Table of Contents

The Indian markets had a great rally last year. The benchmark indices like Nifty 50 and BSE Sensex gained nearly 20% and 18%, respectively, in the last 1 year. This is perfectly correlated with both the country’s economy and the markets, which are growing exponentially. Before reveling the top 5 stocks for 2024, what could be possible reason for a continued bull run?

Interestingly, in 2024, we have two major elections:

- The US Presidential election

- Lok Sabha election

These two major events could be the next driving factors not only for our economy but also for the stock market. Other than these, there are several other factors that could ignite further rallies in the stock market. To know more about it, you may read this blog, Indian Stock Market Prediction For 2024

This blog will reveal the top 5 stocks for 2024 that you may consider investing in this year. Why or how was the stock selection made? Each stock will be discussed separately in detail so that you can make your investment decisions considering the different factors, including the risks and rewards of investing in stocks.

So, without further ado, let’s start:

List of top 5 Stocks for 2024

1. HDFC Bank Ltd.

The first stock in the list of top 5 stocks for 2024 is from the banking sector. Why HDFC Bank can be a good investment opportunity in 2024? Before discussing, here is a fun fact: This stock holds the highest weightage in two major indices; in Nifty Bank, it holds 29.39%, and in Nifty Private Bank, 26.38%. Additionally, HDFC Bank is one of the most valuable brands in India, holding the 2nd spot in the list just after the IT giant TCS. This suggests that you will be investing your money in the best of the best.

Company Overview

HDFC Bank is the biggest private sector bank in India, with a total business (loans + deposits) of over ~₹45 lakhs crore. They offer a range of services, from commercial and investment banking to retail branch banking. Known for its exceptional performance, especially in retail, HDFC Bank has strong asset quality and top-notch margins, making it one of the best-performing banks in the country. So, if you are considering to invest in the banking sector, HDFC Bank can be considered as one of the top stocks for 2024.

Key Growth Factors

- The bank has reported a healthy CAGR credit growth of 19.4% in the past 5 years, and its growth has always remained above the industry average.

- In the recent Q2 FY24 quarter, the Net Interest Income (NII) growth stood at 30.3% YoY and 16% on a sequential basis; strong growth was partly on account of merger impact between HDFC Ltd and HDFC Bank Ltd.

- HDFC Bank has kept the net interest margins (NIMs) at healthy levels of over 4% (average loan basis) mark in the past 5 years.

- Being a highly rated company with a healthy CASA of over 42.5% mark, the cost of liabilities is amongst the lowest in the industry at 3.9%.

- Gross non-performing assets for HDFC Bank stood at 1.34%, and Net NPA of 0.35% as of Q2 FY24. It is one of the lowest among large banks and the best in the industry as well.

