Table of Contents

The Rate of Change (ROC) is a momentum-based technical indicator that measures the percentage change in price between the current price and the price a certain number of periods ago. The ROC indicator is plotted against zero, with the indicator moving upwards into positive territory if price changes are to the upside, and moving into negative territory if price changes are to the downside.

The indicator can be used to spot divergences, overbought and oversold conditions, and centre line crossovers.

An ROC reading above zero is typically associated with a bullish bias.

An ROC reading below zero is typically associated with a bearish bias.

The Formula for the Rate of Change (ROC) is :

ROC = [ (Closing Price p − Closing Price p−n ) × 100 ] / Closing Price p−n

Where:

Closing Price p = Closing price of most recent period

Closing Price p−n = Closing price n periods before most recent period

To know more about Rate of Change, you can watch the video below:

The Rate of Change (ROC) is basically classified as a technical momentum indicator for stock price movements as it measures the intensity of changes in price movements. For example, if a stock’s price at the close of trading today is Rs.100, and the closing price five trading days prior was Rs.70, then the five-day ROC is 42.85, calculated as

( ( 100 – 70 ) / 70 ) * 100 = 42.85

The Rate-of-Change oscillator measures the speed at which prices are changing and it is generally calculated for 12 periods. An upward move in the Rate-of-Change reflects a sharp price increase whereas a downward move indicates a steep price decline.

ROC indicator falls as prices tend to decline and as the prices fall rapidly, it declines at a faster rate and as soon the intensity of price decline decreases, it starts increasing and corrects back to zero levels indicating the trend reversal.

Similarly ROC increases due to increase in prices and then increases at a faster rate when prices tend to grow rapidly and then when there is decline in rate of upward movement in prices, it starts falling back to it zero levels as the prices are close to its top level.

Rate-of-Change indicator tends to move in correlation with price movements and that is the reason it is preferred to use it as a indicator for reasonable time-frame.

Like all technical indicators, the Rate-of-Change oscillator should be used in conjunction with other aspects of technical analysis.

See also: Understanding William% R

Using Rate of Change in StockEdge App:

Above we have discussed the Rate of Change, now let us discuss how we can use this technical indicator to filter out stocks for trading:

