Check out the top trending stocks identified by the StockEdge analysts.

Read about Ambika Cotton Mills and 4 other stocks below:

As of today’s date, this is the Ambika Cotton share price.

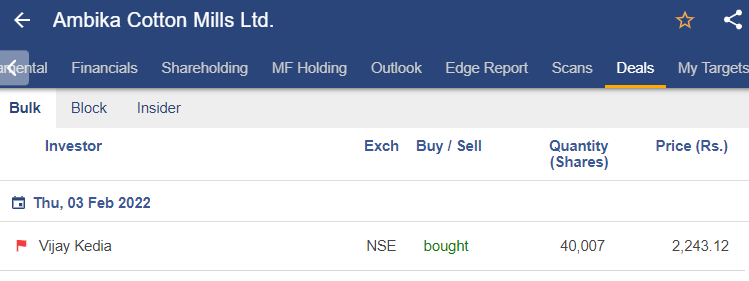

Ambika Cotton rallied after ace investor Vijay Kedia bought nearly 1% stake in textile company through open market on Thursday.

Vijay Kedia paid Rs.7 crore for 40,007 equity shares representing 0.70 percent of Ambika Cotton Mills’ total equity on February 3, 2022. According to bulk deal data, Kedia purchased shares on the NSE for Rs.2,243.12.

Ambika Cotton’s revenues increased by 31% in Q3 to Rs.252.14 crore, up from Rs.192.67 crore in the same period the previous year.

Ambika Cotton reported a 146% increase in net profit to Rs.51.85 crore for the quarter ended December 2021, compared to Rs.21.10 crore profits in the same period last fiscal.

Ambika Cotton Mills is a company that manufactures and sells specialty cotton yarn to manufacturers of premium branded shirts and t-shirts. Exports account for a sizable portion of the company’s revenue. Furthermore, the Company’s expanded product offering in its knitting segment has helped to establish newer markets in the knitting segment.

As of today’s date, this is the HG Infra share price.

The stock started rallying after the company declared its Q3FY22 results.

The company’s revenues increased by 26.73% in Q3 to Rs 951.44 crore, up from Rs 750.74 crore in the same period the previous year.

The company reported a 48.4% increase in net profit to Rs.100.56 crore for the quarter ended December 2021, compared to Rs.67.76 crore profits in the same period last fiscal.

The National Highways Authority of India (NHAI) recently declared H.G. Infra Engineering as the L-1 (lowest) bidder for a Karnataka-based road project.

The project entails 6-laning of Neelmangala-Tumkur, including the Tumkur bypass section of NH-48 (Old NH-4) in Karnataka on an EPC basis under the Bharatmala Pariyojna.

The NHAI’s bid project cost Rs 1,112,10 crore. The project cost proposed by the company is Rs 844.11 crore. The completion time is three years.

H. G. Infra Engineering is a company that builds, develops, and manages infrastructure. The company’s main line of business is to provide engineering-procurement-and-construction (EPC) services on a fixed-fee turnkey basis, as well as to undertake civil construction and related infrastructure projects.

As of today’s date, this is the Torrent Power share price.

The stock rallied after the company declared its Q3 results.

Torrent Power’s consolidated revenue from operations increased by 28% in the third quarter of FY22, to Rs 3,767.43 crore from Rs 2,952.75 crore in the third quarter of FY21. Gains from liquefied natural gas (LNG) trading, among other things, have led to a 15% increase in Torrent Power Ltd’s consolidated net profit to Rs 369.45 crore for the quarter ended December 31, 2021.

In the previous fiscal year 2020-21, the company made a net profit of Rs 321.73 crore in the corresponding quarter.

Torrent Power claims that, in addition to gains from LNG trading, an increase in contribution from merchant power sales offset by a decrease in contribution from long-term PPA in gas-based power plants contributed to an increase in total consolidated income.

Furthermore, the company saw an increase in contribution from distribution franchisee business due to lower T&D losses, partially offset by lower contribution due to lower rate and decrease in finance costs, both due to lower debt and lower interest rates.

Meanwhile, Torrent Power’s board of directors has approved an interim dividend of Rs 9 per share on equity shares worth Rs 10 each for fiscal year 2021-22.

As of today’s date, this is the Deepak Fertilisers And Petrochemicals Corporation Share Price.

The stock has been rallying since the company reported its Q3FY22 results.

In its BSE filing, the company reported a topline increase of 35.14 percent year on year and 9.07 percent quarter on quarter to Rs 1955.70 crore in Q3FY22. On the operational front, the company earned Rs 351.99 crore, an increase of 62.35 percent year on year and 66.01 percent quarter on quarter.

The corresponding margins increased to 18% in Q3FY22 from 14.98% the previous year. In Q3FY22, PAT was Rs 180.61 crore, more than doubling the Rs 88.95 crore reported at the same time last year.

During the Q3 conference call with investors, the company’s management stated that the company has market leadership in all key product segments and that a strong demand outlook should support business growth and profitability. It seeks a complete transition from commodity to specialty products.

