Table of Contents

The Finance Minister, Nirmala Sitharaman, presented the Union Budget 2024 on 23rd July, marking the beginning of the third term of the Prime Minister, Mr Narendra Modi led BJP-NDA government. This budget has focused on aiding underprivileged sections of society, improving education and focusing on youth for new employment generation opportunities, providing subsidies to farmers with a focus on increasing MSP, providing higher loans and releasing new crop varieties that will help farmers tackle climate change.

This was the seventh consecutive budget presented by the Finance Minister. The budget also intended to benefit Medium and Small Enterprises (MSME) by launching new Credit Guarantee Schemes to support small businesses and by offering tax relief to middle-class families of India by reducing direct taxes.

Notable tax modifications were made this year in almost all asset classes, including an increase in Securities Transaction Tax (STT) for futures and options, reductions in capital gains taxes for assets other than equity assets, and the elimination of the angel tax to support startups and new-age businesses. In Equity, Short Term Capital Gains (STCG) were increased to 20% from previous 15%, and LTCG taxes were increased to 12.5% from 10% with increase in exemption limit to 1.25 lakh from previous exemption of 1 lakh.

The budget also introduces changes to income tax slab rates, raises Mudra loan limits, and sets a new record for railway funding. With increased spending in infrastructure, almost doubling the allocation in 5 years, focus on India growth story remain intact. Allocation towards affordable housing for urban poor and middle-class families will give a significant boost to economic growth.

Numerous sectors and industries have gained the Government’s attention in this budget. Let’s look at all the government schemes and Top Mutual Funds that are likely to benefit from the budget allocation.

Which Government Schemes gained most in Union Budget 2024:

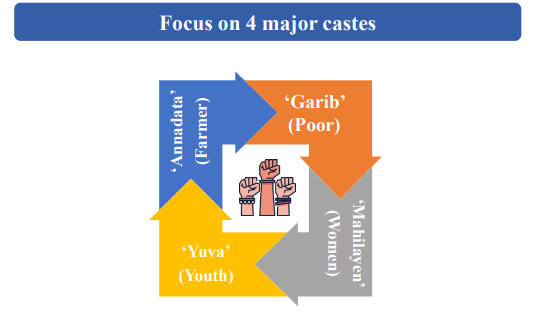

The Finance Minister highlights the priority to be drawn in nine focused areas to achieve the mission of Viksit Bharat. The focus is primarily on productivity in agriculture and allied activities, providing employment and skilling to youth, inclusive human resource development, manufacturing and services-oriented sectors, rural and urban development, push in infrastructure development, adopting renewable Energy and shift to thermal, solar and hydro Energy, innovation R&D, and next-gen reforms focusing on the betterment of Garib, Mahilaye, Youth and Kisan of the nation.

