Table of Contents

Ever found yourself in a stock market roller coaster ride? Picture this: you bought a stock with dreams of a quick profit, but instead, it takes a nosedive and hits your stop loss. Yet, instead of cutting your losses, you cling on, holding it- fast forward a year or two, and you’re still holding on, turning that “quick trade” into long-term investment. On the flip side, you pick up a solid stock for a long-term investment, but before you know it, the price shoots up, and you can’t resist cashing out early, transforming your “investing” stock into a surprise trade.

Welcome to the stock market: where trading becomes investing, and investing turns into trading. This is a common phenomenon which you should avoid as a beginner.

Investing vs Trading: Ever wonder what is the difference between them? Which is best for you? The ultimate goal is to make money from the stock market, which we all know, right? However, investing vs trading has its pros and cons, which you must decipher before you jump into pursuing any one path. Choosing investing vs trading as a path can be a difficult choice to make!

We have come a long way from trading inside the ring of stock exchanges to online trading using smartphones. The ease of use and accessibility have surged online trading and emerged as a career opportunity for many. In the last couple of years, especially after the COVID-19 pandemic, there has been a surge in trading by millennials worldwide.

As per a report by Statista Research Department, the global market for online trading in the coming years may significantly rise and therefore for a beginner in the stock market, there can be a dilemma for choosing a path. Investing vs trading? Which one will be the best?

Hence, in today’s blog, let’s unfold the differences investing vs trading to identify which is the right path for you. However, before that let’s have a basic understanding of the terms: Investing vs. trading. Both are different in their own unique ways but the objective for both remains the same which is to make money for the stock market.

What is Trading?

A simple explanation for trading in stocks would be to buy low and sell high. That’s how you make profits by trading the stocks. It involves quick buying and selling of shares. To excel in trading, you must study the price action moves of a stock in order to identify probable movements in the near term. Hence, analyzing or studying the price chart of a stock is essential in trading.

There are different types of trading that traders follow across the globe. Let’s explore some of them:

Intraday Trading

It involves buying and selling shares on the same day, which basically means squaring off your position before the market closes for the day. This is considered very short-term trading.

For example, Imagine you buy ten shares of Reliance Industries Ltd. at ₹3000 per share. Now, during the same day itself, the stock price of Reliance Industries Ltd. has increased by ₹100. So, you decided to close your position on the same day by selling 100 shares of Reliance Industries with a profit of ₹100 per share.

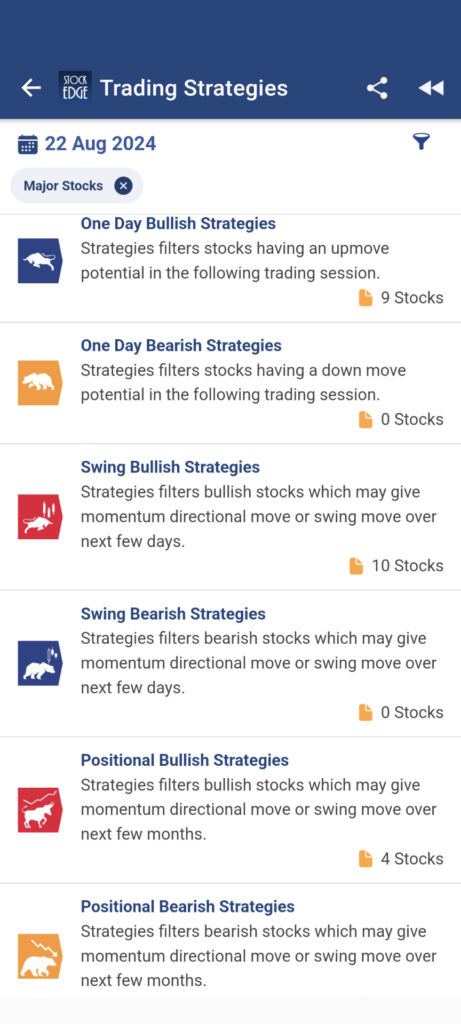

If this sounds lucrative to you, go check out One Day Bullish/Bearish trading strategies in StockEdge, where you can find stocks which are good for intraday trading. Also you can learn more from one of our blogs on How to identify stocks for Intraday Trading?

Swing Trading

Swing trading is one of the most popular trading styles followed by many traders. It basically involves holding on to your trade instead of squaring off on the same day, as it is done for intraday trading.

To explain further swing trading, you need to understand the movement of the share price. In an upward trend, the stock price rises, making higher highs and higher lows, which create swing points on the daily chart. In contrast, in a downtrend, the stock price falls, making lower highs and lower lows, similarly creating swing points.

Now, in swing trading, the objective is to capture the movements between the swing points. In case of a bullish trade, Buy Low & Sell High, whereas in case of a bearish trade, Sell High & Buy Low.

In the above screenshot, you can see that the stock price of Bharti Airtel is rising with higher highs and higher lows, whereas the stock price of Divis Lab is falling with lower highs and lower lows. This creates swing points which a trader captures to make money by trading.

