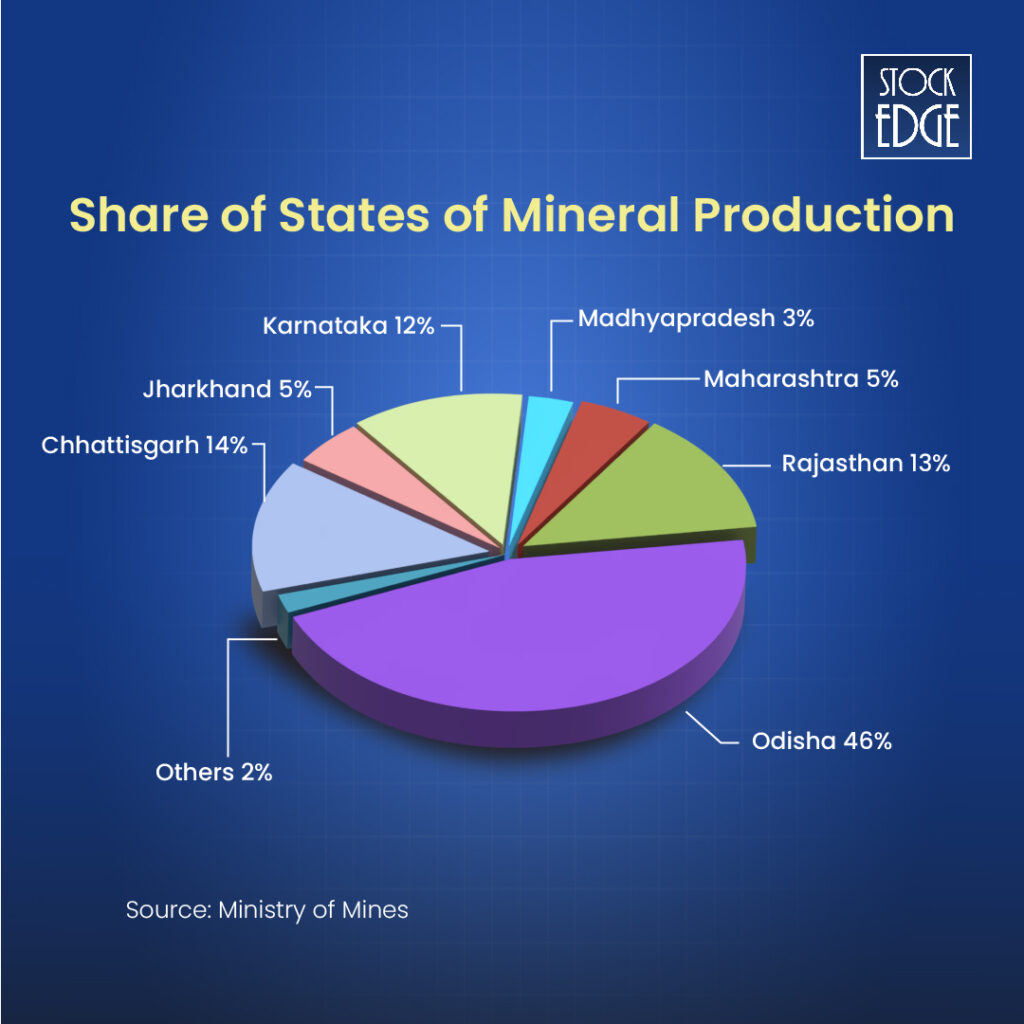

State-Wise Mining Composition in India

For 2023-24, India’s mineral production (excluding atomic, fuel, and minor minerals) is estimated to come from 19 states. However, only eight states account for 97.5% of the total output value. Odisha is the highest contributor, with 46%, followed by Chhattisgarh (14%), Rajasthan (13%), and Karnataka (12%). Other states that made significant contributions included Maharashtra (4.6%) and Jharkhand (4.7%).

Now, let’s move toward how this sector impacts the Indian economy.

