Table of Contents

Nowadays with banking crisis news doing rounds, we would want to invest with a safe bank, Right !!! What if we get to know of the earnings percentage of the total deposits in a bank. Thus if it’s higher than our savings, it is safe, as the bank is able to mobilize its savings wisely and efficiently.

Net Interest Income is the difference between the interest earned from bank’s assets to the interest expenses on the bank’s deposits. A typical bank’s asset consists of all forms of personal and commercial loans, mortgages and securities. The liabilities are the customer deposits. The excess revenue that is generated from the interest earned on assets over the interest paid out on the deposits is the net interest income. Interest income to total funds ratio indicates how much interest is earned with respect to total deposits.

Watch the video below on Everything you want to know about Interest Income To Total Funds:

Importance

The net interest income is very sensitive to changes in interest rates prevailing. The other factors also which affects the net interest income are the type of assets and liabilities that are held as well as if those assets and liabilities have fixed rates or variable rates. Variable rates assets and liabilities will more affect the net interest income as they will be change with changing interest rates as compared to fixed assets and liabilities. Quality of the loan portfolio is also a factor affecting net interest income as circumstances like a deteriorating economy and job losses can cause borrowers to miss payments on their loans and lower the bank’s net interest income as a result.

Impact

By calculating this ratio, we can get an idea of how much interest the bank is earning and compare it with respect to the total funds i.e. deposits. If the ratio is higher, it is a good sign for a financing company. It means the bank is using its funds efficiently to earn interest. And if the total funds increase, the interest should also increase proportionately and if it doesn’t then there can be an efficiency issue.

Formula

Interest Income to Total Funds (%) = Net interest Income/Total Deposits

Explanation

Suppose a bank ABC has net interest-earning of Rs. 1,00,000 and its total deposits are Rs. 10,00,000. Then,

Interest Income to Total Funds (%) = (100000/1000000)*100 = 10%

See also: CASA Ratio (%): Definition, Importance & Formula

Stockedge App

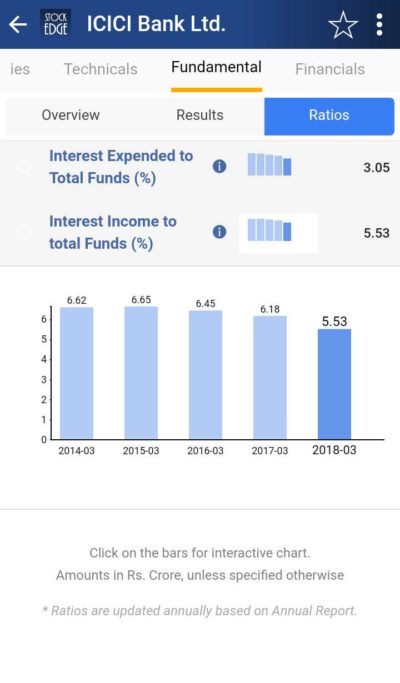

Nowadays we don’t have to calculate Interest Income to Total Funds ratio (%) on our own. StockEdge gives us the Interest Income to Total Funds ratio of the last five years of any company listed in the stock exchange. We can look and compare Interest Income to Total Funds ratio (%) of any company and filter out stocks accordingly.

Suppose we want to look at Interest Income to Total Funds ratio of ICICI Bank Ltd. for the last 5 years then in the Fundamental tab of ICICI Bank Ltd., click on the fundamentals tab, we will get Ratios tab. Then in the Ratios tab click on the Liquidity Ratios, we will get Interest Income to Total Funds ratio (%) of ICICI Bank Ltd.

Bottomline

Interest Income to Total Funds (%) of any bank tells us about the efficiency of funds usage. It can be compared on a yearly basis and with other banks to understand the efficiency of the banks. With a click of a button, you can see the comparison of the bank’sInterest Income to Total Funds ratio (%) for five years. Haven’t subscribed to stockedge yet? So what are you waiting for, subscribe immediately to use this free feature. We also have paid featured scans based on Valuations, with the help of these ready-made scans you can with a click of a button filter out good companies. These scans are part of the premium offerings of the StockEdge app.

Click here to know more about the Premium offering of StockEdge.

You can check out the desktop version of StockEdge using this link.