Table of Contents

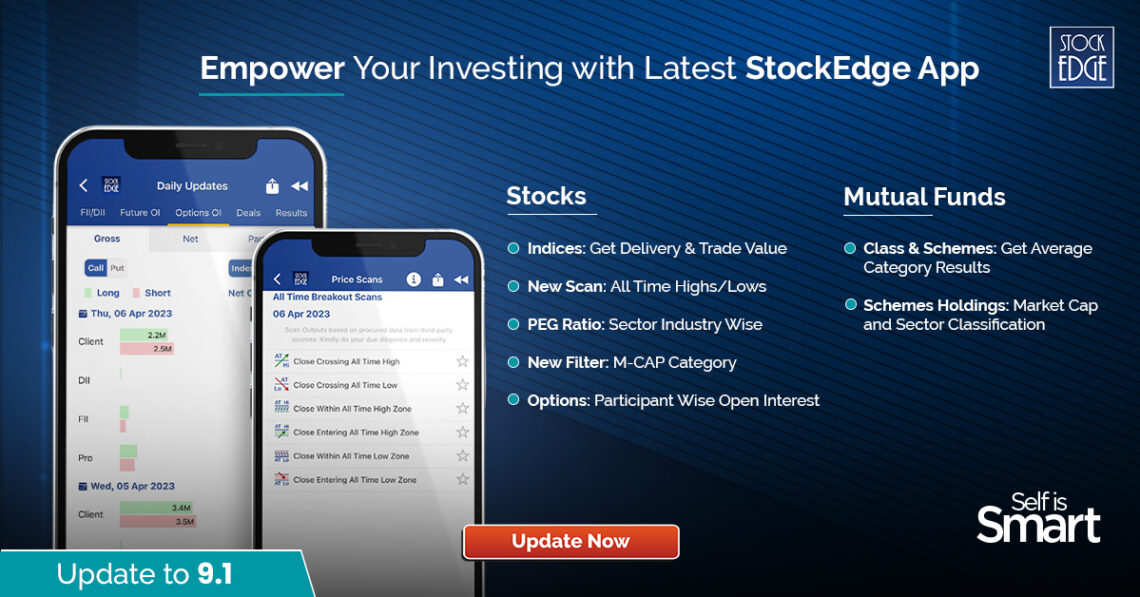

StockEdge launches its latest version 9.1 including new features, bug fixes and improvements over the previous version.

We incorporate a few new features into each release that help StockEdge users better understand the financial markets.

And in this most recent version, StockEdge is happy to add some key features in the Mutual Fund Section along with some more powerful additions in the equity section:

In this release, we introduce the following features to our users:

- All-Time Breakout Scans

- Inclusion of New Filters – MCap Category and BSE PSU

- MF Category Average Return in Classes and Schemes

- MF Category Wise & Scheme Wise Key Parameters

- Market Cap and Sector Classification in Mf Schemes Holding

- Delivery Data of Indices

- Participant Wise Open Interest – Options

- PEG Ratio of Stocks in Sector

Continue reading for a more detailed study of the above-mentioned features:

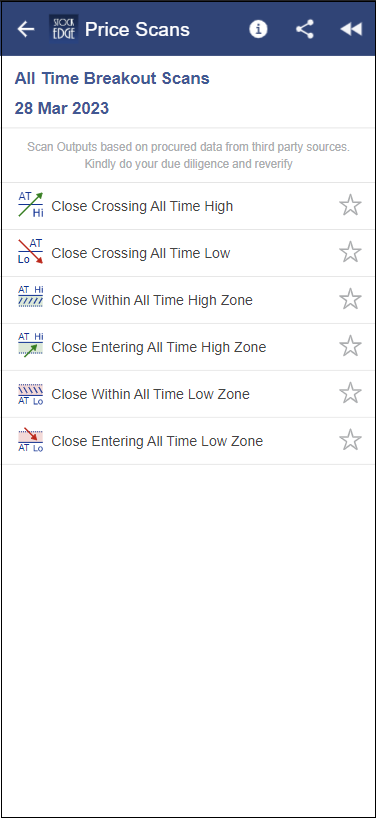

All-Time Breakout Scans

All Time breakout scans are price scans that will enable you to filter out stocks on the relation of their current and all-time high and low prices.

This scan category has been displayed after 5 Year Breakout Scans and includes 6 new Scans to the family.