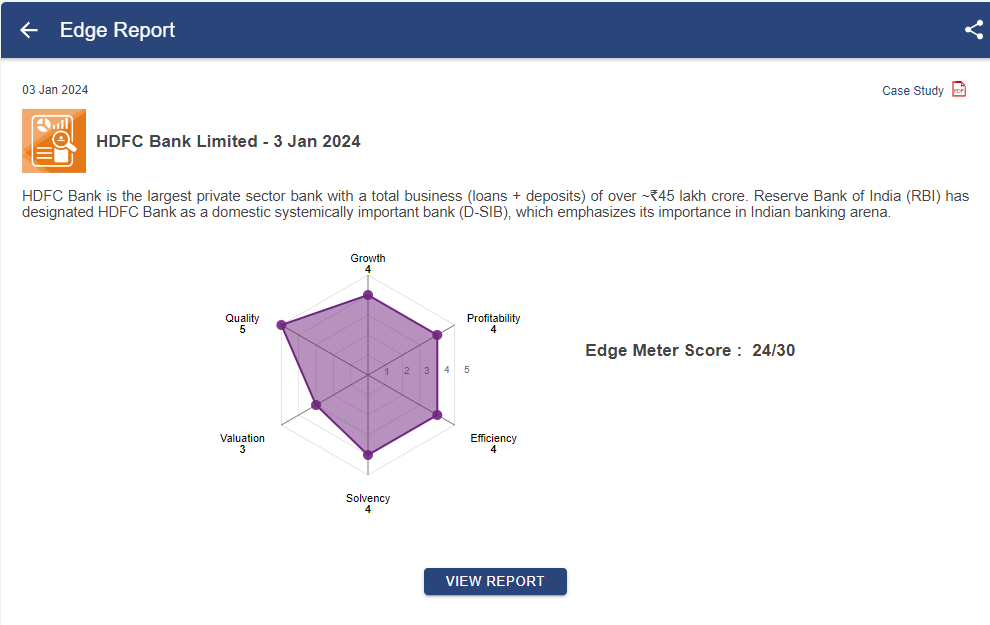

Case Study on HDFC Bank

We have a case study report prepared by our team of analysts. This fundamental report on HDFC Bank stock provides you with a detailed analysis of the company as well as how it stands among its competitors. An Edge score of 24/30 is given as per the spider chart. This can be considered as one of stocks for 2024 which you may invest in.

Click to view the report on HDFC Bank and find out key levels for investments.

2. Wipro Ltd.

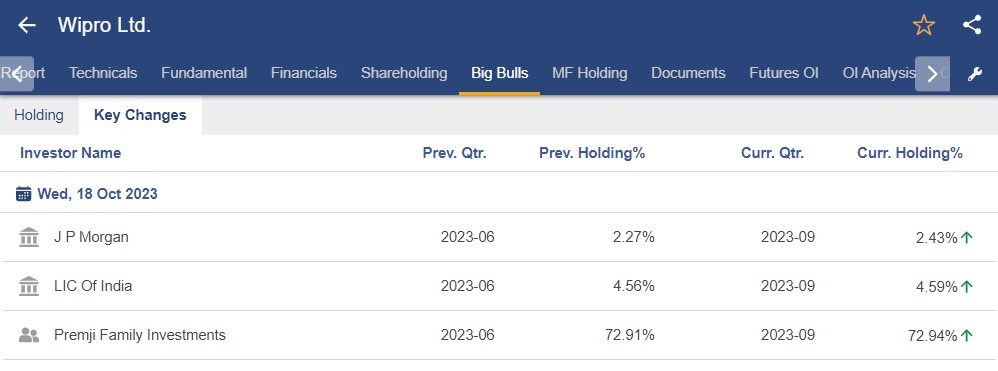

A large-cap IT stock with over 8.24% weightage in the Nifty IT index has a strong upside potential because big bull investors like JP Morgan, LIC India, as well as the promoter group Premji Family Investment, have increased their stake in the previous quarter as you can see from the Big Bulls section in StockEdge App. Therefore, if big bulls are having large stake in the stock, you may consider Wipro as a top pick under the IT sector as one the top stocks for 2024.

Company Overview

Wipro Limited, incorporated in 1945, is a leading global information technology (IT), consulting and business process services company. The company derives revenue primarily from software development, maintenance of software/hardware and related services, business process services, and sale of IT and other products.

Key Growth Factors

- In FY23, the revenue stood at ₹90,488 cr, a growth of 14.1 % YoY.

- The company’s Free cash flow per share in FY23 increased to ₹21.5. The cash conversion was at 115% of net income versus 91% in the previous year.

- The asset turnover ratio in FY23 was 0.81x compared to 0.84x in FY22. Human resources are the main asset for an IT company, so it is imperative to look at the attrition rates. The attrition rate as of Q2 FY24 stood at 15.5%, down by 180 bps QoQ.

- Wipro is currently trading at a TTM PE multiple of 18.79x. The industry TTM PE stands at 28.4.

- Despite a rise in sales, EBITDA remained flat, and PAT declined in FY23, which seems negative, but Price breakout after a long consolidation period may indicate a turnaround in financial numbers going forward.