The management also stated that the two expansion projects – ammonia backward integration and Technical Ammonium Nitrate (TAN) capacity expansion – are on schedule to be completed. The ammonia plant is expected to be operational by Q1FY24, and the TAN plant will be operational by Q2FY25. Aside from these, the company intends to increase capacity utilisation of fertiliser plants and expand its presence beyond Maharashtra, Gujarat, and Karnataka.

The management stated that net profits more than doubled during the quarter due to significant margin expansion in the chemicals segment, while the fertiliser segment faced challenges due to uncertainties in raw material availability and costs.

According to the company release, operating profit “continued to build on growth momentum” despite unfavourable raw material prices affecting Iso Propyl Alcohol and Fertiliser segment profitability.

According to the Investor Presentation, the Mining Chemical business performed exceptionally well in the third quarter; the outlook remains positive, bolstered by an increase in mining and infrastructure-related activities. Market leadership in key product segments, as well as a strong demand outlook, will help to boost business growth and profitability.

Deepak Fertilisers and Petrochemicals Corporation is one of India’s leading fertiliser and industrial chemical producers.

Read this interesting blog on 7 Steps to follow when Trading Breakout Stocks

As of today’s date, this is the Godrej Properties Share Price.

The stock tanked after its board of directors approved a Rs.400 crore investment in DB Realty (DBR) to acquire a 10% stake through the issuance of warrants.

“The board approved a potential investment in DB Realty as well as the formation of a special purpose vehicle with DBR to jointly undertake slum rehabilitation and MHADA redevelopment projects,” Godrej Properties said in a press release issued after market hours on Thursday.

The company will subscribe to warrants convertible into equity shares totaling approximately 10% of DBR’s issued and paid-up capital for a total of approximately Rs 400 crore. According to the company, Godrej Properties and DBR will each contribute an additional Rs 300 crore to the equity platform focused on redevelopment opportunities in Mumbai.

The equity platform will serve as a strategic special purpose vehicle, providing Godrej Properties with ROFR (Right of First Refusal) for all slum rehabilitation and MHADA redevelopment projects identified by DB across Mumbai under a 50:50 equity partnership with the company receiving 10% development management fees. According to Godrej Properties, this will give the company access to a large number of slum rehabilitation and MHADA redevelopment projects in MMR.

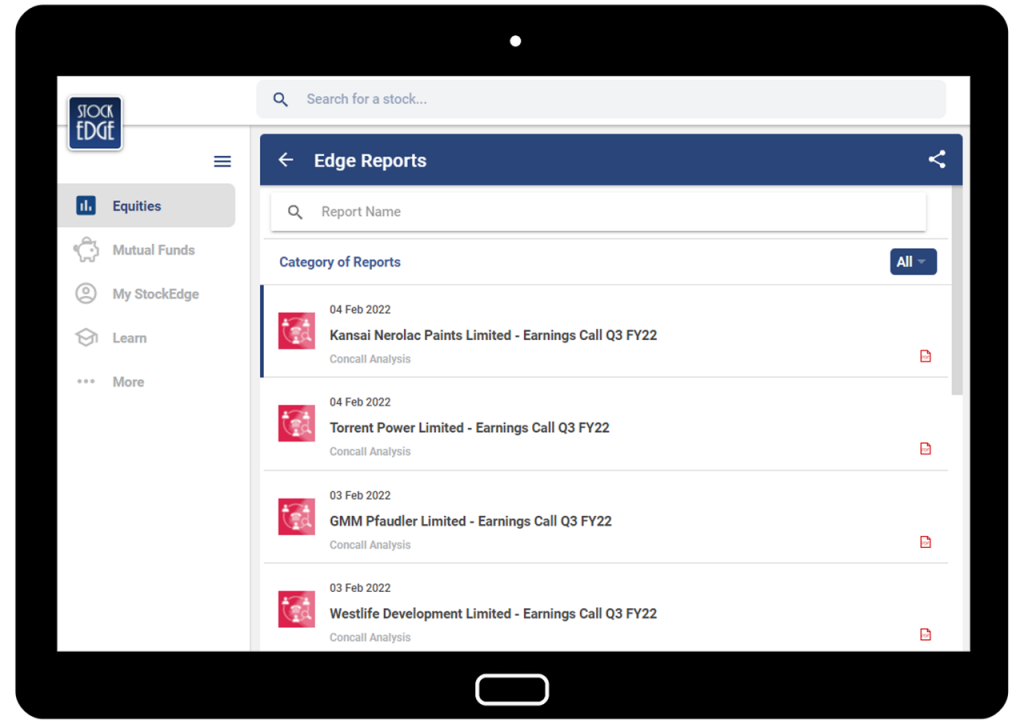

To get more detailed analysis and Reports on Stocks, visit our Edge Report Section by subscribing to our StockEdge premium plans

Disclaimer: This document and the process of identifying the potential of a company have been produced for only learning purposes. Since equity involves individual judgments, this analysis should be used only for learning enhancements and cannot be considered a recommendation on any stock or sector.