Table of Contents

“Electric vehicles are the future of mobility”, right? We all can agree on this as we see the growing demand for EVs. That’s a change we are going through, but it is not just the auto-makers who are benefiting by manufacturing electric vehicles. There are more components that are required to create a production-ready electric vehicle, starting from lithium ion battery packs, electrical chips, Led lights, and even charging solutions for electric vehicles. All such companies that are somehow related to the electric mobility theme benefit from the growing demand for EVs. Now imagine investing in all such companies. That’s thematic investing.

In today’s blog, we will explore a different style of investing in the stock market, which is a theme-based investment, popularly known as Thematic Investing. This blog will be a complete guide for you, where we will explore some of the emerging investment themes that will help you enhance the return of your portfolio.

Basically, thematic investing is a kind of investment strategy that focuses on identifying companies or sectors that are driven by a common theme. Some thematic investing examples are digital transformation, clean energy, healthcare innovation, electric mobility, etc.

In India, thematic investing is gaining immense popularity among investors as they benefit from the long-term emerging trends in the economy and society. According to a report by Morningstar, the assets under management (AUM) of thematic funds in India grew by 78% in 2020, reaching Rs 1.2 lakh crore.

What is Thematic Investing?

Thematic investing is an investment approach that majorly focuses on predicting the market’s emerging geopolitical, macroeconomic, and technological trends. It is a long-term strategy that capitalizes on identifying these emerging trends and investing in specific stocks or sectors to enhance the overall portfolio return.

Sector investing and thematic investing may appear similar at first glance, but they have distinct focuses. Sector investing targets companies within specific sectors of the economy, while thematic investing encompasses various industries that are connected or intertwined by an overarching investment theme.