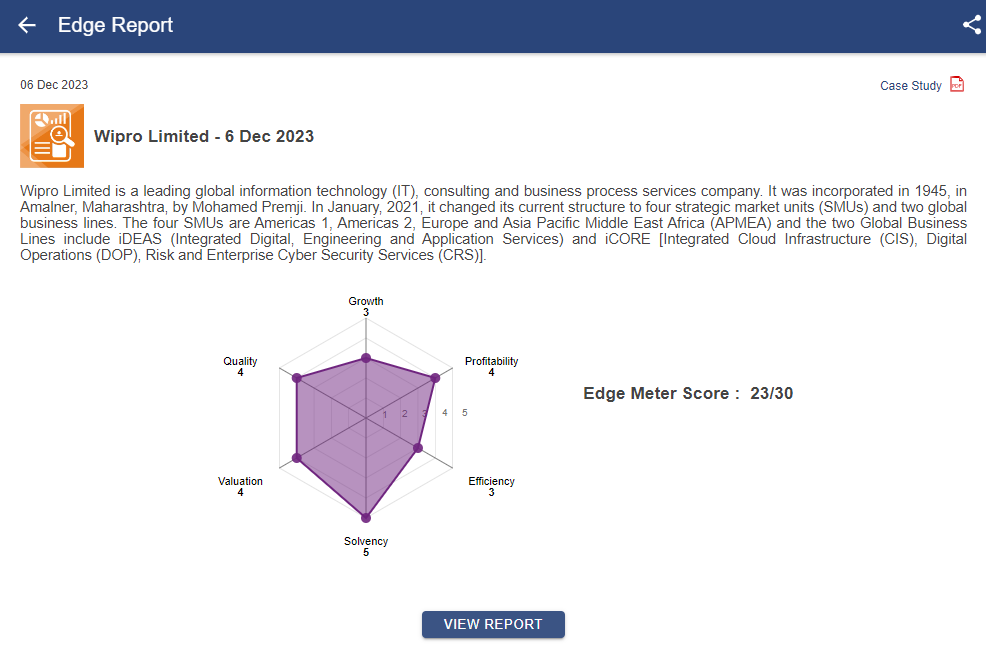

Case Study on Wipro Ltd.

We have a case study report prepared by our team of analysts. This fundamental report on Wipro stock provides you with a detailed analysis of the company as well as how it stands among its competitors. An Edge score of 23/30 is given as per the spider chart. This can be considered as one of stocks for 2024 which you may invest in.

Click to view the report on Wipro Ltd. and find out key levels for investments.

3. Titan Company Ltd.

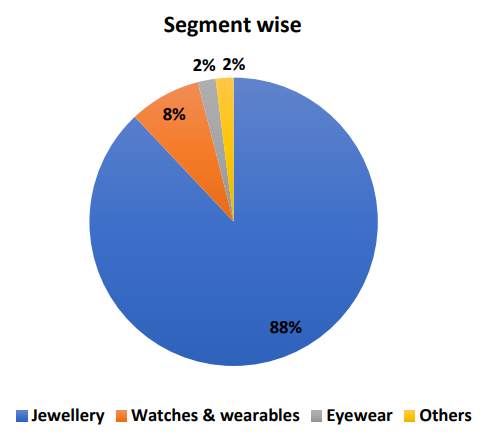

Titan is a brand that we all Indians are familiar with; we all believe in the trust of TATA. However, the majority of us know Titan as a watch brand, right? But did you know that Titan’s maximum revenue is not from watches but from their jewellery segment? Here is the revenue mix of the company as of FY23:

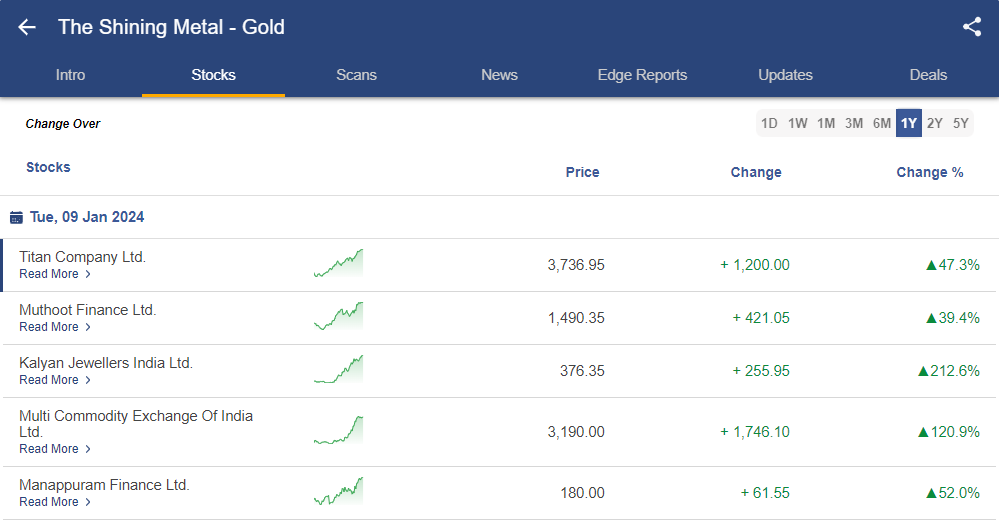

As you can see, 88% of the revenue comes from the jewellery business. So, brands like Tanishq and the recently acquired CaratLane contribute the majority of the revenue. Therefore, due to the highest revenue contribution from the jewellery segment, it could benefit from the rise of Gold prices in India. Gold prices may see a rise due to high inflation and people moving to safe-haven investments like Gold. Hence, if you are looking for diversity in retail sector with a touch of gold, Titan can be a good investment choice and can be considered as one of the top stocks of 2024.

