Table of Contents

Saying Goodbye to 2023 and Welcoming 2024. The Indian Stock market had a stellar rally in 2023, as the benchmark index Nifty 50 rallied from 18000 levels in Jan 2023 to 21000 levels by the end of 2023.

In today’s blog, let’s analyze the Indian stock market and try to predict what could be the outcome in 2024. Will the market continue to rally, or can we see some correction next year?

Before we predict the outcome for next year, we first need to analyze what actually happened in 2023. Here is a brief overview of what happened in the Indian stock market in 2023:

Market Wrap-up in 2023

Broadly, we all are aware that the benchmark indices, the Nifty 50 and the Sensex, have rallied quite significantly. Although it has been a volatile year, we have seen a strong rally in the market by the end of this year. However, there are a few major factors that drive the Indian stock market, such as the dollar index, Crude Oil, US bond yields, and also the US Market, which is one of the biggest in the world.

Starting with the dollar index, which is one of the major drivers of our Indian stock market, we see an inverse relationship between DXY and the Indian stock market. The reason is that when the dollar index falls, the FIIs, which are foreign institutional investors, invest more in Indian stocks as they can get higher returns than returns from US dollars. Over the past year, the Dollar Index has been quite volatile; however, by the end, it has settled flat around the same level of 102-103 as it was a year earlier, which is a sign of comfort for the Indian equity markets.

US Markets

The US market is one of the largest, and any negative outlook triggers uncertainty overall in the global markets, especially our Indian stock market. Let’s have a look at the Dow Jones, which is the benchmark index for the US market.

In the above chart, as you can see, there were no major trends in the US market at the start of 2023. But by the end of 2023, the index witnessed a sharp rally in the past 3 months, giving a strong upward direction for the US markets.

In contracts, the NASDAQ is in a clear uptrend throughout the year, which indicates that new-age tech companies are dominant. Here is a comparison between NASDAQ and DOW given in the chart below:

Crude Oil

Surprisingly, Crude Oil, which was trading around $73/ barrel at the beginning of 2023, has again come back to its level after drastic ups and downs throughout the year. In the last three months, crude oil has seen a sharp correction from $90/ barrel, which has triggered a bullish momentum in the Indian stock market.

All three have been somehow supporting the momentum of our markets.

Mid Caps & Small Caps

Other than these macroeconomic factors, there is another key driver for the Indian markets, which are the mid-cap and small-cap stocks. How? Take a look at the charts of CNX Mid Cap and CNX Small Cap indices below.

They are the stars of 2023. The rise in both indices has been phenomenal, which has actually fueled the growth of the overall Indian stock market.

Analyzing the markets with StockEdge

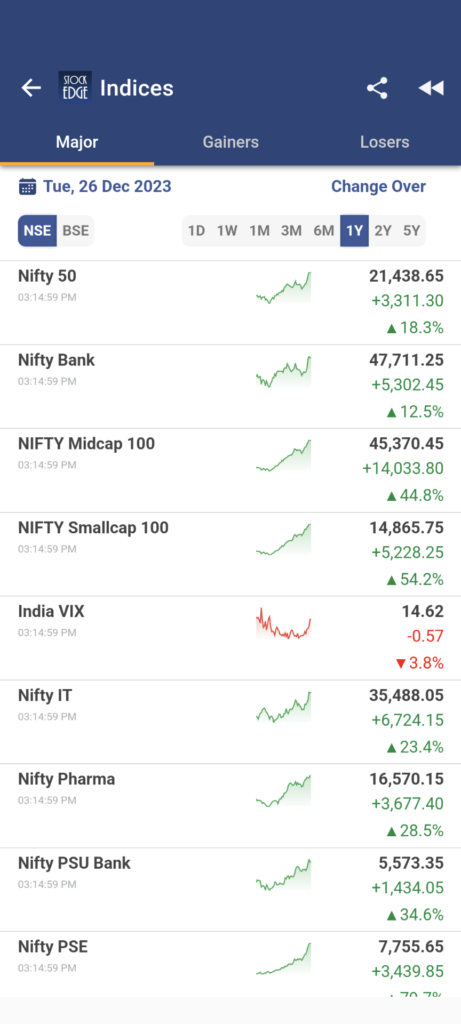

StockEdge is a powerful tool through which you can get the past performance of all the market indices in one place. Simply open up the app on your phone or go to web.stockedge.com. Click on indices to view the list of all the market indexes and check the performance in different time periods as per your choice.

