Table of Contents

It is well-known that investment is a complicated foreplay between risk and return. Earning a high return entails undertaking higher risk, and vice versa. Hence, investors look for various methods to balance risk and return.

This is where Portfolio Diversification comes into play. Portfolio diversification is a strategy to manage the risk of your entire portfolio by spreading your money into different financial instruments to protect the portfolio from economic uncertainties. This strategy strengthens your financial future and helps you weather market instability.

Understanding Portfolio Diversification

Diversification in portfolio management is a strategy to reduce risks by investing in different sectors, assets, industries, and geographical regions.

All financial instruments do not always move in the same direction; In fact, sometimes some markets move in opposite directions. For example, during the COVID-19 pandemic of 2020, while world stock markets crashed, gold prices continued to go up, ultimately reaching an all-time high.

Diversification reduces the overall risk of a portfolio by investing in different asset classes, enabling you to create a strong investment portfolio that can withstand market fluctuations. Whether you are an aggressive investor or a risk-averse one, diversification of assets can have far-reaching benefits for your portfolio.

What is asset allocation?

Asset allocation, an important concept in portfolio and diversification, is a strategy that involves dividing the investable capital into different types of assets. The goal is to maximise returns based on an investor’s objectives, risk tolerance, and investment time horizon. This reduces the portfolio’s dependency on a few asset classes, thus reducing the overall portfolio risk.

The Role of Portfolio Diversification in Risk Management

One of the most important aspects of a diversified portfolio is the management of overall risk. Here are some of the ways in which portfolio diversification can help with risk diversification:

1. Diversification helps mitigate the impact of poor performance of any single sector or asset class. Diversifying across stocks, mutual funds, bonds, real estate, and commodities creates a balanced risk-return profile, shielding against the specific risks inherent in each asset class.

2. By diversifying across sectors and asset classes, investors can reduce exposure to specific markets. For example, a bad monsoon can affect agricultural output, thus resulting in agricultural stocks performing poorly. Having a diversified portfolio with stocks from different sectors can help cushion against this sector-specific downturn, with some other sectors performing better to compensate for the poor performance of agricultural stocks.

3. Diversifying within the same asset classes by holding a variety of individual securities reduces sensitivity to the performance of specific companies, mitigating the impact of poor-performing holdings. If you are a risk-averse investor and prefer to invest in bonds, choose bonds from different issuers to reduce your dependency on a single issuer.

So how do you access different asset classes, and different industries or find out which companies operate within a sector?

Simply download the StockEdge App, India’s premium investment app, to access comprehensive information with regards to the Indian financial market. From stocks to mutual funds to indices, the information available here will help you immensely with choosing the right assets for your portfolio.

Benefits of Portfolio Diversification

Let us now take a look at the main benefits of investment portfolio diversification? Well, a diversified portfolio has two main advantages:

1. Enhanced Stability in Various Market Conditions

Diversification provides a resilient foundation for investments, offering protection from sudden fluctuations and ensuring success in challenging economic situations. By mitigating the risk and volatility in your portfolio, a diversification strategy helps you create a strongly anchored portfolio that remains less affected by economic slowdowns and political events.

2. Seizing Growth Opportunities while Mitigating Volatility

Portfolio diversification helps you make the most of growth opportunities while mitigating volatility. While one asset class is performing poorly, another might do well. Diversified portfolio allocation enables you to take advantage of the asset classes, industries, and economies that are doing well and can act as a hedge against those that are not.

The Risk of Not Diversifying Your Portfolio

Okay, we know what you are thinking. What will happen if you don’t diversify your portfolio?

Well, the risk of not diversifying your portfolio increases the chance of being overly dependent on the performance of only a few asset classes or industries. This means that if the market conditions turn unfavourable for what you have in your portfolio, it can have a much bigger negative impact on your overall investment.

Let us understand this through a case study.

Case Study of a Non-Diversified Portfolio

The IT stock sector of India has been struggling for the past couple of years. Suppose an investor’s portfolio is heavily inclined towards the IT sector and primarily consists of three stocks – Infosys, Tech Mahindra Ltd. and Tata Consultancy Services Ltd. Let us take a look at the returns of these three stocks over the last 1 and 2 years:

| Stock | 1-Year Performance | 2-Year Performance |

| Infosys Ltd. | +2.4% | -16.2% |

| Tech Mahindra Ltd. | +22.2% | -27.2% |

| Tata Consultancy Services Ltd. | +11.8% | -3.6% |

-15%.