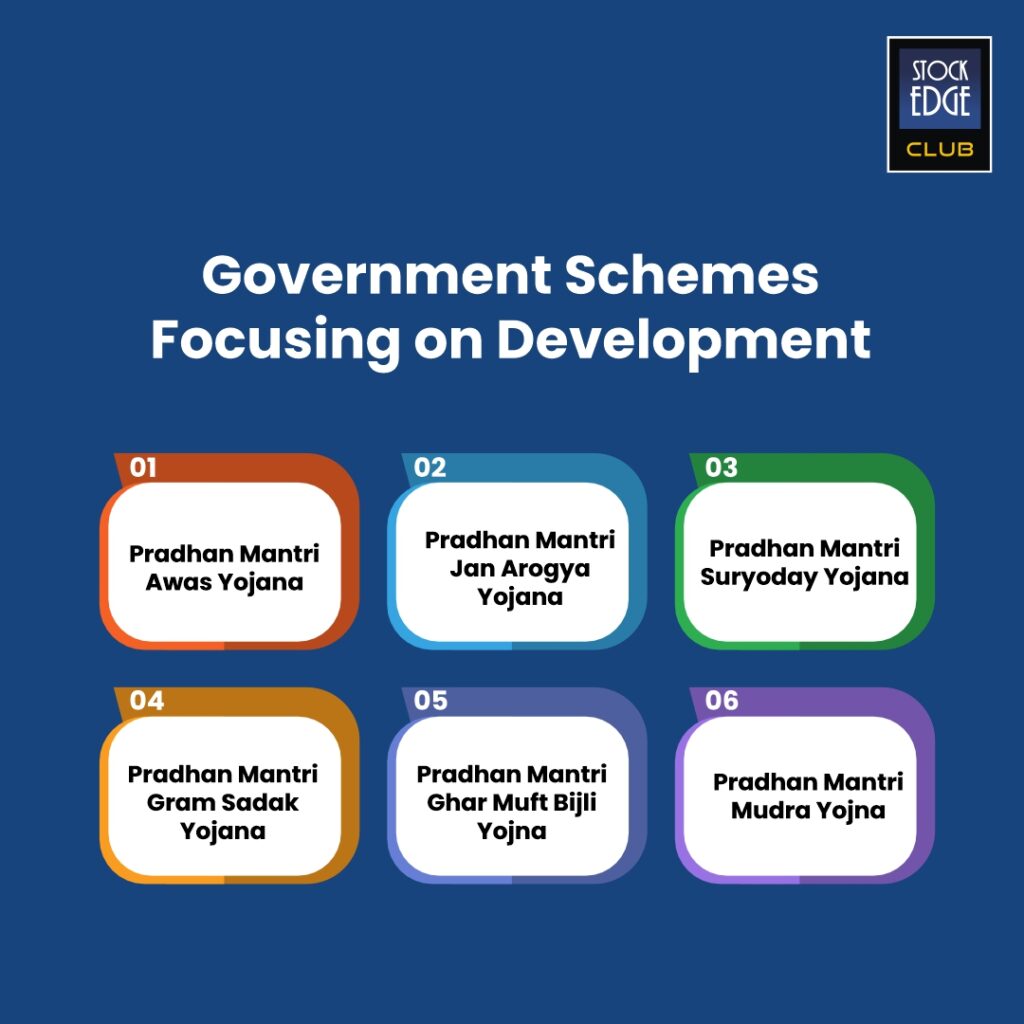

Some Key Government Schemes:

Pradhan Mantri Awas Yojana: Gramin (PMAY): This scheme was launched in 2015. It aims to provide pucca (permanent) houses with basic amenities to all homeless people and households living in kutcha (dilapidated) houses in rural areas. The scheme targets constructing an additional three crore houses. It also aims to create connectivity in underserved regions by building bridges and expressways, as well as increasing road connectivity. The budget allocates Rs. 2.66 lakh crore towards rural development.

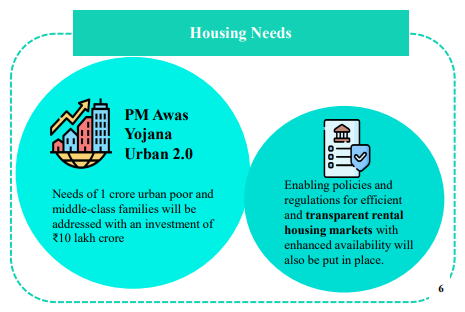

Pradhan Mantri Awas Yojana: Urban 2.0: This scheme focuses on providing affordable housing to the urban poor, including slum dwellers. The mission aims to achieve ‘Housing for All’ through various options, such as redevelopment, affordable housing through credit-linked subsidy, and subsidy for individual house construction.

Pradhan Mantri Jan Arogya Yojana: Pradhan Mantri Jan Arogya Yojana is a health insurance scheme that aims to provide a health cover of Rs. 5 lakh per family per year for secondary and tertiary care hospitalization to over ten crore poor and vulnerable families (approximately 50 crore beneficiaries). The allocation saw a 10% increase in the 2024 budget to Rs 7,300 crore from Rs 6,800 crore from 2023-24.

