Table of Contents

In today’s blog, we are going to discuss the world’s largest two-wheeler manufacturer, Hero MotoCorp Limited formerly known as Hero Honda.

The Story

At the time when two-wheelers in India were synonymous with scooters and the scooter market was monopolized by a single player – Bajaj Auto Limited – Hero’s collaboration with Honda Motors changed everything. Despite Munjal’s long-held desire to manufacture scooters, fate had other plans.

They began commercial production at the Dharuhera plant in Haryana and introduced the first motorcycle, the CD 100, to the market. By 1987, the company had produced its one millionth motorcycle.

Today, Hero MotoCorp Limited is engaged in the manufacturing and marketing of motorcycles and scooters, and commands a market share of 35.8% in India.

It has a large product portfolio across various price segments, and few of its prominent brands include: Splendor, Passion, Glamour in the bike segment and like Pleasure, Maestro in the scooter segment and others.

It has six plants in India with a combined manufacturing capacity of 92 lakh units per annum. It also has a plant in Columbia and Bangladesh with capacity of 1.5 lakh units per annum. As of today’s date, this is Hero MotoCorp share price.

The company also has two R&D centers at Centre of Innovation and Technology in Jaipur and Hero Tech Center in Germany.

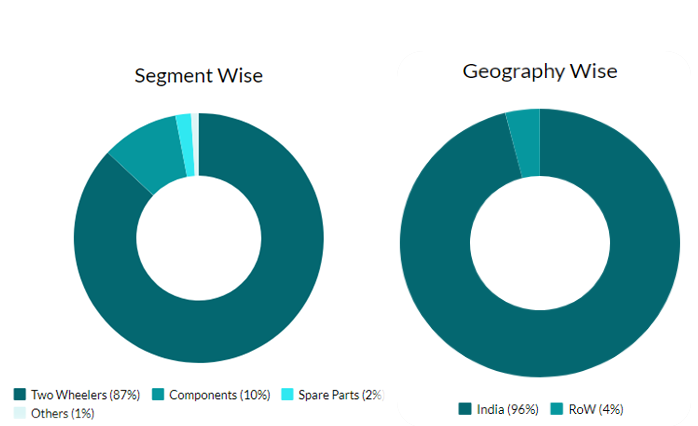

Where does Hero MotoCorp Limited get most of its money from?

To know more about Hero MotoCorp Limited and increase your understanding about fundamentals of the company, click here

Operational Highlights

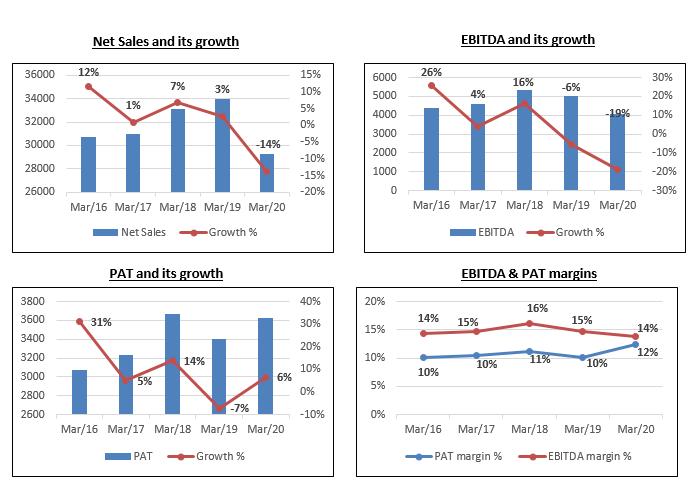

- In Q3 FY21 the net sales was Rs. 9,827.05 crore, a growth of 38.90% YoY. The company recorded the highest ever revenue for the quarter.

- Volume growth – 18.45 lakh units sold in Q3 FY21, a growth of 19.7% over the corresponding quarter in the previous fiscal.

- EBITDA was Rs. 1,447.55 crore, a growth of 36.86% YoY. EBITDA margin was 14.73%, a contraction of 22 bps YoY.

- PAT was Rs. 1,127.85 crore, a growth of 28.14% YoY.

- The company reported a strong set of numbers during the quarter which was achieved on the back of robust sales volume during the quarter and a combination of key strategic initiatives such as cost reduction efforts to partially offset the impact of the commodity costs and intense operational efficiencies.

- During the quarter, the company launched a range of premium and youthful motorcycles and scooters (Glamour Blaze, Pleasure+ Platinum, Maestro Edge 125 ‘Stealth’ Edition and Splendor+ Black and Accent and Xtreme 200S BS-VI).