Instead of holding primarily IT stocks, if the investor had opted for stock diversification and included various industries such as FMCG and automobiles as well, and included ITC Ltd., and Tata Motors in his portfolio, the scenario would have been quite different. The past returns of these two stocks are:

| Stock | 1-Year Performance | 2-Year Performance |

| ITC Ltd. | + 37.1% | +112.1% |

| Tata Motors Ltd. | +107.6% | +64.8% |

| Tata Consultancy Services Ltd. | +11.8% | -3.6% |

Of course, the example given above is quite simple, and real-life scenarios can be more complicated. However, as you can see, a well-diversified portfolio reduces the dependency on a single investment (or sector, in this case).

Assessing historic returns is one of the key factors in deciding asset allocation. You can find comprehensive details related to the returns of any financial asset available on the StockEdge App. All you need to do is search the security’s name, and all the details will be available at your fingertips.

Impact on Returns and Stability

An undiversified portfolio can have a significant impact on returns and stability, especially at times of market volatility.

Portfolios concentrated on a few assets are highly dependent on the performance of those individual assets. This increases the risk of substantial losses if the sector underperforms. Non-diversified portfolios may also miss out on potential gains from other sectors. Lack of proper diversification in a portfolio may make the portfolio more volatile and susceptible to sharp fluctuations and potential losses. This can add emotional stress for investors, and recovery from substantial losses can take longer compared to diversified portfolios.

Types of Portfolio Diversification

Portfolio diversification can be done in a variety of ways, however, the two primary ones are:

Stock Portfolio Diversification

Stock portfolio diversification involves including stocks of different industries, and geographical locations in the portfolio to reduce volatility and mitigate risks. This also involves investing in international stocks which can diversify portfolio risk by reducing country-specific risks.

