Table of Contents

Have you ever wondered how an investor/shareholder in any company, be it a start-up or a small business or even a listed company earns returns for their investments?

Well, there are 2 ways how shareholders make profits by investing in a company.

- Any profits that a company makes essentially belongs to its shareholders. But most companies reinvest their profits into the business itself. In order to expand. When the company grows, its shares become more valuable, pushing its share price higher. An existing shareholder can sell their shares at a higher price making returns. This is known as Capital Appreciation.

- The other way a shareholder can make gains is through Dividends. Some companies do not reinvest the entire profit back into the business. They share a portion of their profits with its shareholders by paying them a dividend.

Dividend Yield Mutual Funds

Dividend Yield Funds are mutual fund schemes which invest majorly in stocks of companies known to pay dividends consistently.

So in the blog, we will understand the features and other aspects of Dividend Mutual Funds also known as Dividend Yield Funds.

According to the Securities and Exchange Board of India’s Mutual Fund categorization rules, A dividend yield fund is an open ended equity scheme predominantly investing in dividend yielding stocks. A minimum 65% of the scheme’s total exposure should be in equity related instruments such as stocks. The remaining portion may comprise debt securities or money market instruments.

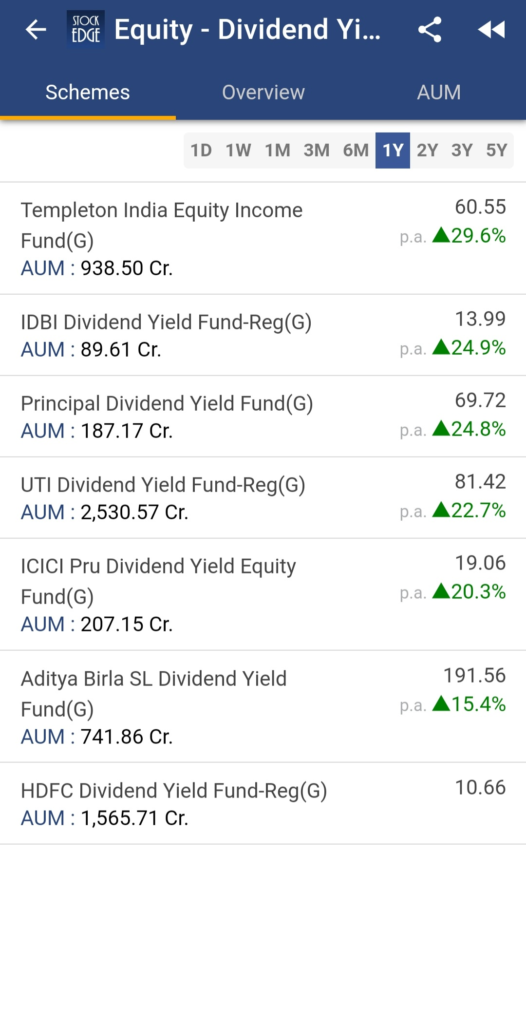

Best Dividend Yield Funds based on 1 year performance on StockEdge App:

Dividends:

The way dividends work is fairly simple. When companies make profits, the board of directors may decide to distribute a portion of it with its shareholders. The earnings shared with shareholders is known as a dividend.

For example, on 29th January 2021, Indian Oil Corporation announced that it would pay its shareholders a dividend of Rs.7.5 per share. So if someone who owned 100 shares of IOC would receive Rs.750(100 shares*7.5) as dividend. Similarly someone who owns 5000 shares would receive Rs.37,500(5000 shares*7.5) as dividend.

Dividend Yield:

Dividend Yield on the other hand is a financial or accounting ratio which tells us the return% per share an investor makes through dividend payouts.

Dividend Yield = Dividend ÷ Share Price

For example, as of the time of writing this blog, the price per share of Indian Oil is Rs.93. Since they announced a dividend of Rs.7.5,

Dividend Yield = 7.5 ÷ 93 = 0.08 or 8%.

Reasons to invest in high Dividend Yield companies:

A few reasons why dividend yield funds are a good option to be a part of your portfolio are as follows:

- Only profit making companies declare dividends. Similarly companies which declare dividends consistently will naturally have stable cash flows and growth prospects. Hence dividend yield funds include not only dividend paying stocks in their portfolio but also stable and profitable companies.

- If a company pays regular dividends, it would also imply that the company is either a growing company or a market leader in its respective industry. So the fund manager also looks at the growth prospects and fundamentals of a company before investing.

See Also: What are Contra Mutual Funds

Types of Dividend Mutual Funds

It is important to know that not all dividend mutual funds are dividend yield funds. Certain mutual fund schemes have a “dividend option” to invest in. Do note that such funds are not dividend yield funds.

On the contrary, “dividend option” schemes is where a mutual fund pays a portion of your profits back to you on regular intervals. The other option to choose is a “growth option” where the profits made by your investments are retained by the fund house and reinvested in the same fund.

As mentioned above, dividend yield funds comprise stock investments which are known to offer high dividend yields. It is also important to note that a company which merely pays high dividends is not the same as a high dividend yield company. Let’s find out why!

Assume 2 companies, ABC Ltd. and XYZ Ltd. Abc has a share price of Rs.5000 and pays a dividend of Rs.200.

Meanwhile, Xyz has a share price of Rs.50 and pays a dividend of Rs.5 only. Now let’s calculate the dividend yield of each company:

ABC Ltd. = 200 ÷ 5000 = 4%

XYZ Ltd. = 5 ÷ 50 = 10%

As you can see, though the dividend of ABC is a much higher Rs.200 its dividend yield is only 4% because the share is also very expensive.

So dividend yield mutual funds will focus investing in high dividend yield stocks rather than companies paying high dividends.

But each mutual fund scheme offers unique advantages along with certain caveats and risks. So this brings us to the final part of the blog. Where we will talk about the advantages and limitations of Dividend Yield Funds.

Advantages of Dividend Yield Funds

- Dividend yield funds may get less affected by market downturns as they invest predominantly in fundamentally sound companies.

- Another benefit is that when the overall stock markets are underperforming, investors can still earn returns by way of dividends.

Points to remember before investing in Dividend Yield Funds

Dividend yield funds at times may underperform during bull markets as high dividend yield companies are blue chip stocks. During bull runs, growth or value stocks may perform better.

Before investing it is important that the risks and tenure of investment is understood. Like most mutual funds, dividend yield funds are best for long term investments and may not be very prudent for short term investors.

You can also view the video below to know more about Contra Funds!

Click here to know more about the Premium offering of StockEdge.

You can check out the desktop version of StockEdge.