Impact of the Mining Sector On the Indian Economy

The mining and quarrying sector plays an important role in the Indian Economy. According to the EY report, for every 1% growth in the mining and quarrying sector, there is an estimated 1.3% increase in overall industrial production and a 0.3% boost in India’s GDP.

- Contribution towards the Government Initiative: With programs like Atmanirbhar Bharat, Make in India, and Amrit Kaal, the government has increased its attention on the mining industry by investing more money in energy and electricity, smart cities, infrastructure, electric cars, and renewable energy markets.

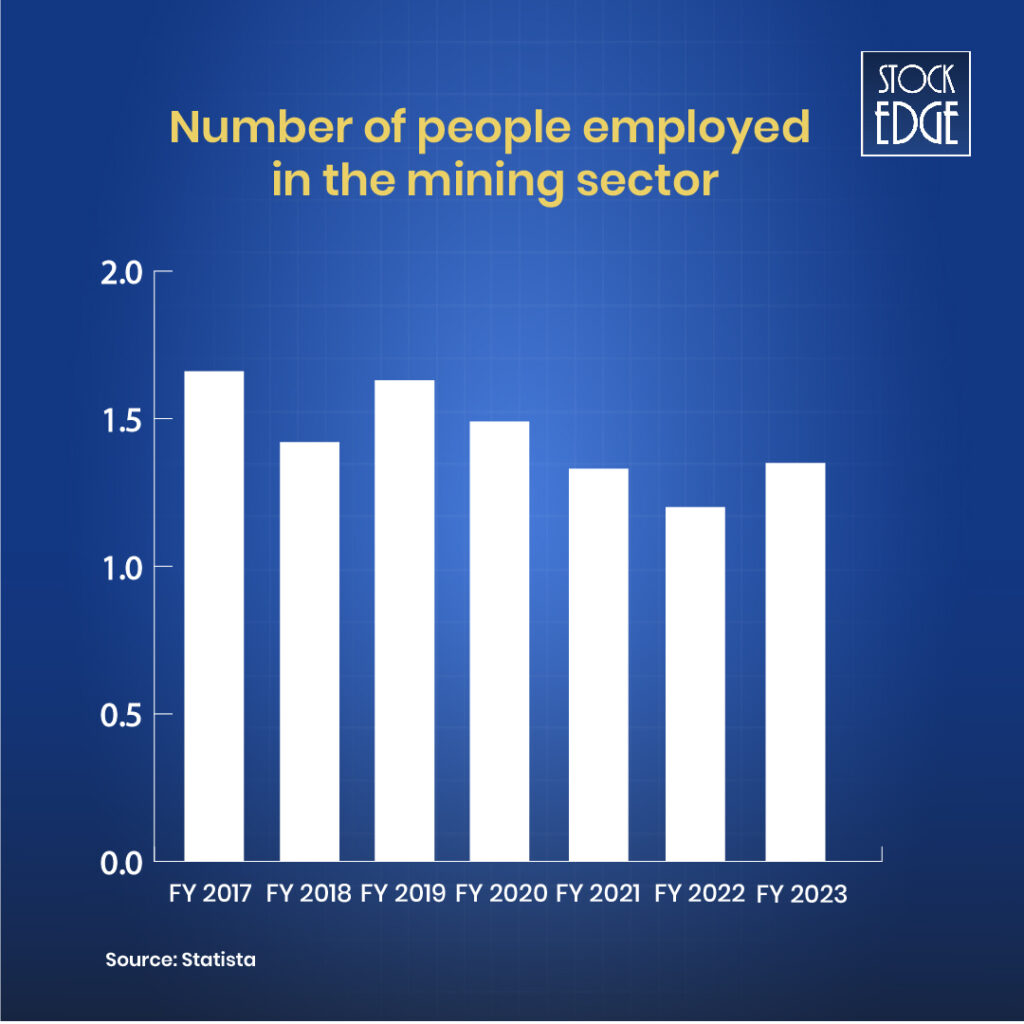

- Opportunities for Job Creation: One of the mining sector’s most significant contributions to the Indian economy is its ability to generate employment opportunities. The industry provides job opportunities to both unskilled and skilled workers.

