Check out the share trend of Lux Industries Ltd.

Lux Industries Ltd. – Highlights

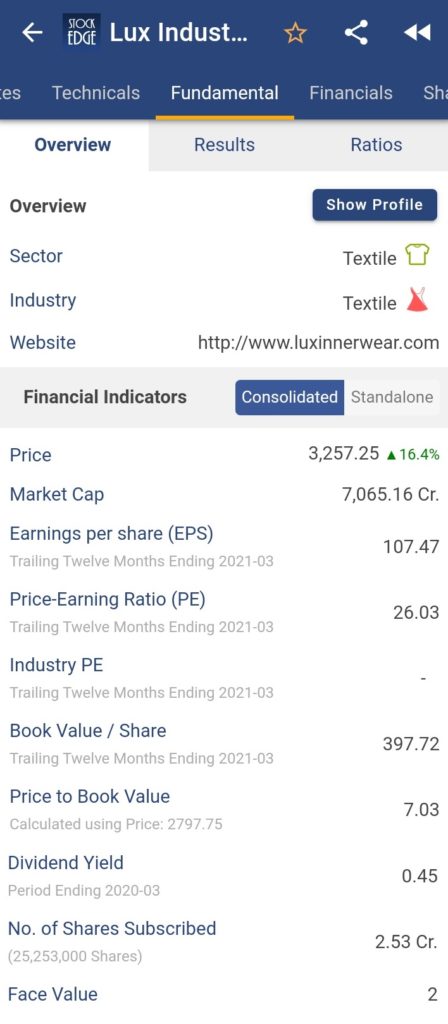

- Lux Industries Ltd., was trading at Rs.3257.25, up by 16.42% on the BSE.

- The stock is up by 59.54% in last one week as compared to a 1.51% surge in S&P BSE 500 in the same period.

- The stock hit a fresh 52-week high of Rs.3322.75 in today’s trading session.

- This massive rally in the stock came after the company reported a more-than-doubled net profit of Rs.90.64 crores in Q4FY21, on the back of healthy operational income, on Tuesday after the market hours. In Q4FY20, it made a profit of Rs.41.49 crores.

- During the quarter under review, the company’s income from operations increased by 49% year on year (YoY) to Rs.601 crore, up from Rs.404 crore in the previous fiscal’s corresponding quarter.

- EBITDA (earnings before interest, taxes, depreciation, and amortization) margins increased by 507 basis points (bps) to 21.45% from 16.38% in the previous quarter. Higher EBITDA Margins were achieved as a result of a greater share of value-added products and overall cost-cutting measures, including advertising expenditure.

- According to the company’s management, the strong performance has been driven by a gradual improvement in demand and consumption across the innerwear industry. The company saw healthy traction in the economy and mid-premium categories, as well as a gradual pickup in the premium and export segments.

- Nonetheless, management anticipates that the April-June quarter (Q1FY22) will be relatively weak due to the pandemic, and that it will gradually improve from the second quarter onwards. “The economic recovery will be back on track in the coming months, as the company witnessed in Q2 and Q3 of FY21,” management predicted.

- The company announced a Rs.110 crore capital expenditure for a greenfield expansion. The capital expenditure will be completed over the next 12-18 months and will be funded through internal accruals. The management expects the company to generate an additional sale of around Rs.400 crore as a result of this investment.

- Lux Industries Limited was founded in 1995 and has grown to become one of the largest players in the hosiery industry. To meet the growing demand of customers, the company offers a wide range of products under various brands. The company’s products are available in many retail points across India, with a focus on growing exclusive retail outlets and providing customers with a seamless buying experience.

- The company’s primary business is the production and sale of Knitwear. The Company is headquartered in India and serves both domestic and international markets.

For more fundamental data and analysis, click on Lux Industries Ltd.

Read our latest article on Adani Transmission Limited – Energizing India, Enriching Lives.

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company has been produced for only learning purpose. Since equity involves individual judgments, this analysis should be used for only learning enhancements and cannot be considered to be a recommendation on any stock or sector.

Excellent information

Very good collection and very useful

Deep insight