To view its chart on StockEdge, click on the link given here

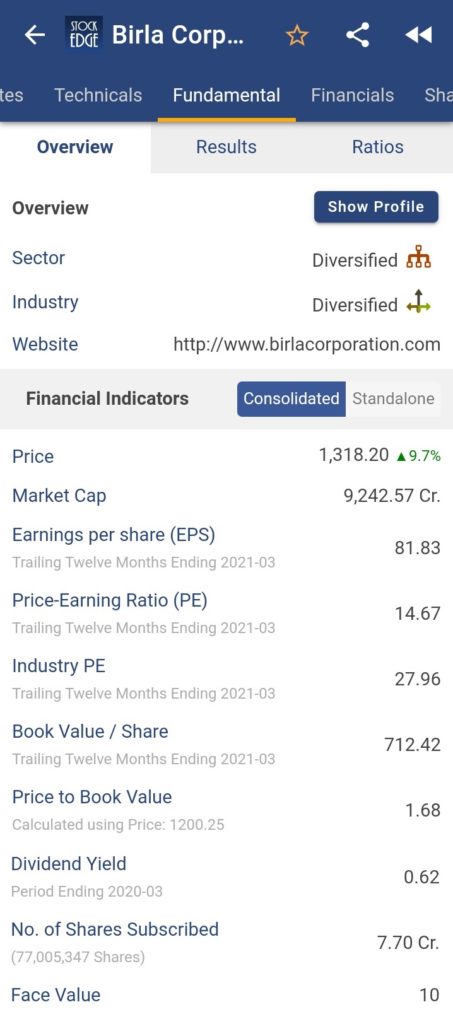

Birla Corporation Ltd. – Highlights

- Birla Corporation Ltd. was trading at Rs.1326.60, up by 10.53% on the BSE.

- The stock is up by 27.13% in last one week as compared to a 2.16% surge in S&P Bse 500 after reporting a strong set of numbers for the quarter ended March 2021 (Q4FY21).

- The stock of the cement & cement Products company hit a fresh 52-week high of Rs.1374.85 today.

- Birla Corporation reported a fourth-quarter net profit of Rs.249.33 crore, up by 28% year on year (YoY) from Rs.194.73 crore in the same period during the previous year, due to strong realization. The sales volume increased by 24.5 % year on year to 4.17 million tonnes (mt). Revenue increased by 24.9% year on year to Rs.2146 crore.

- The quarter was one of the best ever for the company in terms of production and sales, with a capacity utilization of 108%. The company’s Ebitda (earnings before interest, taxes, depreciation, and amortization) for Q4FY21 was Rs.405.53 crore, and cash profit was Rs.338.16 crore, both of which were the highest ever.

- Birla Corporation managed to raise prices during the March quarter in response to improved demand, resulting in a marginal improvement in realization per tonne, but profitability was put under pressure due to a sharp increase in raw material and fuel costs. While Ebitda/ton was down 10.3% year on year in Q4FY21, it increased 4% year on year to Rs.1012.

- The company claimed that aggressive cost-cutting helped it make up for a loss in production and sales at the start of the fiscal year. Most notably, finance costs were reduced by Rs.91.39 crore, or 23.6% year on year, to Rs.296.28 crore. The company also benefited from a stronger-than-expected recovery in cement demand beginning in the second quarter, particularly in the rural sector, which was largely the result of the Union government injecting cash into the economy by boosting infrastructure development.

- Birla Corporation Limited is the M.P. Birla Group’s flagship company. It was founded in 1919 as Birla Jute Manufacturing Company Limited by Late Mr. Madhav Prasad Birla. As Chairman of the Company, he transformed it from a jute goods manufacturer to a leading multi-product corporation with diverse operations. The company passed the Rs.1300-crore turnover mark under the chairmanship of Mrs. Priyamvada Birla, and the name was changed to Birla Corporation Limited in 1998.

- As its primary business activity, the Company manufactures cement. It also has a significant presence in the jute goods industry.

For more fundamental data and analysis, click on Birla Corporation Ltd.

Read our latest article on Tata Power Company Ltd – Lighting Up Lives

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Food information

Good company