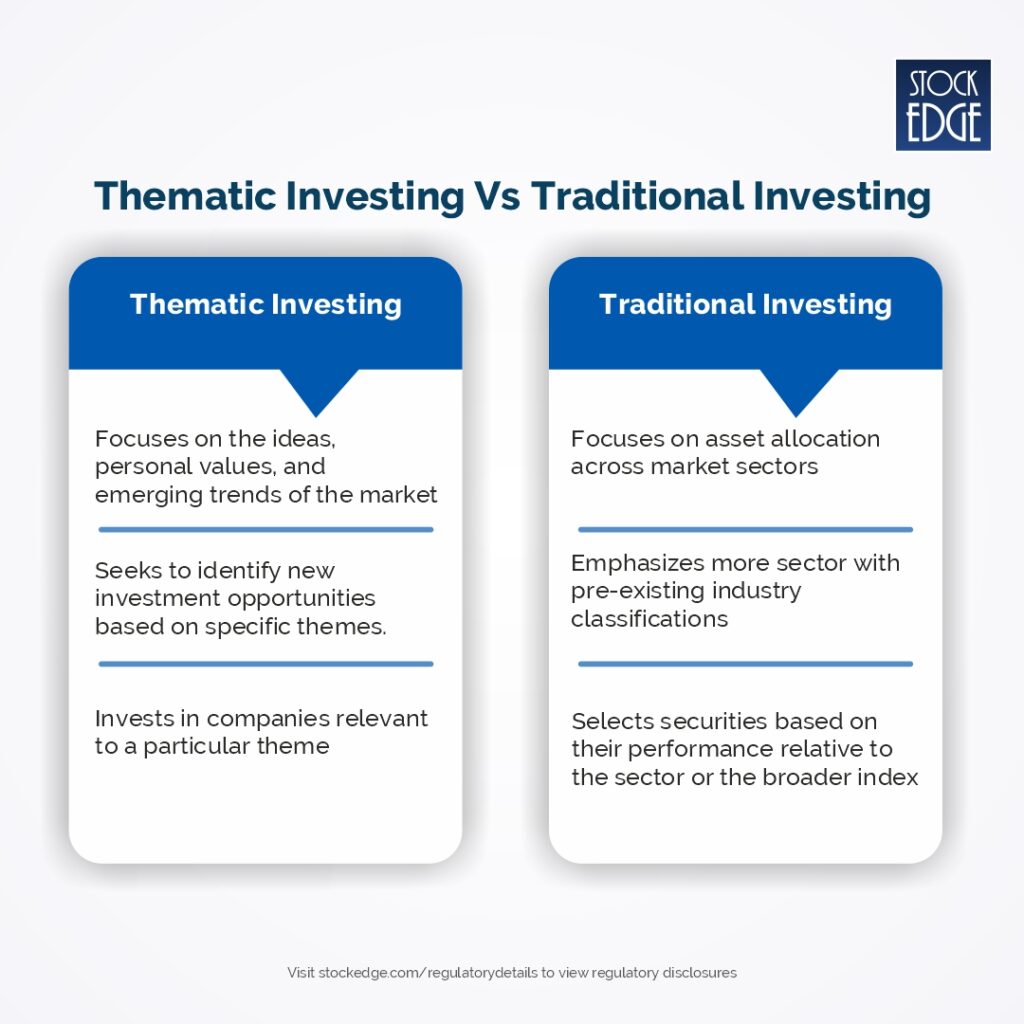

In fact, thematic investing meaning is quite different from the traditional investing style. Traditional investing emphasizes asset allocation across market sectors and focuses on diversification of risk. In contrast, thematic investment takes a concentrated approach to investing, where it focuses on identifying emerging trends and investing in companies that don’t necessarily fit into pre-existing industry classifications. Here is a brief distinction between thematic investing and traditional investing.

Why choose Thematic Investing?

As you now have a clear idea of the distinction between thematic and traditional investing, you may ask yourself why you should choose a thematic investment approach over the traditional style of investing in the market.

So, to answer your there are three major benefits such as:

- Thematic investing allows you to capitalize on social or technological trends or shifts in the economy by investing in businesses that are most likely to benefit from the change.

- Thematic investing also has the potential to outperform the market with a greater margin than conventional investing as it follows a more concentrated approach of investing based on the change in macroeconomic trends, benefiting you to get higher returns.

- Thematic Investing has a forward-looking nature, allowing you to invest in companies that are at the forefront of emerging trends of the future.