- Promotes Manufacturing Sector: Due to government initiatives, domestic and foreign companies have established production plants within the country. Indian companies such as BEML and TIL, as well as global giants like Thyssenkrupp and Komatsu, have established domestic production operations. As a result, vital mining machinery, including excavators, dump trucks, and drilling machines, are now produced within the country.

- Contribution to GDP Growth: India is aiming to become a US$5 trillion economy by 2025. However, it would not have been possible without the due attention paid to the further development of the mining and coal sectors in India. So, the government has implemented various reforms and initiatives to develop the mining sector, which helps them contribute to GDP growth. In the first quarter of 2024, GDP from mining increases to ₹1004.93 billion from ₹826.45 billion in the last quarter

How the Mining Sector Works?

India has a unique blend of opencast and underground mines. There are usually two types of mines: opencast and underground. In the coal industry, 96% of the production comes from opencast mines, but hardly 4% from underground. The method of mining may be manual, mechanized, or semi-mechanized.

Let’s understand its value chain.

Value Chain of the Mining Sector

To identify the profitable stock, you have first to understand their business. Let’s check out the mechanism of metal stocks.

It begins with the identification of mineral deposits. For that, geologists conduct research to find commercially viable mineral deposits. After finding the land, they extracted raw materials from opencast or underground mines. Then, these raw materials are processed and refined to extract the metal. Next, the processed minerals are stored in inventory to ensure a steady supply. Once they reach their destination, these minerals are delivered to the end customer, who could be a manufacturer, distributor, or retailer.

How does the Mining Sector earn revenue?

Now, let’s understand how mining stocks in India earn profit.

Mining companies earn revenue from selling minerals and byproducts. The primary source of revenue for mining companies is the selling of the extracted mineral or metal. They sell byproducts that are produced at the time of extraction, such as tailings (waste material left after processing ore) or waste rock.

Usually, the mining sector incurs various expenses such as operating costs, labour costs, selling costs and royalties & other levies.

The mining industry is affected by volatile commodity prices, which impact profitability. So, smaller companies and individuals are typically involved in exploration, while larger companies focus on production and operations.

Let’s look at the reason for investing in mining stocks.

Why Invest in Mining Stocks in India?

With the increasing demand for manufacturing and infrastructure, mining has become an attractive sector for investors seeking growth and diversification. Globally, the mining industry is experiencing rapid technological advancements in mining, increasing demand for minerals, and a pressing focus on sustainability.

The government has launched the National Mineral Policy 2019, which aims to promote the sustainable and responsible development of the mining industry, with a focus on environmental protection, social inclusion, and the fair distribution of economic benefits. Now, India is looking to collaborate with international partners, such as the European Union and Japan, to develop new technologies and improve operational efficiency. These global collaborations provide access to cutting-edge technologies and best practices, facilitating improvements in mining efficiency and sustainability.

Now, look at the parameters to consider before investing in mining stocks in India.

Key Parameters to Consider Before Investing in Mining Stocks

To analyze the mining stock, some key parameters should be considered before investing in mining stocks.

- Global Commodity Price: Commodity prices play a significant role in determining the profitability of the mining sector. You have to analyze the demand and supply of the commodity. When commodity prices rise, the miners generally benefit from increased revenue as the commodity is sold at a higher price.

- Geopolitical Risk: One of the significant factors that has to be considered is geopolitical risks, including regulatory changes, government stability and potential conflicts, as these factors can significantly affect mining operations and financial performance. To know more about geopolitical risk, read our blog, Top 3 Geopolitical Risks Influencing The Stock Market.

- Operational Cost: Mining is a capital-intensive industry that requires significant investments to start the business. However, once the mines are established and operational, the operational expenditures become lower and stable.