If you are looking for thematic-based investment in Gold, you can check out our investment theme: The Shining Metal-Gold in StockEdge

Company Overview

Despite the highest contribution of revenue from the jewellery segment, Titan Company Ltd. is an Indian lifestyle company that mainly manufactures fashion accessories such as jewellery, watches and eyewear. In 1984, Titan started its operations with its watches, and later, it diversified into jewellery with Tanishq and subsequently into eyewear with Titan Eyeplus.

As of 30th September 2023, the company had 2,859 stores with an area of ~3.8 million square feet in 415 towns.

Key Growth Factors

- In FY23, revenue stood at ₹40,575 cr, a growth of 40. 9 % YoY. In H1 FY24, revenue grew by 31 % YoY, driven by all the segments. In the jewellery segment, Tanishq witnessed higher sales.

- EBITDA stood at ₹4,879 cr in FY23, an increase of 46% YoY. The jewellery contributed most to profitability and saw an increase of 44% YoY to ₹4,387 cr. PAT stood at ₹3,273 cr, a growth of ~49% YoY.

- In FY23, the asset turnover ratio was 1.7x. This was led by a robust increase in sales during the year.

- India’s gems and jewellery sector’s market size was about US$ 75 billion in 2017 and is expected to reach US$ 100 billion by 2025. Titan is most likely to benefit from the growth of the overall industry.

- In the jewellery segment, the company has a market share of 7% from the overall market of ₹4,50,000 cr. They are aiming to go double-digit in the next 3-4 years.

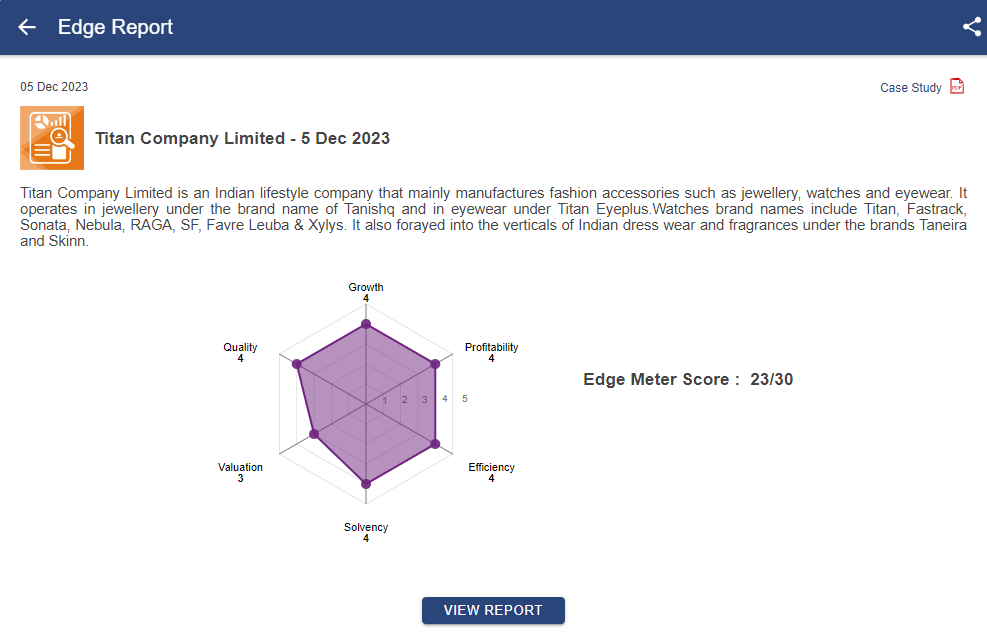

Case Study on Titan

We have a case study report prepared by our team of analysts. This fundamental report on Titan stock provides you with a detailed analysis of the company as well as how it stands among its competitors. An Edge score of 23/30 is given as per the spider chart. This can be considered as one of stocks for 2024 which you may invest in.

Click to view the report on Titan Company Ltd. and find out key levels for investments.

