Check out the top trending stocks identified by the StockEdge analysts.

Read about DCM Shriram and 4 other stocks below:

As of today’s date, this is the DCM shriram share price.

The stock rallied after DCM Shriram Ltd. reported their company’s Financial Results for the Q3FY22.

DCM Shriram Ltd reported a 29.78 per cent increase in total revenues for the Dec-21 quarter, totalling Rs2,790.78cr on a consolidated basis. Total revenues increased by 28.71 per cent sequentially.

The company’s top-line revenues from the Chloro Vinyl vertical more than doubled to Rs1,042cr, while farm solutions revenues more than doubled to Rs446cr.

Sugar and bio seed revenues were down year on year. However, due to higher global prices, the fertiliser business increased by 40% yearly to Rs367cr.

The consolidated profit after tax (PAT) for the Dec-21 quarter increased by 38.01 per cent to Rs349.79cr, owing to a 118 per cent increase in EBITDA profits from the Chloro Vinyl business. The Farm Solutions and Sugar businesses of DCM Shriram Ltd. saw a sharp increase in EBITDA profits for the quarter. In contrast, the Bio seeds business saw its EBITDA dip into a wider loss in the Dec-21 quarter.

In case, you want to understand the factors that affect EBITDA and EBIT, then you can check our blog on it.

However, higher fertiliser input costs meant that, despite higher revenues, the EBIT was more than halved in the quarter. PAT margins of DCM Shriram Ltd. increased from 11.79 per cent to 12.53 per cent on a year-over-year basis.

Surplus cash net of debt at December 31, 2021, is Rs 245cr, of DCM Shriram Ltd. compared to net debt of Rs385cr at the same date in 2020. ROCE was higher in December, at 27 per cent, compared to 17 per cent in December of last year.

The Board declared a second interim dividend of 260 per cent, amounting to Rs 81.1 crore.

HSIL ltd share price, as of today’s date.

The stock has been rallying after the company announced divesting its building products division for Rs 630 crore.

HSIL announced that its Board of directors had approved the sale of its building products division to Brilloca, a wholly-owned subsidiary of Somany Home Innovation Limited (“SHIL”), in a slump sale transaction for Rs 630 crore in cash, subject to regulatory approval. Brilloca will take over the entire operating facilities of the building products division as part of the proposed transaction.

The Rs 630 crore in cash proceeds will be used to prepay existing bank borrowings, further strengthening HSIL’s balance sheet and creating capital to expand its packaging business. According to the company, in the future, HSIL will entirely focus on increasing its packaging business, capitalising on both organic and inorganic opportunities.

According to its management, this transaction will have a transformative impact on HSIL’s market positioning and growth prospects. As a result, the company will emerge as a focused packaging company, well-positioned to execute its strategic plans to drive the packaging business and unlock value for all stakeholders.

HSIL is India’s leading Packaging Products Company, producing and marketing a wide range of packaging products such as glass containers and Polyethylene Terephthalate (PET) bottles, products and security caps, and closures.

Tata Elxsi share price, as of today’s date.

The stock rallied after the company delivered another quarter of consistent and robust growth, with 33.2 per cent year-on-year revenue growth and profit after tax (PAT) growth of 43.5 per cent in the Q3FY22.

Tata Elxsi, a Tata Group company, is a global leader in design and technology services for industries such as transportation, media, communications, and healthcare and medical devices.

The company reported Rs.635.4 crores in revenue from operations for Q3FY22, a 6.7% increase over the previous quarter, driven by Embedded Product Design (EPD), the company’s largest division, which grew 9.9% sequentially and 36% year on year.

The company’s net profit for the quarter was Rs.151 crore, a 20.4 per cent increase from the previous quarter and a 43.5 per cent increase year on year. For the first time in its history, the company delivered industry-leading bottom-line performance, surpassing the Rs.200 crore PBT and Rs.150 crore PAT milestones.

Its management stated that the company is experiencing significant growth in the automotive market, with large and strategic deals with OEMs and suppliers across electric, autonomous, connected, and digital, highlighting its technological and engineering leadership.

This quarter, the company won strategic multi-year large deals against the best global competitors in all three industries. “We enter the fourth quarter with the confidence of a strong order book and a healthy deal pipeline across key markets and industries,” the company stated.

One97 Communications share price, as of today’s date.

The stock price has been falling for the last three days.