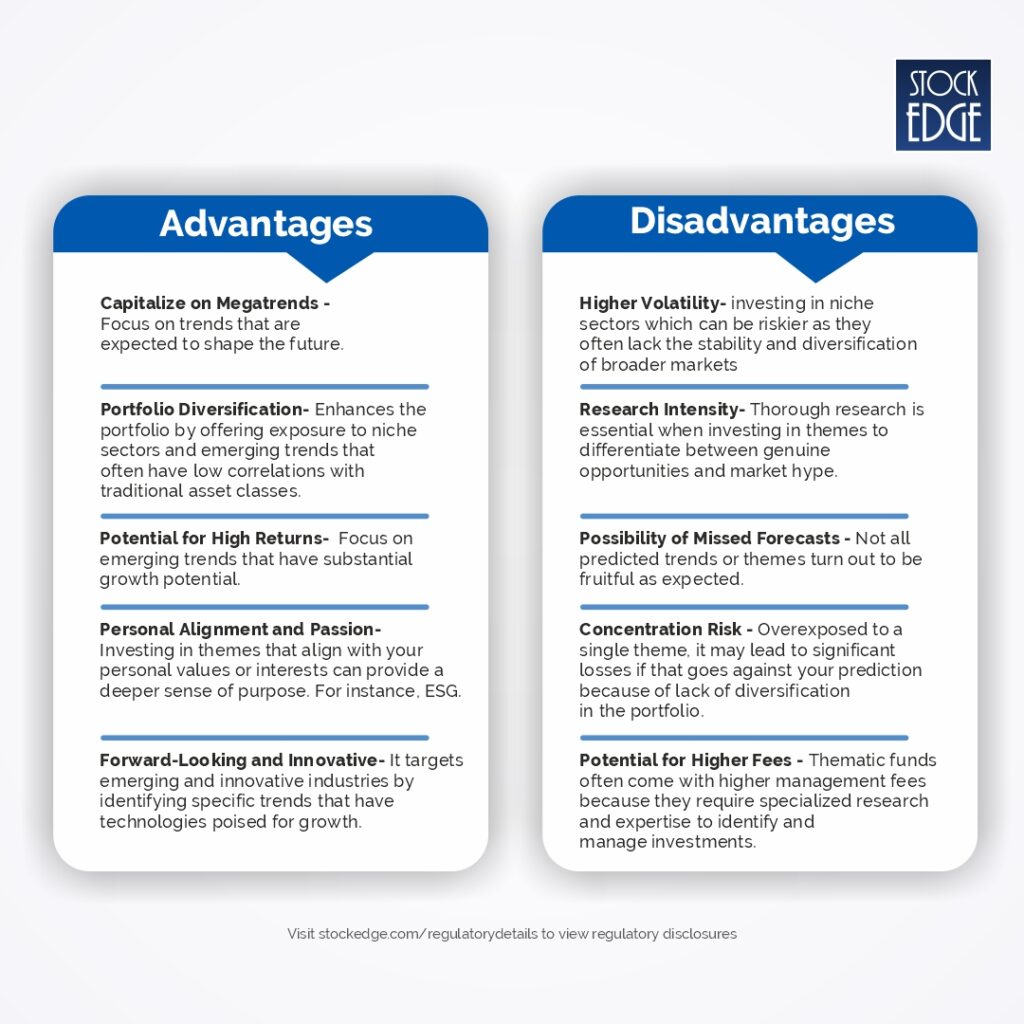

Although investing in themes can be rewarding, it has various challenges. The first and foremost is identifying thematic investing ideas, which requires thorough research of the emerging trend. Any misidentifying themes can lead to poor investment decisions. The next challenge you face is the risk of volatility. If there are any rapid shifts in sentiment, changes in government policies, or unexpected events can lead to significant price fluctuations. As you are focusing on specific themes, there is hardly any diversification of your portfolio. Lastly, timing is a very important factor for thematic investing, as entering a theme too early or too late can impact returns significantly.

So, to overcome these challenges, you must do in-depth research into the theme or trends you want to invest in. Understand the key drivers, underlying fundamentals, and potential risks associated with the theme. Keep a long-term perspective. Do understand that themes can take time to fully play out, and their success may not be linear. Lastly, the most important is to continuously monitor your thematic investments and regularly reassess their viability.

But how do these emerging trends come up?

Here, global events play a significant role in shaping thematic investments by influencing the emergence, evolution, and relevance of various themes and trends in the financial markets.

Major global crises and disruptions, such as financial crises, pandemics, or geopolitical conflicts, can accelerate the emergence of new themes. For example, the COVID-19 pandemic accelerated remote work, e-commerce, and healthcare innovation trends, creating investment opportunities in these areas.

But before we proceed with our discussions, let’s understand the pros and cons of thematic investing.

Pros and Cons of Thematic Investing

So, as you have undoubtedly understood the pros and cons of thematic investing, it is up to you whether it suits your investment style or not! In case you are ready, knowing the right approach is a must to invest in specific themes!

Thematic Investing Research and Approach

Let’s get the basics right for identifying the right theme of investment at the right time! The following is a list of things you must focus on while investing in themes.

Emphasis on Research:

Your research about the economic shifts and identifying the right stocks to invest in are two basic fundamentals of thematic investing. It is important not to be swayed away by short-term market sentiments, and you must conduct thorough research on your theme and trust your instinct.

Strategic Planning:

Setting clear objectives in thematic investing is essential to define your risk tolerance and desired returns. Diversifying within chosen themes reduces concentration risk. For instance, if you’re investing in the “Renewable Energy” theme, diversify across wind, solar, and energy storage companies to spread risk and ensure you’re not overly exposed to any one sub-sector. This strategy helps minimize the impact of poor performance in a single area while aligning with your broader investment goals.