The respective Scans are :

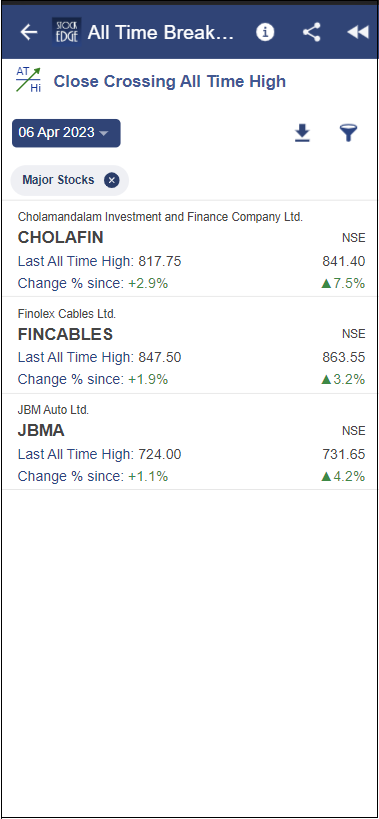

Close Crossing All-Time High

This scan filters out stocks that have crossed their all-time high prices and closed above them respectively.

Like we can see in the above image Cholamandalam Investment and Finance Company Ltd has crossed its All-Time High of 817.75 and closed above it at 841.40, giving an all-time breakout.

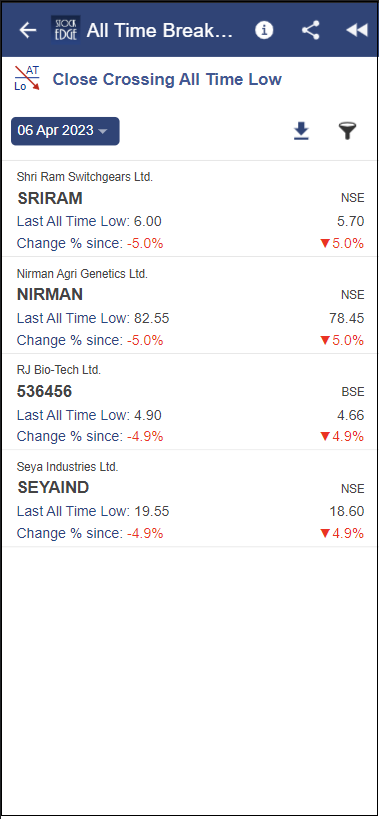

Close Crossing All-Time Low

This scan filters out stocks that have crossed their all-time low prices and closed below them respectively.

Closed Within All Time High Zone

This scan filters out stocks that have closed within the range of 15% of their All Time High prices and have high chances of reaching out for an all-time breakout.

Close Entering All Time High Zone

This scan filters out stocks that have just entered and closed within the 15% range of their All time-high prices.

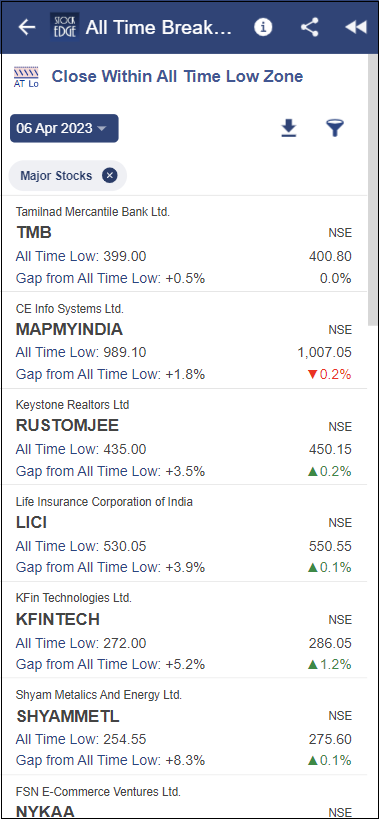

Closed Within All Time Low Zone

This scan filters out stocks that have closed within the range of 15% of their All Time low prices.

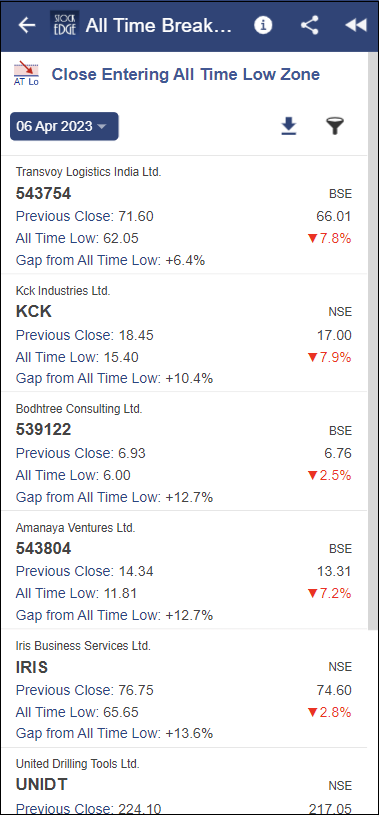

Close Entering All Time Low Zone

This scan filters out stocks that have just fallen down and closed within the 15% range of their All time-low prices.

