Successful trading is not about predicting tops and bottoms. It is about identifying strong trends and participating in them at low-risk points. Most trends pause before continuing further, and these pauses often provide some of the best trading opportunities.

This is where continuation candlestick scans become extremely powerful. Instead of manually searching charts, traders can use scans to systematically identify stocks that are consolidating within a trend and preparing for the next move.

In this blog, we will understand what continuation candlestick scans are, how to identify them, the types of continuation patterns, and how to trade using continuation scans.

What are Continuation Candlestick Scans?

Continuation candlestick scans are predefined scans designed to identify stocks that present potential trading opportunities where an existing market trend is likely to resume after a brief pause or consolidation period.

These scans highlight stocks where buyers or sellers are still in control, and the existing momentum may carry forward.

Continuation scans are useful for traders who prefer entering trades in the direction of the prevailing trend rather than anticipating reversals.

How to Identify Continuation Candlestick Patterns?

Finding continuation candlestick patterns by manually scanning charts can quickly become overwhelming. With thousands of stocks listed across the NSE and BSE, monitoring each one daily to identify consolidations within trends is neither practical nor efficient for most traders.

Markets move fast, and continuation setups often appear quietly right when attention is elsewhere. Trying to track every stock across multiple timeframes only adds to confusion and missed opportunities.

This is where candlestick scans play a crucial role.

With StockEdge, traders can instantly filter stocks showing continuation-type candlestick behaviour on daily charts. Instead of manually flipping through charts, the scan engine does the heavy lifting by highlighting stocks that are pausing within an existing trend and may be preparing for the next move.

You can access these scans by logging into the StockEdge app or through the web platform at

https://stockedge.com/ or https://web.stockedge.com/app/markets.

The StockEdge platform offers a wide range of candlestick scans that automatically track price action across the market. These scans help traders identify stocks where momentum remains intact, but price is temporarily consolidating, which is often a precursor to trend continuation.

While StockEdge provides scans for several candlestick patterns, the focus of this blog is on continuation candlestick scans and how traders can use them to align with strong trends rather than chase price moves.

By using scans effectively, traders can spend less time searching and more time analyzing, planning, and executing trades with confidence.

Types of Continuation Candlestick Scans

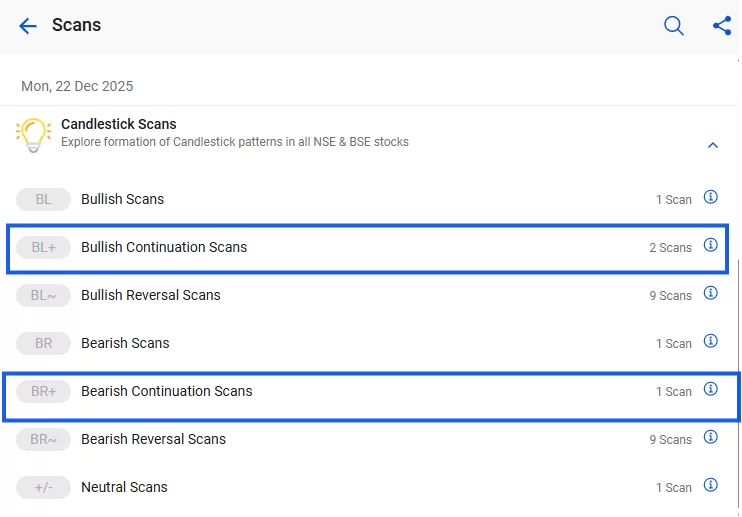

In StockEdge scans, there are two types of continuation candlestick scans:

- Bullish Continuation Candlestick Scans – These scans identify stocks that are in a strong uptrend, temporarily consolidating, and showing signs of resuming the upward move.

- Bearish Continuation Candlestick Scans – These scans identify stocks that are in a strong downtrend, pausing briefly, and indicating a continuation of the downward move.

