Table of Contents

Steel companies had made a strong comeback after the first wave of COVID. With supernormal profits in the second quarter of FY22 mainly due to rapid increase in production, strong recovery in demand, and record-high selling prices, the stock prices of major steel producers had seen a massive rally. But if we look at the last one month, stock prices have fallen. Let’s find out what does that indicates?

But before we dive in to know whether the profits will sustain or not, let’s first learn the A, B, C’s of the Steel Industry.

Steel Industry in India

The steel industry is well-known for being cyclical in nature. Now, you must be wondering what a cyclical business is. A cyclical business/industry is one that is sensitive to the business cycle, with revenues generally higher during times of economic prosperity and expansion and lower during times of economic downturn and contraction.

Automobile, construction, and infrastructure are all cyclical industries that rely heavily on the steel industry for raw materials.

Characteristics of the Cyclical Industry

When the economy is in a recovery phase and on the verge of a boom, companies in various cyclical sectors often begin aggressively expanding their capacities and you will be hearing a lot of CAPEX plans all over the news anticipating that demand will skyrocket when the economic cycle reaches its peak.

The optimism is such that the management and investors believe that “this time it’s going to be different”, which encourages these companies to make large investments. As a result, most of them take massive amounts of debt in order to achieve their expansion goals.

However, when the economic cycle enters a recession and demand begins to dwindle, these companies become trapped and incur heavy losses as a result of massive debt parables.

This causes the stock price of these debt-ridden companies to plummet, collapsing like a house of cards.

Production in India

India is the world’s second-largest steel producer. In FY21, crude steel production stood at 102.49 MT, and finished steel production stood at 94.66 MT, respectively. India’s crude steel output is expected to increase by about 18% to 120 million tons (MT) by the end of the current fiscal year. The domestic availability of raw materials such as iron ore and cost-effective labor has fueled growth in the Indian steel sector. The government has set a production target of 300 MT by 2030-31 in the National Steel Policy (NSP) 2017.

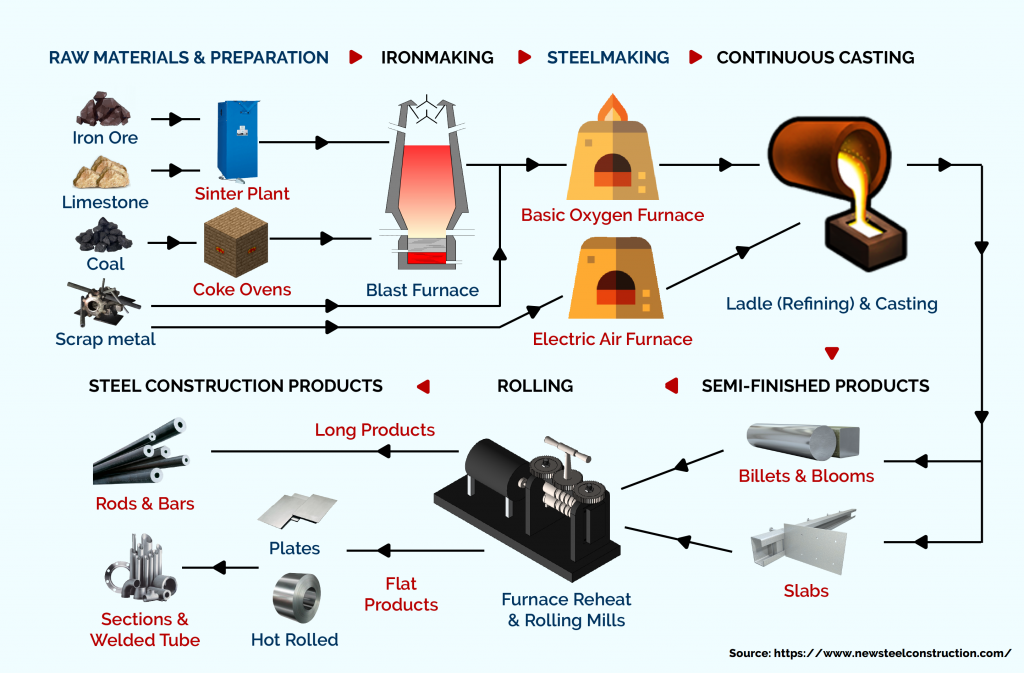

Steel production in India is dependent on two key raw materials: iron ore and coking coal.

India is self-sufficient in iron ore. There is sufficient supply in India to meet domestic demand, and we even export excess supply to other countries.

However, for coking coal, India is almost entirely reliant on imports, primarily from Australia. Our country lacks the necessary mines and resources for Coking Coal. As a result, any disruption in Coking Coal production can disrupt the overall demand-supply equation, exacerbating the situation.

Tailwinds of Indian Steel Industry

Government support for infrastructure development is one of the tailwinds for the Indian steel industry. The Union Cabinet approved the production-linked incentive (PLI) scheme for specialty steel in July 2021. The scheme is expected to attract Rs. 400 billion (US$ 5.37 billion) in investment and increase specialty steel capacity by 25 million tons (MT) to 42 MT in FY27, up from 18 MT in FY21.