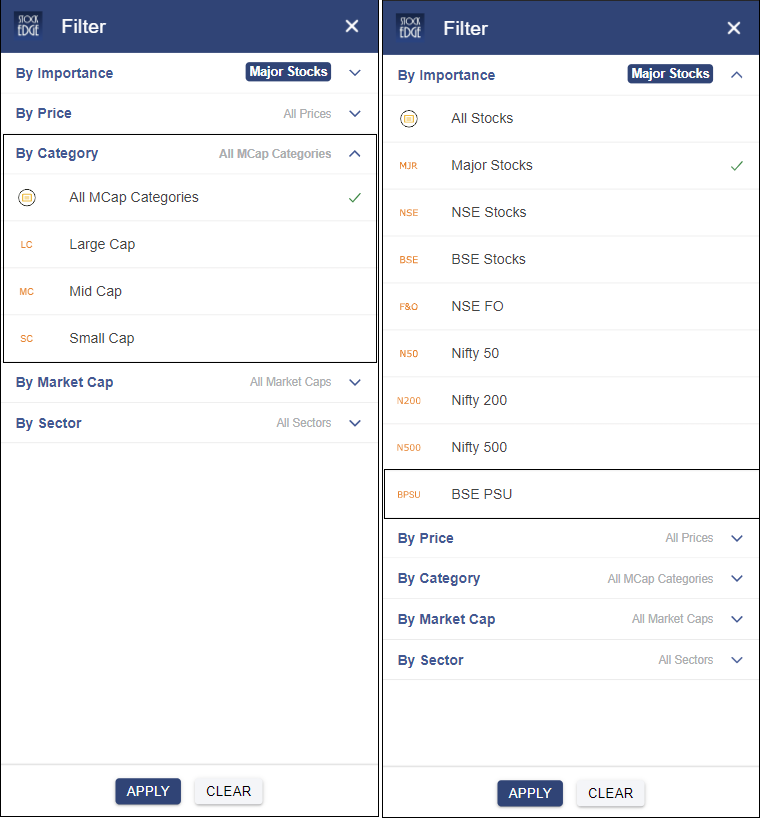

Inclusion of New Filters – MCap Category and BSE PSU

StockEdge has enhanced its advanced filters by adding a whole new category of filter: By Category, i.e Market Cap Category – Large Cap, Mid Cap & Small Cap and the addition of a new index in the By Importance category: BSE PSU.

A market Cap Category Filter is added so that our users can filter out stocks on the basis of the above market cap categories.

BSE PSU filter is added so that the output can be filtered for PSU stocks.

