Table of Contents

With over 44 registered mutual fund houses and over 2500 mutual fund schemes, the mutual fund market in India is a highly competitive one. Each mutual fund scheme has unique offerings and are all trying to attract customers with varying financial objectives. One such scheme known as a Contra Fund. Contra Funds have a unique take on their investment strategy.

A contra fund capitalises on short term triggers which stretch the demand or supply of a stock leading to mispricing from its deserved valuation. The fund managers of such funds follow an investment strategy known as Contrarian Investing.

What is Contrarian Investing?

A contrarian style of investing is to avoid investing in stocks or sectors currently in the limelight. It rather focuses on investing in undervalued stocks which are not currently in demand by the masses with the hope that the masses will realise its true value over time.

Stock prices are often a victim of extreme short term volatility, a result of maybe a recent announcement, a sector specific news or even upon the news of an investment by a famous investor. This creates a sense of enthusiasm around the stock which leads to its mispricing. The enthusiasm creates a spike in the demand or supply of a stock which can also be referred to as “crowd or herd mentality”.

A contrarian investor will do the opposite of what the prevailing market sentiment is. Such a style of investing can not only apply to individual stocks but also the stock markets as a whole. A contrarian investor will invest in the stock markets when others are negative about it.

For example, let’s say that the news and people’s sentiments around the Energy sector is negative at a given point of time. A contrarian investor will purchase stocks of fundamentally strong and undervalued stocks from this sector. When the turnaround of the sector happens and energy prices recover, the value of the stocks should rise greater than the overall sector due to the company’s rising earnings along with it.

Contrarian vs Value Investing

Contrarian and value investing are both very similar investment strategies in many ways. Both focus on investing in fundamentally sound companies which have an intrinsic value higher than their current market prices. Basically the essence of both is to invest in undervalued stocks with the hope that their true value will be realised in the future by the wider market.

One possible difference between the two is that while Value investing solely focuses on the fundamental parameters of a company, a contrarian investor may also look at technical indicators pointing towards oversold or overbought zones too.

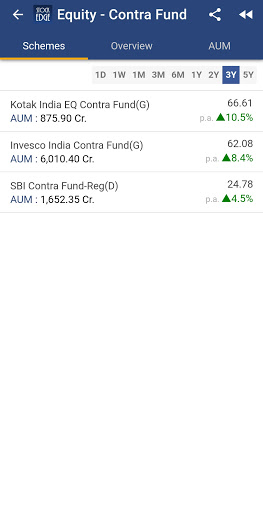

Top performing or the Best Contra Funds over the past 3 years on the StockEdge App:

Avail the course on Value Investing from Elearnmarkets : VALUE INVESTING COURSE IN ENGLISH

Features and Taxation of Contra Funds:

Contra Funds are equity oriented funds and as per the mandate of the Securities and Exchange Board of India(SEBI), at least 65% of the total investments of Contra Funds must be in Equity and related instruments or stocks.

Since Contra Funds fall under the category of equity investments, they are taxed in the same manner as other equity oriented mutual fund schemes.

For investments upto a period of 12 months, you would be subject to a short term capital gains tax of 15%. This 15% tax will be deducted from the net gains from the investment.

Meanwhile for investments more than a period of 12 months, you would be liable to pay a long term capital gains tax of 10% at the time of redemption. This 10% tax would be deducted from any profits of more than Rs.1 lakh. Say suppose the total returns from the investment is Rs.3 lakhs. Then 10% will be deducted from Rs.2 lakhs( 3 lakh – 1lakh) as a long term capital gains tax.

See Also: What are Focused Mutual Fund Schemes?

Advantages of investing in Contra Funds

- Contra fund managers focus on investing in fundamentally strong companies. This could limit the potential downfall of its portfolio during uncertain times.

- Contra funds have the potential to generate superlative returns for investors over a long term time period.

- The strategy of buying at lower valuations, and profiting from the gradual rise in prices, has the potential to generate high returns for investors.

Disadvantages of Contra Fund investments

- Contra funds rely heavily upon the research and decisions made by the fund manager. Mistakes by the fund manager can seriously affect the net returns.

- Since these funds work on the assumption that the prices of undervalued stocks will eventually rise in the future, changes in the macroeconomic scenario might lead to worsening of stock valuations.

- Investors who believe in Contrarian investing need to be resilient and stay patient for long time periods.

Are Contra Funds right for you?

Though Contra Funds can potentially generate high returns for you, they come with the caveat of high risks. Making Contra Funds high-risk-reward investments.

So it’s in the investor’s best interest to evaluate how such a fund would help them achieve their financial goals.

Before investing, it is also important to evaluate the fund manager by looking at his experience and performance during market downturns. Having a slight idea about the companies the fund invests in is also beneficial.

Due to a high amount of research involved , Contra funds are suitable for aggressive investors with time and experience.

You can also view the video below to know more about Contra Funds!

Click here to know more about the Premium offering of StockEdge.

You can check out the desktop version of StockEdge.

Comments 1