Table of Contents

The Story

Everyone loves to see their portfolio in green, but that’s not always possible, especially when the markets dance to the tune of Russia-Ukraine headlines. So a common person goofs up thinking about what to buy what to sell; and ends up calling all the financially bent people he knows, resulting in further nervousness and anxiety.

The stock market starts to get discussed everywhere, and you know that milk has spilt all over the place when your cab driver starts to talk about it AND give you financial advice. Let us warn you!! Do not engage. We repeat. Do not engage!!

If it’s something we’ve learned from years of experience, one should take the opportunity when the time is right. So without further delay, let’s get back to business.

Today we look at three companies that are showing positive relative strength.

Relative strength is a strategy used in momentum investing and value stock identification. It focuses on investing in stocks or other assets that have outperformed the market as a whole or a relevant benchmark.

Let’s look at the first stock with positive relative strength.

Fine Organic Industries Ltd.

Fine Organic Industries Ltd. is India’s largest Oleo Additives player and a dominant player globally. They have a strong moat in Oleochemicals, including High Entry Barriers, High Customer Stickiness, High Return Ratios, and Strong R&D Capabilities. The company reported a revenue of Rs.463.43 crores (Q3FY22), up 54.8% year on year. Revenue growth was driven by improved realization, aided by a price increase and strong volume growth. Export volume increased faster, accounting for 59% of total growth. As of today’s date, this is the Fine Organic Share Price.

On the other hand, domestic sales increased at a slower pace during the quarter due to Covid19 (3rd wave)-led restrictions. To protect and recover from raw material price volatility and higher freight costs.

Due to a 3.7% decrease in employee costs year on year, the EBITDA margin increased by 145 basis points to 17.2% in Q3FY22. PAT increased by 81.5% year on year to Rs. 51.98 crores, thanks to other income and a positive profit share from joint ventures.

The company is considering inorganic growth and downstream and upstream integration projects. These plans, however, are still in the early stages. Based on the strong demand scenario, the company expects to reach peak utilisation of all capacities by March 23. They attempt to finalise land parcels in Gujarat for future expansion to meet rising demand. It will be finalised in the next 2-3 months, and the new plant is expected to be operational in 20-24 months.

Fine Organics remains a strong play, with sustained traction for a niche IP chemical business, a strong client base, high margins and return ratios, and a strong balance sheet. In-house product innovations and engineering improvements to build advanced machinery will help the company gain a competitive advantage over other local players.

Let’s look at the chart of the company.

Fine organic Industries are currently looking at a strong uptrend.

Today, the stock witnessed a breakout and is currently trading near a 52-week high zone supported by higher than average volumes.

The Relative Strength of the stock in relation to nifty is positive and trending upwards, signifying that the stock is outperforming its benchmark index, Nifty 50.

Hindalco Industries Ltd.

Aditya Birla Group-backed Hindalco Industries Ltd. has it’s third-quarter profit nearly doubled, owing to favorable macroeconomic conditions, a focus on downstream value-added products, and improved operating efficiencies.

Hindalco reported a nearly 96% increase in consolidated profit after tax (PAT) to Rs.3,675 crore for the quarter ended December 31, 2021, compared to Rs.1,877 crore the previous year. While its consolidated revenue from operations increased by 44% to Rs 50,272 crore in the October-December quarter of FY22 from Rs 34,958 crore the previous year. As of today’s date, this is the share price of Hindalco share price.

EBITDA was Rs 7,624 crore, up 38% year on year. The company reported its highest net profit in Q3FY22, outperforming all previous quarterly results.

The results were driven by a consistent performance by Novelis and an exceptional performance by the India business, supported by favourable macros, strategic product mix, and improved downstream performance.

Despite challenges in the automotive segment due to a global semiconductor chip shortage, unplanned production downtime in South America, and supply chain bottlenecks in Asia.

Hindalco acquires Hydro’s high-end extrusions facility in Kuppam, Andhra Pradesh, and has retained its position as the world’s most sustainable aluminium company in DJSI 2021.

The strong balance sheet and consistent performance drive their plans for additional organic Capex (capital expenditure). They have already announced investments of over Rs 3,000 crore in their downstream pipelines Hirakud and Silvassa and acquisitions of Ryker and Hydro’s Kuppam units.

Let’s look at the chart of the company.

Hindalco Industries is currently trading in a bullish zone, as indicated by the super trend.

The stock was witnessed facing rejection from its super trend support, and the stock continues its upward trend.

The volumes have been high for the stock in the last two trading sessions, along with a positive price change, signifying demand.

The stock’s relative strength is positive, signifying that the stock is outperforming its benchmark index, Nifty 50.

Orient Bell Ltd.

Our last stock is Orient Bell, which is engaged in manufacturing ceramic tiles.