4. Hindustan Unilever Ltd.

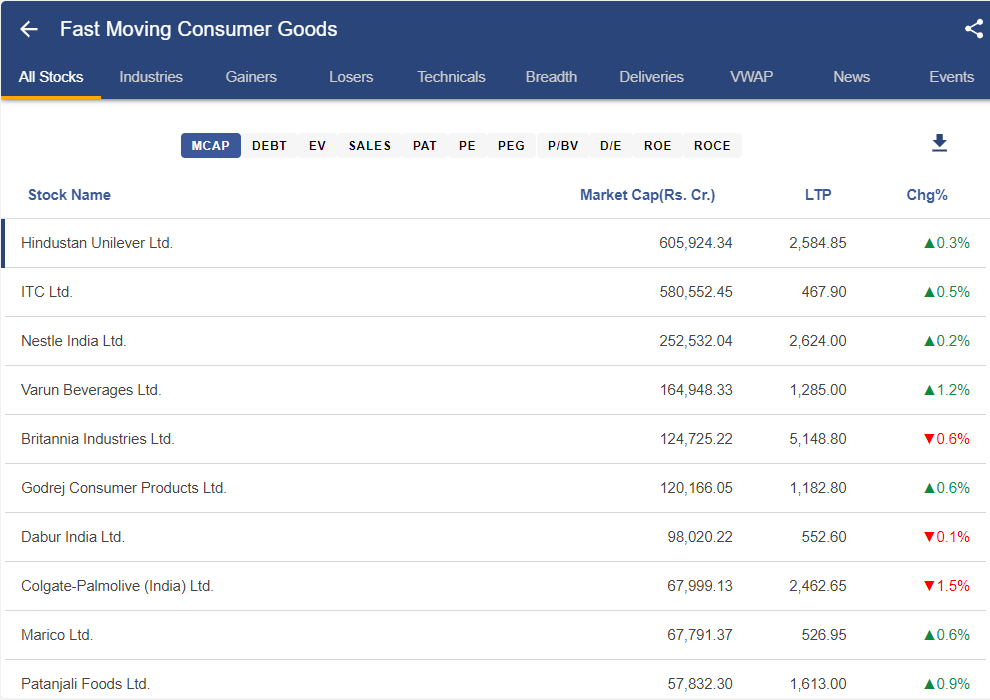

FMCG is one such sector that keeps growing strong no matter what unexpected challenges come its way, proving its steadfast and enduring success. Hindustan Unilever is one such company with the highest market capitalization of 6 lakhs crores among its industry peers. With StockEdge, you have the ability to do a peer comparison analysis, as you can see in the image below:

Hence, with the highest market capitalization, Hindustan Unilever can be considered as one the top stocks for 2024.

Company Overview

Hindustan Unilever Ltd. is the largest Fast Moving Consumer Goods company in India, with a revenue base of ₹61,931 cr (TTM basis). It is an Indian subsidiary of Unilever PLC, which is a British-Dutch multinational company. Unilever Group has 61.90% in Hindustan Unilever.

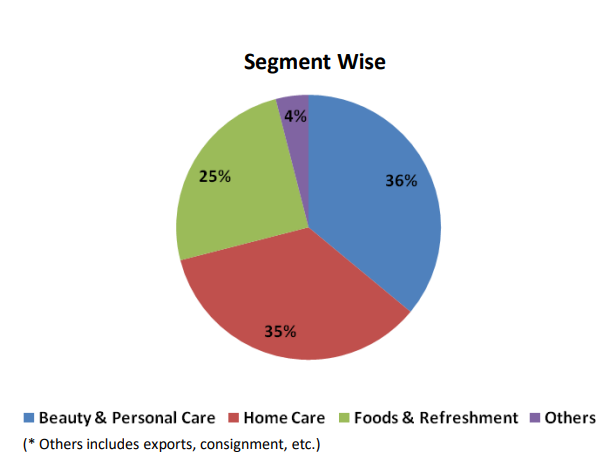

The company has a diverse product portfolio with over 50 brands across 15 distinct categories. Here is segment-wise revenue break-up as of FY23:

Some well-known brands include LUX, Surf Excel, Dove, and others. In 2020, they acquired GlaxoSmithKline Consumer Healthcare, adding popular brands like Horlicks and Boost to their portfolio, marking an entry into the wellness segment.

Key Growth Factors

- In FY23, net sales were ₹60 580 cr, a growth of 16 % YoY with a volume growth of 5 % YoY. In H1 FY24, net sales were ₹31,119 cr, a growth of 5 % YoY.