Pradhan Mantri Suryoday Yojana: This scheme aims to provide solar power in rural and remote areas of India. It seeks to harness solar energy to ensure sustainable and renewable energy sources for households and communities.

Pradhan Mantri Gram Sadak Yojana (PMGSY): This scheme aims to provide good all-weather road connectivity to unconnected villages. It focuses on the construction of quality roads to enhance rural connectivity and boost economic activities in rural areas. Under Phase 4 of the scheme, the Government announced the development of all-weather road connectivity to rural habitats.

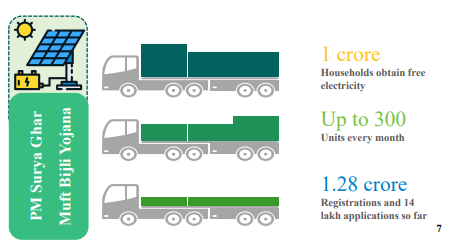

Pradhan Mantri Ghar Muft Bijli Yojna (PMGMBY): Pradhan Mantri Ghar Muft Bijli Yojna is a newly launched scheme that aims to provide free electricity connections to households in rural areas, ensuring that every household has access to reliable and affordable electricity. This scheme will benefit one crore households with upto 300 units of electricity free every month.

Pradhan Mantri Mudra Yojana: Pradhan Mantri Mudra Yojana aims to provide financial support to micro and small enterprises by offering loans up to Rs. 10 lakh. The scheme will promote entrepreneurship and generate employment through the establishment and growth of small businesses. This limit to Mudra loans is Rs. 20 lakh in the Union Budget 2024.

Top Sectors Focused on Union Budget 2024

Agriculture and Allied activities:

• Farmers and the agricultural sector remain the backbone of every nation, with an allocation of ₹1.52 lakh crore towards agriculture and allied sectors.

• Government to develop 10,000 bioresearch centres along with financing programmes of Kisan Credit Cards in 5 states.

• The Government will release 109 new varieties of 32 climate-resilient horticultural crops that farmers will cultivate.

• The government will strengthen the production and marketing of various pulses and oil seeds, such as mustard, groundnut, sesame, and sunflower.

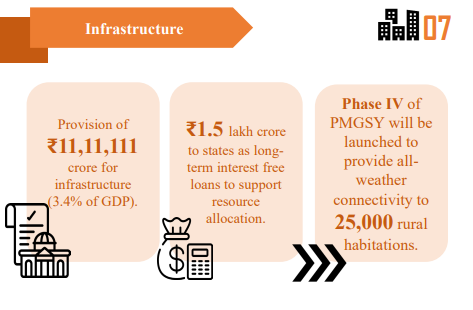

Infrastructure Development: Rural and Urban:

The Government has focused heavily on infrastructure for the last four years, with budget allocations growing from 2.5 lakh crore to 10 lakh crores.

• In Budget 2024, the Government announced a fiscal support package of Rs. 11,11,111 crore (11.11 lakh crore) for cap-ex, which accounts for 3.4% of the GDP.

• The Government also announced Rs. 2.6 lakh crore for rural infrastructure development.

• To boost infrastructure, 12 industrial park projects will be further developed.

• A 26,000 crore boost in road connectivity projects for various highways and a 2-lane bridge over the River Ganga at Buxar will further boost development.

Housing and Home Financing:

• The government announced packages of Rs. 10 lakh crore to support smart cities mission town planning in suburban areas.

• The government will also provide subsidies for housing loans, making it attractive for the middle class to construct their new home.

• The government will also promote areas in water supply, sewage treatment, solid waste management, and irrigation facilities for 100 large cities.

Employment and Education:

• The FM announced Rs. 1.48 lakh crore for education, employment, and skill development.

