We’re excited to introduce StockEdge Version 13.2, a major upgrade designed to improve your stock research, scanning, and strategy-building capabilities, making them even more powerful.

Let’s take you through what’s new in this version and how it can help you with your market analysis.

Combination Scans

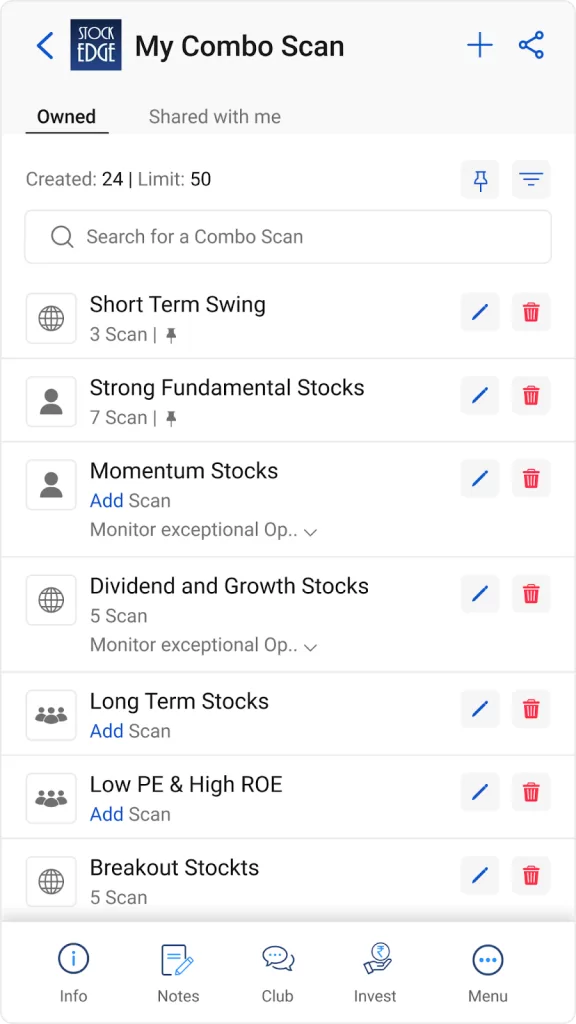

Combination Scans are one of the most powerful tools in StockEdge. They let you combine multiple technical or fundamental conditions to filter the right stocks based on your strategy.

- New Upgraded Combo Scans: With version 13.2, you can now create up to 50 combo scans. That means more flexibility, more experiments, and more chances to catch the right opportunities.

- Pin Your Go-To Scans: Now, you can pin your most-used combo scans to the top of your list. No more scrolling through 50 combo scans – just tap and go.

3. Enable or Disable Scans Without Deleting Them: With StockEdge 13.2, you can now enable or disable scans within a combo scan anytime with a toggle switch. This allows you to experiment without losing your original scan setup.

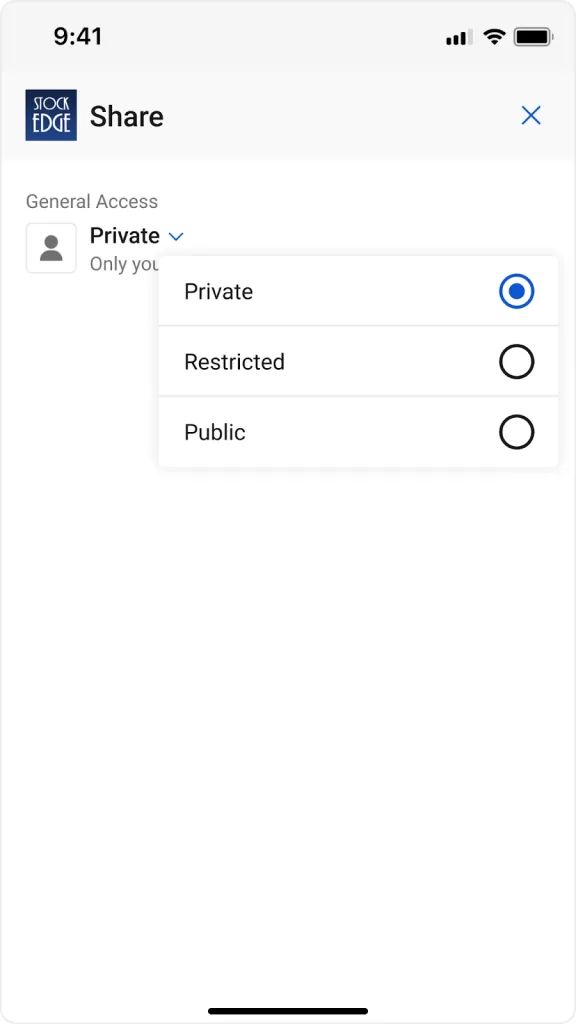

4. Share Combo Scans with Anyone: Now, you can share your combo scans with, Everyone (Public), Only yourself (Private) or Selected users (Restricted).

