Read about BSE Ltd. and 4 other stocks below:

The shares of BSE Ltd. were trading at Rs.2234.95, up by 7.6% in today’s trading session.

The stock rallied after the company announced on Tuesday after the trading hours board had approved the bonus shares as on the record date. BSE said it would inform the record date soon. As of today’s date, this is the BSE share price.

Bonus shares are extra shares that companies give to existing shareholders at no extra cost by reorganizing their current cash reserves. When a business makes a profit, it increases its employed capital. This surplus is distributed by increasing the number of shares issued. For the quarter ended December 31, BSE’s net profit increased by 86% to 58.5 crore.

BSE reported an 86% year-on-year (YoY) increase in net profit to Rs.58.6 crore in its Q3 . During the quarter, the BSE’s net sales increased by 60% year on year to Rs.192.7 crore. The strong growth was fueled by a 44% increase in average daily turnover (ADTV) in the equity cash segment, which reached Rs.5,217 crore.

The ADTV for the equity derivatives and currency derivatives segments increased by 23% and 29%, respectively, to Rs.2.47 trillion and Rs 27,124 crore.

The shares of CreditAccess Grameen Ltd. were trading at Rs.754.85, up by 3.9% in today’s trading session.

The stock started rallying after the company declared its Q3FY22 results and as of today, this is the CreditAccess Grameen share price.

CreditAccess Grameen reported a consolidated net profit of Rs.117 crore for the quarter ended December 31, 2021, compared to a loss of Rs.79 crore the previous year, boosted by healthy business growth and higher interest income.

The country’s largest NBFC-MFI increased their business by 18.4% year on year to Rs 14,587 crore, with collection efficiency at 95%. The lender increased its branch network by nearly 15% year on year to 1,593.

At the end of December 2021, liquidity remained strong at INR 1,625.3 crore in cash and cash equivalents, accounting for 10.3% of total assets.

The company’s net sale increased by 27% to Rs 690 crore, while net interest income increased by 36% to Rs 412 crore. Pre-provision operating profit increased by 61% to Rs 274 crore. The ratio of gross non-performing assets was 6%.

“We draw enormous strength from our resilient business model and deep rural presence, which helped us to consistently outperform despite temporary challenges due to the Omicron variant (of Covid-19 virus),” said managing director Udaya Kumar Hebbar.

The shares of Gujarat Narmada Valley Fertilizers & Chemicals Ltd. were trading at Rs.546.55, up by 1.5% in today’s trading session.

The stock has been rallying after the company declared its Q3 results and as of today’s date, this is the GNFC share price.

The consolidated net profit of GNFC more than doubled to Rs.540.78 crore from Rs.242.59 crore in the previous fiscal’s corresponding quarter. Consolidated revenue from operations increased by 58% year on year to Rs.2,380 crore.

EBITDA margins increased 400 basis points to 28%.

According to GNFC, overall production and sales volume performance have improved, with the exception of product mix optimization (Make vs. Buy Decisions as well as Upstream vs. Downstream product choices depending on market conditions), which has resulted in increased margins.

However, despite rising input costs, the company’s margins remained protected, owing to the support of higher realisations on the output products front, led by chemicals, as well as serving a profitable product mix.

In the case of fertilisers, the government’s support for granting a special subsidy to compensate fertiliser producers, primarily of DAP/NP/NPKs, served as a breather and a shield, according to the report.

In terms of the future, GNFC stated that the company is in a position to capitalize on the boom in specific products and optimize both realization and profits through flexible and diverse product baskets. The company is confident in its ability to maintain consistent performance by balancing its product mix to serve markets.

The shares of Ishan Dyes & Chemicals Ltd. were trading at Rs.156.35, up by 12.9% in today’s trading session.

The stock has been rallying since Ace Investor Shankar Sharma bought a stake and as of today, this is the Ishan Dyes & Chemicals share price.

According to BSE bulk deals data, Shankar Sharma purchased 7 lakh shares of Ishan Dyes, representing 4.4% equity, at an average price of Rs.121.71 per share. Similarly, Standard Greases & Specialties purchased 1 lakh shares at Rs.123 per share, according to data.

According to BSE, promoter Piyushbhai Natvarlal Patel sold 20 lakh shares, or 12.5% of Ishan Dyes, at an average price of Rs 123.83 per share. The total promoter shareholding in the company as of the December quarter was 58.5%, including Piyushbhai’s 24.9% stake.

Read this interesting blog on 7 Steps to follow when Trading Breakout Stocks

The company reported a 9.1% year-on-year (YoY) increase in net profit at Rs 5.04 crore for the quarter ended December 2021, compared to Rs 4.62 crore in the corresponding quarter a year ago. Total income, on the other hand, fell 359.9% year on year to Rs 15.86 crore, down from Rs 24.76 crore in the previous comparable period.