Bullish Continuation Candlestick Scan

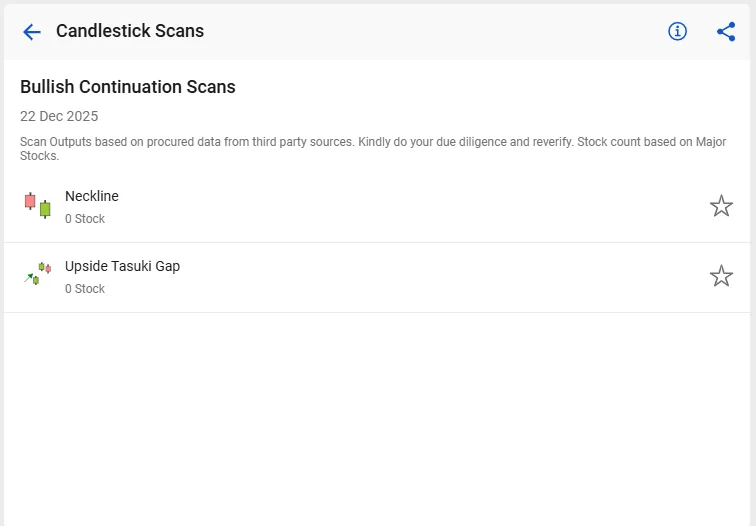

Bullish continuation candlestick scans are designed to identify stocks that are already in an uptrend and are showing signs of continuing their upward momentum after a brief pause.

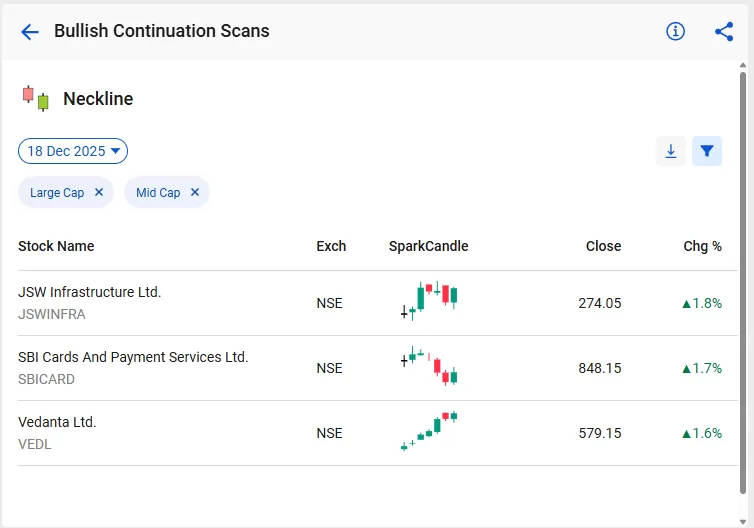

Under the bullish continuation candlestick scan, StockEdge provides the following candlestick patterns:

- Neckline Pattern – This pattern highlights stocks that are consolidating near a breakout level, indicating that buyers are maintaining control and the uptrend may resume once the price moves above the neckline.

- Upside Tasuki Gap – This pattern reflects strong bullish momentum where price gaps up and briefly consolidates, suggesting that the underlying strength of the trend remains intact.

These patterns help traders spot opportunities to enter trend-following trades with defined risk.

Bearish Continuation Candlestick Scan

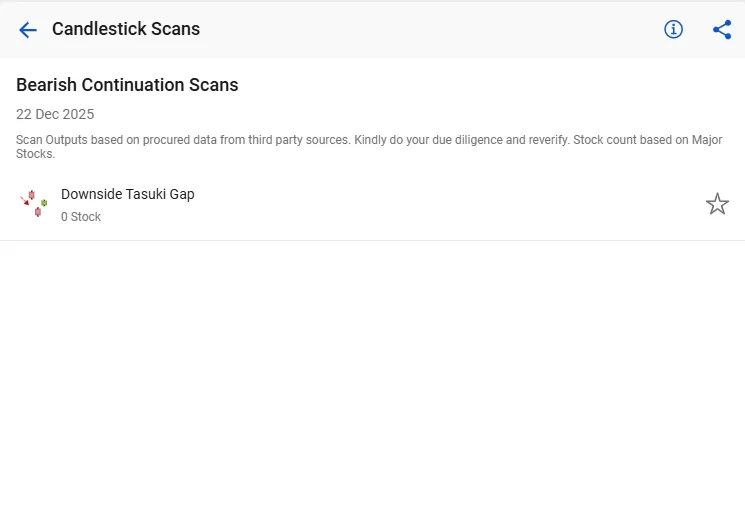

Bearish continuation candlestick scans focus on stocks that are in a clear downtrend and are showing signs of further downside potential after a temporary consolidation.