- Company’s Fundamentals: It is important to analyze the fundamentals of the company and whether or not the company is fundamentally strong. The important financial ratios for analyzing mining stocks are the quick ratio, inventory turnover ratio, Operating Profit Margin and many more.

Now look at the top 4 mining stocks in India.

Top 4 Mining Stocks in India

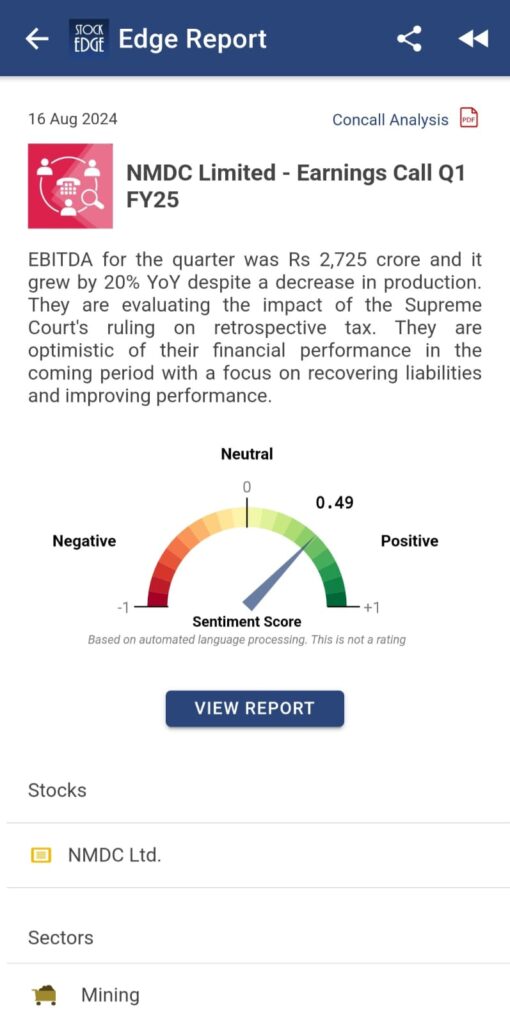

NMDC Ltd.

NMDC Ltd. is India’s largest iron ore producer, accounting for 16% of the market share. They are expanding their mineral portfolio, including operations in diamonds, gold, and coal, which enhances our resilience against market fluctuations. For FY24, NMDC’s EBITDA stood at Rs. 8,709 crores, showing a 28% growth from the previous financial year. The company’s operating profit margin was 34%, an upward movement of 6% in operational efficiency from FY23.

To know more about the financial performance of NMDC Ltd., check out our Edge Reports.

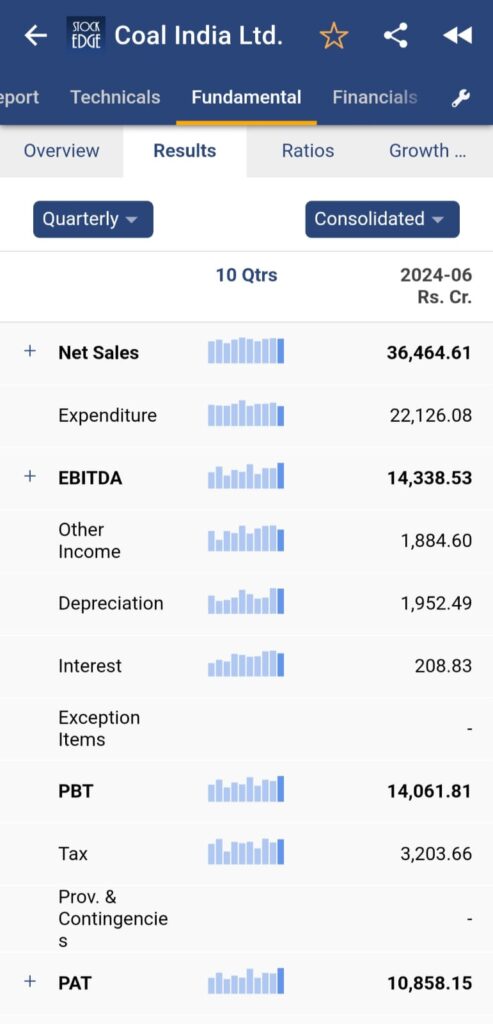

Coal India Ltd.