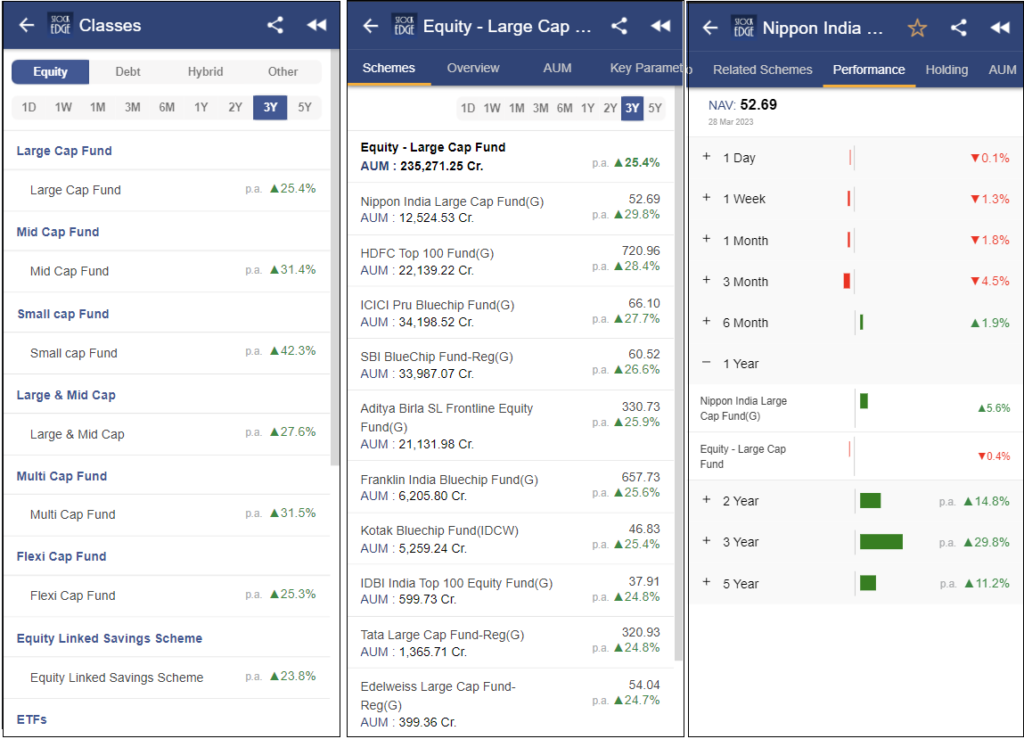

MF Category Average Return in Classes and Schemes

The category returns help us to compare different categories in terms of returns for different time frames. It helps the user to determine which categories meet their return expectations for a particular time frame. It can serve as a good starting point for the user in his/her quest to find a suitable scheme for investment. Having the category return also helps to see which schemes have outperformed/underperformed the category in terms of returns.

Thereby, StockEdge has launched category average returns on class and scheme levels so that investors can compare and filter out across best-performing classes leading to the selection of best-performing funds across a specific class.

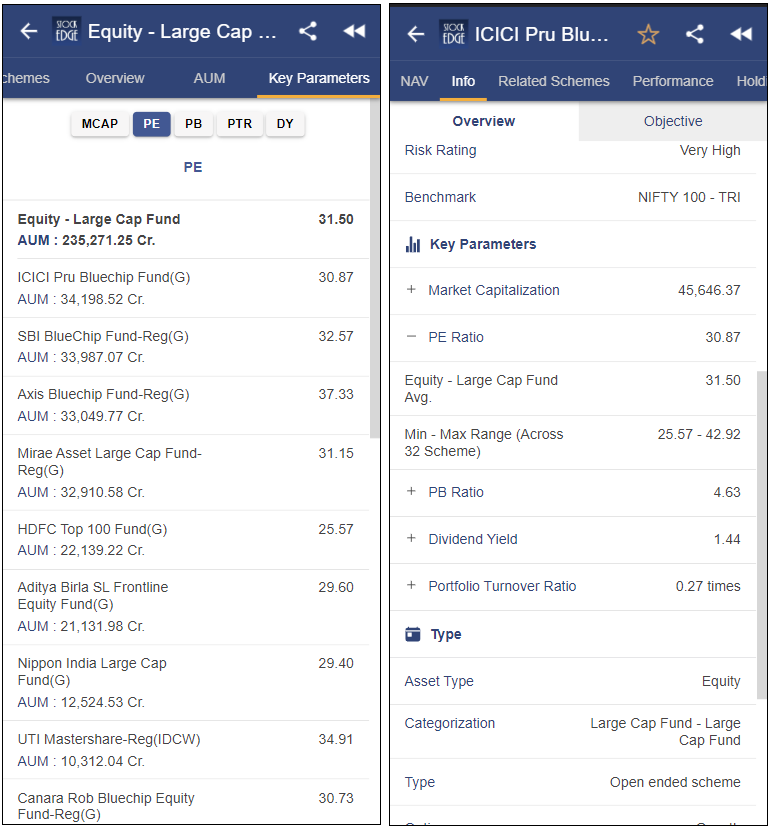

MF Category Wise & Scheme Wise Key Parameters

Key parameters for the category on an average will help the user to compare a particular scheme’s key parameter vs that of the category. It just gives a better sense of where the scheme stands in terms of the overall category, considering the key parameters. It gives us a sense of the fund manager’s investment strategy/framework.

Market Cap and Sector Classification in Mf Schemes Holding

The market-cap and sector classification for a scheme’s holdings will give the user a much better sense of the fund manager’s investment strategy, sectoral inclination, and market-cap inclination. Many times, the user might only look at the top holdings of a scheme and not go through the entire stock holdings. In this case, having the sector and market-cap classification for those top holdings will give the user a much better sense of the type of stocks held by the scheme.