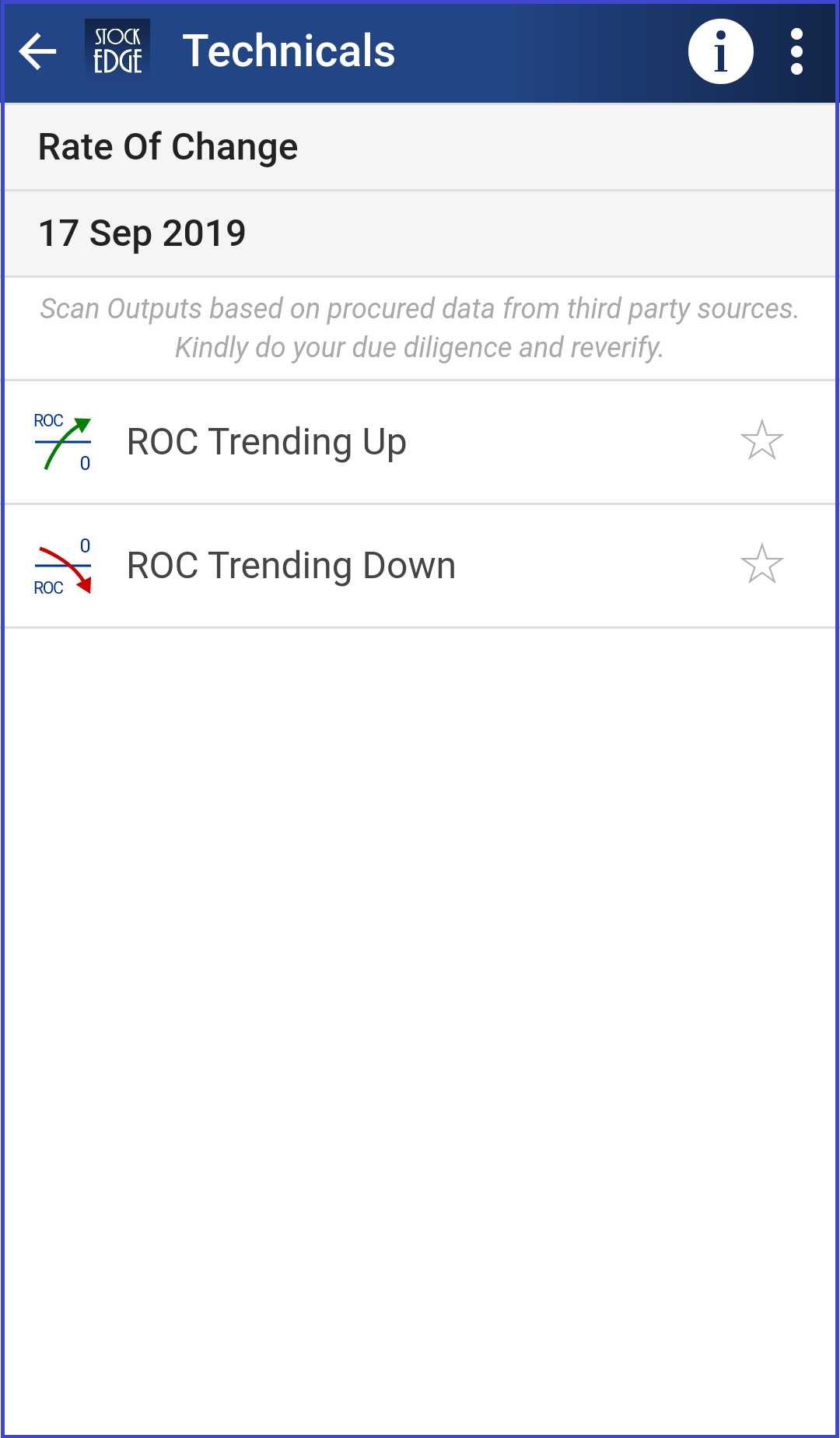

In StockEdge, there are two Rate Of Change scans available for filtering out stocks for trading:

Let us discuss in details about some of these scans:

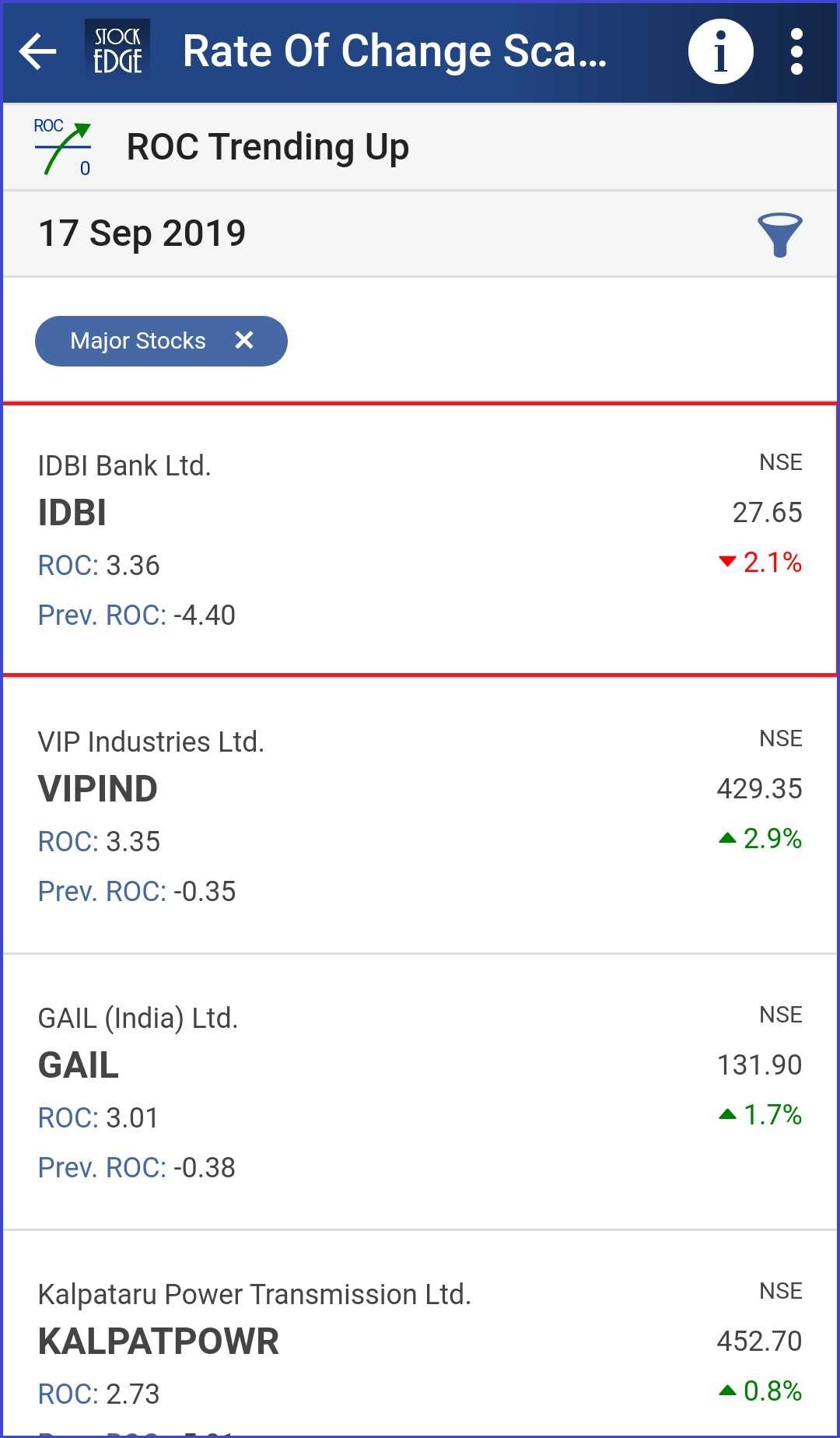

1. ROC Trending up :

It is an uptrend signal which means that the ROC value has crossed above 0 from below levels indicating a bullish bias.