Leveraging Technology:

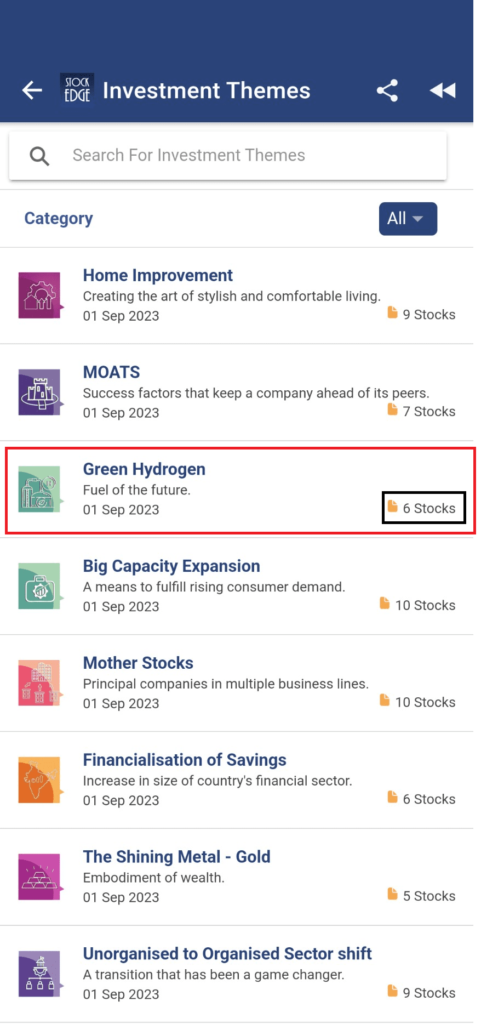

We have come a long way with the advancement of technology. Use the necessary tools to do your research and must have proper due diligence before investing in specific themes. At StockEdge, we have made a section named “Investment Themes“. This section includes the list of themes that are identified by our team of analysts. Each investment theme is backed by a logical thesis that you must read before investing. That’s the advancement of technology with StockEdge, where you get a ready-made list of stocks to invest in based on that theme.

Continuous Adaptation:

Recognizing the dynamic nature of themes is crucial in thematic investing because trends can evolve over time. Regular portfolio reviews and rebalancing ensure that your investments stay aligned with the evolving landscape. For instance, if you’ve invested in the “Artificial Intelligence” theme, you might need to adjust your holdings to reflect emerging sub-sectors or companies that become more prominent as AI technology evolves, maintaining the theme’s relevance and potential for growth.

Now that you have undergone the ideal way of investing in specific themes let’s discuss a few popular thematic investments:

Popular Thematic Investing Ideas

Thematic Investing ESG:

ESG (Environmental, Social, and Governance) thematic investing focuses on companies and projects that prioritize sustainability, ethical practices, and social responsibility. For example, an ESG thematic investment strategy might target companies involved in renewable energy, clean technology, and responsible supply chain management, aligning with investors’ values while seeking financial returns aligned with sustainability goals.

Thematic Investing in Clean Energy:

Thematic investing in clean energy, such as green hydrogen, involves allocating capital to companies and projects that advance environmentally friendly and sustainable energy solutions. For instance, investors may choose to invest in companies specializing in green hydrogen production technologies, like electrolysis, which generates hydrogen using renewable energy sources like wind or solar power. This thematic approach aligns with the transition toward clean and sustainable energy systems.