By default, you can see the performance of all major indices in the market. Moreover, this is live data. So, at any point in time during the market, you can easily figure out the top-performing index.

Additionally, you can get the top gainers and losers at one glance. In a one-year time period, there are no major losing indexes, but a few of them have not performed well compared to the others which are most likely to be the star performer for next year in 2024.

Indian Stock Market Outlook in 2024

Now that we have covered most of the data-driven factors that led to such strong momentum in the market. Let’s discuss some probable scenarios that could be the next driving factors for the Indian stock market in 2024.

In the stock market, we see different actions taking place over time, which are mostly driven by some market scenarios at a given point in time. So, what are those factors?

There are three major aspects that play a significant role in the actions of the stock market. They are:

- Liquidity

- Socio-Political Changes

- Corporate Earnings

We will discuss each of the above aspects to make a conclusion about the Indian stock market predictions for 2024.

Liquidity

In the stock market, liquidity is a function of interest rates. When the interest rates in the economy fall, it indicates that there is more money flow, and hence, it suggests higher liquidity. In contrast, when there is a rise in interest rates, money flow is restricted, which brings a lack of liquidity.

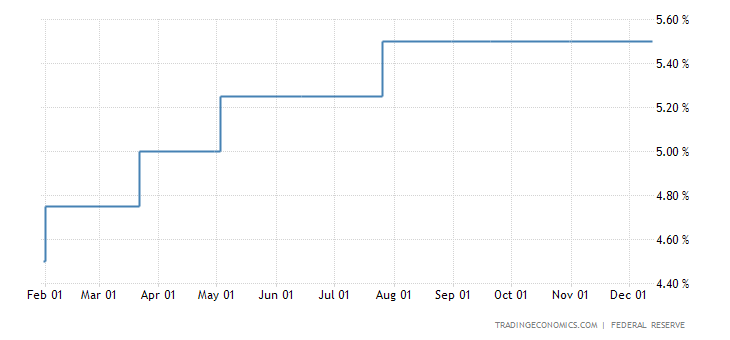

As you can see, the US Fed has hiked interest rates from 4.5% to 5.5% in 2023 due to a rise in inflation in the economy. Despite the money flow being restricted in the US economy by the FED, we have seen the stock market climb. Moreover, if you see the US 10-year yield, which started off with 3.8% in Jan 2023, came back to the same level by the end of this year after surging to 5% in mid-year, the fall in yield indicates the sentiment that FED might cut interest rates from next year onwards which will drive more liquidity into the market.

In comparison to the 10-year yield of India, it fell from 7.3% at the beginning of 2023 and has now come down to 7.1%. This indicates a positive outcome for the Indian stock market in 2024.

Therefore, we can expect a liquidity driven rally in the Indian stock market in 2024.

Socio-Political Changes

The economic growth of a nation is significantly influenced by its social and political conditions. Additionally, the stock market serves as a barometer for a country’s economic well-being. Thus, a robust and steady economy is indicative of the potential positive performance of the stock market.

In 2024, we have the presidential election in the US and Lok Sabha Election in India. These two are major driving factors of the stock market. Definitely, a stable political environment and a confirmation that the upcoming government of the country can push the economy higher will be a positive sign not only for the country but also for the stock market.

In India, the recent state elections have already triggered a positive sentiment in the market. The 2024 Lok Sabha Election will definitely shape the stock market trend next year.

The only negative point in the socio-economic scenario will remain the ongoing war between nations and a high inflation environment. However, as we are ending the year, the war scenario is gradually fading away, and inflation is slowly getting moderate.

So, from a socio-political point of view, India is on its growth trajectory, and the upcoming Lok Sabha elections in 2024 will be the foundation for the next 5 years of growth in the country.