Coal India Ltd. is the largest coal producer in the world. In India, where 57% of primary commercial energy is dependent on coal, CIL alone meets 40% of primary commercial energy requirements. They reported a strong performance in FY 2023-24, resulting in a robust Profit Before Tax (PBT) of ₹48,812.61 crore and Profit After Tax (PAT) of ₹37,369.13 crore.

To explore more about the company’s fundamentals, check out StockEdge.

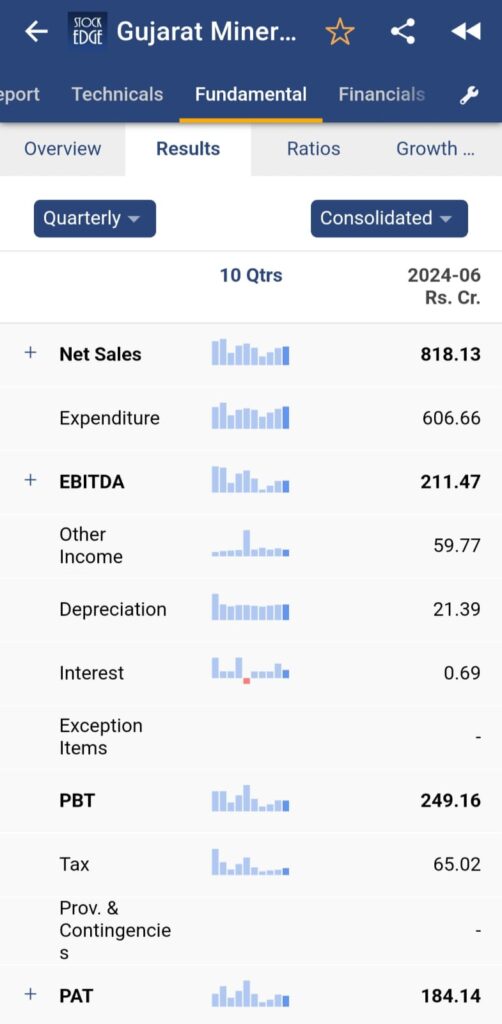

Gujarat Mineral Development Corporation Ltd.

Gujarat Mineral Development Corporation is primarily engaged in 2 sectors, i.e. mining and power. Its projects include Lignite, Bauxite, Fluorspar, Multi-Metal, Manganese, Power, Wind and Solar. Their management expected a strong performance in FY25 & FY26, mainly focusing on substantial volume targets due to revived operations at Tadkeshwar and new coal mines in Odisha, projecting increasing coal production.

To know more about their financial performance, check out the StockEdge.