- It is virtually a debt-free company. As of 30th September 2023, total debt stood at ₹96 cr, which was completely short-term in nature.

- The company’s ROCE stood at ~27.06%, owing to improved operating profitability. The metric saw an uptick on the back of improved operating profit.

- The company’s working capital cycle continues to be negative as it has done a commendable job in improving the working capital cycle, which has been a result of higher payable days coupled with inventory days.

- In FY23, it generated ₹9,991 cr from cash from operations aided by improved operating profitability coupled with working capital adjustments.

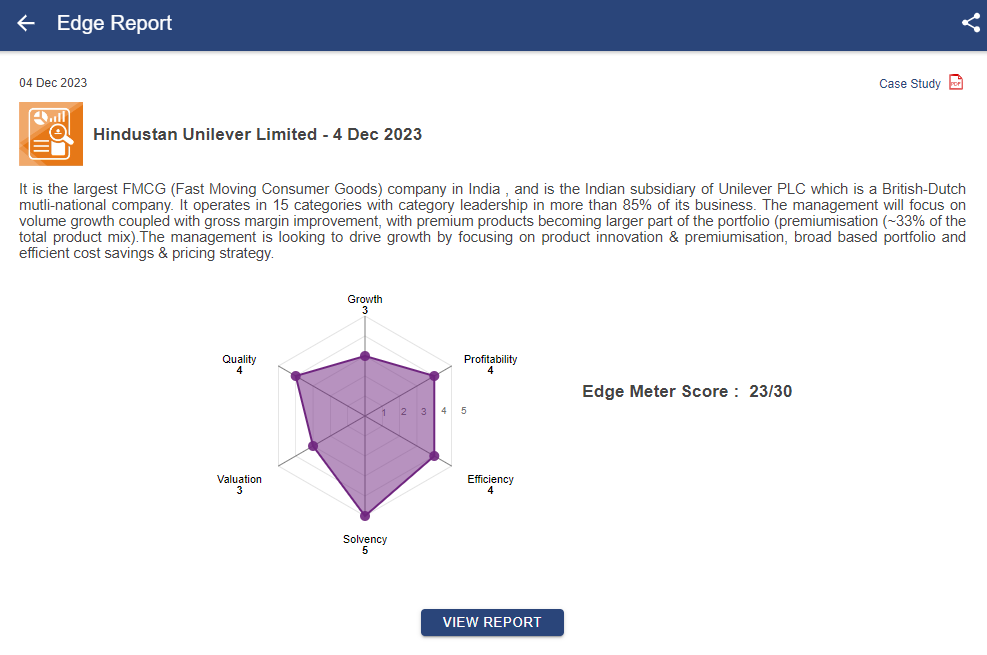

Case study on Hindustan Unilever Ltd.

We have a case study report prepared by our team of analysts. This fundamental report on HUL stock provides you with a detailed analysis of the company as well as how it stands among its competitors. An Edge score of 23/30 is given as per the spider chart. This can be considered as one of stocks for 2024 which you may invest in.

Click to view the report on Hindustan Unilever Ltd. and find out key levels for investments.

5. IRCTC Ltd.

The company is a central public sector enterprise wholly owned by the Government of India and under the administrative control of the Ministry of Railways. It is the only company approved by Indian Railways to offer bottled drinking water at Indian train stops and stations, online train tickets, and catering services to railways. A PSU stock with a comitative advantage can be considered as one of the top stocks for 2024.

Recently, IRCTC Stock has given a symmetrical triangle breakout (as shown below).

This classical chart pattern was identified with the help of artificial intelligence used in StockEdge. It is a Pro analytic feature of stockEdge that can help you to identify breakouts of classical chart patterns in the stocks

Company Overview

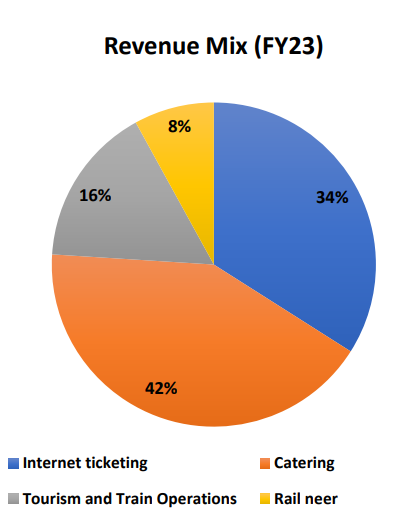

IRCTC’s business is divided into 4 main segments:

Internet ticketing

Catering and hospitality

Tourism & Train operations

Packaged drinking water (Rail Neer)

The revenue mix as of FY 23 is given below:

The highest revenue is contributed by catering services, followed by internet ticketing. Pertaining to their catering business, the company has a presence in over 474 trains equipped with pantry cars as of 31st March 2023.