Under the bearish continuation candlestick scan, StockEdge currently offers one key pattern:

- Downside Tasuki Gap – This pattern appears during strong downtrends and indicates a pause in selling pressure before the next leg lower, signalling continuation of bearish momentum.

This scan is particularly useful for traders looking to participate in sustained downtrends rather than attempting premature reversals.

You can also read How to Use StockEdge Candlestick Scans to understand this better

How to Trade Any Continuation Candlestick Pattern Using Scans?

Let’s now understand how to trade these candlestick patterns using Scans.

To trade continuation candlestick patterns effectively, the first step is to confirm the existing trend, whether bullish or bearish.

After identifying the pattern, it is crucial to analyze the volume and the overall market sentiment. During the formation of the continuation pattern, volume generally contracts, reflecting temporary indecision or consolidation.

This contraction should be followed by a clear expansion in volume on the breakout candle, which confirms that momentum is returning in the direction of the prevailing trend. At the same time, traders should observe nearby support and resistance levels, as continuation signals that form near support in an uptrend or near resistance in a downtrend tend to be more reliable.

For trade execution, entries are best taken on the close of the breakout candle that confirms the resumption of the trend. Conservative traders may choose to wait for a brief retest of the breakout level before entering. Risk management remains critical; stop losses should be placed below the pattern’s low in bullish setups and above the pattern’s high in bearish setups.

Profit targets can be estimated using a measured-move approach, where the height of the continuation pattern is projected from the breakout point. When combined with volume confirmation and key price levels, this structured approach helps traders participate in continuation moves with clarity and discipline.

Now, let’s take a real-life example to understand this better. The first step is to identify the candlestick pattern, which can be done easily using StockEdge continuation candlestick scans.

On 18th December 2025, a bullish neckline continuation pattern was identified in Vedanta Ltd. Before the pattern formed, the stock was already in a well-established uptrend, indicating strong underlying bullish momentum. After the prior up-move, the stock entered a brief consolidation phase near the neckline level, suggesting a pause rather than a trend reversal.

Once the pattern was identified, the combined high and low of the neckline consolidation were marked. The next step was to wait for confirmation. When price closed above the neckline with a strong bullish candle, it confirmed the continuation of the existing uptrend.

A long trade could be initiated on the close of the breakout candle. The stop-loss was placed below the low of the neckline pattern, ensuring defined risk. The initial target was calculated by measuring the height of the consolidation range and projecting the same distance upward from the breakout point. This setup offered a favourable risk–reward structure, while staying aligned with the prevailing trend.

Conclusion

Continuation candlestick scans help traders stay on the right side of the trend while avoiding emotional decision-making. By focusing on consolidation within strong trends, traders can enter trades with defined risk, better reward potential, and higher consistency.

Also Read: How To Trade Using Reversal Candlestick Scans?

Frequently Asked Questions (FAQs)

1. How reliable are continuation candlestick scans?

Continuation candlestick scans offer high-probability trade setups, especially because they align with the prevailing market trend. However, their reliability increases significantly when they are combined with trend confirmation, volume analysis, and disciplined risk management.

2. What mistakes do beginners make with these scans?

Some common mistakes are trading against the main trend, ignoring broader market direction, entering without confirmation, and poor stop-loss placement.

3. What is the difference between continuation and reversal patterns?

Continuation pattern signals a temporary “pause” in an existing trend. The price consolidates briefly before resuming its previous direction. They are common in the middle of a trend.

Whereas a Reversal Pattern signals that the current trend has exhausted itself and is about to change direction completely. They typically form at market “tops” or “bottoms.”