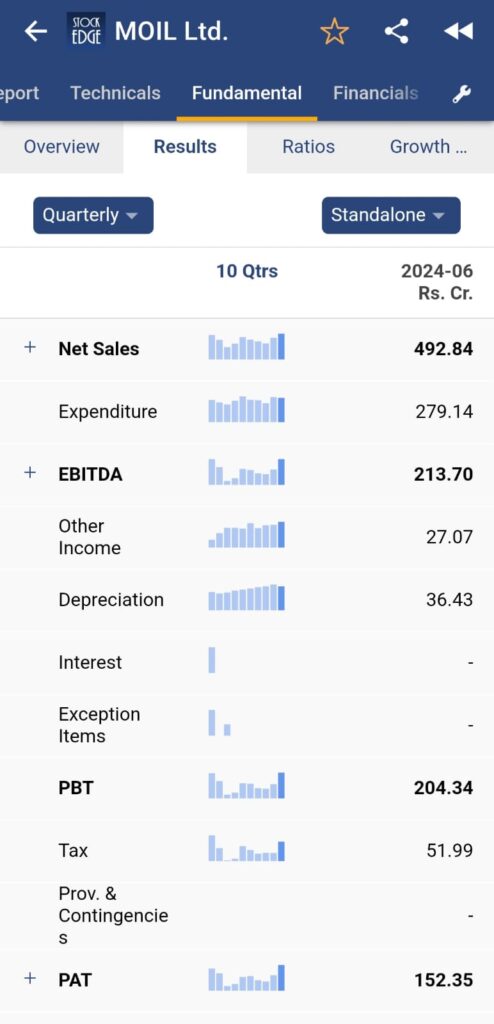

MOIL Ltd

MOIL Ltd is the largest manganese ore producer, accounting for around 52% of market share. The company operates 10 mines, including 7 underground and 3 open-cast mines. In Q1FY25, they also reported strong performance with best-ever quarterly revenue of ₹492 crores, a 30% year-on-year growth.

To explore more about the company’s fundamentals, check out StockEdge.

Future Prospects for India’s Mining Sector

We all know that India is well rich in minerals and coal. But surprisingly, we rely heavily on imported goods. For instance, 35% of our coal requirements are imported. However, the government has taken various measures to reduce the dependency on imports. As a result, in FY24, the mining sector grew by 7.5%, with the production of iron ore and limestone recording high growth during the year.

Currently, mining stocks in India are down. One of the reasons is that the Supreme Court allowed states to levy tax and royalties on minerals, apart from Central duties, and also allowed states to collect past dues. Second, the volatility spiked due to several ongoing geopolitical risks.

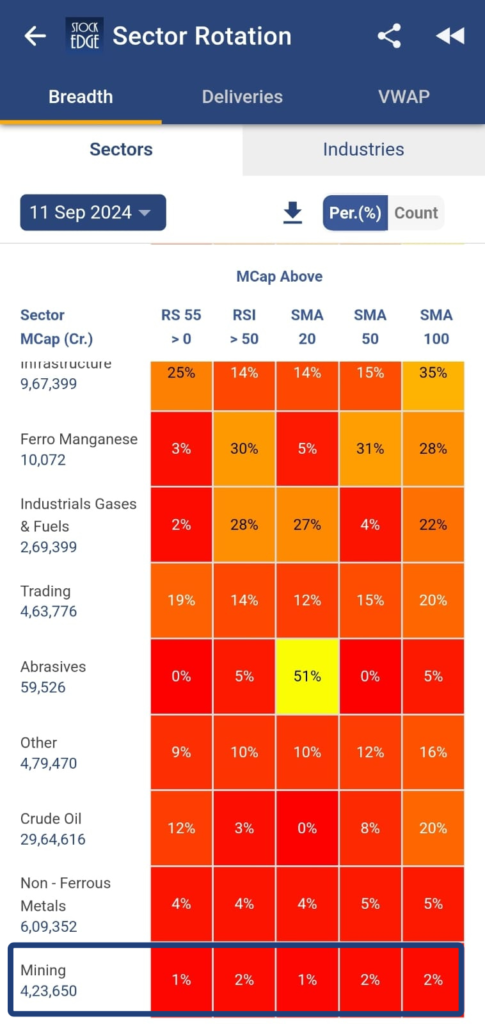

Now, let’s talk about the current trend in India’s mining sector. To find out, we can use StockEdge’s “Sector Rotation” feature. At StockEdge, we offer a sector rotation model that uses key technical indicators to determine if a sector is outperforming or underperforming.

From a technical perspective, sector rotation will be a crucial indicator because when technical parameters signal a bullish trend, i.e., green in colour, metal stocks are likely to outperform the market.

Conclusion: The Bottom Line

In conclusion, we can say mining stocks in India are undergoing a significant transformation. Traditionally reliant on manual labour, the industry has increasingly adopted mechanized operations. This shift towards automation has improved efficiency and safety. Additionally, government reforms have made it easier for companies to enter the mining sector, leading to increased competition and innovation.