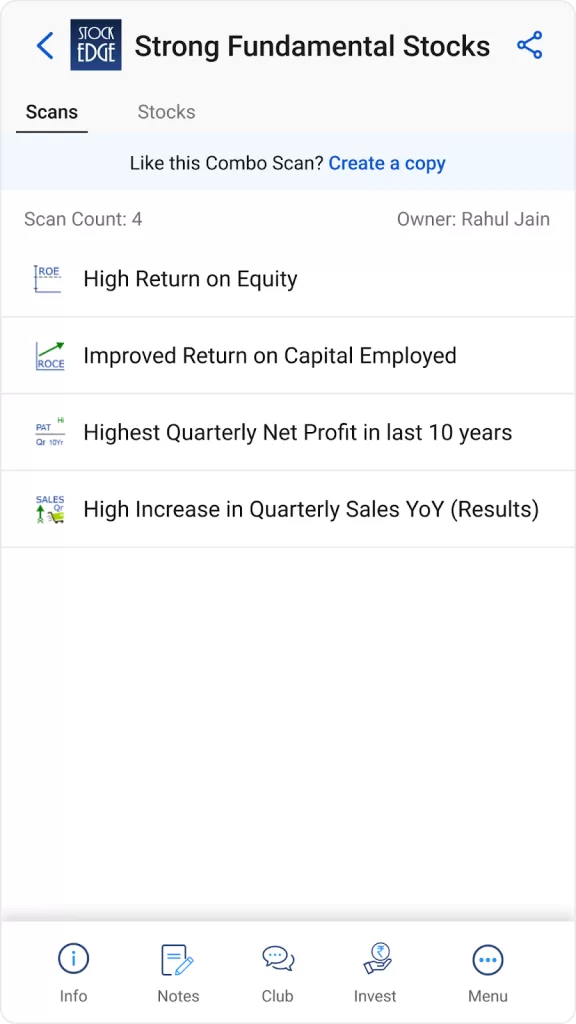

5. Clone Shared Scans Instantly: Found a combo scan shared by someone that fits your strategy? Now you can clone it instantly into your own account.

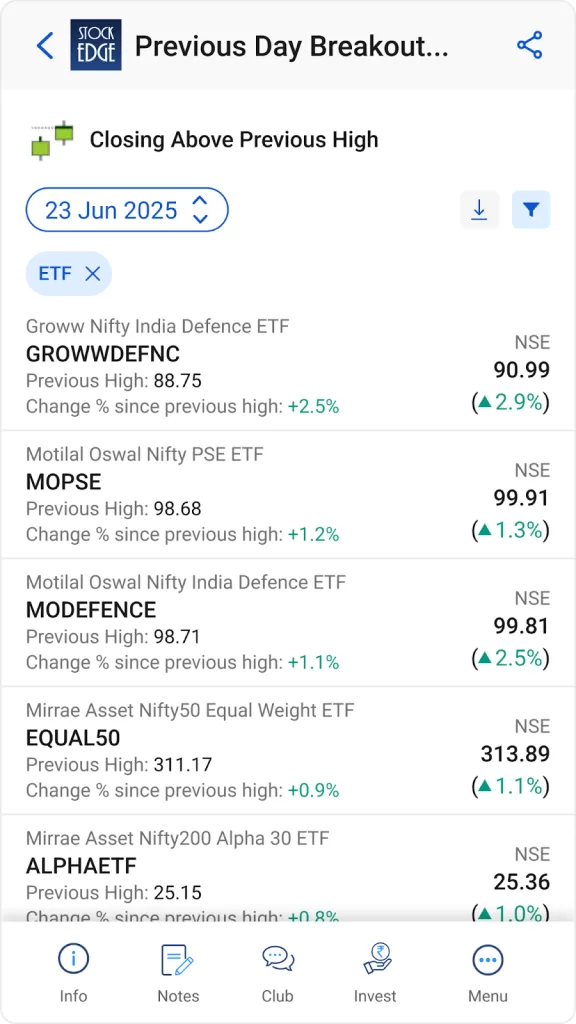

ETF Filters in Scans

Exchange-traded funds (ETFs) are gaining popularity among Indian investors. But finding the right ETF based on momentum, delivery volume, or price movement has been tricky – until now.