In Q3FY22, Orient reported 60.7% YoY growth in its consolidated net profit at Rs.12.1 crore from Rs.7.5 crore in the year-ago quarter (Q3FY21). The operating income grew 24% YoY at Rs 184 crore while Ebitda margins improved to 10.8% from 10.6% in Q3FY21. As of today’s date, this is the Orient Bell share price.

Despite rising energy and other costs, Orient Bell stated that consistent improvements in consumption key performance indicators and operating leverage resulted in improved profitability margins compared to last year.

During the 3rd quarter, they completed an expansion project at Sikandrabad, adding 0.7 million square metres (MSM) of capacity per year. In addition, two other projects, one at each of the company’s existing facilities in Sikandrabad, Uttar Pradesh, and Dora, Gujarat, are on track and expected to be completed in Q1FY23, with a combined incremental volume potential of around 1.9 MSM p.a.

Meanwhile, another CAPEX project in the South is underway at the company’s existing facility in Hoskote, Karnataka (incremental capacity of 1.8 MSM p.a.) and is expected to be completed by Q3FY23.

These projects are primarily funded through internal accruals, as the company continues to prioritise working capital to generate cash flows for future expansion. Nevertheless, the increase in the real estate sector is a positive sign for the industry, and Orient Bell seems confident that they will continue to improve all operational metrics.

Let’s look at the chart of the company.

Orient Bell has witnessed strong demand in the last three trading sessions and is currently trading near its new 52 week high.

The volumes have been much higher as the stock made its new 52 week high.

The stock’s relative strength is positive and trending upwards, indicating strong outperformance of the stock relative to its benchmark index Nifty 50.

Explore Top 52 Week High Stocks and Seize Market Opportunities Today!

Bottomline

These three picks could be referred to as “Chhota packet bada dhamaka.”

However, each stock is exposed to different risks, and there is no better time to repeat the adage “no risk, no reward.”

So, we will leave that up to you?

Until then, keep an eye out for the next blog and our midweek and weekend editions of “Trending Stocks and Stock Insights.” Also, please share it with your friends and family.

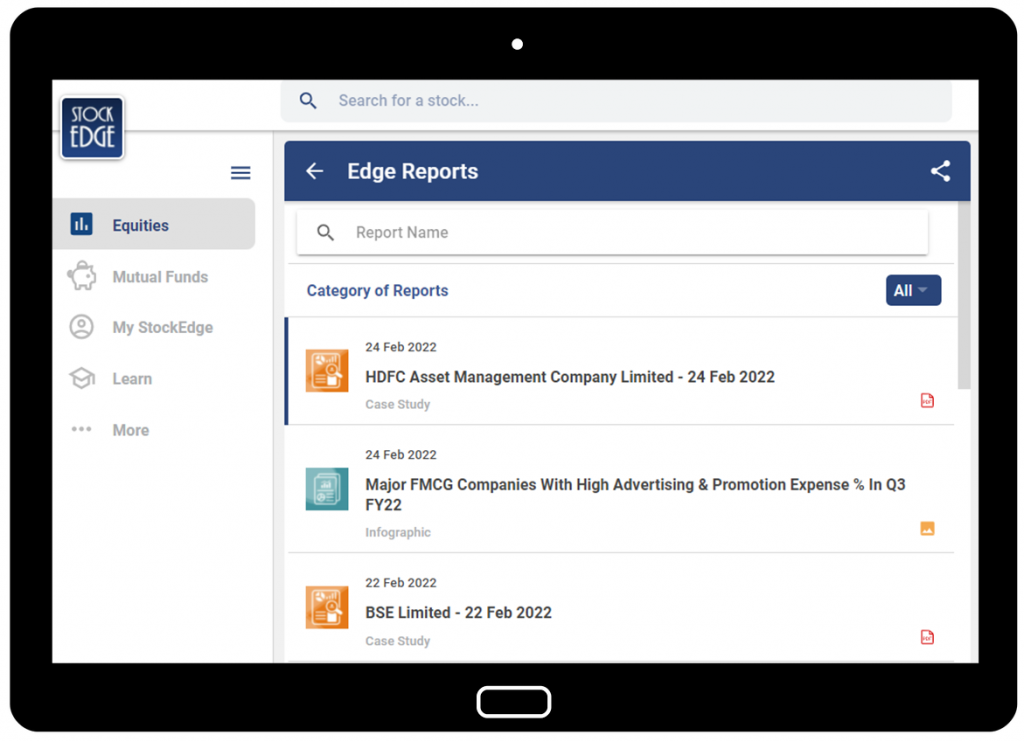

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans.

Disclaimer: This article and the process of identifying a company’s potential have been produced for only learning purposes. Since equity involves individual judgments, this analysis should be used only for learning enhancements and cannot be considered a recommendation on any stock or sector.