Following is a list of stocks which has fulfilled this criterion on 17th September:

If you want to see the technical chart of IDBI Bank Ltd., then you can click on the company and find the technical chart with ROC plotted on the sub-graph:

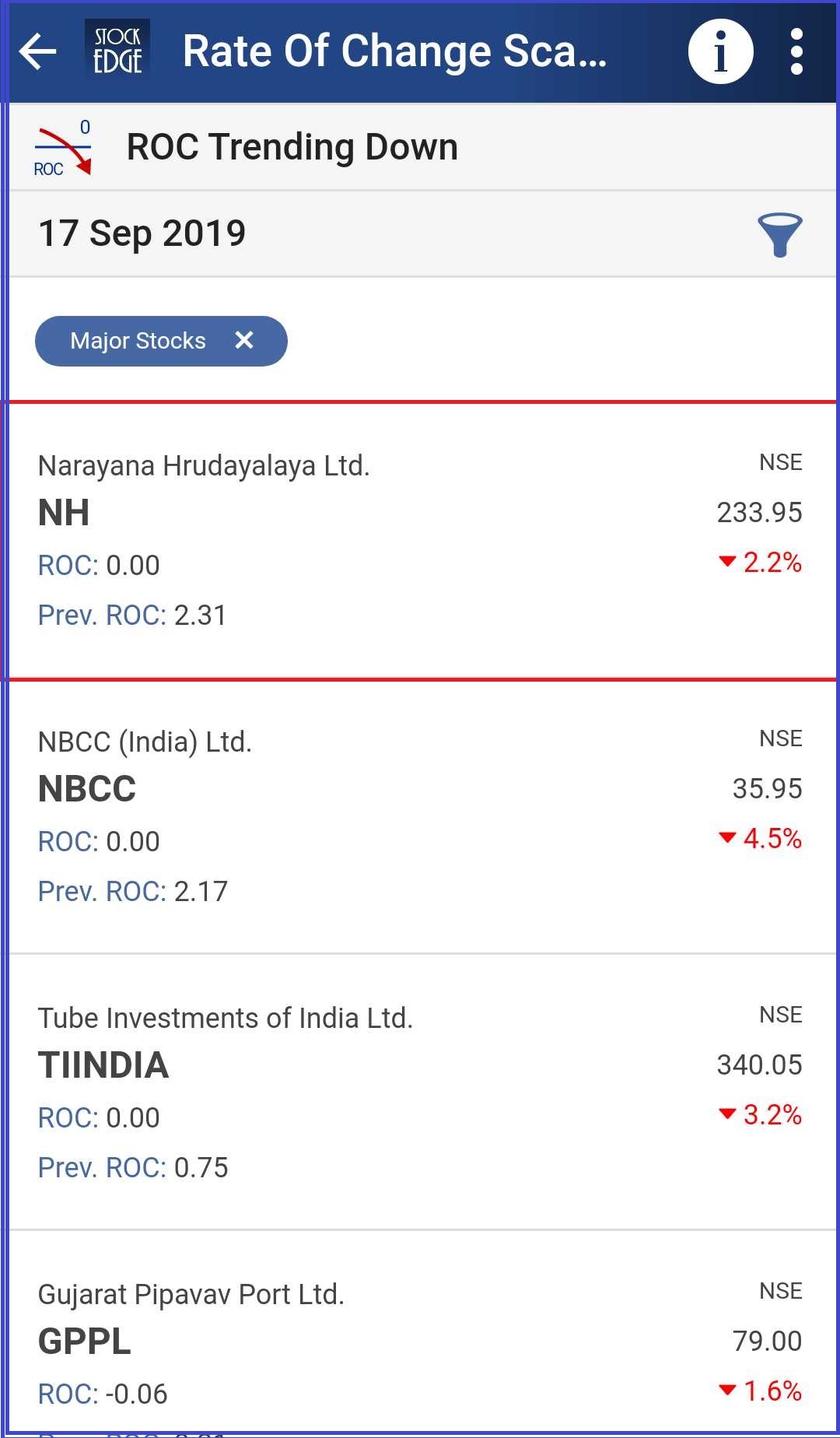

2. ROC Trending Down :

It is a downtrend signal which means that the ROC value has crossed below 0 from above levels indicating a bearish bias.

Following is a list of stocks which has fulfilled this criterion on 17th September:

If you want to see the technical chart of Narayana Hrudayalaya Ltd., then you can click on the company and find the technical chart with ROC plotted on the sub-graph:

See also: Using Stochastic Indicator

Above are examples of Rate of Change scans that tell you if the stock is bearish or bullish and also give us a list of the stock which fulfils the criteria of the particular day.

Also Read : ROC Indicator – How to trade with Rate of change Indicator ?

Join StockEdge Club to get more such Stock Insights.

You can check out the desktop version of StockEdge.