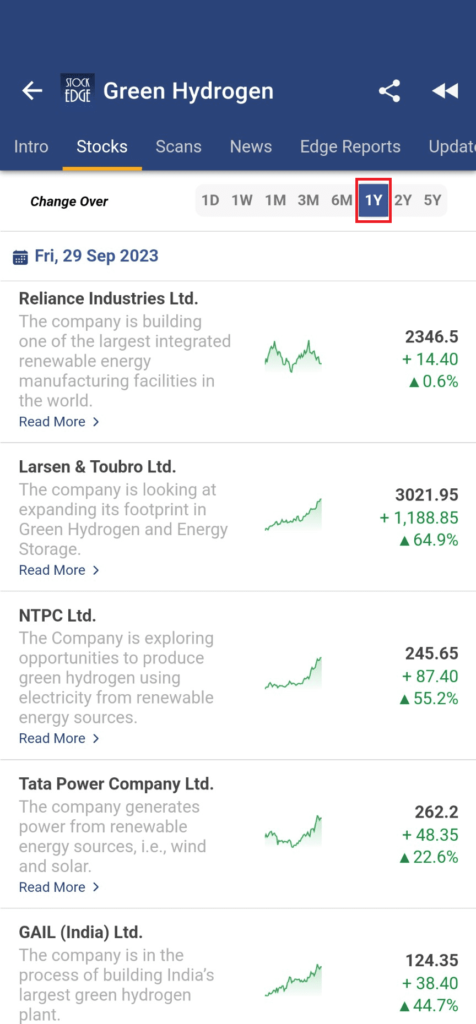

You may check out our investment theme on Green Hydrogen and find out the list of stocks in which you can invest.

Crisis Thematic Investing:

Crisis thematic investing involves identifying investment opportunities arising from crises or disasters. For instance, India is facing a water shortage problem in many major cities, and as it has become the most populated country in the world, recently surpassing China, the demand for drinking water will only rise in the near future. Now, investing in companies offering water purification and desalination solutions could be a thematic investment options.

You may check out our investment theme on Water Crisis and find out the list of stocks in which you can invest.

Commodities Thematic Investing:

Commodities thematic investing focuses on allocating capital to specific commodities or raw materials to capitalize on trends or economic conditions related to those resources. For example, investors may turn to Gold as a thematic investment during periods of economic uncertainty or inflation concerns. Investing in Gold is often viewed as a safe-haven asset because the price of Gold generally tends to rise when financial markets are volatile or when there are fears of currency devaluation.

You may check out our investment theme on Gold and find out the list of stocks in which you can invest.

At this moment, you might be wondering how you can invest in such themes. Right? So, there are two main ways you can start theme-based investments! Let’s find out what they are.

Instruments and Platforms for Thematic Investing

There are two basic instruments to invest while doing thematic investing: one is with mutual funds or ETFs, and the other is directly with stocks!

Thematic Investing with Mutual Funds and ETFs

Thematic mutual funds provide a simple way to invest in specific investment themes or trends within the context of a professionally managed, diversified portfolio. They offer a convenient way for investors to gain exposure to themes they believe in or expect to perform well while also benefiting from the expertise of professional portfolio managers. However, it’s essential for investors to research and understand the specific theme and strategy of a thematic mutual fund before making investment. It ensures alignment with their financial goals and risk tolerance level.

Some examples of thematic investing mutual funds are:

ICICI Prudential Technology Fund: This mutual fund focuses on investing in companies within the technology sector, capitalizing on innovations and advancements in the tech industry.

SBI Banking & Financial Services Fund: This thematic fund primarily invests in companies within the banking and financial services sector, aiming to benefit from growth opportunities in the financial industry.

Aditya Birla Sun Life Digital India Fund: This fund is centered around the digitalization theme, with investments in companies related to information technology, e-commerce, and digital services.

Nippon India Pharma Fund: This mutual fund is thematic in nature and primarily invests in the pharmaceutical and healthcare sector, targeting opportunities within the healthcare and pharmaceutical industries.

Also, you can invest through several exchange-traded funds, commonly known as ETFs. The only advantage of thematic investing ETFs is the ease of liquidity as you can buy and sell through the stock exchanges rather than investing through mutual funds houses. However, the availability of ETFs and their specific themes may change over time as new ETFs are introduced and existing ones are modified. Here are a few examples of thematic ETFs:

Nippon India ETF Nifty Bank: This ETF tracks the Nifty Bank Index, which represents the banking sector in India.