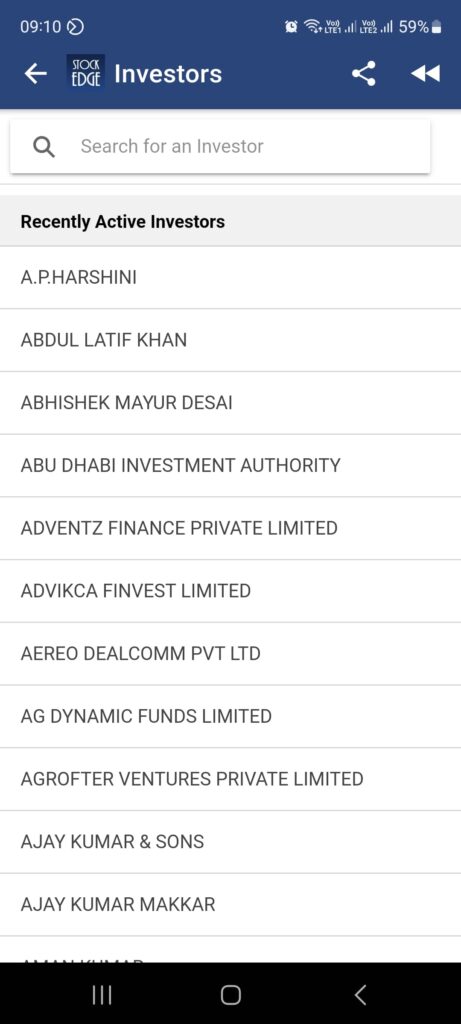

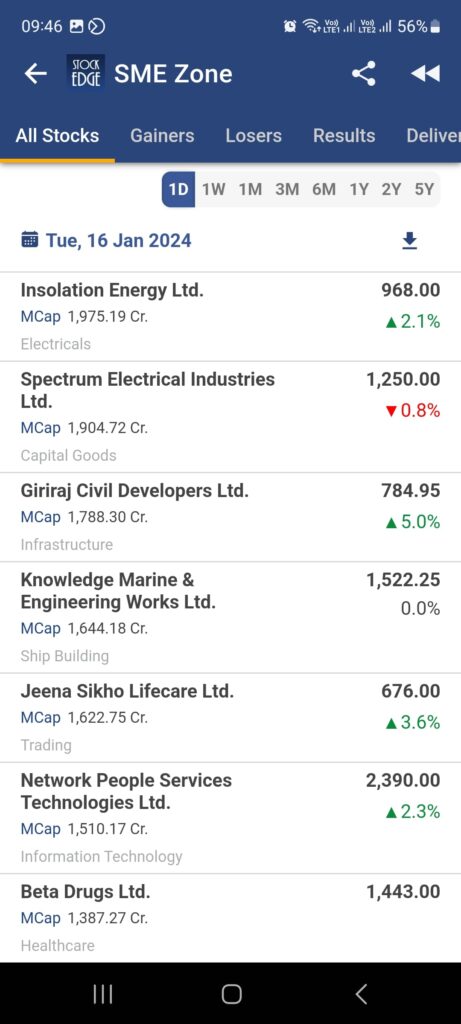

The best way to choose stocks for a diversified stock portfolio is to use the StockEdge App. From individual stock listings to sector-wise grouping of stocks, the StockEdge App has been meticulously designed to help you with stock selection. You can also access portfolios of famous investors to check out examples of diverse portfolios.

Mutual Fund Portfolio Diversification

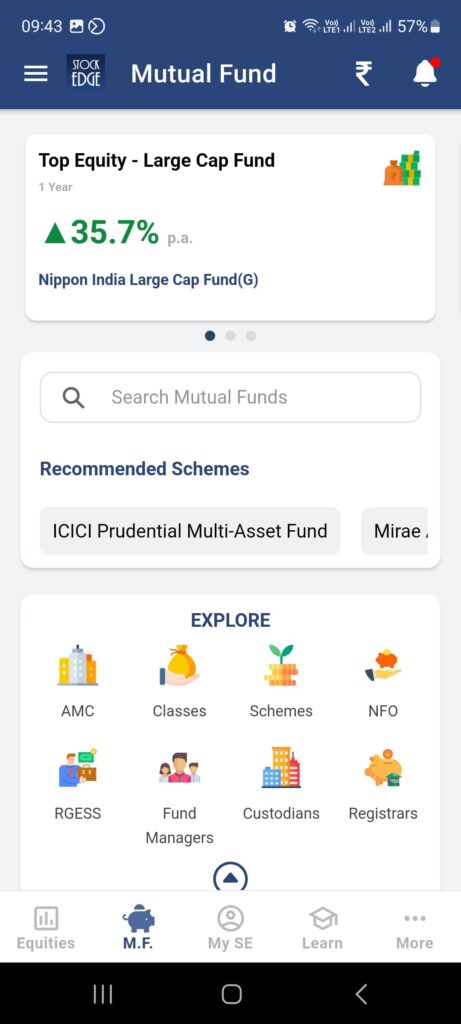

One of the most popular investment vehicles, mutual funds balance risk and returns and are ideal for those investors who do not have much time or knowledge to maintain an active portfolio. Mutual fund diversification involves holding various types of mutual funds in a portfolio. It works similarly to stock diversification, only that it aims at reducing risk further by including various types of mutual funds in the portfolio, such as equity funds, balance funds, contra funds, bond funds, income securities mutual funds, money market funds, and others.

Even within one kind (such as equity funds), you can diversify into mutual funds with specific themes such as banking sector funds, pharma sector funds, pharma sector funds, large-cap funds, flexi-cap funds, mid-cap funds, and so on.

StockEdge has an entire segment on mutual funds to help you with diversification of portfolio risk. You can access mutual funds based on asset classes, scheme names, fund managers and more and obtain help to attain your investment objectives.

Finally, create your own portfolio of stocks or mutual funds. Track your investment and modify with StockEdge’s Portfolio Analytics feature.

Read: How to make Smarter Investments with Portfolio Analytics?

How to Diversify Your Portfolio?

Now that you have a clear understanding of portfolio diversification and have seen a portfolio diversification example too, let us now get to the practical part and understand how you can diversify your portfolio.

Investment in Various Asset Classes

It all starts with asset allocation and diversification. Look at all the available investment options, such as stocks, bonds, mutual funds, indices, real estate, and commodities. To diversify well, assess the risk of each asset class as well as your own risk appetite, investment objectives, and investment timeline. Look for asset classes with a negative correlation with each other, such as stocks and bonds. This way, the underperformance of one asset class will be compensated by the overperformance of another.