Paytm said in a business update last week that its GMV, or gross merchandise value, was Rs 2.5 lakh crore in the December quarter, up from Rs 1.1 lakh crore in the same period last year.

But, the recently Reserve Bank of India’s (RBI) has proposed digital payments regulations which may limit wallet fees. Paytm’s payments business still accounts for 70% of total gross revenue, so any rules limiting these changes could significantly impact revenues. In addition, to that, the Insurance Regulatory and Development Authority recently rejected Paytm’s foray into insurance. This could affect the company’s chances of obtaining a banking licence.

Paytm, One97’s flagship brand is India’s largest digital goods and mobile commerce platform, inspired and driven by a commitment to providing excellent customer service. Paytm is also a leading provider of payment solutions to E-commerce merchants via its RBI-approved semi-closed wallet. In addition, through India’s most widely deployed telecom applications cloud platform, One97 provides mobile content and commerce services to millions of mobile consumers. One97, headquartered in New Delhi, employs over 4,500 people and has regional offices in Mumbai, Bengaluru, Pune, Chennai, and Kolkata and a global presence in Africa, Europe, the Middle East, and South-East Asia.

Triveni Engineering & Industries share price, as of today’s date.

Triveni Engineering & Industries Ltd. announced on Tuesday that the rating agency ICRA reaffirmed the company’s ratings for existing bank facilities and increased its commercial paper limit. The outlook for the long-term rating is stable.

ICRA expects the company’s revenues to remain flat in FY22, despite higher revenues from the distillery division offset by lower sugar volumes (both domestic and exports). Furthermore, more increased sucrose diversion to B-heavy molasses/juice-based ethanol would moderate inventory levels and, as a result, lower future working capital borrowing levels.

Furthermore, in FY21, TEIL expanded into the production of country liquor, facilitating further forward integration. Furthermore, TEIL’s grain-based distillery with a capacity of 60 kilolitres per day (KLPD) is expected to begin operations in Q4FY2022, strengthening its operational profile and increasing revenue diversification.

Furthermore, ICRA observes that implementing the minimum support price (MSP) for sugar in FY2019 provides some protection against any decline in operating profits in sugar surplus years compared to previous years. Over the medium term, Triveni Engineering & Industries Ltd.’s operating profits are likely to be less volatile than in the past, owing to the expected continuation of MSP and the industry’s emphasis on diverting excess cane to ethanol production.

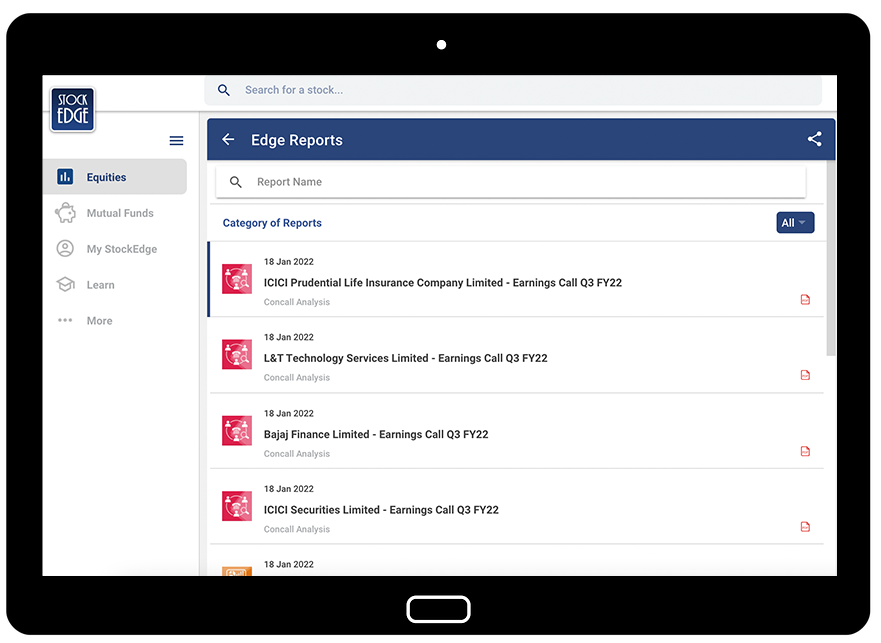

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company have been produced for only learning purposes. Since equity involves individual judgments, this analysis should be used only for learning enhancements and cannot be considered a recommendation on any stock or sector.

Very nicely explained