• The Government will incentivise 30 lakh youth looking to start jobs in the manufacturing sector.

• The upgradation of 1000 select institutes and colleges in the next five years.

• The focus is also planning to set up women’s hostels, which will impact 25,000 students every year.

Power and Energy:

• Allocations up to 69,000 crore have been given to the energy sector, with initiatives like installing rooftop solar plants and providing 300 units of free electricity to one crore households each month.

• The Government will focus on building thermal energy power plants, Bharat Small Modular Reactor, and pump storages, and a dedicated road map will be formulated.

• The government will also tie up with the private sector in nuclear energy.

Defence and Railways:

• The Government focuses on the Make-in-India initiative on Aerospace, Aircraft, weapons, and other defence-allied sectors.

• In Budget 2024, allocation of Rs. 4.55 lakh crore to indigenize defence equipment and make India self-sufficient.

• A Venture capital fund of Rs. 1000 crore will be established.• Rs. 2.62 lakh crore in the Union Budget 2024 has been allocated to Indian Railways to boost railway safety and the manufacturing of 12,500 general train coaches.

Tourism Sector

• Tourism in India has grown 43% since last year.

• Temple corridors: Vishnupath temple at Gaya and Mahabodhi temple in Bodhgaya will be developed to attract global tourism.

• Tourism boost in Odisha, with a focus on temples, wildlife sanctuaries, beaches, and natural landscapes in FY25.

• New airports, medical colleges, and sports infrastructure to be developed in Bihar. Tourist centres of Rajgir and Nalanda will also be comprehensively redeveloped.

Tata Nifty India Tourism Index Fund – Direct Plan is a New Fund offered by Tata AMC invested in companies engaged in travel, tourism and the hospitality industry.

To know about the specific stocks benefiting from Union Budget 2024 check out our recent blog.

Top Mutual Funds focusing on the theme of Budget 2024-2025.

Mutual Funds are pooled investments that invest in a basket of securities from different sectors, market capitalizations, or asset classes.

Thematic or Sectoral-focused Mutual Funds are those that invest in a particular sector, such as banking, healthcare, automobile, etc., or in a particular theme that benefits all sectors, such as EV, renewables, railways, manufacturing, etc.

Thematic Funds are considered very risky as they have a concentrated portfolio and invest in stocks with the same idea as the underlying theme. However, these funds can be rewarding if the economic trends remain favourable.

One key thing investors should keep in mind is the risk associated with such funds. As per SEBI’s risk-o-meter, these funds have a Very High rating. A major correction or fluctuation in the market can greatly reduce the fund’s value.

A suitable investment horizon to avoid such fluctuations is a minimum period of 7+ years, as historically, the Nifty 500 has not delivered any negative returns when investments are made for the long term.

Some of the Mutual Funds that are likely to benefit from the Union Budget 2024 are mentioned below.

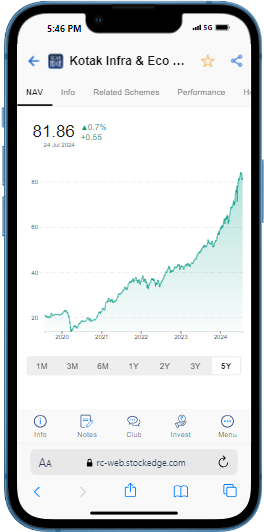

Kotak Infrastructure and Economic Reform Fund – Direct Plan:

This fund invests in companies involved in India’s economic development as an outcome of potential investments in infrastructure and unfolding economic reforms.

This mutual fund’s sector allocation is mainly in the materials, industrials, and consumer discretionary sectors, with a combined weightage of 50%.