Describing the Steel making process through Charts

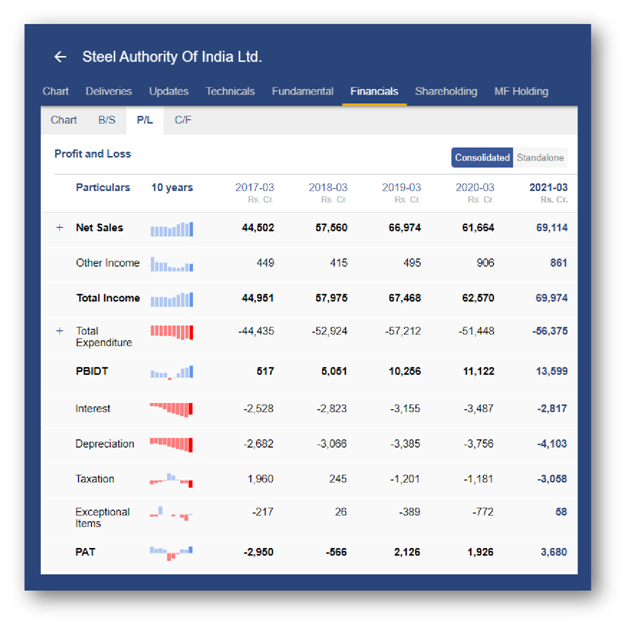

Understanding the Cyclicity in share price movement with respect to its profitability!

Let’s take a quick look at the historical price chart of Steel Authority of India Ltd.

SAIL’s share price journey resembles an adrenaline-fueled roller coaster, with wild ups and downs. The same is true for the company’s profitability trend and as of today’s date, this is Steel Authority of India share price

These charts epitomize the sensitivity and high correlation of a cyclical company’s stock prices with the economic cycles.

Major Concerns

The EBITDA margin of primary steelmakers can fall by a third to 24-26% in the second half of this fiscal year compared to the first, as input costs skyrocket due to a more than twofold increase in coking coal prices since July.

According to a CRISIL report, on a Global level, coking coal prices have risen sharply since July, rising from $175 per tonne in June to $400 per tonne in October, owing primarily to mine disruptions in Australia and China, as well as logistical issues such as freight and container unavailability, amid healthy demand from global steel producers, particularly those outside of China.

Prices are expected to fall gradually as supply increases over time. Because domestic primary steel producers rely primarily on imported coking coal, their production costs will skyrocket.

In contrast, iron ore, the other key raw material that accounts for 15-20% of production costs, is entirely sourced domestically (captive plus merchant supplies). Although global iron ore prices fell by 60% between July and October, domestic prices fell by only 30% because supply remained tight.

The rise in coking coal prices, which account for roughly one-third of total production costs, will significantly increase cost pressures on domestic primary steelmakers. At the same time, the drop in domestic iron ore prices has been significantly lower than the rise in coking coal prices, providing only a limited cushion. These factors will result in a 30-35% increase in production costs for domestic steelmakers in the second half of the fiscal year.

Domestic steel prices, which are heavily influenced by the landed cost of imports, have also remained strong, despite a slight slowdown in the second quarter of this fiscal year due to weak domestic demand during the second wave. Furthermore, healthy global realizations, strong domestic demand growth (14-16% year on year this fiscal), high export potential, and higher production costs are expected to support domestic prices in the second half of the fiscal.

Although domestic steel prices are expected to remain strong, further upside from current levels may be limited because the domestic steel price discount to the landed cost of imports has already decreased to 15% in October from 25% at the start of the fiscal. Furthermore, due to the nascent economic recovery, players may face difficulties in implementing steep price increases in the domestic market.

This, combined with higher production costs, could reduce EBITDA margins in the second half.

The key things that need to be monitored will be a sharper-than-expected correction in global steel prices, weaker global demand, and significantly higher-than-expected input costs.

Is the Govt. of India making any effort to curb the above problem?

Govt. intends to remove bottlenecks in the process of accelerating investments by establishing land banks, ensuring the availability of iron ores at competitive prices, and providing statutory clearances on time.

According to the govt. official “The government has identified 11 zones and nine clusters for this purpose and is getting ready to launch its pilot steel cluster in Kalinganagar, Odisha.” The government is also focusing heavily on using inland waterways to relieve congestion in eastern India’s ports.

Conclusion

One thing that is evident from this cyclical business is that it is never going to be different. With supernormal profits comes the burden of expansion plans in anticipation of greater demand and that is covered by CAPEX plans which involve taking on more debt or using reserves. Any disruption in any raw material (here we would consider iron ore and coking coal) leads to a change in plans, exactly, what we foresee for the third quarter and onwards. Hoping the government looks at the problem holistically and not from an iron ore perspective only, we shall continue to see strong growth in this business.

Otherwise, as we’ve mentioned above a rise in production costs seems inevitable and maybe it is time the steel companies gear up for a “different” part of the cycle.

Until then, stay tuned for the next blog and keep watching this space for our midweek and weekend editions of ‘Trending Stocks”.