Motilal Oswal NASDAQ 100 ETF: While not a thematic ETF per se, it offers exposure to the NASDAQ 100 Index, which includes many technology and innovation-focused companies.

Kotak PSU Bank ETF: This ETF is centered around the public sector banks in India.

Thematic Investing in Stocks

Compared to investing in specific themes through mutual funds or ETFs, direct thematic investing in stocks offers greater control over individual stock selection and portfolio customization, allowing you to create a portfolio of stocks based on specific themes. However, it requires you to conduct your own research, manage diversification, and actively monitor thematic portfolios. Unlike mutual funds, which are managed by professionals and offer built-in diversification, direct stock investing may involve higher fees for brokerage transactions and requires a higher level of individual involvement in managing the portfolio.

So, identifying themes is a crucial factor. Hence, we at StockEdge have developed “Investment Themes” that are readily available for you. Explore the different themes and the stocks that are suggested based on that specific theme.

Finding Investment Themes with StockEdge

Let’s find out how you can identify different themes using StockEdge:

- Go to StockEdge App or web.stockedge.com

- You will get Investment Themes under the Premium Analytics section of StockEdge.

- By clicking on Investment Themes you will see the list of theme based investment strategies.

- Clicking on each theme you can read the entire logic behind the theme as well as the list of stocks.

Let’s see an example below:

In the above screenshots, you can see a list of themes that are developed by our team, and each theme has an elaborate description, so that you know the basic intricacies before investing. Also, you can view the list of stocks which are under that theme and how they have performed over multiple time periods.

For better understanding of StockEdge feature of Investment Themes, you can read this blog: Powerful Investment Themes for Retail Investors