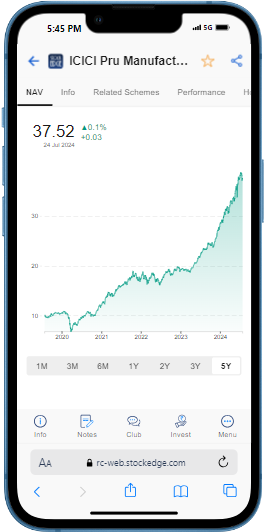

ICICI Pru Manufacturing Direct Plan:

This fund invests in companies that are engaged or expected to benefit from the growth in housing and its allied business activities.

Around 70% of the portfolio allocation is spread across Financial, Materials, and Industrial activities. The fund has performed well over the past five years, with CAGR returns of 21%.

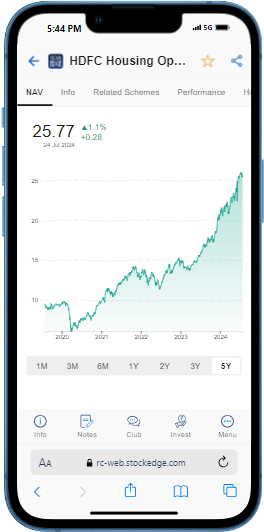

HDFC Housing Opportunities Fund – Direct Plan

This fund invests in companies that are engaged or expected to benefit from the growth in housing and its allied business activities.

Around 70% of the portfolio allocation is spread across Financial, Materials, and Industrial activities. The fund has performed well over the past five years, with CAGR returns of 21%.

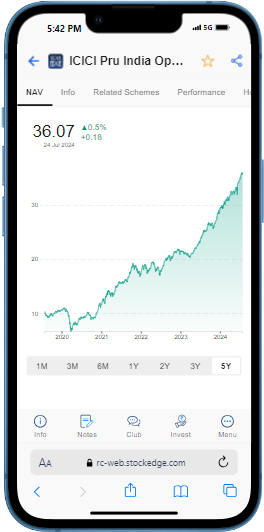

ICICI Prudential India Opportunities- Direct Plan

This five-year-old fund, launched in January 2019, has delivered 26.03% annual returns since its inception. Sankaran Naren oversees the fund’s performance.

The scheme generates long-term capital appreciation by investing in opportunities that arise out of special situations such as corporate restructuring, Government policy and regulatory changes, companies experiencing temporary unique challenges, and similar instances.

The fund comes with a low expense ratio and is well-diversified among 56 stocks.

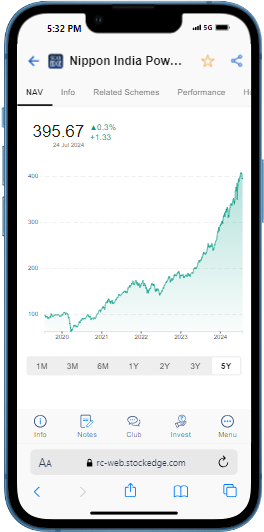

Nippon India Power & Infra Fund – Direct Plan

This fund is inclined towards the power and infrastructure space in India, mainly focusing on infrastructure-related companies. It is a highly concentrated fund with approximately 30 stocks in the portfolio.

The fund continues to outperform its peers and has generated robust returns of 31.41 annually over a 5-year time frame. However, the fund charges comparatively high expenses and fees.

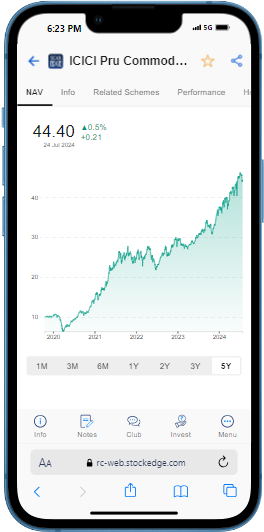

ICICI Prudential Commodities Fund – Direct Plan

This fund is a commodity-focused fund that invests in companies engaged in commodity and commodity-related sectors. It has chemicals and fertilizers as a part of allocation in its portfolio.

Currently, no direct schemes are focusing on agri-tech, chemicals, fertilizers, or related agri-themed companies.

