In this blog, we will share our spotlight on Shree Renuka Sugars Ltd.

Shree Renuka Sugars Ltd. – Highlights

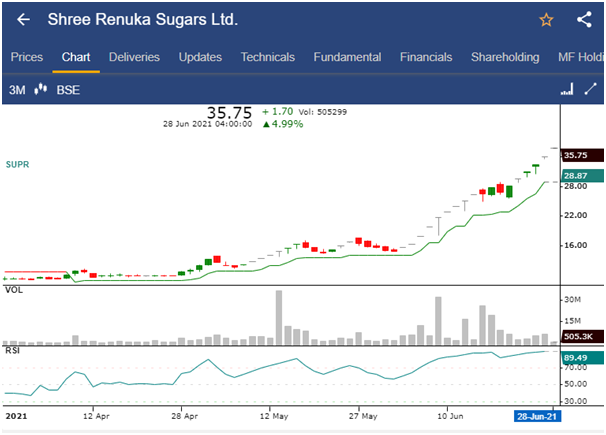

- The shares of Shree Renuka Sugars Ltd. was trading at Rs.35.75, hitting an upper circuit of 5% in today’s trading session.

- The stock price has increased by 125.27% in last one month, while the benchmark index S&P BSE Sensex has increased by 2.55%.

- The reason behind the rally in the stock was after the company said its board has approved capacity expansion of ethanol production.

- The board of directors approved an expansion in ethanol production capacity from 720 Kilo Litre Per Day (KLPD) to 970 KLPD at their meeting on February 9, 2021. Given the enormous untapped demand for ethanol as a result of the Government of India’s ethanol blending policies, the Company’s Board of Directors, at its meeting today, i.e. “On June 25, 2021, Shree Renuka Sugars approved further capacity expansion for ethanol production from 970 KLPD to 1400 KLPD,” the company said in an exchange filing.

- The capacity expansion would be finished by October 2022.

- The company reported a net loss of Rs 44 crore for the March quarter, compared to a net loss of Rs 146.00 in the same quarter last year. Sales declined 7.79 percent to Rs 1320.40 crore in Q4 from Rs 1,431.90 crore the previous year.

- The net loss for FY21 was reported to be Rs 114.70 crore, compared to a net profit of Rs 2,099.20 crore in FY20.

- During the fiscal year, the company received a waiver of interest accrued on trade payables for the purchase of raw sugar and advances for the sale of white sugar amounting Rs 65.9 crore from its parent company Wilmar Sugar Holding PTE Ltd and its fellow subsidiary Wilmar Sugar PTE Ltd.

- The company also received Rs 185.0 crore from the preferential issue of 211,670,481 equity shares to Wilmar Sugar Holdings Pte Ltd (Promoter Company) at a cash price of Rs 8.74 per share.

- Shree Renuka Sugars Limited (SRSL) was founded in 1995. In 1998, it purchased a sick unit with a capacity of 1,250 TCD owned by the Andhra Pradesh government. Later, SRSL relocated the acquired plant’s asset base to its own production facility in Munoli. With a captive power plant of 11.2 MW, this increased production capacity to 2,500 TCD. Shree Renuka Sugars is a fully integrated player specialising in the production and marketing of sugar, power, and ethanol.

- It is one of the world’s largest sugar producers, India’s leading sugar manufacturer, and one of the world’s largest sugar refiners. In India, the company owns and operates seven integrated sugar mills and two port-based refineries.

For more fundamental data and analysis, click on Shree Renuka Sugars Ltd.

Read our latest article on Laurus Labs Ltd. – A leading research-driven pharmaceutical company

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company has been produced for only learning purpose. Since equity involves individual judgments, this analysis should be used for only learning enhancements and cannot be considered to be a recommendation on any stock or sector.