Corporate Earnings

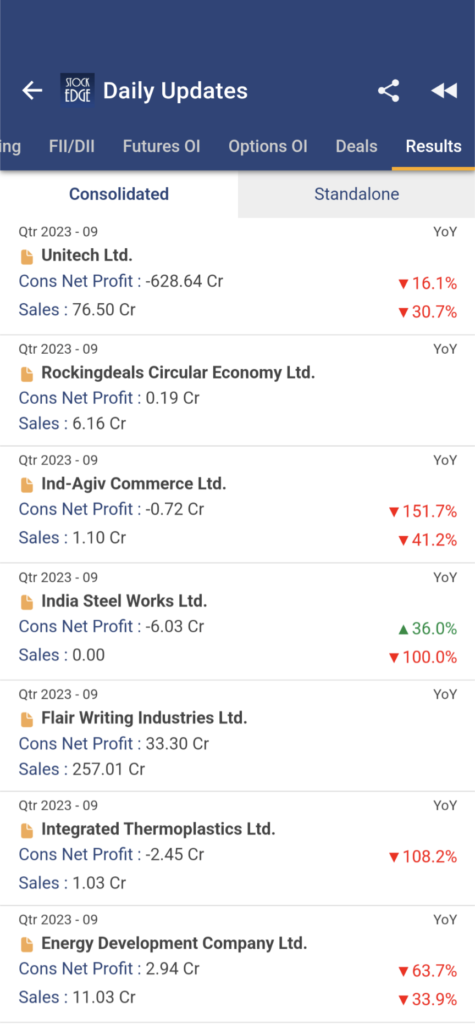

The third and last aspect, which could be the most important driving factor for the Indian Stock Market in 2024, is earning surprises by the companies.

Earnings surprises are basically when the company reports exponential growth in Sales or its net profit in a particular quarter or year.

To check the earnings of all the listed companies, you can use StockEdge.

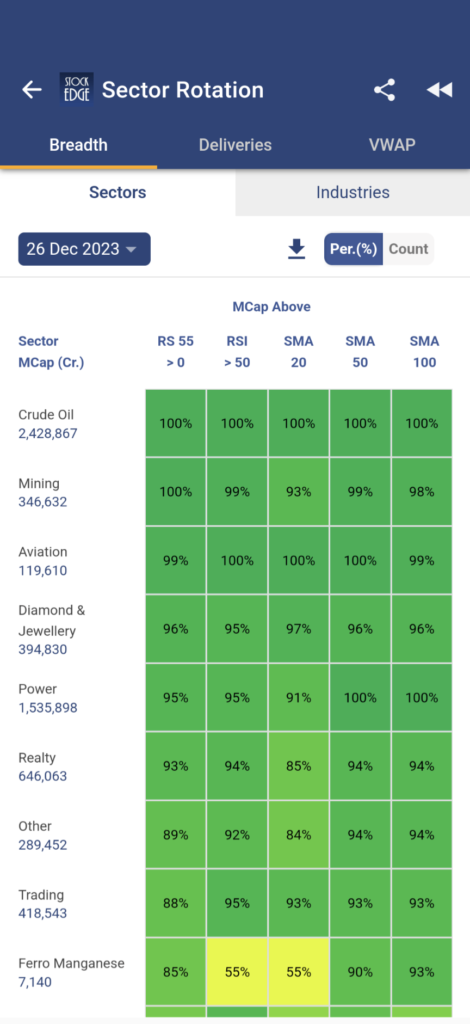

However, it is not easy to scroll through the entire list of stocks. So, it is advisable to look for trending sectors in the market. How do we identify trending sectors in the stock market?

Worry not! StockEdge’s Sector Rotation is there to help you out.

To learn how to identify the trending sectors in the market and also find strong stocks from the sector, you can read this blog: Beat the Street with Sector Rotation Strategy.

In the end, if a company can achieve higher growth and stability, then only the stock market rally will continue further in the next year.

Market Valuation

Lastly, analyzing the current valuation of the market is important. To find out, let’s take the P/E Ratio of Nifty 50, which is currently around 22, and the long-term median of Nifty P/E is around 20. It seems that markets are slightly expensive compared to their long-term average.

Historically, the market faced a sell-off when Nifty 50 P/E reached 25 to 29 levels. Hence, there is still scope for the market to form higher highs in the next year, 2024.

How to ride the Market Momentum?

Now, when the majority of signals indicate that the year 2024 could be extremely positive for the market, how can you ride the bullish momentum?

For an active trader, you identify the sectors or industries first and then identify strong stocks from them. However, for a passive trader or investor, it is better to start doing SIPs in Nifty 50, Nifty Mid Caps, or Small Caps indices through ETFs. Investing in the market through ETFs is a great way to ride the bullish momentum.

For more deep insights about the overall market in 2024, you can watch:

The Bottom Line

The Indian Stock Market is gaining strong momentum, and this trend is most likely to continue in 2024. So, gear up to make your trading or investing journey to the next level.

Happy New Year to all the aspiring traders or investors in the market.