The top 4 stocks are from the Steel and Metal sector, with a combined weightage of nearly 32%.

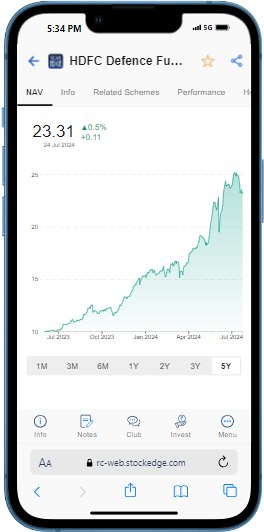

HDFC Defence Fund- Direct Plan

This fund is a one-of-a-kind fund that invests in defence manufacturing and other allied defence companies. It is an actively managed and invests in 20 stocks with a 40% allocation to Hindustan Aeronautics and Bharat Electronics.

The fund stopped new investments on July 22nd, but investors looking to invest in the Defence Indigenization theme can keep an eye on the fund when it opens a subscription for repurchase.

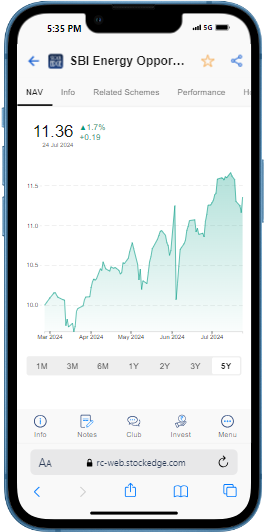

SBI Energy Opportunities Fund – Direct Plan

This fund was launched in February 2024 but has gained a lot of traction from its aggressive investment objective. The fund invests in companies in the natural resources and energy sectors, including those involved in exploration, production, distribution, and transportation in the Energy and Power sector.

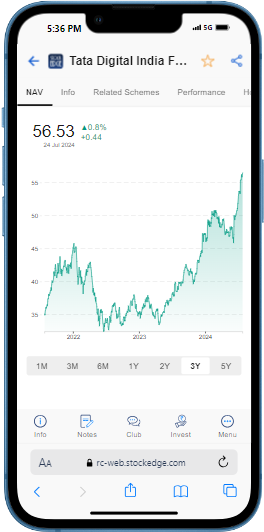

Tata Digital India Fund – Direct Plan

The scheme is sector-focused and invests at least 80% of its net assets in equity/equity-related instruments of the Indian information Technology Sector.

The fund was launched in December 2015 and has given exceptional returns of 28% CAGR in the last seven years.

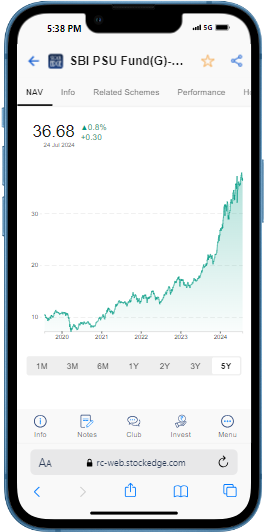

SBI PSU Fund – Direct Plan

Through active management, this fund invests in diversified basket stocks owned by Public Sector Undertakings. This scheme has invested mainly in the energy and financial sectors, which are owned and operated by the Government of India.

CONCLUSION

The Union budget focuses mainly on three sectors: Infrastructure development, urban housing opportunities, and Agriculture and allied sectors, with budget allocations reaching all-time highs. Sectors like financials, railways, defence, tourism, and consumption also play a major role in the country’s overall development.

One should note that Sectoral and Thematic funds are pure-equity-oriented mutual funds with complete exposure to stocks related to that particular sector or theme. Such funds might benefit from government expenditures and the mission of achieving Vikisit Bharat. However investors should be well-versed about the risks involved in investing in thematic funds. Opportunistic investors who are looking to take higher degree of risk and have in-depth knowledge about the markets should consider investing in such funds.