Key Growth Factors

- In Q1 FY24, the sales grew by 17.5% YoY to ₹1,002 cr, led by growth in all the segments. Catering business growth was supported by an increase in the number of catering trains.

- The company’s EBITDA grew from ₹297 cr in FY17 to ₹698 cr in FY20, mainly driven by operating profit growth in the ticketing and catering segment.

- In Q1 FY24, the EBITDA margin contracted by 340 bps YoY to 34.2%. This was due to the increase of lower margin catering business in the total sales mix. Segment-wise operating profit margin stood at ~85% for internet ticketing, ~11% for catering business, ~11.6% for Rail neer, ~4% for Tourism and ~19% for State Teerath.

- Over the years, the company has remained debt-free

- The Indian rail network continues to grow, expanding its presence and adding new trains that will be beneficial to IRCTC. Hence, this can be considered as one of the stocks for 2024 that you may invest in.

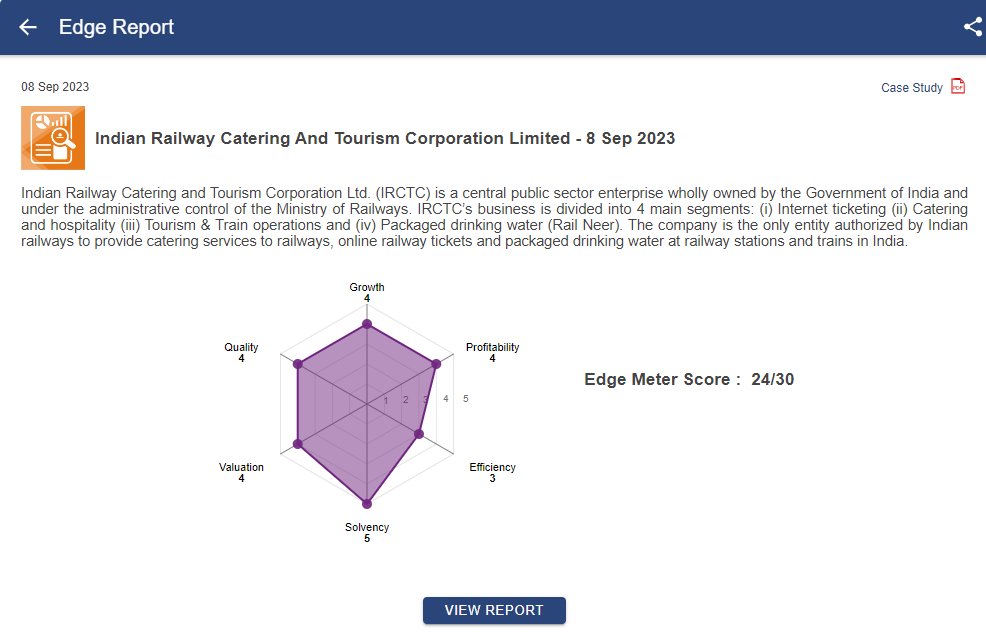

Case Study on IRCTC

We have a case study report prepared by our team of analysts. This fundamental report on IRCTC stock provides you with a detailed analysis of the company as well as how it stands among its competitors. An Edge score of 24/30 is given as per the spider chart. This can be considered as one of stocks for 2024 which you may invest in.

Click to view the report on IRCTC Ltd. and find out key levels for investments.

The Bottom Line

This completes the list of stocks for 2024. Additionally, stocks may get an updated review on a quarterly or annual basis, for which you can follow the investment ideas section of StockEdge. Also, key levels of buying and profit booking levels are updated for stocks. Hence, tracking your investment is essential for the long-term growth of your portfolio. New investment ideas are shared on the StockEdge app, and old investment ideas are updated as required.

To fully understand the investment ideas feature of StockEdge. You may read this blog, Understanding ‘Investment Ideas’ of StockEdge

Keeping following investment ideas of StockEdge. Happy Investing!