Thematic Investing Worldwide

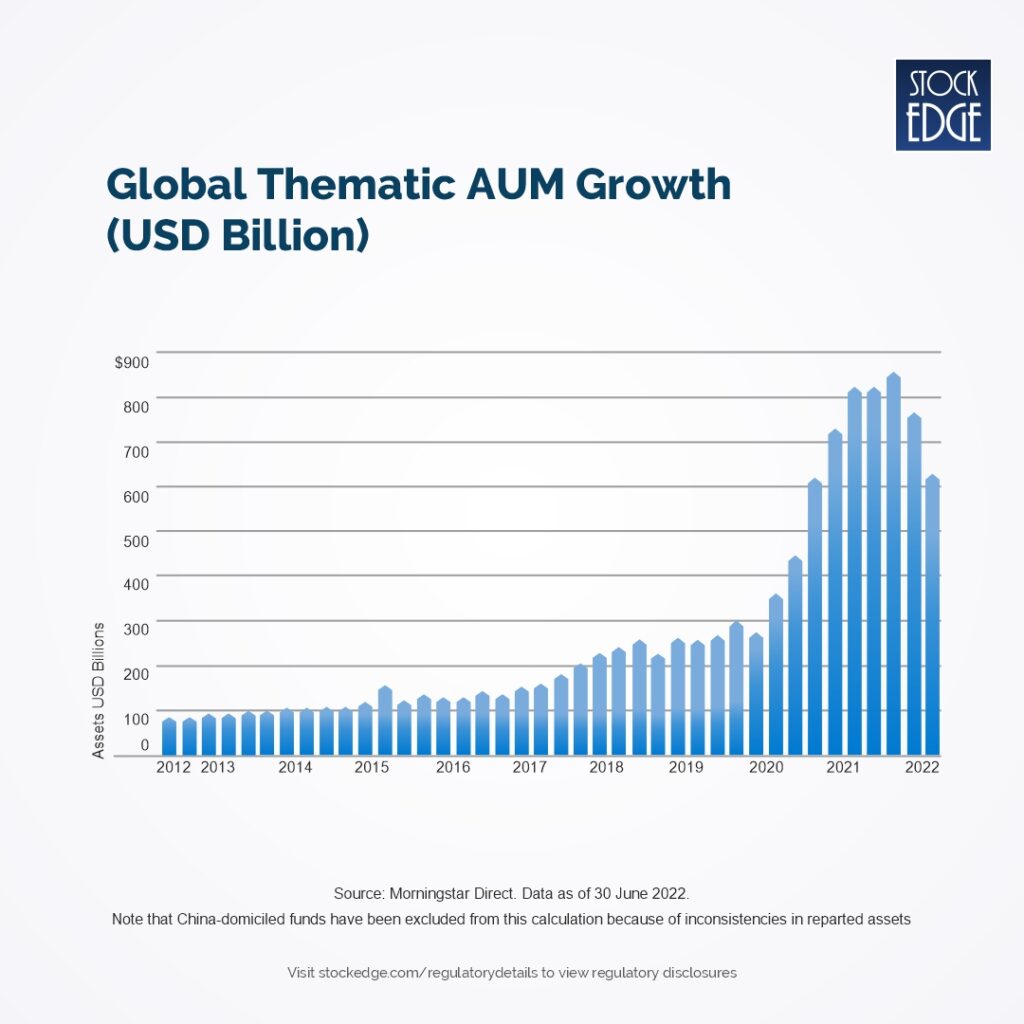

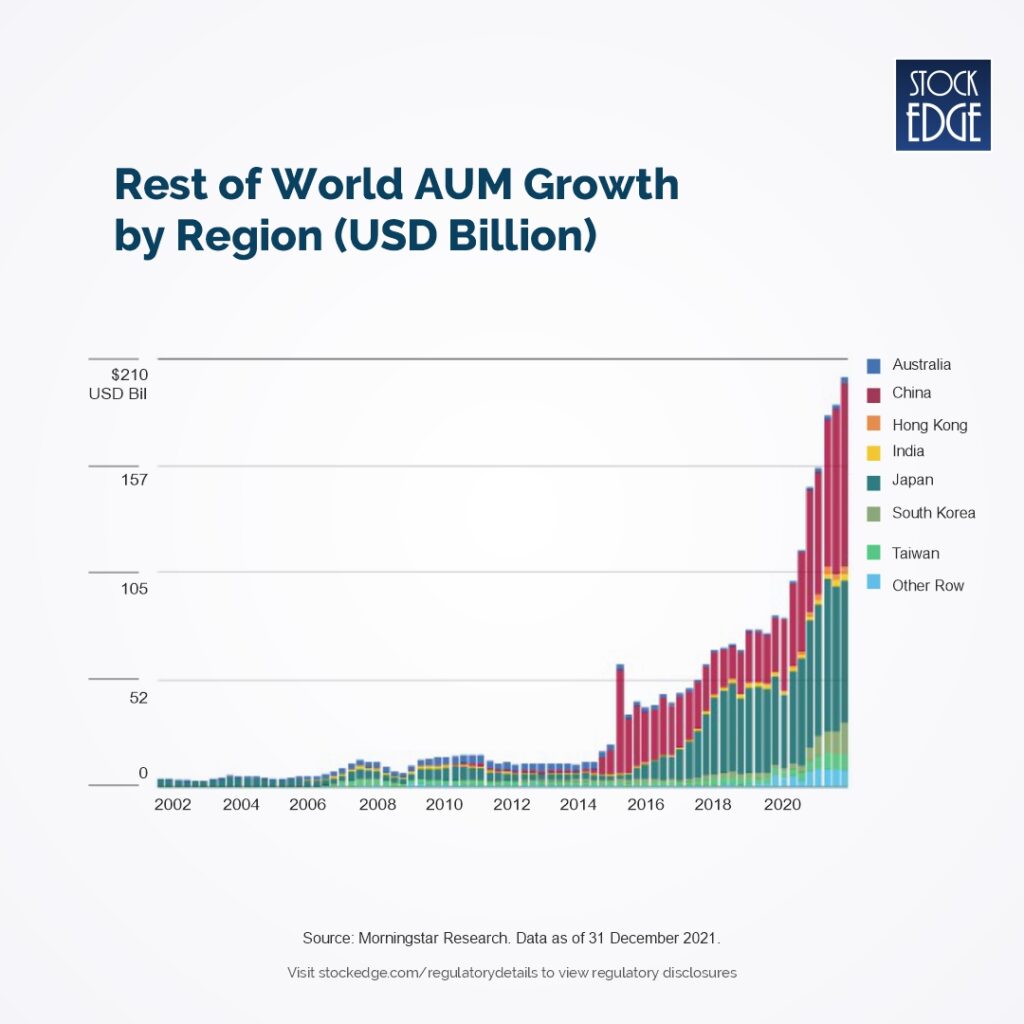

The global thematic funds landscape is huge compared to India. According to a report published by Morningstar, there were 589 new thematic funds debuted globally in 2021, more than double the previous record of 271 new fund launches in 2020. Europe is the largest market for thematic funds, accounting for 55% of global thematic fund assets, having expanded from 15% since 2002. In the U.S, Thematic funds’ market share shrank to 21% from 51% over the same period.

As you can see the growth of thematic investing globally is huge, but India still has room for immense growing opportunities!

Thematic Investing in India

According to Morningstar, Assets in India-domiciled thematic funds grew 78% from a year ago to $3.7 billion as of the end of 2021. However, China has the largest thematic fund market outside of Europe and the U.S., with 11% global market share.

Let’s now take a look at some of global asset management companies who are into thematic investing offering:

Global Players and Companies

- BlackRock: BlackRock is one of the largest asset management companies globally and offers a range of thematic ETFs through its iShares brand. Their thematic offerings cover various themes, including technology, clean energy, and ESG.

- State Street Global Advisors: State Street Global Advisors, the investment management arm of State Street Corporation, offers thematic ETFs under the SPDR ETFs brand. They have thematic offerings in areas like artificial intelligence and cybersecurity.

- Invesco: Invesco offers thematic ETFs focused on various themes, such as disruptive technology, clean energy, and biotechnology.

- J.P. Morgan Asset Management: J.P. Morgan offers thematic ETFs focusing on sustainable thematic investing and disruptive innovation.