Furthermore, on February 3, 2022, the company informed the BSE that its factory in Gujarat had become fully operational and stabilized, and the company anticipates that it will begin yielding favorable results from the same.

The shares of Stove Kraft Ltd. were trading at Rs.725.90, down by 14.3% in today’s trading session.

The stock tanked after the company reported a 67% year-on-year (YoY) drop in profit after tax (PAT) of Rs 11.1 crore in the December quarter (Q3FY22), owing to higher operational costs. In the previous quarter, the manufacturer of home and kitchen appliances reported a profit of Rs 33.50 crore (Q3FY21). As of today’s date, this is the Stove Kraft share price.

The company’s revenue remained flat in Q3FY22 at Rs 298 crore, while the earnings before interest, taxes, depreciation, and amortisation (ebitda) margin contracted 770 basis points to 7.2%.

During the quarter, the company experienced cost pressures due to an increase in raw material prices. However, the company did not pass this increase on to end-users because it expected the increase to reverse, which did not occur. As a result, both the gross margin and the EBITDA margin fell from the previous year.

A tepid revenue growth, primarily driven by a higher base in FY21 because Diwali was in the middle of November last year, had a positive impact in the third quarter of FY21. This year, the majority of Diwali purchases occurred before the third quarter, so volumes were relatively low when compared to last year.

The company added 7,182 retail outlets in Q3FY22, an 11.3% increase over September 2021 and a 36% increase over March 2021. “The expansion of our distribution network, combined with increased product offerings and technological advancements, will provide significant growth opportunities in the future and allow us to increase our market share,” the company’s management stated.

Stovekraft is India’s largest kitchen appliance manufacturer. It provides premium kitchen solutions through a diverse range of products such as pressure cookers, nonstick cookware, gas and induction cook tops, mixer grinders, chimneys, and hobs.

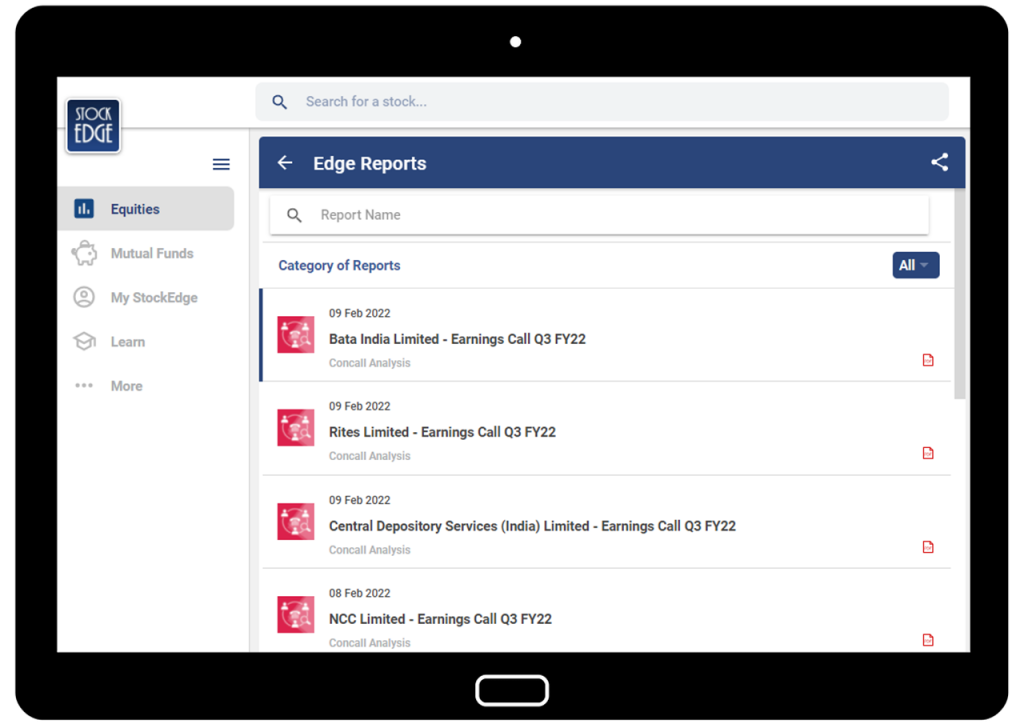

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company have been produced for only learning purposes. Since equity involves individual judgments, this analysis should be used only for learning enhancements and cannot be considered a recommendation on any stock or sector.

Very nice update is given by infoedge hearty congratulations