In the StockEdge app, you will find in-built swing trading strategies from which you can easily identify stocks. Moreover, you can also learn more about swing trading strategies from the blog: Top 3 Swing Trading Strategies for Beginners

Positional Trading

Positional trading is a strategy where traders hold onto assets for an extended period, typically ranging from weeks to months, to capitalize on broader market trends. Unlike intraday trading or swing trading, it focuses on the long-term movement of prices, combining fundamental analysis, technical indicators, and macroeconomic factors to make a decision. It involves capturing the larger price shifts, ignoring short-term volatility, and maintaining the positions until the desired target is reached.

Now, the question remains how to identify stocks for positional trading. Do not worry! At StockEdge, we have developed trading strategies for intraday, swing and even positional trading using scans to filter out stocks. Simply log in to https://stockedge.com/ and go to Trading Strategies, you will several strategies based on different styles of trading:

Each trading strategy has its defined rules or entry and exit along with risk-reward ratio. Read it carefully before you start trading! Now, let’s try to understand how investing is done in the stock market. Investing vs trading is tug of war between every market participants. So, is it trading that suits you best or is it investing?

What is Investing?

Investing involves a long-term approach, where you buy or invest in stocks with an aim to grow your wealth through price appreciation, dividends, etc., by holding on to your position for a long period of time. But how long? There is no right or wrong answer to it, nor is there any definitive period of holding. However, to give you a perspective, here is what investment guru Mr Warren Buffett has to say, “Only buy something that you would be perfectly happy to hold if the markets shut down for ten years” So, in the case of investing, it is more focused on its business, instead of just price action. There are two major types of investing, which are as follows:

Value Investing

In simpler terms, value investing is identifying — a stock you can buy for less than what it’s actually worth. It is popularized by legendary investors like Benjamin Graham and Warren Buffett, revolves around the concept of buying undervalued stocks.

Growth Investing/ Momentum Investing

Contrary to value investing, growth or momentum investing focuses on capitalizing on trends in stock price movements. This strategy operates on the premise that stocks that have performed well in the past are most likely to continue their upward trajectory, while those that have underperformed are likely to continue their descent.

To know and learn more about the value of momentum investing, you can read the blog that describes the difference between Value investing and Momentum investing.

Irrespective of value stocks or momentum stocks, if you are looking for good stocks for long-term investments, then StockEdge can help you find them. We have a section of Investment Ideas where you will find stocks for long-term investment. You will get a list of stocks that have detailed case study reports attached to it. Read it before making an investment decision.