- Fidelity Investments: Fidelity offers thematic investment options, including mutual funds and ETFs, covering themes such as health care, technology, and ESG.

Conclusion

In summary, thematic investing is an appealing strategy because it allows investors to bet on specific trends and themes, providing a focused and meaningful approach to their portfolios. By aligning with personal values and interests, diversifying within chosen themes, and capitalizing on long-term growth potential, thematic investing offers a path to both financial returns and impact in a dynamic global landscape. However, it’s important to approach it with careful research and a recognition of its inherent risks to maximize its effectiveness.

Happy Investing!

What are thematic investments?

Thematic investments are strategies that focus on specific trends, themes, or megatrends in the market, allowing investors to build portfolios aligned with these themes, such as clean energy, technology innovation, or demographic shifts.

Does thematic investing work?

Thematic investing can work effectively when aligned with an investor’s goals and backed by thorough research. Success depends on choosing the right themes and managing associated risks.

What are thematic indices?

Thematic indices are benchmark indexes that track the performance of specific themes or trends. They help investors gauge how well a theme is performing compared to broader market indices.

How does StockEdge help in thematic research?

StockEdge provides data, tools, and analytics to aid thematic research. It offers features like theme-based screeners, thematic portfolios, and trend analysis to support investors in identifying and tracking thematic opportunities.

Are there specific tools on StockEdge for thematic analysis?

Yes, we do have separate sections for thematic investments. We offer ready-made investment for various themes and you can also find the stock list of stocks to invest in for each theme.