Hero MotoCorp Limited financials over the years

March-April Update

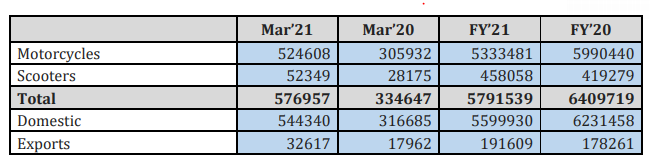

- It sold 576,957 units of motorcycles and scooters in March 2021, registering a growth of 72% over the corresponding month in the previous year.

- It also registered its highest-ever sales in Global Business in a single month by clocking 32,617 units in the month of March, a growth of 82% over the corresponding month in 2020.

- Despite various challenges, the company sold 57, 91,539 units of two-wheelers in the fiscal year (April 2020-March 2021).

Read our latest article on Jubilant Ingrevia Ltd. – Nurturing Innovation.

Future Outlook

- The company which is a leader in the budget bike segment, is aiming to strengthen its position in the premium bike segment as well as in the electric two- wheelers for both mass and premium segments.

The company’s strategy is to create a full portfolio of premium across segments and across engine capacity. As per the management, over the next few years, the company will continue to fill premium portfolios with more and more new models.

- Hero MotoCorp Limited will be launching a host of new motorcycles and scooters over the next five years, keeping in view its vision to ‘Be the Future of Mobility’.

- Going forward, the management expects input costs to remain under pressure due to the rising prices of commodities and fuel. The price increase on its range of products that the company undertook from January 1 will partially offset these cost pressures. The management will continue to focus on driving cost savings, and take judicious price increases if and when necessary.

- The company has entered into a distribution agreement with Grupo Salinas and have come together to form one of the largest distribution networks globally to sell competitive, high-quality products in the large Mexican market.

- The company has also entered into an alliance with Harley-Davidson. Hero MotoCorp will develop and sell a range of premium motorcycles under the Harley-Davidson brand name in the country. Besides, it will take care of service and parts requirements for Harley bikes.

The Harley-Davidson partnership accelerates and enhances the company’s premium segment strategy.

- Regarding the company’s strategy regarding electric vehicles, the management stated that besides investing in Ather Energy, the company is also looking to develop its own products in the segment.

The company increased its equity share in Ather Energy and made an additional investment of Rs 174 crore (US$ 24 million) in Ather Energy, taking up its shareholding in the company to 34.81%.

- The company is reinforcing its presence in Central America and Mexico. The global business has been gaining traction and the management is optimistic of maintaining the healthy growth trajectory across geographies in the coming months.

- Key concerns: exposure to intense competition; modest presence in premium motorcycles segment and in the overseas market.

Note: The Board of Directors to consider and approve the audited Standalone and Consolidated Financial Results for the quarter and financial year ended March 31, 2021 (Q4 FY21) on Thursday, May 6, 2021.

Technical View

Hero MotoCorp Limited bounced from the convergence of 38.2% Fibonacci retracement and support zone in the daily chart along with a positive divergence in RSI. Likely to stay positive and bounce in the near term till the stock holds 2750-2800 zone. Probable resistance in the short term comes at 3000 and then at 3200 level.

Bottom line

The company is continuously diversifying and expanding into related growth segments like scooters, premium motorcycles and export markets. Its partnership with Ather Energy and Harley Davidson will help HMCL increase its presence in new technology and premium segment bikes. However, any meaningful contribution from the same may take some time.

Moreover, the rising fresh COVID-19 cases and the regulations pertaining to the same could have a bearing on the company’s overall performance as it majorly caters to the domestic market.The company continues to maintain a strong business risk profile because of leadership position in the two-wheeler market in India, and robust financial risk profile due to large net worth, negligible debt, and substantial liquid surplus.

Moreover, it is included in the Nifty 50, which serves as India’s benchmark index. For further insights into Nifty 50 stocks, explore All About NIFTY50, its components, and strategies for investing in it.

Know more about Hero MotoCorp Limited and its peers by using the Sectors tab in the StockEdge Web

Check out StockEdge Premium Plans.

Very nice information about all aspects of company at one plateform

We are glad you liked the content. Keep following us on Twitter to read more such Blogs!

It’s very much useful Re entry to the market like me. Thanks

We are glad you liked the content. Keep following us on Twitter to read more such Blogs!