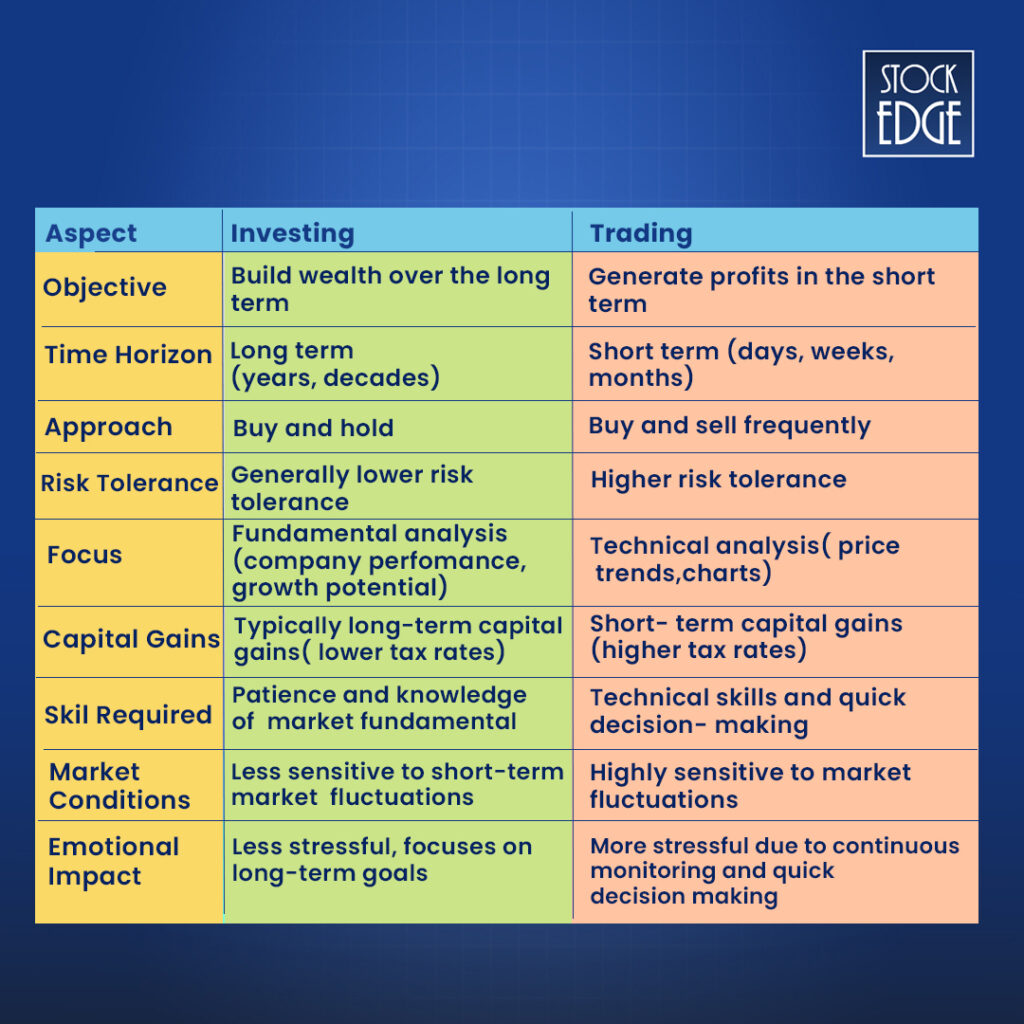

Now that you get the idea of both trading and investing, here are some of the major differences between the two:

Investing Vs Trading: Key Differences

The above differences showcase the traits of investing vs trading. But which one suits you best? If you are still finding it difficult to choose your path in the stock market, let’s take a look at the mindset of a trader and an investor.

What is the Psychology of a Trader?

A trader in the stock market is someone who is always monitoring the price action movements in stocks in order to identify training opportunities for himself or herself. It requires actively monitoring stock’s price movements along with tracking the important insights about the stock. In simple terms, a full-time trader is actively monitoring the markets to generate trading ideas to make money.

List of Behavioral traits of a trader

Here are some key behavioral traits of a successful trader:

- Discipline: Consistently following a set strategy, avoids emotional decisions.

- Risk Management: Apply proper risk control, never risking more than what can be afford.

- Adaptability: Adjust strategies based on market conditions and trends.

These traits help traders navigate volatile markets and maintain consistency.

What is the Psychology of an Investor?

An investor is focused on the business itself, instead of tracking the price action. Imagine, if you have to start a business then the most important thing is to know every tiny detail of that business model to run the company. It is equally important for an investor as well, he must have a good understanding about the business along with acumen to analyze the financial statements of the company. An investor seeks to identify a good business instead of identifying good stocks.

List of Behavioral traits of an Investor

Here are key behavioral traits of a successful investor:

- Patience: Willing to hold investments for long periods, avoiding impulsive reactions to short-term market movements.

- Analytical Thinking: Dives deep into the fundamentals of companies or assets before investing, focusing on long-term value.

- Goal-Oriented: Keeps a clear focus on financial objectives and timelines, aligning investments accordingly.

So, Investing vs trading! What would you prefer to choose?

How to choose the right path? Investing Vs Trading

To start your journey as a beginner in the stock market, there are two major factors that determine you to select the right path for yourself. They are:

- Time

- Capital

As a beginner, the majority of market participants face these two constraints in starting their journey in the stock market. Some have big capital but no time to analyze the markets, and others have time to analyze but not much capital to invest in. There is a solution to this. As wise men say, “when there is a will, there is a way.”

So, let’s break-up these two determinants which can help you decide what’s right for you? Investing or Trading.

Time

There is a popular saying, “Time is Money”. Well! That’s very true in the stock market as well. If you can not invest your time in analyzing the markets, then trading could be a risky game for you. Even if you can give 1-2 hours a day, then intraday trading or swing trading can be a good starting point if you want to become a trader. But, if you can only give 1-2 hours in a week, then positional trading can be a good point to start, where you build a medium to long-term position in stocks. But even if that does not seem possible for you, then a good option is to start investing for a long period of time indirectly through ETFs (exchange-traded funds), mutual funds, or PMS (portfolio management services).

Capital

This is the second most important determinant for you to start your journey as a beginner in the stock market. Often, beginners have a small capital of money to start, but that should not stop you! In fact, the legendary big bull of the Indian stock market, the Late Rakesh Jhunjunwala, started his career in the stock market as a trader. Then, slowly and gradually, he built his corpus to shift towards investing, where wealth creation became the aim. If you are struggling, too, for capital, then starting your journey as a trader and then moving to long-term investing can be a good path to begin your journey in the stock market.

You can watch this video to learn more about Investing vs trading!

If you want to make a career in trading, then you can join India’s first multi-asset trading program, where you will learn not only how to trade stocks but also other assets like currency and commodities. Join the Trading Mentorship Program today!

The Bottom Line

Investing vs trading are two parallel railway tracks that meet at a station called financial success, where the ultimate goal is to make money. Navigating your journey in the stock market can feel like riding on uncertain terrain, full of twists, turns, and occasional bumps. While trading demands agility, quick reflexes, and constant vigilance, investing requires patience, discipline, and a long-term perspective. No matter which track you choose, staying focused and committed to your strategy can lead to significant rewards over time. Whether you are an investor planting seeds for future growth or a trader seizing short-term opportunities, the key is to stay on track and adapt wisely to market conditions.

Ready to embark on your investment journey? Check out our Beginner’s Guide to Investing and start building your financial future today!