Investing Across Different Industries

After the first step of asset allocation, take a look at different industries and avoid concentrating on only a few. Diversifying your portfolio across different industries reduces industry-specific risks. Creating a well-rounded mix can help you earn stable returns in dynamic market conditions.

Through the StockEdge App, you can access information regarding stocks of a variety of industries including small and medium enterprises.

Consideration of Market Capitalisations

Once you’ve decided on the asset allocation, industry types, and geography, consider diversifying based on the size of the company you want to invest in. . Create a balanced mix of large-cap, mid-cap, and small cap companies to manage the level of risk, and adapt to market changes. Mutual funds are a great tool to obtain exposure across various asset classes.

StockEdge App is a great tool to access mutual funds investing in different types of market capitalizations. It groups funds based on their investment objective to make your investment journey easier.

Core Principles of Diversification

The core principles of diversification are based on the idea that instead of concentrating on a single asset, industry, market size, etc., a well-balanced and varied portfolio can help investors manage risk more effectively. Here are the key principles:

Balancing Risk and Return Objectives

Different assets have different risk profiles. The same applies to returns. For example, bonds have a low-risk profile, but returns are also lower. Mutual funds entail higher risk than bonds, providing better returns too. The risk profile of stocks is higher than that of mutual funds, with the potential to deliver higher returns as well, and so on.

Consequences of Over-Diversification on Returns

While diversification is a crucial risk management strategy, one must remain careful of over-diversification. Whenever you add a new instrument to your portfolio, the overall risk of the portfolio is adjusted, and so is the return. Over diversification occurs when the drop in return is higher than the reduction in risk, due to the addition of a huge number of instruments to your portfolio.

Over-diversification can have far-reaching consequences, such as:

- Reduction in the chances of making high returns. Spreading investments too thin reduces the impact of strong performers and diminishes any gains.

- Higher transaction costs, which can reduce overall returns. Constantly buying and selling multiple assets incurs fees and taxes that eat into profits.

- Lack of focus and bad decision-making on the investor’s part. Having too many investments to manage can lead to overlooking important information.

- Managing a heavily diversified portfolio can be time-consuming and mentally exhausting for investors, as it involves tracking multiple asset classes simultaneously.

Role of Research and Due Diligence in Portfolio Diversification

One of the key aspects of diversified asset allocation is research and due diligence, as they help investors identify suitable assets, assess risks, and make informed decisions. An understanding of the fundamental aspects, historical performance, and potential risks of various asset classes as well as markets reduces the chances of making poor decisions.

Importance of Periodic Portfolio Review and Rebalancing

Periodic portfolio review and rebalancing are the pillars of maintaining a well-constructed investment strategy. Rebalancing is the process of changing the weights of different assets in a portfolio. The investor buys and sells different securities to reach their desired portfolio composition.

Periodic reviews, on the other hand, help investors assess investments based on evolving economic and market conditions, allowing them to make informed decisions reflecting current trends. It can help you remove underperforming assets from your portfolio and include assets with promising growth potential.

How to Use StockEdge for Portfolio Diversification?

India’s premium stock market analytics and research app, StockEdge is specifically designed to help you with all of the above.

How? Let’s see:

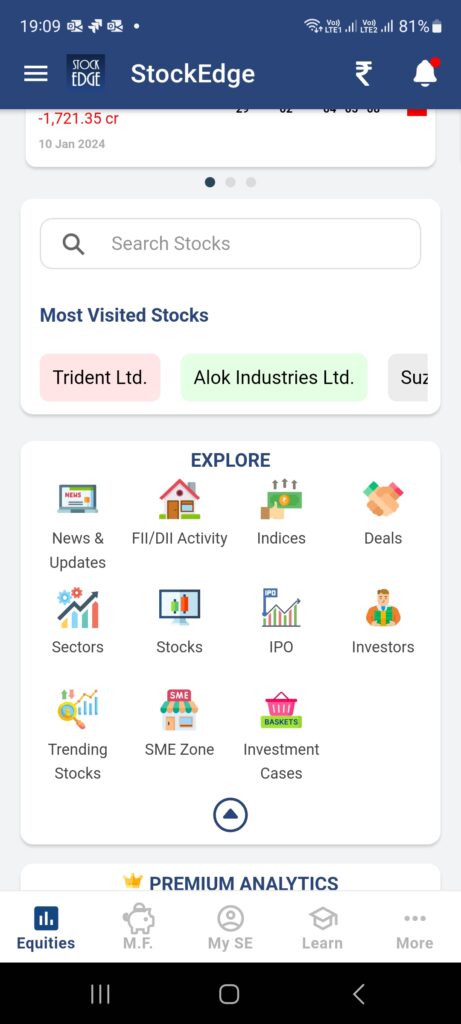

1. Asset Class Analysis: StockEdge lists an extensive variety of asset classes, including stocks from various sectors, mutual funds, commodities, and indices. It can be of immense help to you in deciding the asset allocation for your portfolio.

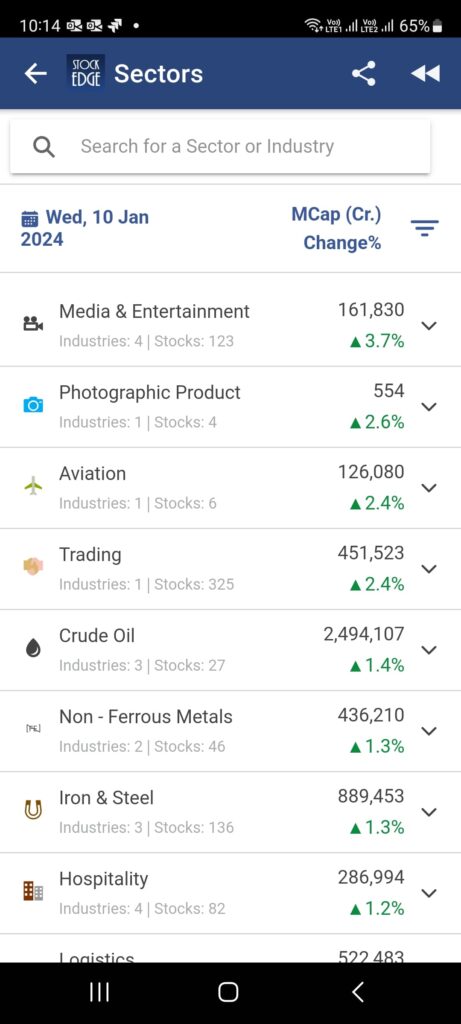

2. Sectoral Allocation: Leverage StockEdge’s features to study and track stocks across different sectors. Diversify your portfolio by allocating funds to sectors that are not closely correlated, reducing the impact of adverse movements in any single industry.

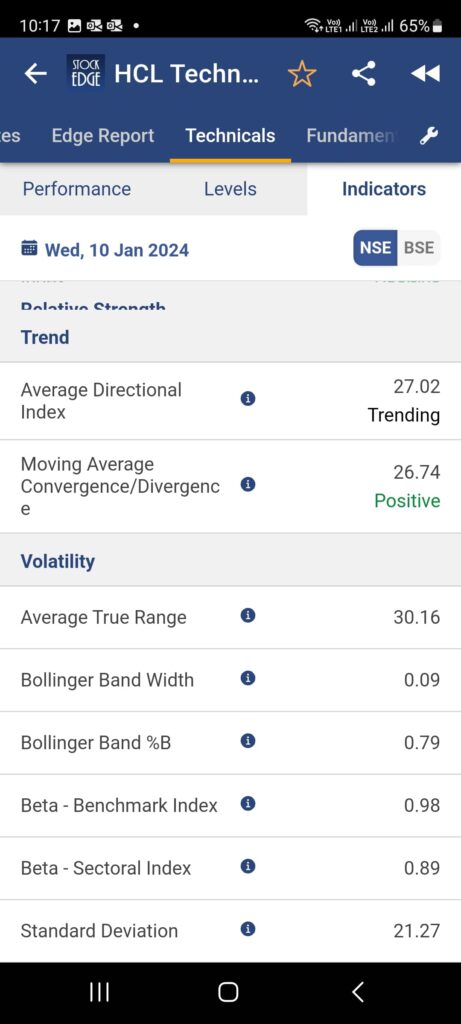

3. Risk Assessment: Use StockEdge to assess the risk levels of individual stocks. Consider factors such as volatility, beta, and historical performance to make informed decisions on how different stocks contribute to the overall risk profile of your portfolio.