With the new ETF filter in scans, you can now apply all your strategies to ETFs as well.

Looking for high-volume ETFs? Or maybe sector-specific ETFs with bullish breakouts?

You can just apply your combo scan and spot them easily. This update opens a whole new segment for analysis and trading.

It helps you align with market trends and make smarter sector-level decisions.

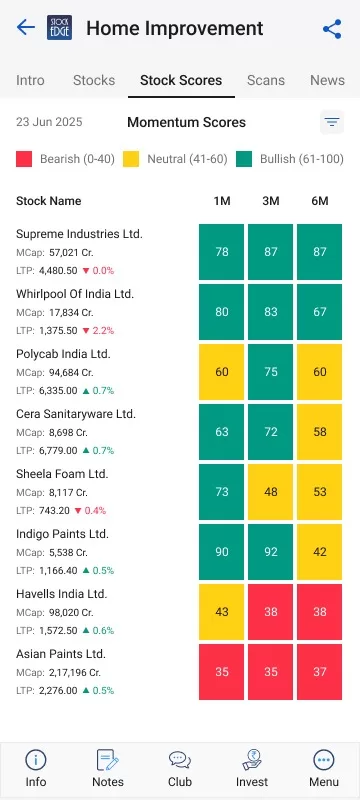

Momentum Score in Business Houses & Themes

We’ve expanded the reach of the Momentum Score – now available across Business Houses and Investment Themes.

This provides a quick way to understand where the market’s strength is building, not just in individual stocks, but across broader ideas.

It helps you align with market trends and make more intelligent sector-level decisions.

You can track momentum across:

- Investment Themes (like Home Improvement, Defence, EV)

Each stock is ranked with 1M, 3M, and 6M momentum scores, making it easy to spot which stocks are gaining strength in the respective periods.

This helps traders identify breakout candidates early, ride trending sectors, and avoid weak stocks within the same theme. It’s an innovative, time-saving way to trade with the trend, not against it.

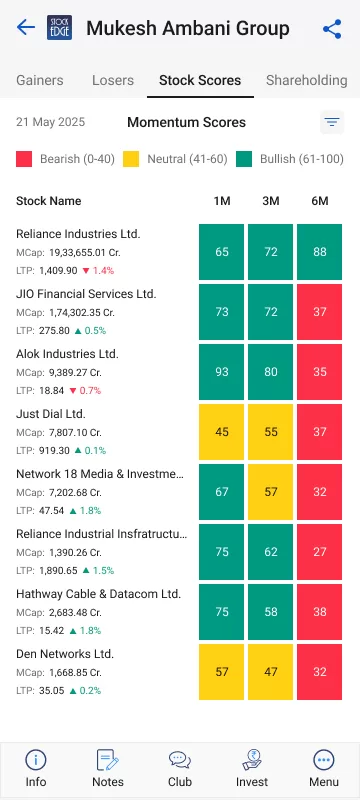

- Business Houses (like Tata, Ambani, Adani) – all with Momentum Scores across 1M, 3M, and 6M timeframes.

Tracking momentum scores in business houses like Tata, Ambani, or Adani helps traders quickly identify which group stocks are showing strength or weakness over short- to medium-term timeframes.

With 1M, 3M, and 6M momentum data, traders can focus on stocks with rising momentum for potential breakouts, while avoiding those with fading strength.

For example, in the Ambani group, Alok Industries shows fresh 1M momentum while Reliance Industries shows consistent strength. This allows traders to pick the right stock within a group, align with broader trends, and time entries more efficiently based on momentum shifts.

Conclusion

StockEdge Version 13.2 is more than just a feature release. It’s about giving you more control, speed, and flexibility to build, test, and share your strategies.

It also makes it easier to switch between equity and ETF-based strategies, giving you more depth without complicating the experience.

Ready to Try It?

If you haven’t already, update your StockEdge app to version 13.2.