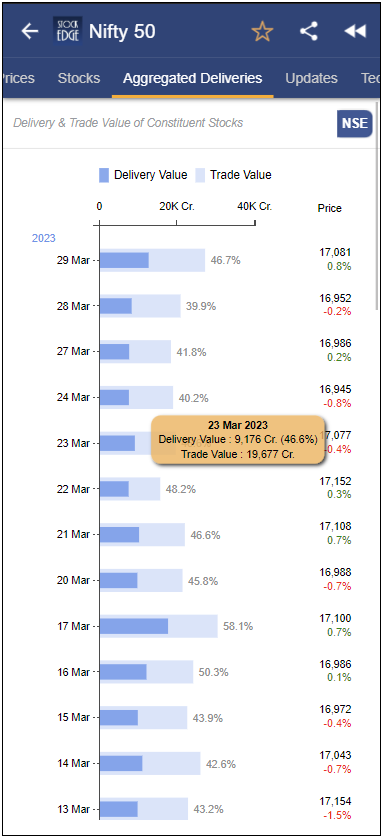

Delivery Data of Indices

Understand and interpret the trade and delivery data of Indices calculated on the basis of trade and delivery of the constituent stocks of the respective index. Interpreting and analysing the delivery and traded value of indexes provide a key overview of the liquidity scenarios along with the demand and supply of the respective indexes ( based on its stock constituents).

Analyse the market trend and traders’ and investors’ overall view with respect to the Index on the basis of changes in the trend of trade and delivery value.

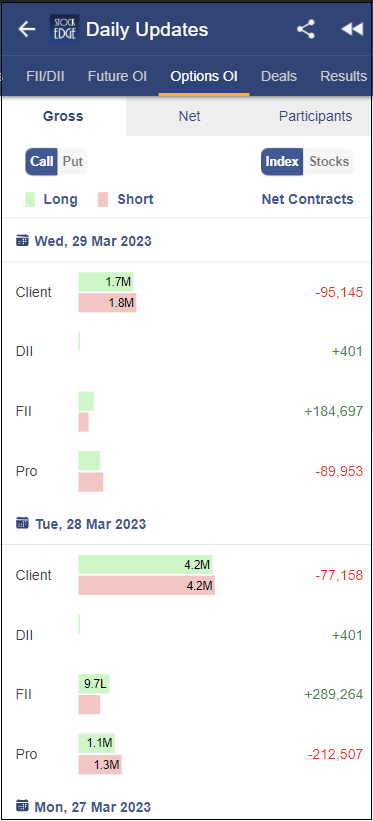

Participant Wise Open Interest – Options

Options Open Interest provides an overview of the current market expectations with respect to the positions of key participants in the market: Client, FII, DII and Pro.

It provides the view of the respective participants about the markets and one can inter and co-relate it with the market levels to better understand and comprehend it.

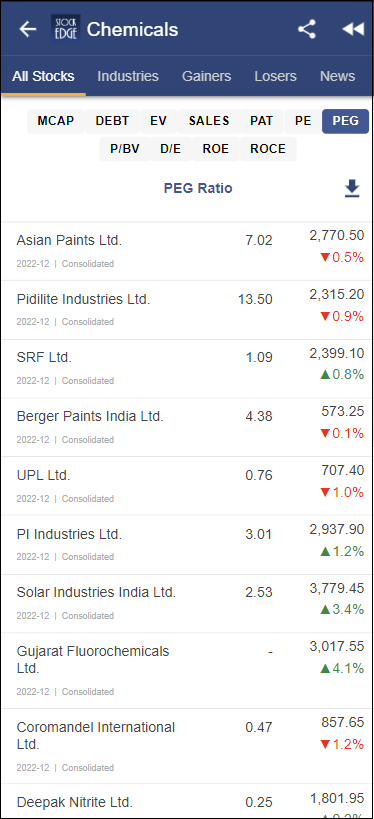

PEG Ratio of Stocks in Sector

PEG Ratio is the Price to Earnings Growth Ratio which is calculated by dividing the P/E ratio of the stock but its growth. Over here growth% is taken as the 5-year Net Profit CAGR.

The PEG ratio helps in understanding the valuation of the stocks with respect to their historical growth trends. When added to the sector section, it gives immense value in analysing and comparing stocks with their peers in the same sector.

This is it for now from Team StockEdge. We hope these features enhance your investment journey and make StockEdge more valuable.

If you enjoy using StockEdge, don’t hold back from sharing the platform with your near and dear ones.

Check out StockEdge’s Premium Plans to get the most out of it. Also, watch this space for our midweek and weekend editions of ‘Stock Insights‘.

Excellent information regarding mutual funds

Very good information regarding mutual funds

Very Good Application, Thanks Mr Bajaj ji,

please add a facility to short Vollume wise investment of Large investors, At present it is Alphavatically only,