4. Correlation Analysis: Conduct correlation analysis using StockEdge to understand the relationships between various stocks and asset classes. Opt for assets that have low or negative correlations to ensure one asset class can compensate for the negative performance of others.

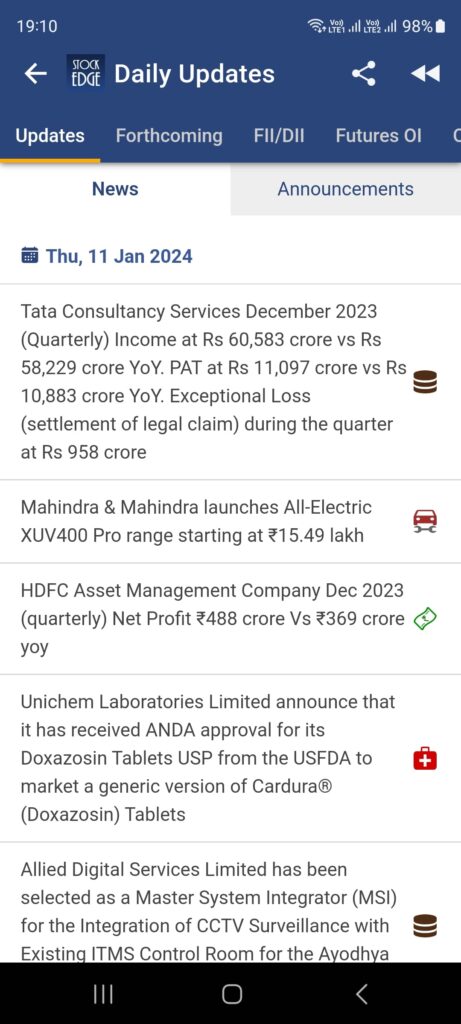

5. News and Event Analysis: Stay updated with market news and events through StockEdge and stay on top of market-moving events that can impact specific sectors or stocks. StockEdge provides constant updates on economic, political, and company-specific events that can affect the price of financial instruments.

Impact of Portfolio Diversification on Long-Term Financial Goals

Portfolio diversification helps you create a resilient investment strategy, thus assisting in achieving your long-term financial goals.

Portfolio Diversification as a Long-Term Strategy

While diversification may or may not be useful in the short term, in the long term, portfolio diversification can have far-reaching consequences and provide immense benefits to an investor. By holding a well-balanced mix of investments, investors can mitigate the impact of volatility in any single asset or market segment. This approach not only provides a buffer against market downturns but also allows for exposure to various opportunities that may arise over the long term.

How Does Portfolio Diversification Affect Your Financial Future?

Markets are unstable and can be affected by a range of factors. Diversified portfolios bring stability during volatile markets. The combination of various assets with different risk levels cushions against market fluctuations, leading to a more predictable financial journey.

A well-diversified portfolio is important for long-term financial stability, assisting in steady wealth growth and a secure financial future. This, in turn, can help you attain your financial objectives. If you are interested in regular income, investing in dividend-paying stocks or including monthly income plans in your portfolio can provide a steady income stream. If you are looking for long-term wealth creation, investing in a variety of stocks, mutual funds, and bonds can enable you to create a perfect balance between risk and return.

1. What is portfolio diversification and why is it important?

Portfolio diversification involves dividing the total investable fund across various assets to mitigate risk and maximise returns, thus providing a safeguard against individual asset volatility.

2. Can diversification help protect against market volatility?

Yes, diversification has proven to be an effective protection against market volatility. Including various asset classes in your portfolio reduces the impact of downturns in any single sector or security.

3. What are some common mistakes to avoid when diversifying my portfolio?

The most common mistakes to be avoided while diversifying a portfolio are:

1. Overconcentration

2. Neglecting periodic reviews

3. Chasing trends

4. How often should I review and adjust my investment portfolio?

You should review and adjust your investment portfolio at least once a year on average. If there are significant market changes, you may want to review them more often to ensure that your financial goals and the portfolio’s risk levels are aligned.

5. How can I determine the right mix of investments for my portfolio?

The right mix for your portfolio is solely dependent on your risk appetite and return expectations. Take these two into concentration and choose the right mix from the wide variety of instruments available to create a portfolio well-aligned to your investment goals.